[Your Name] [Your Address] [City, State, Zip Code] [Email Address] [Phone Number] [Date] [Client's Name] [Client's Address] [City, State, Zip Code] Subject: Maricopa Arizona Sample Letter for Debt Collection Dear [Client's Name], I hope this letter finds you well. As discussed, I have prepared a Maricopa Arizona Sample Letter for Debt Collection on behalf of [Your Company Name], outlining the necessary information and guidelines to pursue debt collection effectively. Please find attached the document for your review. Maricopa Arizona is renowned for its diverse population, vibrant culture, and thriving economic landscape. With countless businesses operating in the region, it is not uncommon for organizations to face challenges related to debt collection. Therefore, having a well-crafted debt collection letter is imperative to maintain a balanced financial position. The Maricopa Arizona Sample Letter for Debt Collection is a comprehensive tool designed specifically for creditors, maximizing the chances of successful recovery. It encompasses several key elements, including: 1. Clear Identification: The letter starts by stating the exact details of the debtor, such as their full name, contact information, and any relevant account numbers. This ensures that there is no ambiguity in identifying the debtor and minimizes the chances of sending the letter to the wrong individual. 2. Detailed Debt Description: The letter provides a detailed breakdown of the outstanding debt, including the amount owed and the dates of the original transaction or agreement. This level of transparency helps the debtor understand the origin of the debt and encourages prompt payment. 3. Formal Demand for Payment: The sample letter emphasizes the urgency and seriousness of the situation by explicitly stating the demand for immediate payment within a specified timeframe. This establishes clear expectations and gives the debtor an opportunity to rectify the situation. 4. Consequences of Non-Payment: It is vital to outline the consequences of non-payment in a professional and legally compliant manner. The letter specifies the potential actions that may be taken to recover the debt, such as reporting to credit agencies or pursuing legal action. By understanding the potential repercussions, the debtor is more likely to take the matter seriously. 5. Compliance with Debt Collection Laws: The Maricopa Arizona Sample Letter for Debt Collection ensures compliance with all applicable state and federal debt collection laws, protecting both the creditor's and debtor's rights. This helps maintain a professional relationship and reduces the risk of legal complications. In conclusion, the Maricopa Arizona Sample Letter for Debt Collection is a comprehensive resource that provides creditors with an effective approach to recovering unpaid debts. It enables you to assert your rights as a creditor while maintaining professional conduct. By using this letter, you enhance your chances of resolving outstanding debts and maintaining a positive financial position. Should you have any questions or require further assistance, please do not hesitate to reach out to us. We are ready to support you throughout the debt collection process. Thank you for entrusting your debt collection needs to [Your Company Name]. We look forward to a successful collaboration. Sincerely, [Your Name]

Maricopa Arizona Sample Letter for Debt Collection for Client

Description

How to fill out Maricopa Arizona Sample Letter For Debt Collection For Client?

