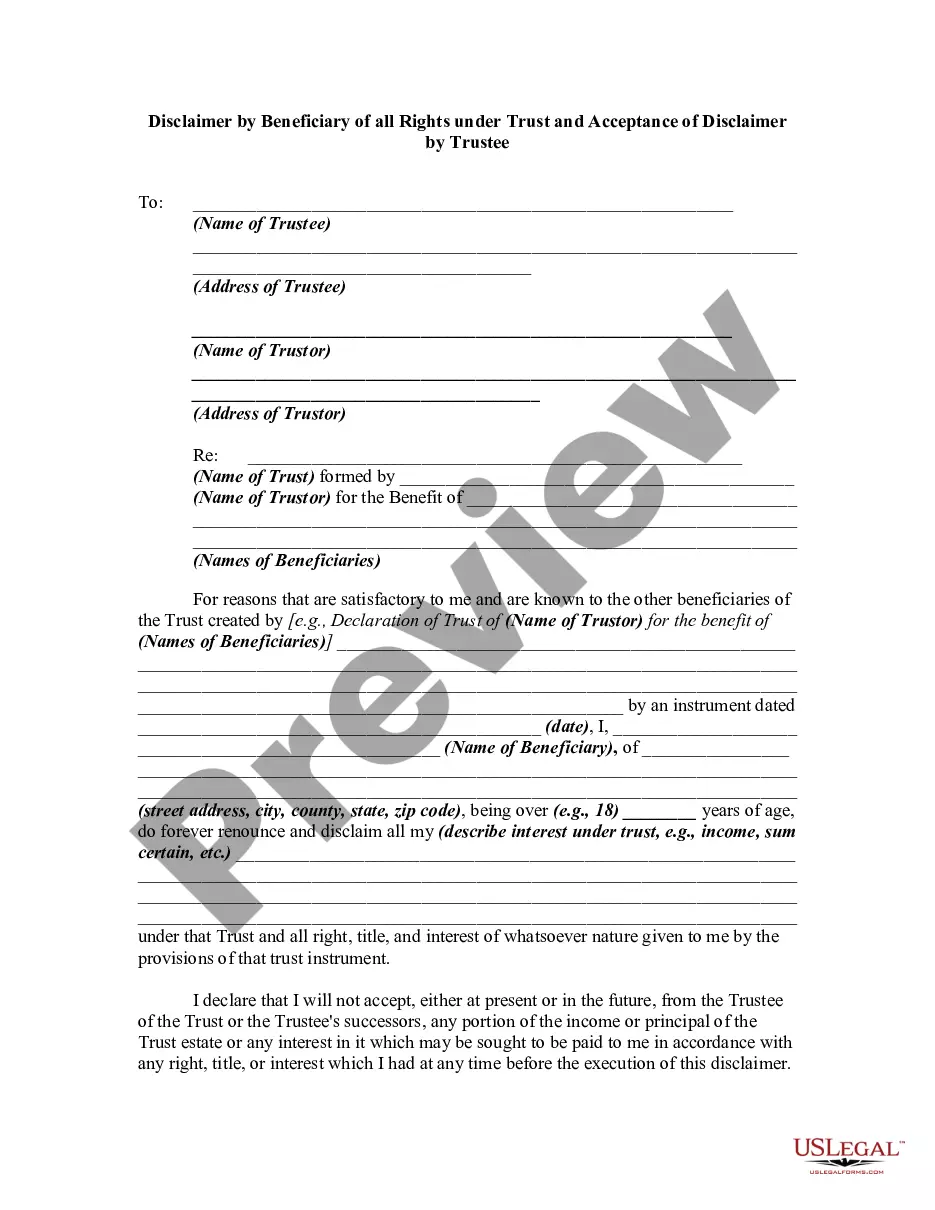

A disclaimer is a denial or renunciation of something. A disclaimer may be the act of a party by which be refuses to accept an estate which has been conveyed to him. In this instrument, the beneficiary of a trust is disclaiming any rights he has in the trust.

