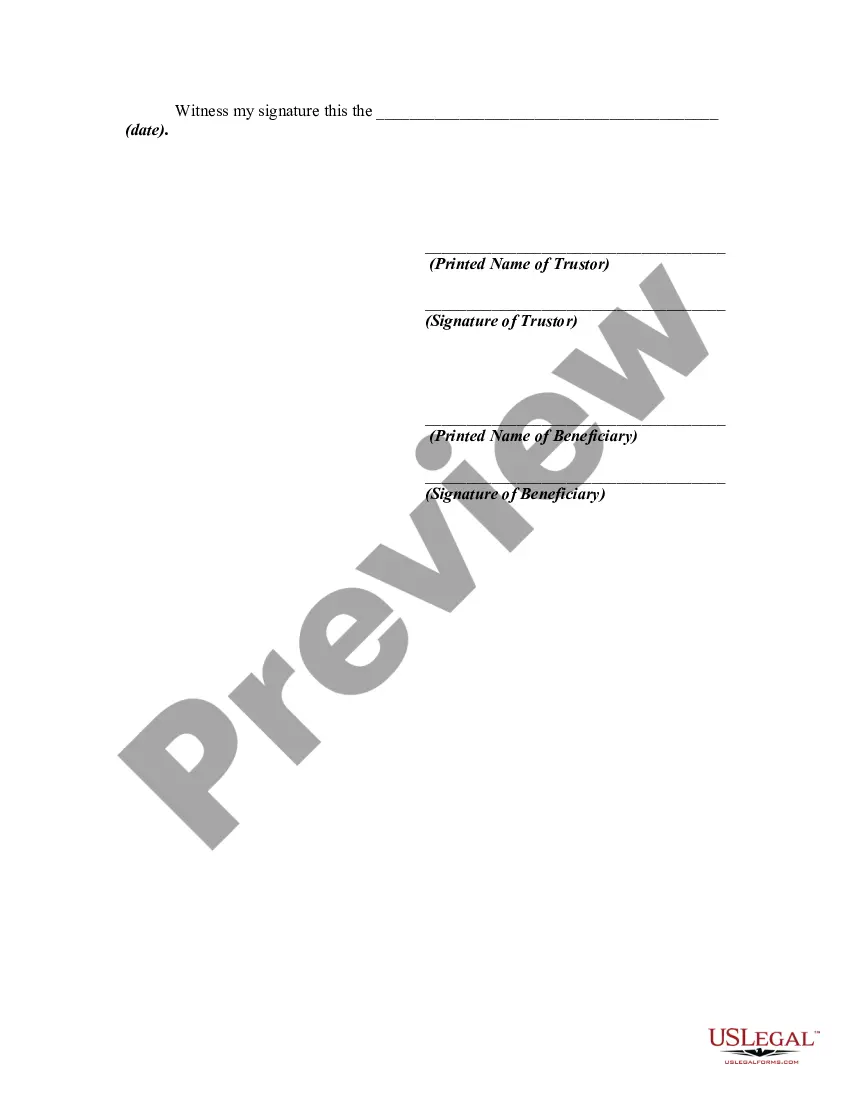

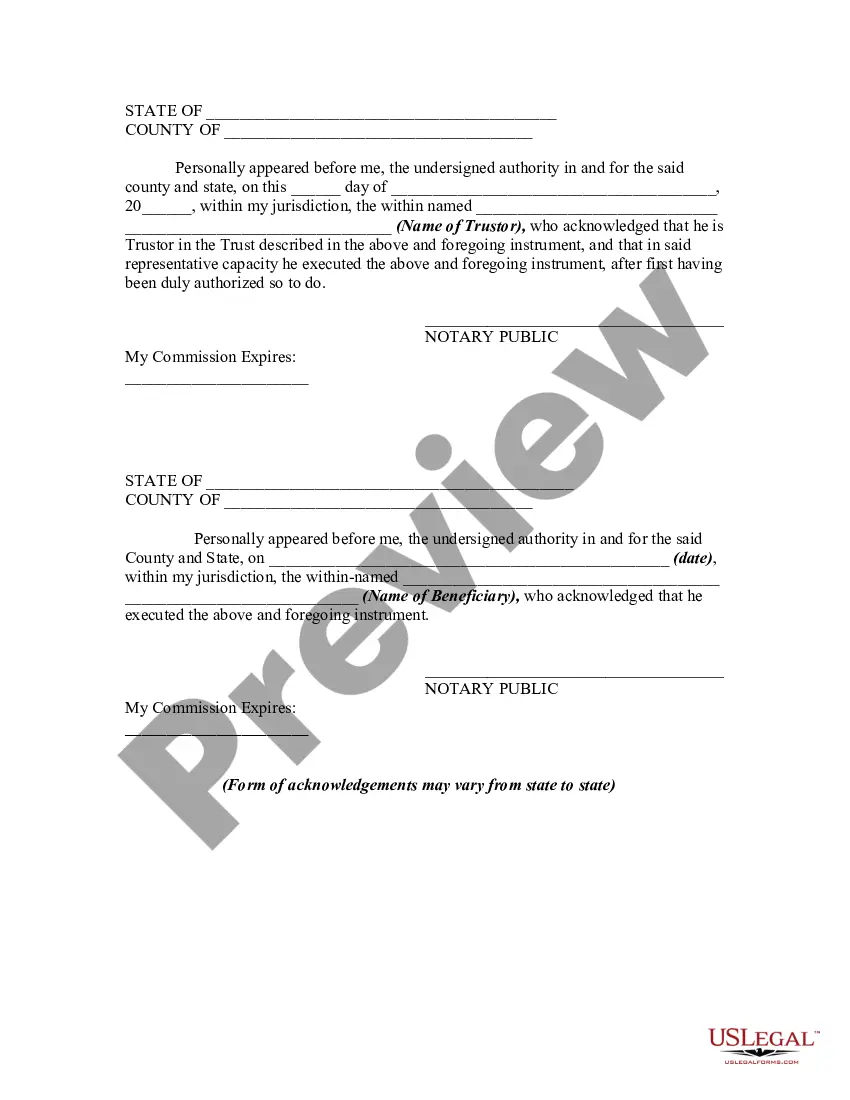

In this form, the trustor exercises his right to terminate a trust by setting a date in the future for the trust to terminate. However, trustor and beneficiary agree that the trust will not terminate prior to that date and that trustor cancels, waives, and relinquishes the right he has under the trust to terminate it on a date earlier than the date he has set in this instrument. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Chicago, Illinois is a bustling city known for its rich history, iconic architecture, vibrant cultural scene, and diverse population. Located in the heart of the Midwest, Chicago offers a unique blend of urban charm and Midwestern hospitality. When it comes to estate planning, one key element to consider is the setting termination date and release by trust or of the right to revoke trust before the termination date. A trust is a legal arrangement where a trust or transfers their assets to a trustee to be managed for the benefit of the beneficiaries. In Chicago, there are different types of termination dates and releases that can be utilized by trustees to ensure the smooth administration of their trusts. 1. Fixed Termination Date: This type of termination date sets a specific date on which the trust will end, and the trust assets will be distributed to the beneficiaries. It provides a clear timeline for the termination of the trust, which can be beneficial when planning for specific events, such as the beneficiaries reaching a certain age or milestone. 2. Event-based Termination: This type of termination date is based on a specific event happening or not happening. For example, a trust may specify that it will terminate once a beneficiary gets married, graduates from college, or reaches a certain financial goal. This allows the trust or to align the trust's termination with important life events. 3. Revocable Trust: A revocable trust allows the trust or to maintain control over the assets and make changes or revoke the trust entirely before the termination date. The trust or has the right to modify or terminate the trust as per their wishes without any restrictions. This flexibility can be particularly useful if circumstances change or if the trust or wishes to restructure their estate plan. 4. Irrevocable Trust: Unlike a revocable trust, an irrevocable trust cannot be modified, amended, or revoked by the trust or once it is established. However, in some cases, a trust or may include a provision that allows them to release their right to revoke the trust before the termination date. This provision grants the trust or the ability to reclaim control over the trust assets under certain circumstances. Setting a termination date and including a release provision in a trust is a crucial step in estate planning. It ensures that the trust assets are distributed according to the trust or's wishes and that the trust