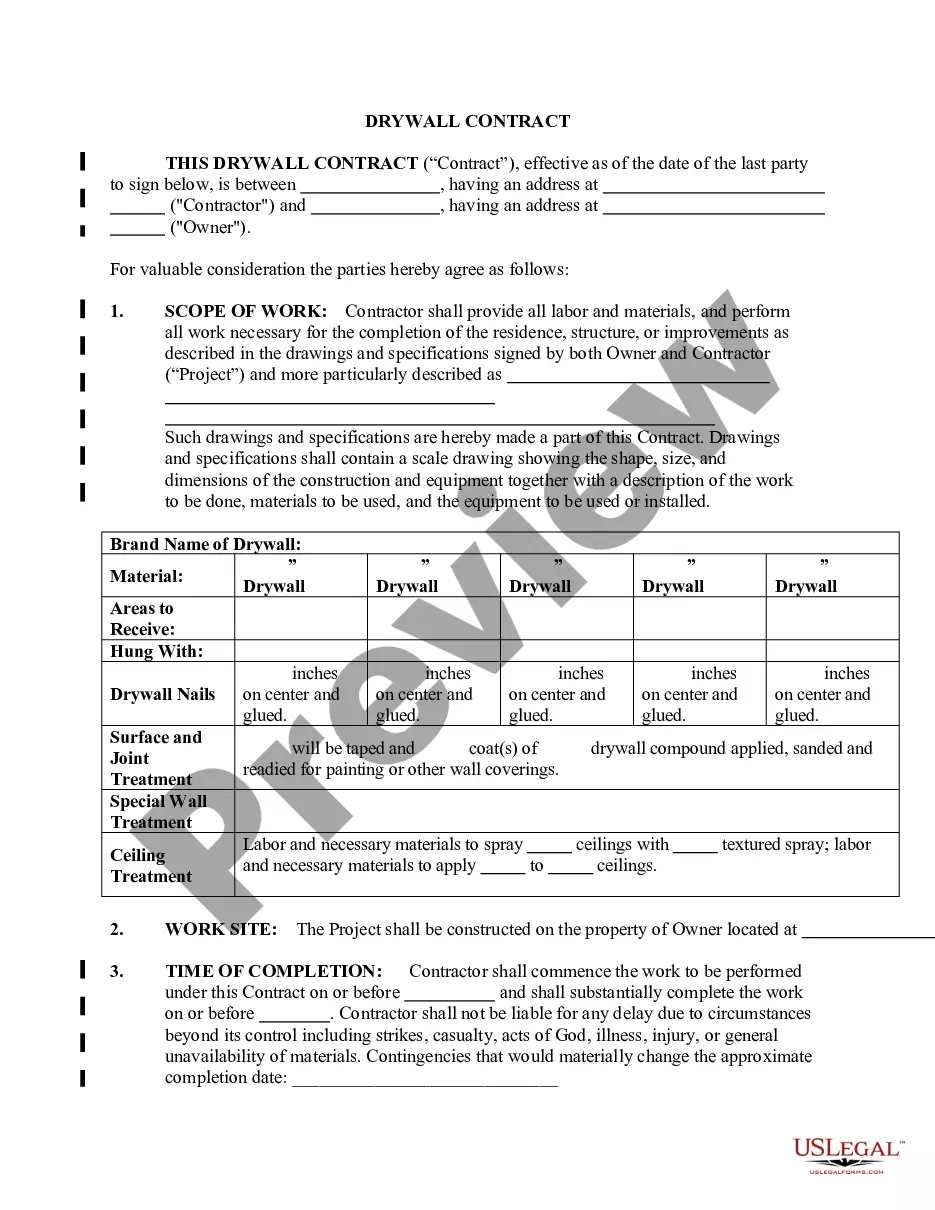

Are you looking to quickly draft a legally-binding Maricopa Sample Letter for Debt Collection for Client or probably any other form to manage your own or corporate affairs? You can select one of the two options: contact a professional to write a legal document for you or draft it entirely on your own. The good news is, there's another solution - US Legal Forms. It will help you get professionally written legal paperwork without paying sky-high fees for legal services.

US Legal Forms provides a rich collection of over 85,000 state-compliant form templates, including Maricopa Sample Letter for Debt Collection for Client and form packages. We offer documents for an array of life circumstances: from divorce paperwork to real estate documents. We've been on the market for more than 25 years and got a rock-solid reputation among our customers. Here's how you can become one of them and obtain the necessary template without extra troubles.

- To start with, double-check if the Maricopa Sample Letter for Debt Collection for Client is adapted to your state's or county's laws.

- In case the form comes with a desciption, make sure to check what it's suitable for.

- Start the searching process over if the template isn’t what you were looking for by using the search box in the header.

- Select the plan that best suits your needs and move forward to the payment.

- Select the file format you would like to get your form in and download it.

- Print it out, fill it out, and sign on the dotted line.

If you've already set up an account, you can easily log in to it, find the Maricopa Sample Letter for Debt Collection for Client template, and download it. To re-download the form, just go to the My Forms tab.

It's easy to find and download legal forms if you use our catalog. In addition, the paperwork we offer are updated by industry experts, which gives you greater confidence when dealing with legal matters. Try US Legal Forms now and see for yourself!

Form popularity

FAQ

The sample is as follows: Dear XX (name of debtor), We regret to inform you that due to your unpaid debt amount of XX (full debt amount, additional charges and interest cost) to XX (creditor's name and company), from today, XX (date) we have passed your case to court.

Looking into how to send someone to collections before the 90 days are up is considered an overreaction in most circles. Step One Resend Outstanding Invoices. Step Two Speak to the Debtor. Step Three Contact a Lawyer and Send a Formal Demand. Average Collection Agency Fees.

3. Your full name and address. The collections agency's name and address. A request for the amount of the debt claimed to be owed. A request for the name of the original creditor. A request for the judgment information (if applicable) A request for proof of the company's license.

Collection letters should do two things: 1) retain customer goodwill, and 2) help you get paid....Your collection letter should: Tell the reason for your letter in the first sentence. Explain more about the first sentence in your second sentence. Suggest a solution. Thank the recipient.

A debt collection letter should include the following information: The amount the debtor owes you. The initial due date of the payment. A new due date for the payment, whether ASAP or longer. Instructions on how to pay the debt.

Collection Letter on Company Dear (name), We are writing you this letter to remind you that the payment for our services dated 23rd March 2020 is still due and we haven't received any payments till now. The due date for this payment was on 31st March 2020, but we didn't receive any check before that.

This first collection letter should include important points, such as: Days past due. Amount due. Note previous attempts to collect. Summary of account. Instructions- what would you like them to do next? Due date for payment- it is important to use an actually date, not in the next 7 business days as this can be vauge.

I would be very grateful if you would consider writing off the outstanding debt owing. I have always taken my financial responsibilities very seriously but unfortunately, my circumstances are so bad that I cannot realistically maintain payments of any kind.

Be polite, but firm, in your tone. For example, if you are writing with regard to a personal loan, you could begin by saying: "As you are aware, on date you contacted me for help regarding your delinquent car payment. I lent you the sum of dollar amount and you promised to pay back the money within time period."

Contact the creditor you've selected and ask the requirements for a letter of credit. You'll need to follow the creditor's procedures to get your letter. Provide any documents the creditor requests, such as the agreement you have with the seller and your financial documents.