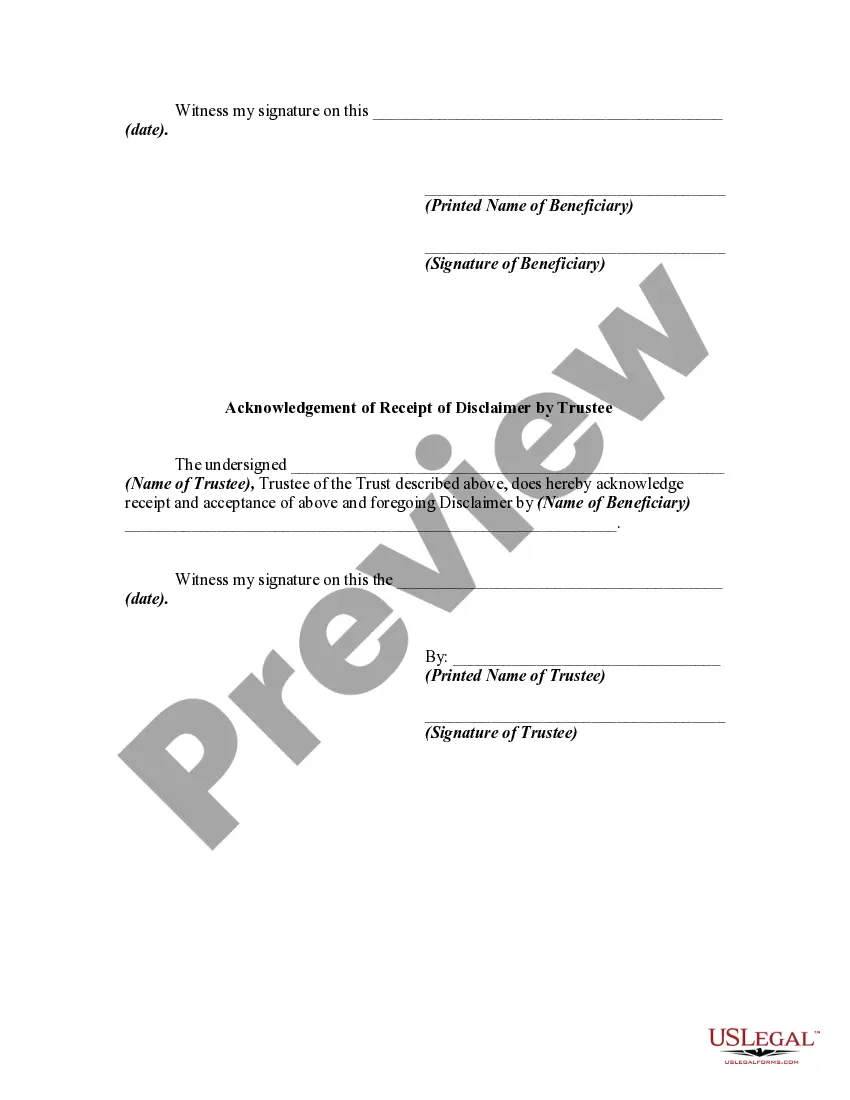

Cook Illinois Disclaimer is a legal document that addresses the relinquishment of all rights and interests under a trust by a beneficiary, and the subsequent acceptance of this disclaimer by the trustee. A Cook Illinois Disclaimer can arise in various situations where a beneficiary decides to forego their rights and interests in a trust to avoid potential tax consequences or other legal implications. By accepting the disclaimer, the trustee assumes full responsibility for managing the trust assets without any interference from the disclaiming beneficiary. There are several types of Cook Illinois Disclaimer by Beneficiary of all Rights under Trust and Acceptance of Disclaimer by Trustee. These include: 1. General Disclaimer: This type of disclaimer is a broad relinquishment of all rights and interests the beneficiary would have had in the trust. By disclaiming, the beneficiary renounces their entitlement to the assets and allows the trust to be distributed to the alternate beneficiaries or follow the trust's distribution provisions. 2. Partial Disclaimer: In certain cases, a beneficiary may want to disclaim only a portion of their interest in the trust. This type of disclaimer allows the beneficiary to choose which part of their entitlement they would like to relinquish, while still retaining some rights in the trust. 3. Qualified Disclaimer: A qualified disclaimer is designed to meet specific requirements outlined by the Internal Revenue Service (IRS). By disclaiming in a qualified manner, the beneficiary can potentially avoid certain tax consequences that would have otherwise applied to the trust assets. 4. Non-Qualified Disclaimer: Unlike a qualified disclaimer, a non-qualified disclaimer does not meet the requirements set by the IRS. This means that disclaiming in a non-qualified manner may result in tax implications for the beneficiary or the trust. It is important to note that Cook Illinois Disclaimers must comply with specific legal requirements, including the timing of the disclaimer and the method of delivery to the trustee. Seeking professional advice from an attorney or trust advisor is recommended to ensure compliance with all legal obligations. The precise terms and conditions of a Cook Illinois Disclaimer by Beneficiary of all Rights under Trust and Acceptance of Disclaimer by Trustee may vary depending on the specific trust agreement and the intentions of the involved parties.Cook Illinois Disclaimer is a legal document that addresses the relinquishment of all rights and interests under a trust by a beneficiary, and the subsequent acceptance of this disclaimer by the trustee. A Cook Illinois Disclaimer can arise in various situations where a beneficiary decides to forego their rights and interests in a trust to avoid potential tax consequences or other legal implications. By accepting the disclaimer, the trustee assumes full responsibility for managing the trust assets without any interference from the disclaiming beneficiary. There are several types of Cook Illinois Disclaimer by Beneficiary of all Rights under Trust and Acceptance of Disclaimer by Trustee. These include: 1. General Disclaimer: This type of disclaimer is a broad relinquishment of all rights and interests the beneficiary would have had in the trust. By disclaiming, the beneficiary renounces their entitlement to the assets and allows the trust to be distributed to the alternate beneficiaries or follow the trust's distribution provisions. 2. Partial Disclaimer: In certain cases, a beneficiary may want to disclaim only a portion of their interest in the trust. This type of disclaimer allows the beneficiary to choose which part of their entitlement they would like to relinquish, while still retaining some rights in the trust. 3. Qualified Disclaimer: A qualified disclaimer is designed to meet specific requirements outlined by the Internal Revenue Service (IRS). By disclaiming in a qualified manner, the beneficiary can potentially avoid certain tax consequences that would have otherwise applied to the trust assets. 4. Non-Qualified Disclaimer: Unlike a qualified disclaimer, a non-qualified disclaimer does not meet the requirements set by the IRS. This means that disclaiming in a non-qualified manner may result in tax implications for the beneficiary or the trust. It is important to note that Cook Illinois Disclaimers must comply with specific legal requirements, including the timing of the disclaimer and the method of delivery to the trustee. Seeking professional advice from an attorney or trust advisor is recommended to ensure compliance with all legal obligations. The precise terms and conditions of a Cook Illinois Disclaimer by Beneficiary of all Rights under Trust and Acceptance of Disclaimer by Trustee may vary depending on the specific trust agreement and the intentions of the involved parties.