administration process is carried out smoothly. Before making any decisions, it is always advisable for trustees in Chicago, Illinois, to consult with an experienced estate planning attorney who can provide personalized advice based on their unique circumstances.Chicago, Illinois is a bustling city known for its rich history, iconic architecture, vibrant cultural scene, and diverse population. Located in the heart of the Midwest, Chicago offers a unique blend of urban charm and Midwestern hospitality. When it comes to estate planning, one key element to consider is the setting termination date and release by trust or of the right to revoke trust before the termination date. A trust is a legal arrangement where a trust or transfers their assets to a trustee to be managed for the benefit of the beneficiaries. In Chicago, there are different types of termination dates and releases that can be utilized by trustees to ensure the smooth administration of their trusts. 1. Fixed Termination Date: This type of termination date sets a specific date on which the trust will end, and the trust assets will be distributed to the beneficiaries. It provides a clear timeline for the termination of the trust, which can be beneficial when planning for specific events, such as the beneficiaries reaching a certain age or milestone. 2. Event-based Termination: This type of termination date is based on a specific event happening or not happening. For example, a trust may specify that it will terminate once a beneficiary gets married, graduates from college, or reaches a certain financial goal. This allows the trust or to align the trust's termination with important life events. 3. Revocable Trust: A revocable trust allows the trust or to maintain control over the assets and make changes or revoke the trust entirely before the termination date. The trust or has the right to modify or terminate the trust as per their wishes without any restrictions. This flexibility can be particularly useful if circumstances change or if the trust or wishes to restructure their estate plan. 4. Irrevocable Trust: Unlike a revocable trust, an irrevocable trust cannot be modified, amended, or revoked by the trust or once it is established. However, in some cases, a trust or may include a provision that allows them to release their right to revoke the trust before the termination date. This provision grants the trust or the ability to reclaim control over the trust assets under certain circumstances. Setting a termination date and including a release provision in a trust is a crucial step in estate planning. It ensures that the trust assets are distributed according to the trust or's wishes and that the trust administration process is carried out smoothly. Before making any decisions, it is always advisable for trustees in Chicago, Illinois, to consult with an experienced estate planning attorney who can provide personalized advice based on their unique circumstances.