The Cuyahoga Ohio Amendment of Inter Vivos Trust Agreement for Withdrawal of Property from Trust is a legal document that enables a trust or (also known as a granter or settler) to make changes to an inter vivos trust, particularly when it involves withdrawing property from the trust. Inter vivos refers to a trust created during the lifetime of the trust or, as opposed to a testamentary trust which is established through a will after the trust or's death. This amendment is specifically designed for residents or trustees residing in Cuyahoga County, Ohio. Cuyahoga County is located in the state of Ohio and belongs to the Greater Cleveland metropolitan area. It encompasses various cities, including Cleveland, Parma, Lakewood, and Euclid, amongst others. The Cuyahoga Ohio Amendment of Inter Vivos Trust Agreement for Withdrawal of Property from Trust allows trustees to modify their trust by removing certain assets or properties from the trust. This can be necessary to accommodate changing circumstances, such as the sale or transfer of property, changes in financial goals, or adjustments to estate planning strategies. By utilizing this amendment, trustees can manage their trust effectively and ensure that it aligns with their current needs and objectives. It provides a convenient and legally binding means to update the trust without undergoing the process of creating an entirely new trust agreement. Some potential types of Cuyahoga Ohio Amendments of Inter Vivos Trust Agreement for Withdrawal of Property from Trust may include: 1. Real Estate Withdrawal: This type of amendment specifically focuses on withdrawing real estate or properties from the trust. It outlines the legal requirements and processes involved in removing real estate assets from the trust. 2. Financial Asset Withdrawal: This amendment deals with the withdrawal of financial assets, such as bank accounts, stocks, bonds, or retirement accounts, from the trust. It clarifies the necessary steps and procedures for removing these types of assets. 3. Personal Property Withdrawal: This amendment concentrates on withdrawing personal property, such as vehicles, artwork, jewelry, or other tangible assets, from the trust. It establishes guidelines for the proper removal of these items from the trust agreement. 4. Business Interest Withdrawal: This type of amendment is tailored for trustees who have business interests held within their trust. It offers specific guidance on how to withdraw or transfer ownership of business entities, partnerships, or shares from the trust. 5. Combined Asset Withdrawal: This amendment covers multiple types of assets, allowing the trust or to withdraw various properties from the trust in a single comprehensive amendment. It is crucial to consult with an experienced attorney when considering any amendments to an inter vivos trust agreement. By seeking legal guidance, trustees can ensure compliance with state-specific regulations and maximize the effectiveness of their trust structures.

Cuyahoga Ohio Amendment of Inter Vivos Trust Agreement for Withdrawal of Property from Trust

Description

How to fill out Cuyahoga Ohio Amendment Of Inter Vivos Trust Agreement For Withdrawal Of Property From Trust?

Laws and regulations in every sphere vary throughout the country. If you're not a lawyer, it's easy to get lost in various norms when it comes to drafting legal documents. To avoid pricey legal assistance when preparing the Cuyahoga Amendment of Inter Vivos Trust Agreement for Withdrawal of Property from Trust, you need a verified template legitimate for your county. That's when using the US Legal Forms platform is so advantageous.

US Legal Forms is a trusted by millions web catalog of more than 85,000 state-specific legal templates. It's a perfect solution for specialists and individuals looking for do-it-yourself templates for different life and business scenarios. All the documents can be used multiple times: once you obtain a sample, it remains available in your profile for further use. Therefore, if you have an account with a valid subscription, you can just log in and re-download the Cuyahoga Amendment of Inter Vivos Trust Agreement for Withdrawal of Property from Trust from the My Forms tab.

