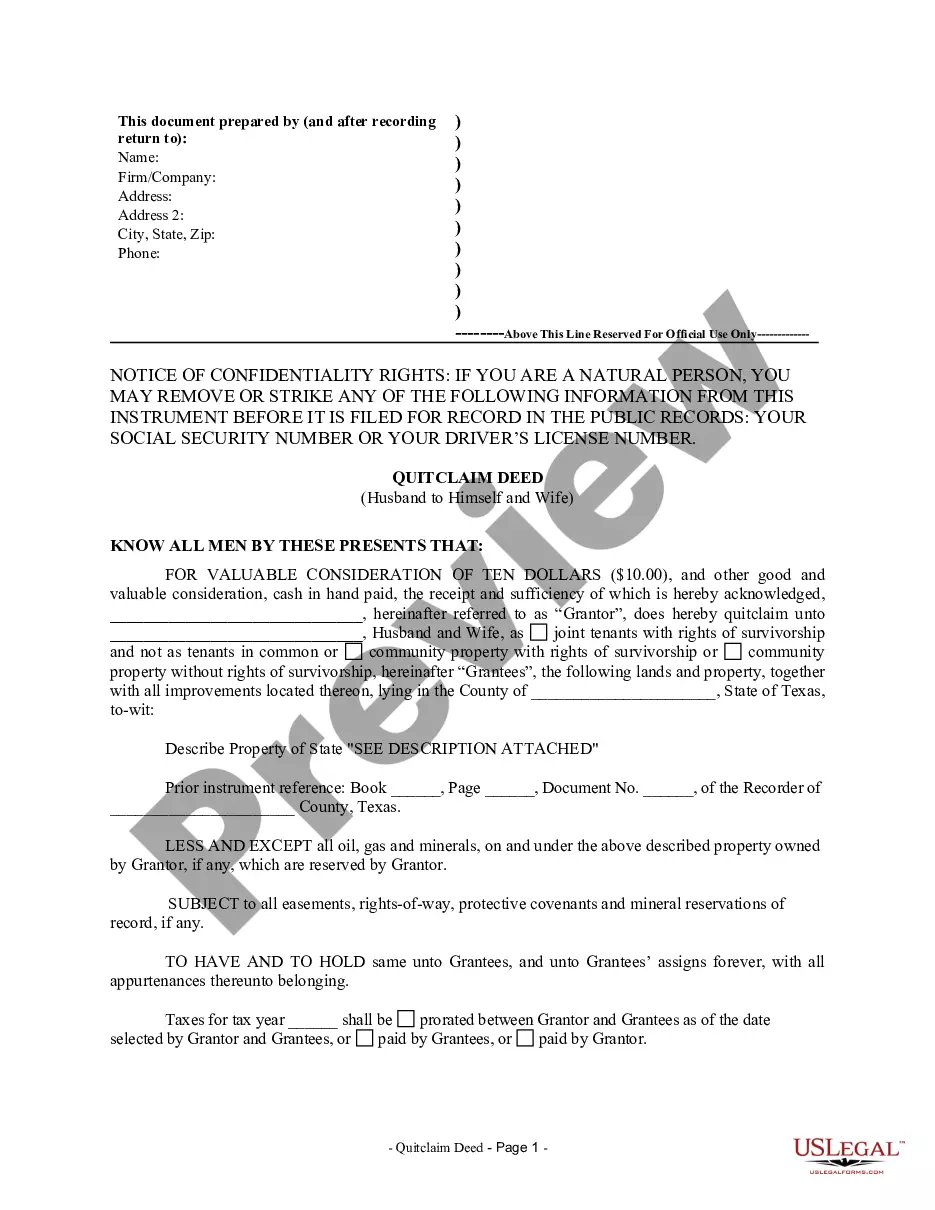

This form assumes that the Beneficiary has the right to make such an assignment, which is not always the case. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

San Diego, California is a vibrant and diverse coastal city located in the southwestern corner of the United States. Known for its stunning beaches, year-round pleasant weather, and thriving cultural scene, San Diego attracts millions of visitors each year. In the realm of legal matters, a "Notice to Trustee of Assignment by Beneficiary of Interest in Trust" is an important document used in trust administration. It is applicable when a beneficiary of a trust wishes to transfer or assign their interest in the trust to another individual or entity. This notice serves as a formal communication to the trustee, informing them of the beneficiary's decision to assign their interest. There are different types of San Diego California Notice to Trustee of Assignment by Beneficiary of Interest in Trust, which may include: 1. Irrevocable Trust Assignment Notice: This type of notice is used when a beneficiary of an irrevocable trust decides to transfer their interest to another party. Irrevocable trusts come with more restrictions, often requiring court approval for any assignment of interest. 2. Revocable Trust Assignment Notice: Revocable trusts offer more flexibility, allowing the settler (the person who established the trust) to make changes, including assigning their interest to another beneficiary. This notice informs the trustee of such a transfer. 3. Testamentary Trust Assignment Notice: Testamentary trusts are created through a person's will and only take effect upon their passing. If a beneficiary wishes to assign their interest in such a trust, a Testamentary Trust Assignment Notice would be used to notify the trustee of the intended transfer. When drafting a San Diego California Notice to Trustee of Assignment by Beneficiary of Interest in Trust, it is crucial to include relevant keywords to ensure clarity and accuracy. These may include trust administration, beneficiary assignment, trust transfer, irrevocable trust, revocable trust, testamentary trust, San Diego, California, legal document, trust law, and estate planning. Remember, it is always advisable to consult an experienced attorney or legal professional specializing in trust administration to ensure compliance with state laws and to accurately complete the required documents.