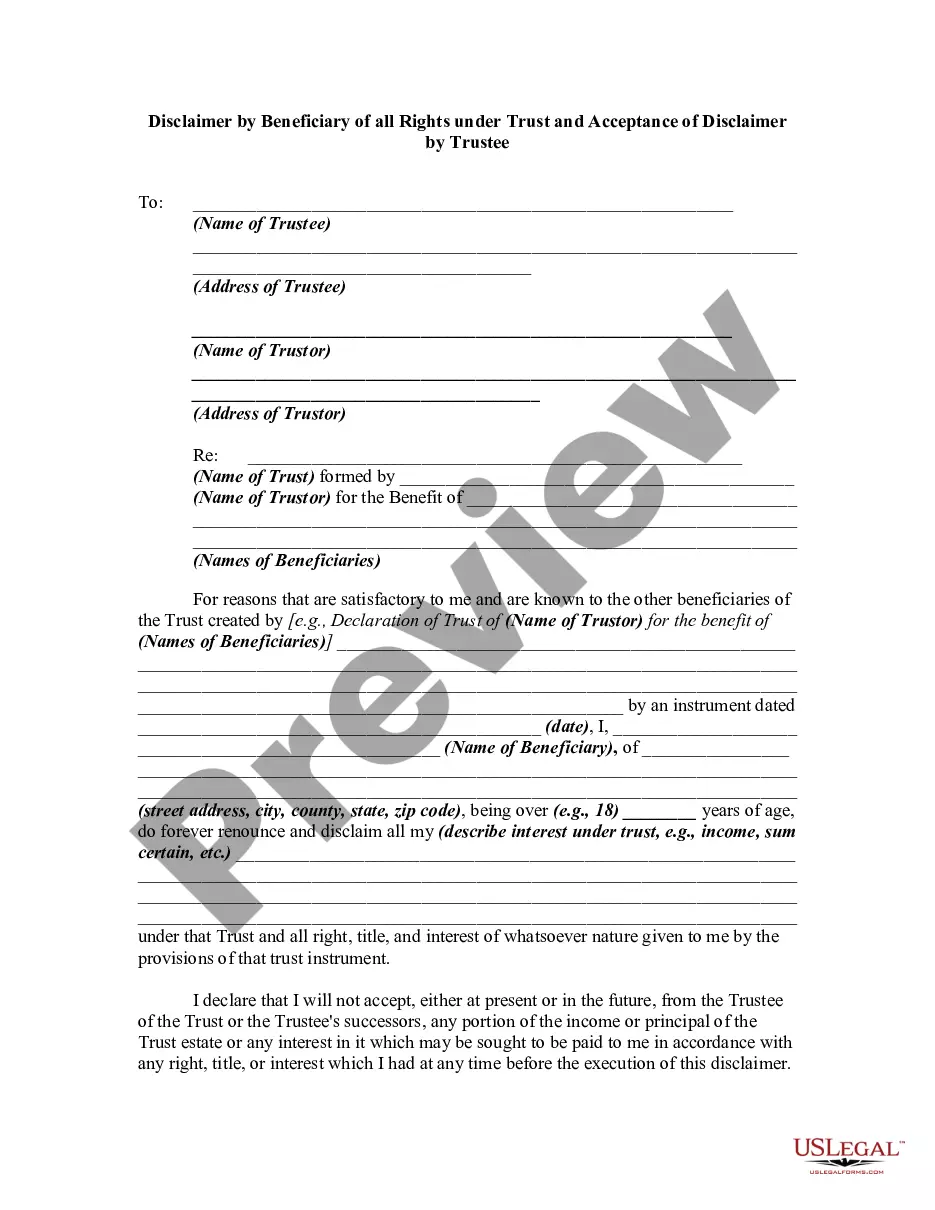

A disclaimer is a denial or renunciation of something. A disclaimer may be the act of a party by which be refuses to accept an estate which has been conveyed to him. In this instrument, the beneficiary of a trust is disclaiming any rights he has in the trust.

