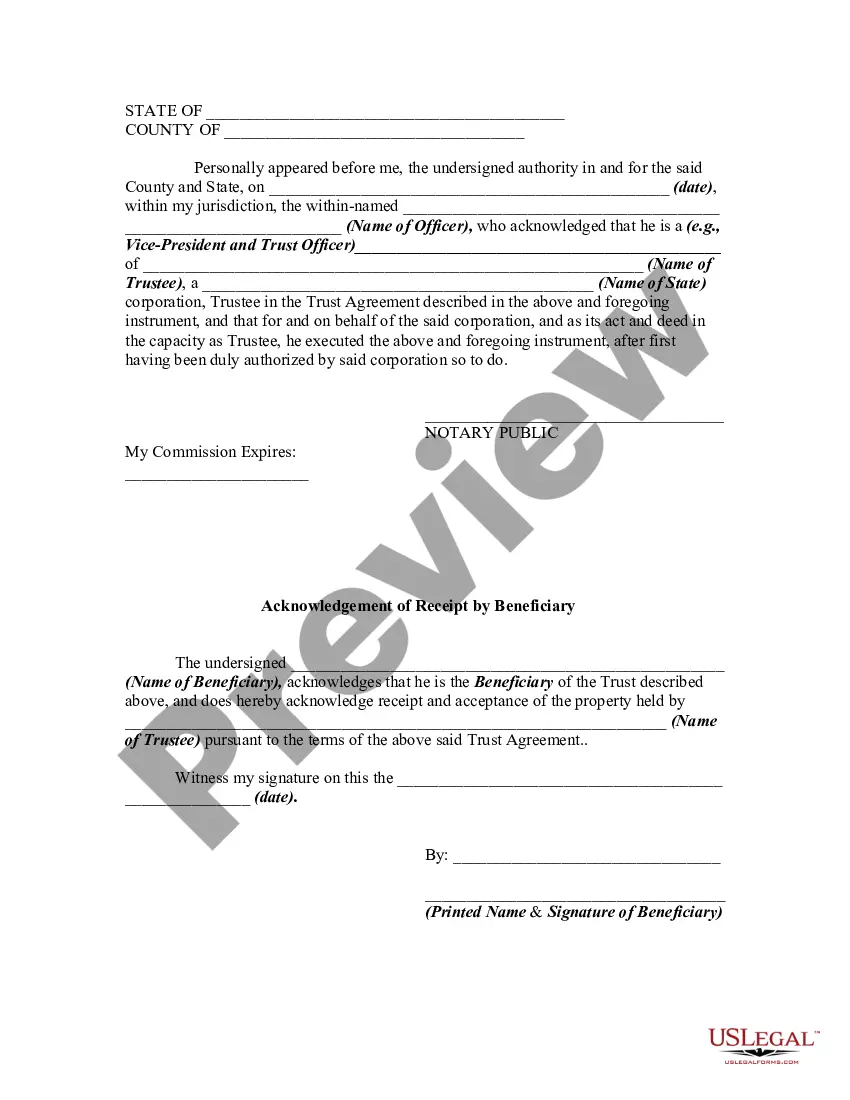

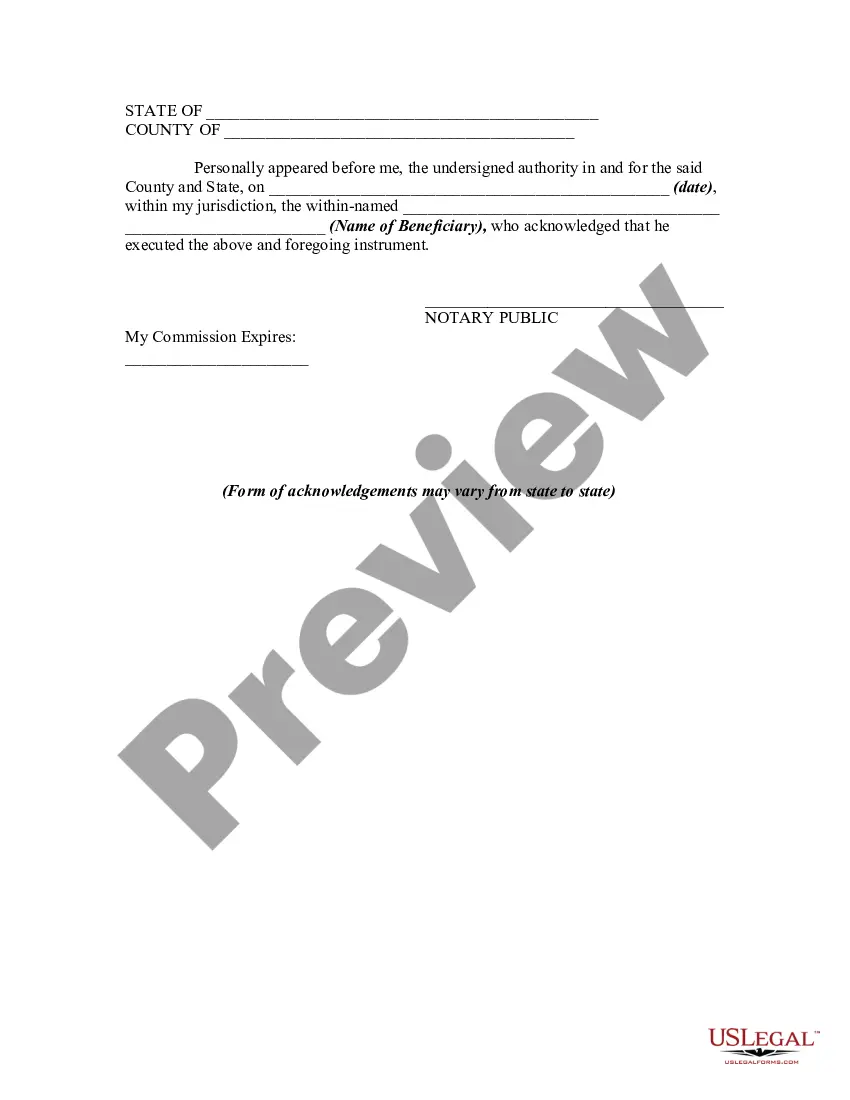

This form is a sample of a release given by the trustee of a trust agreement transferring all property held by the trustee pursuant to the trust agreement to the beneficiary and releasing all claims to the said property. This form assumes that the trust has ended and that the beneficiary has requested release of the property to him/her. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Nassau New York Release by Trustee to Beneficiary and Receipt from Beneficiary is a legal process that involves the transfer of assets or properties held in a trust to the intended beneficiaries. This transaction typically occurs upon the fulfillment of certain conditions outlined in the trust agreement, such as the achievement of a specific age, reaching a milestone, or the occurrence of a specific event. The release by trustee signifies that the trustee, who is responsible for managing and safeguarding the assets in the trust, has fulfilled their obligations and is now transferring the assets to the beneficiary. This process is crucial, as it grants the beneficiary ownership and control over their entitled share of assets. In Nassau County, New York, there are various types of releases by trustee to beneficiary and receipts from beneficiary, depending on the nature and purpose of the trust. Some common types include: 1. Testamentary Trust Release: A trustee releases assets to beneficiaries according to the instructions outlined in a deceased individual's last will and testament. 2. Revocable Living Trust Release: This type of release occurs when a granter, who created and funded a revocable living trust, becomes incapacitated or passes away. The trustee then releases the trust assets to the beneficiaries as per the trust's provisions. 3. Special Needs Trust Release: Special needs trusts are created to protect the assets of individuals with disabilities while still allowing them to receive government benefits. When the specified conditions are met, the trustee releases assets to the beneficiary for their care and support. 4. Charitable Trust Release: Charitable trusts are established for charitable purposes. When the predetermined terms are satisfied, the trustee releases the trust assets to the designated charitable organization. 5. Spendthrift Trust Release: A spendthrift trust provides protection from creditors to the beneficiary. Upon meeting certain requirements, the trustee releases the assets to the beneficiary while ensuring their protection against potential creditors. Regardless of the specific type of release by trustee to beneficiary and receipt from beneficiary in Nassau New York, the process typically involves the trustee providing a written and detailed account of the assets being released and the beneficiary providing a signed receipt to confirm the receipt of the assets. This documentation is crucial for legal purposes and ensures transparency and accountability throughout the process. Disclaimer: