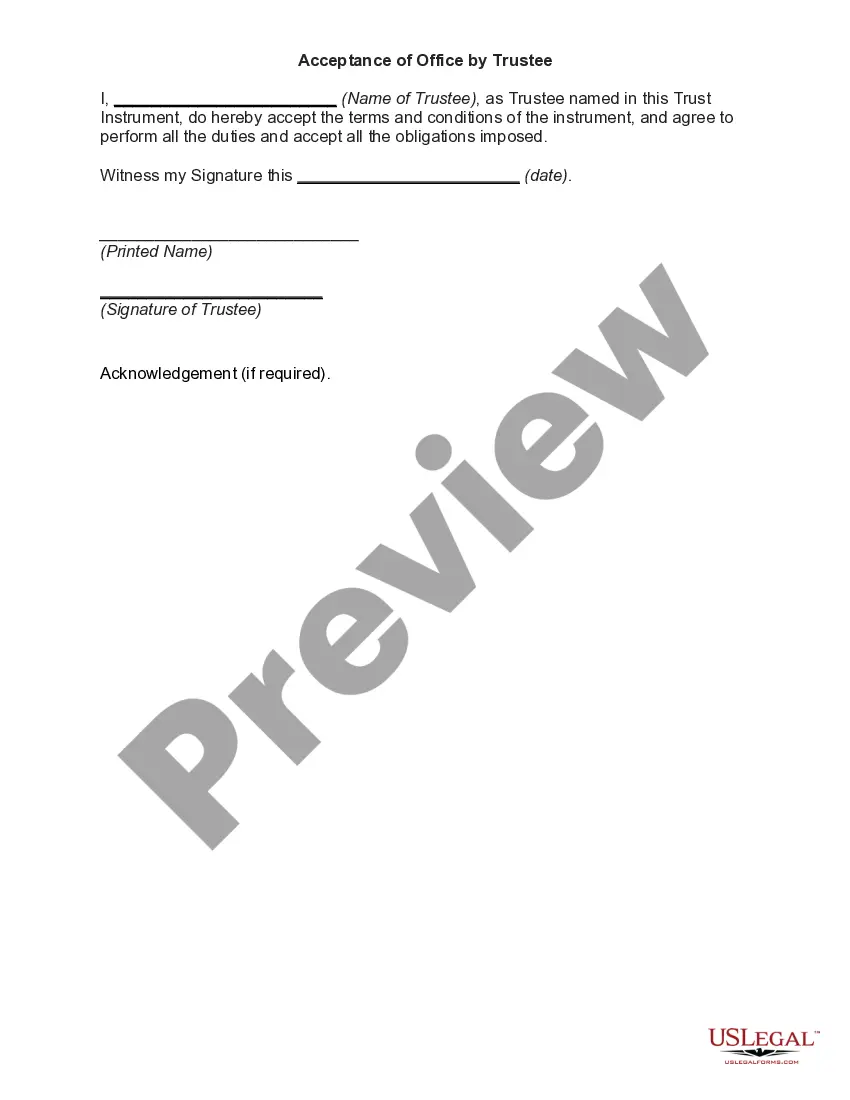

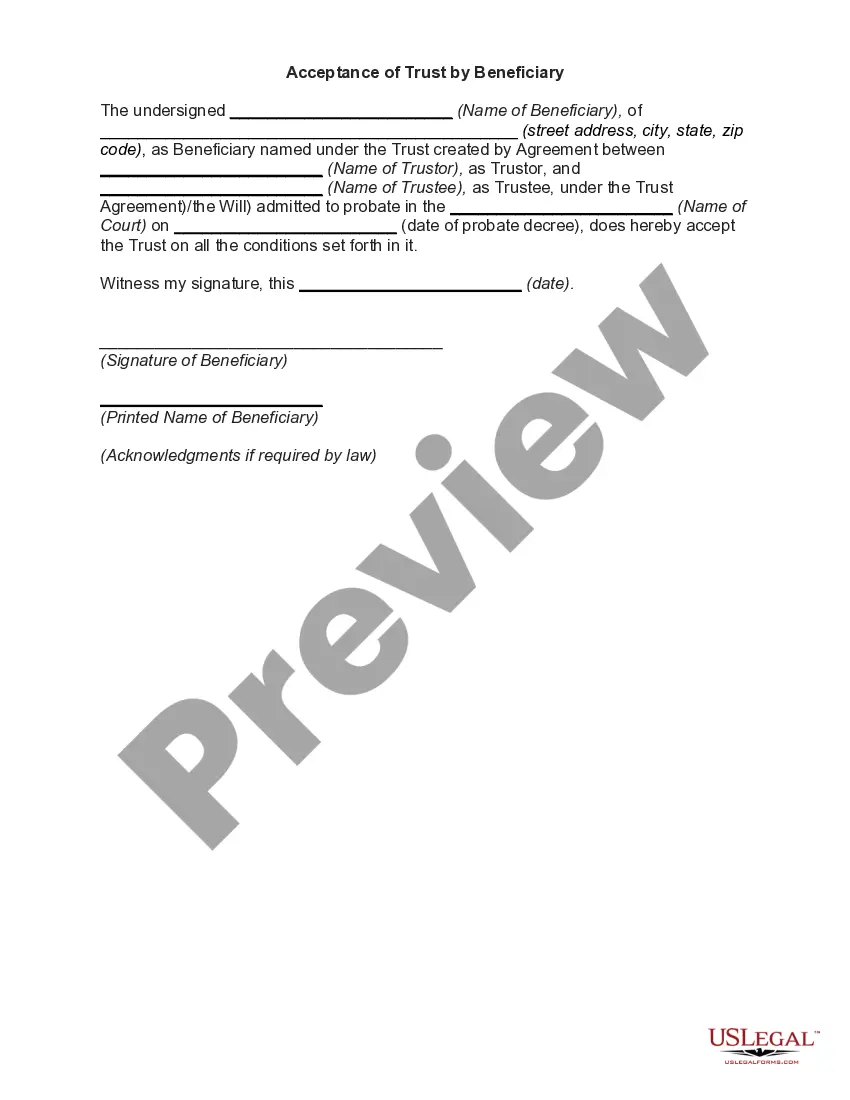

Acceptance of a trust by the person designated in the trust instrument as trustee is not necessary to the existence or validity of the trust. However, acceptance by a trustee is necessary in order to charge the trustee with the responsibilities of the office of trustee and the administration of the trust. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Dallas Texas Acceptance of Appointment by Trustee

Description

How to fill out Acceptance Of Appointment By Trustee?

Developing documents, such as Dallas Acceptance of Appointment by Trustee, to oversee your legal matters can be a challenging and lengthy endeavor.

Numerous situations necessitate the involvement of an attorney, which additionally renders this task not particularly economical.

However, you can take control of your legal matters and handle them independently.

The onboarding process for new users is equally uncomplicated! Here's what you need to do before downloading Dallas Acceptance of Appointment by Trustee.

- US Legal Forms is here to assist.

- Our platform features over 85,000 legal documents designed for diverse cases and life scenarios.

- We ensure that each document complies with the regulations of each state, so you need not be concerned about possible legal compliance issues.

- If you are already familiar with our offerings and possess a subscription with US, you understand how simple it is to obtain the Dallas Acceptance of Appointment by Trustee form.

- Proceed to Log In to your account, download the template, and tailor it to your specifications.

- Have you misplaced your form? No need to be concerned. You can retrieve it from the My documents section in your account, whether on desktop or mobile.

Form popularity

FAQ

Original trustees. Trustees will usually be appointed by the instrument that brings the trust into existence. The trust instrument should also make provision for any additional appointments that may be necessary during the continuance of the trust.

