This form assumes that the Beneficiary has the right to make such an assignment, which is not always the case. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Kings New York Notice to Trustee of Assignment by Beneficiary of Interest in Trust

Description

How to fill out Kings New York Notice To Trustee Of Assignment By Beneficiary Of Interest In Trust?

A document routine always accompanies any legal activity you make. Staring a company, applying or accepting a job offer, transferring property, and lots of other life situations require you prepare formal paperwork that differs from state to state. That's why having it all collected in one place is so valuable.

US Legal Forms is the largest online collection of up-to-date federal and state-specific legal templates. Here, you can easily locate and download a document for any personal or business objective utilized in your county, including the Kings Notice to Trustee of Assignment by Beneficiary of Interest in Trust.

Locating templates on the platform is amazingly straightforward. If you already have a subscription to our service, log in to your account, find the sample through the search field, and click Download to save it on your device. Afterward, the Kings Notice to Trustee of Assignment by Beneficiary of Interest in Trust will be available for further use in the My Forms tab of your profile.

If you are using US Legal Forms for the first time, follow this simple guide to get the Kings Notice to Trustee of Assignment by Beneficiary of Interest in Trust:

- Make sure you have opened the correct page with your localised form.

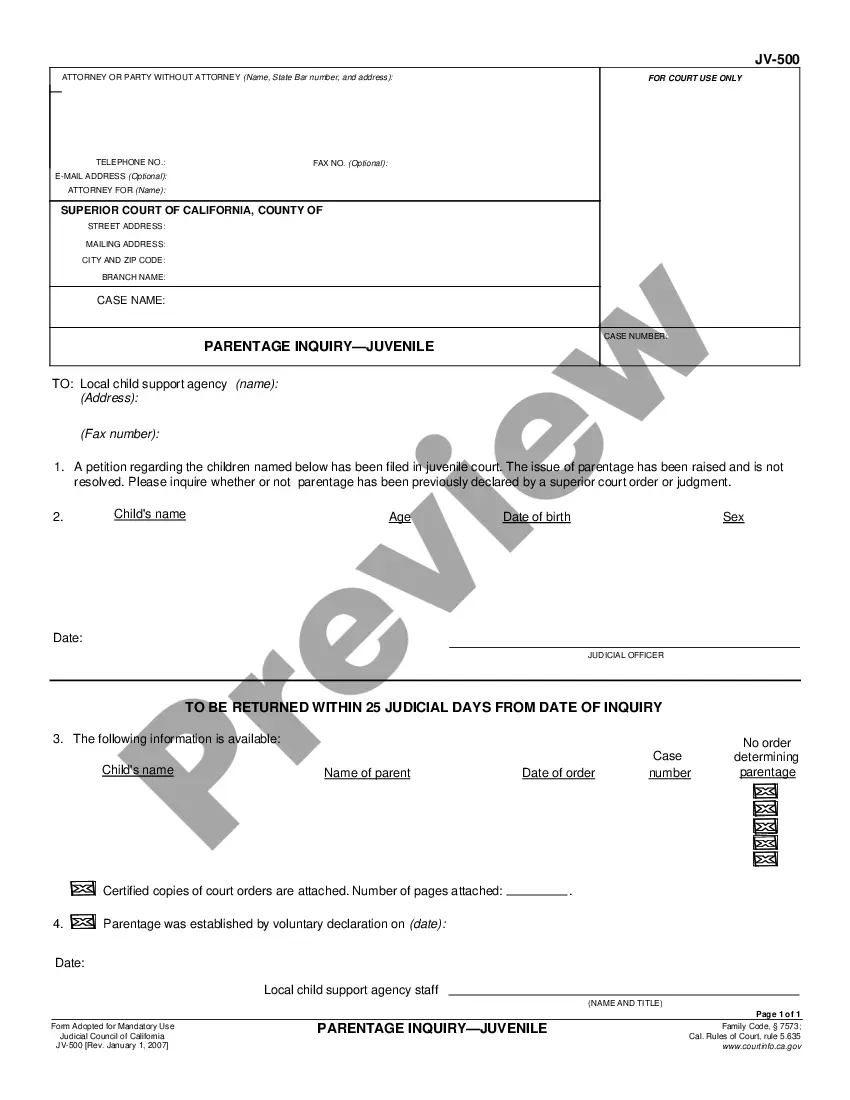

- Use the Preview mode (if available) and scroll through the template.

- Read the description (if any) to ensure the form satisfies your requirements.

- Look for another document via the search option if the sample doesn't fit you.

- Click Buy Now when you locate the required template.

- Select the appropriate subscription plan, then sign in or register for an account.

- Choose the preferred payment method (with credit card or PayPal) to proceed.

- Opt for file format and download the Kings Notice to Trustee of Assignment by Beneficiary of Interest in Trust on your device.

- Use it as needed: print it or fill it out electronically, sign it, and send where requested.

This is the simplest and most trustworthy way to obtain legal paperwork. All the templates available in our library are professionally drafted and verified for correspondence to local laws and regulations. Prepare your paperwork and run your legal affairs properly with the US Legal Forms!

Form popularity

FAQ

Usually, a trust prohibits beneficiaries from assigning their interest in the trust before distribution. The anti-assignment provision protects undistributed trust assets from claims by a beneficiary's creditors.

A beneficiary typically has a future interest in the trust's assets meaning they might access funds at a determined time, such as when the recipient reaches a certain age.

Any other business interest or sole proprietorship can generally be transferred to trust by an Assignment of Business Interest. This document assigns all property/assets owned in the name of the business, for the purpose of determining title, into your trust so that these interests will avoid probate.

Yes. In England or Wales an Executor can sell a property without beneficiaries approving, but they still have a duty to act in the best interests of beneficiaries. In cases where there is more than one Executor, Executors will have to reach an agreement about selling the property.

Is a trustee able to sell trust property? Yes. A trustee has the powers of an absolute owner and can even postpone a sale. However, in order to sell any property there must be at least two trustees able to sign the contract for sale.

A beneficiary can override a trustee using only legal means at their disposal and claiming a breach of fiduciary duty on the Trustee's part. If the Trustee stays transparent and lives up to the trust document, there is no reason to override the Trustee.

There's absolutely nothing to stop you from taking possession of an inheritance, then giving it away. Some people have good reasons for not accepting such gifts, from tax issues to simple generosity.

A letter of instruction (also known as a letter of intent) is an informal supplement to an estate plan which provides your Successor Trustee/Executor with detailed information concerning your wishes after you die.

Yes. In England or Wales an Executor can sell a property without beneficiaries approving, but they still have a duty to act in the best interests of beneficiaries. In cases where there is more than one Executor, Executors will have to reach an agreement about selling the property.

What if the beneficiary decides to simply sell his/her interest in the trust or use that interest as collateral for a loan? Can a beneficiary do that? As a general rule, trust property cannot be sold outright by a beneficiary; the property must be first transferred to the beneficiary and placed in his name.