Fulton Georgia Disclaimer by Beneficiary of all Rights under Trust and Acceptance of Disclaimer by Trustee is a legal document that outlines the relinquishment of rights and responsibilities by a beneficiary under a trust, and the subsequent acceptance of this disclaimer by the trustee. This document is commonly used in trust administration to establish the terms of disclaiming any rights or interests in the assets or property held in trust. In Fulton, Georgia, there are several types of disclaimers that a beneficiary may choose to make under a trust, each with its own implications. Some common types include: 1. General Disclaimer: A general disclaimer is a broad statement made by a beneficiary disclaiming any and all rights under the trust. By giving up these rights, the beneficiary effectively declines any entitlement to the trust's assets or property. The trustee must accept this disclaimer and take appropriate actions to distribute the property according to the terms of the trust or applicable state laws. 2. Partial Disclaimer: Unlike a general disclaimer, a partial disclaimer allows a beneficiary to disclaim only a portion of their rights or interests under the trust. This can be useful if the beneficiary wishes to forego certain assets or property, while still maintaining their entitlement to others. The trustee must acknowledge and accept the partial disclaimer to proceed with the administration of the trust. 3. Qualified Disclaimer: A qualified disclaimer is a more specialized form of disclaimer that allows a beneficiary to disclaim their rights with specific conditions or restrictions. Depending on the circumstances, a qualified disclaimer might be used to redirect assets to another beneficiary or to meet certain tax planning objectives. The trustee must carefully review and accept the qualified disclaimer, ensuring that it is in compliance with applicable laws and guidelines. It is important to note that a Fulton Georgia Disclaimer by Beneficiary of all Rights under Trust and Acceptance of Disclaimer by Trustee is a legal document that should be drafted and executed with the assistance of an experienced attorney. The legal intricacies and potential tax implications involved in disclaiming trust assets require careful consideration and professional guidance to ensure compliance with all applicable laws and regulations.Fulton Georgia Disclaimer by Beneficiary of all Rights under Trust and Acceptance of Disclaimer by Trustee is a legal document that outlines the relinquishment of rights and responsibilities by a beneficiary under a trust, and the subsequent acceptance of this disclaimer by the trustee. This document is commonly used in trust administration to establish the terms of disclaiming any rights or interests in the assets or property held in trust. In Fulton, Georgia, there are several types of disclaimers that a beneficiary may choose to make under a trust, each with its own implications. Some common types include: 1. General Disclaimer: A general disclaimer is a broad statement made by a beneficiary disclaiming any and all rights under the trust. By giving up these rights, the beneficiary effectively declines any entitlement to the trust's assets or property. The trustee must accept this disclaimer and take appropriate actions to distribute the property according to the terms of the trust or applicable state laws. 2. Partial Disclaimer: Unlike a general disclaimer, a partial disclaimer allows a beneficiary to disclaim only a portion of their rights or interests under the trust. This can be useful if the beneficiary wishes to forego certain assets or property, while still maintaining their entitlement to others. The trustee must acknowledge and accept the partial disclaimer to proceed with the administration of the trust. 3. Qualified Disclaimer: A qualified disclaimer is a more specialized form of disclaimer that allows a beneficiary to disclaim their rights with specific conditions or restrictions. Depending on the circumstances, a qualified disclaimer might be used to redirect assets to another beneficiary or to meet certain tax planning objectives. The trustee must carefully review and accept the qualified disclaimer, ensuring that it is in compliance with applicable laws and guidelines. It is important to note that a Fulton Georgia Disclaimer by Beneficiary of all Rights under Trust and Acceptance of Disclaimer by Trustee is a legal document that should be drafted and executed with the assistance of an experienced attorney. The legal intricacies and potential tax implications involved in disclaiming trust assets require careful consideration and professional guidance to ensure compliance with all applicable laws and regulations.