A beneficiary can override a trustee using only legal means at their disposal and claiming a breach of fiduciary duty on the Trustee's part. If the Trustee stays transparent and lives up to the trust document, there is no reason to override the Trustee.

The trustee cannot do whatever they want. They must follow the trust document, and follow the California Probate Code. More than that, Trustees don't get the benefits of the Trust. The Trust assets will pass to the Trust beneficiaries eventually.

The trustee usually has the power to retain trust property, reinvest trust property or, with or without court authorization, sell, convey, exchange, partition, and divide trust property. Typically the trustee will have the power to manage, control, improve, and maintain all real and personal trust property.

Refusing to Follow the trust The trustee cannot refuse to carry out the wishes and intent of the testator and cannot act in bad faith, refuse to represent the best interests of the beneficiaries at all times during the probate administration of the trust, and refuse to wind up close a trust.

A trustee has a fiduciary duty to act in the best interests of both current and future beneficiaries of the trust and can be held personally liable for any breach of that duty.

The trustee acts as the legal owner of trust assets, and is responsible for handling any of the assets held in trust, tax filings for the trust, and distributing the assets according to the terms of the trust. Both roles involve duties that are legally required.

A trustee is the individual appointed to administer assets or property for the benefit of a third party. A trustee could be appointed for the purpose of bankruptcy, a charity or certain kinds of retirement plans, but the most common is a trust.

Each trustee owes specific duties toward the beneficiaries, including the duty of good faith, to act in accordance with the trust deed and they have an obligation to account to the beneficiaries for their stewardship of trust assets.

Whether it is buying, selling, paying, or bartering, the Trustee calls the shots. That's just how Trusts work. The Trustee is the legal owner, meaning he has the right to make ownership decisions.