For new users, it's necessary to make a few more steps to get the Cuyahoga Amendment of Inter Vivos Trust Agreement for Withdrawal of Property from Trust:

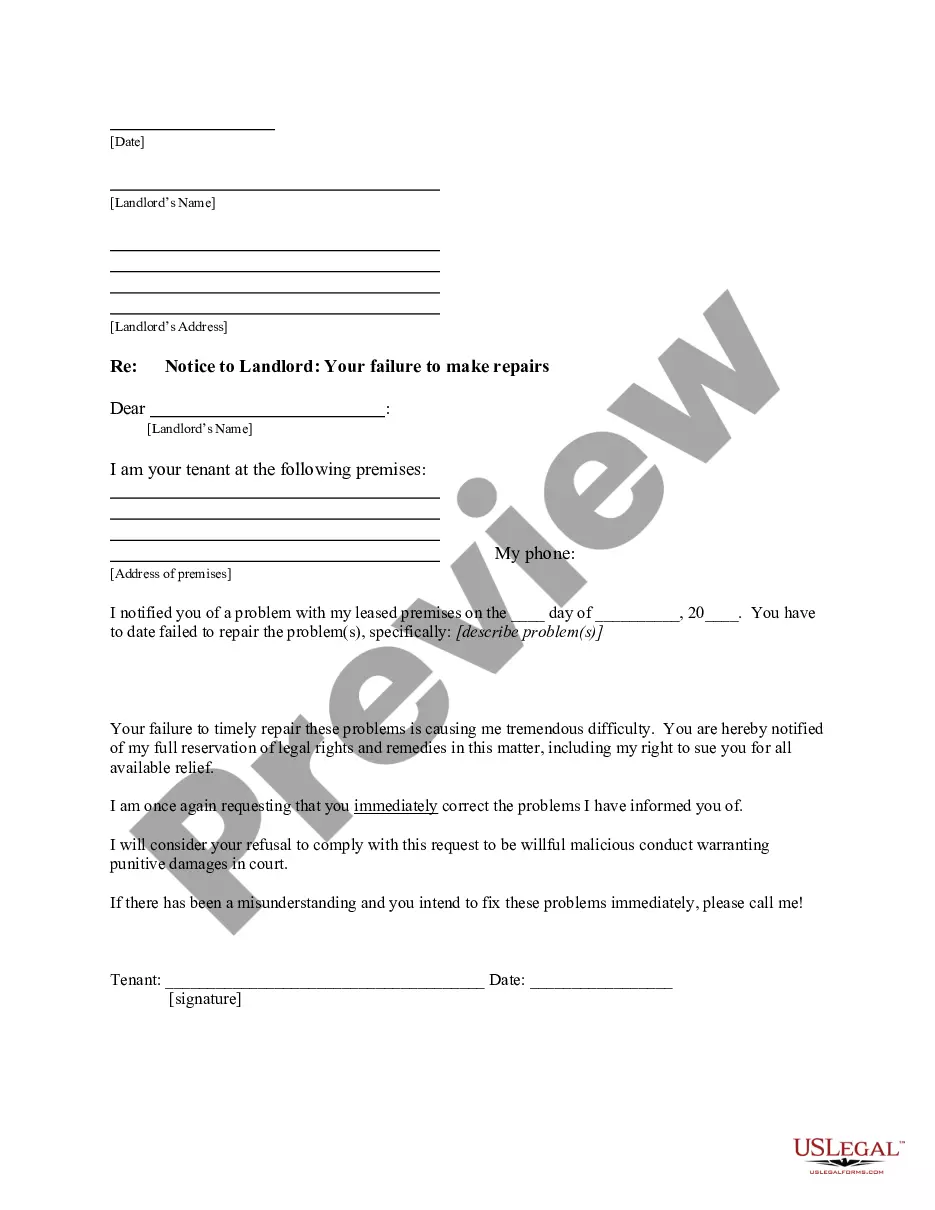

- Take a look at the page content to make sure you found the correct sample.

- Take advantage of the Preview option or read the form description if available.

- Search for another doc if there are inconsistencies with any of your criteria.

- Utilize the Buy Now button to obtain the document when you find the appropriate one.

- Opt for one of the subscription plans and log in or sign up for an account.

- Choose how you prefer to pay for your subscription (with a credit card or PayPal).

- Select the format you want to save the file in and click Download.

- Complete and sign the document in writing after printing it or do it all electronically.

That's the simplest and most economical way to get up-to-date templates for any legal reasons. Locate them all in clicks and keep your documentation in order with the US Legal Forms!