The information provided above is for general informational purposes only and does not constitute legal advice. It is always advisable to consult with a qualified attorney for guidance on specific trust matters in Nassau New York.Nassau New York Release by Trustee to Beneficiary and Receipt from Beneficiary is a legal process that involves the transfer of assets or properties held in a trust to the intended beneficiaries. This transaction typically occurs upon the fulfillment of certain conditions outlined in the trust agreement, such as the achievement of a specific age, reaching a milestone, or the occurrence of a specific event. The release by trustee signifies that the trustee, who is responsible for managing and safeguarding the assets in the trust, has fulfilled their obligations and is now transferring the assets to the beneficiary. This process is crucial, as it grants the beneficiary ownership and control over their entitled share of assets. In Nassau County, New York, there are various types of releases by trustee to beneficiary and receipts from beneficiary, depending on the nature and purpose of the trust. Some common types include: 1. Testamentary Trust Release: A trustee releases assets to beneficiaries according to the instructions outlined in a deceased individual's last will and testament. 2. Revocable Living Trust Release: This type of release occurs when a granter, who created and funded a revocable living trust, becomes incapacitated or passes away. The trustee then releases the trust assets to the beneficiaries as per the trust's provisions. 3. Special Needs Trust Release: Special needs trusts are created to protect the assets of individuals with disabilities while still allowing them to receive government benefits. When the specified conditions are met, the trustee releases assets to the beneficiary for their care and support. 4. Charitable Trust Release: Charitable trusts are established for charitable purposes. When the predetermined terms are satisfied, the trustee releases the trust assets to the designated charitable organization. 5. Spendthrift Trust Release: A spendthrift trust provides protection from creditors to the beneficiary. Upon meeting certain requirements, the trustee releases the assets to the beneficiary while ensuring their protection against potential creditors. Regardless of the specific type of release by trustee to beneficiary and receipt from beneficiary in Nassau New York, the process typically involves the trustee providing a written and detailed account of the assets being released and the beneficiary providing a signed receipt to confirm the receipt of the assets. This documentation is crucial for legal purposes and ensures transparency and accountability throughout the process. Disclaimer: The information provided above is for general informational purposes only and does not constitute legal advice. It is always advisable to consult with a qualified attorney for guidance on specific trust matters in Nassau New York.