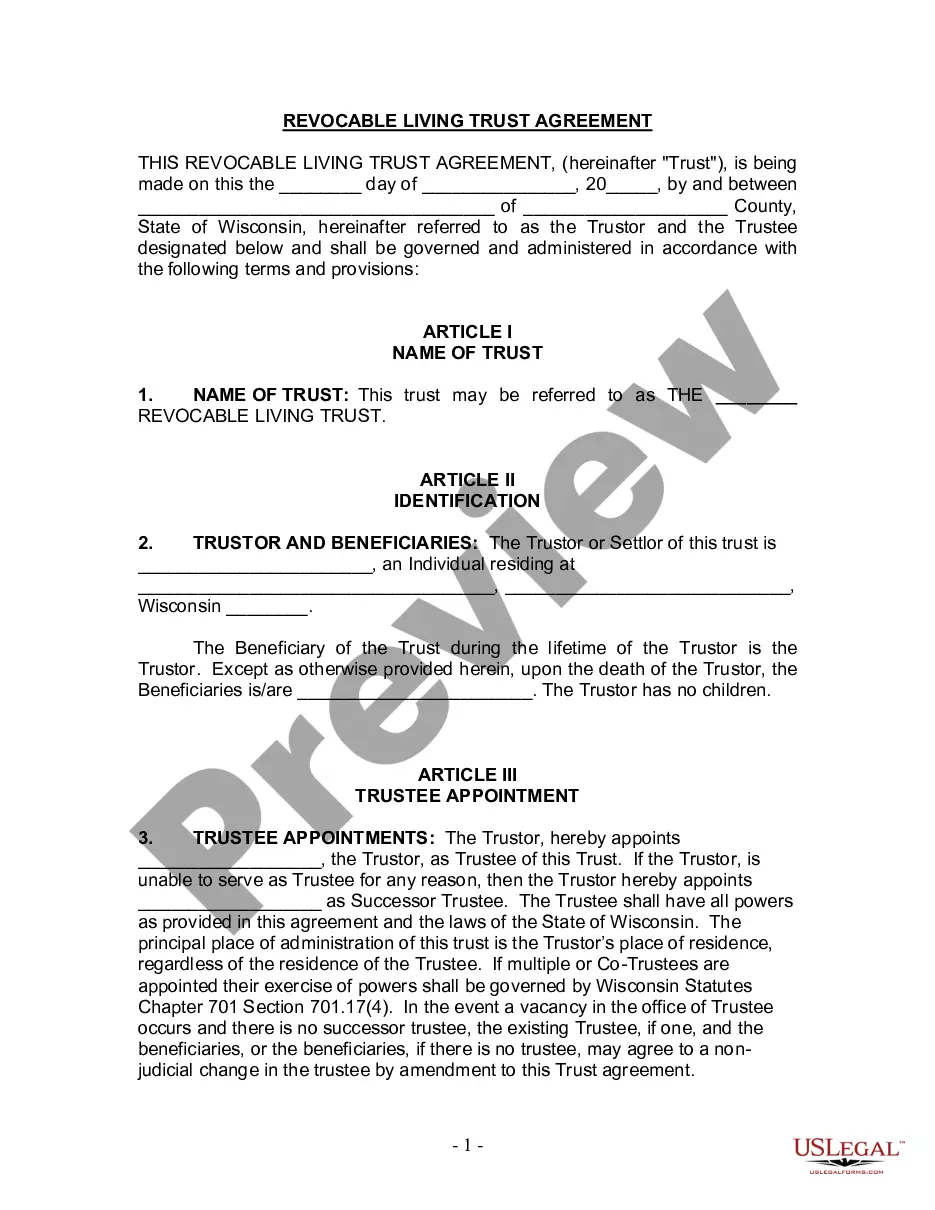

A disclaimer is a denial or renunciation of something. A disclaimer may be the act of a party by which be refuses to accept an estate which has been conveyed to him. In this instrument, the beneficiary of a trust is disclaiming any rights he has in the trust.

Title: Wayne Michigan Disclaimer by Beneficiary of all Rights under Trust and Acceptance of Disclaimer by Trustee Explained Introduction: In the realm of estate planning, Wayne, Michigan, provides a legal mechanism known as a disclaimer by beneficiary of all rights under trust and acceptance of disclaimer by trustee. This important legal document allows beneficiaries to renounce their rights and interests in a trust, while trustees formally accept and acknowledge this disclaimer. In this article, we will explore the concept of this disclaimer, its significance, and the different types that may exist in Wayne, Michigan. Understanding the Wayne Michigan Disclaimer by Beneficiary of all Rights under Trust: 1. The Basic Idea: A disclaimer by beneficiary of all rights under trust refers to the beneficiary's decision to refuse or disclaim their interest in a trust, which in turn alters the distribution of assets and responsibilities outlined in the trust document. The trustee, who oversees and manages the trust assets, plays a crucial role in accepting the beneficiary's disclaimer. 2. Significance and Implications: — Flexibility: The disclaimer provides beneficiaries with the flexibility to modify the distribution of assets according to their unique circumstances or personal preferences. — Tax Planning: Disclaimers are often utilized as part of effective estate and tax planning strategies, allowing beneficiaries to redirect assets to other family members or minimize potential tax burdens. — Asset Protection: Disclaiming the rights under trust may be beneficial if the beneficiary faces claims from creditors or wants to protect their assets from potential legal liabilities. Types of Wayne Michigan Disclaimer by Beneficiary of all Rights under Trust: 1. Full Disclaimer: The beneficiary renounces and disclaims their entire interest in the trust, ensuring that they won't receive anything from the trust and their rights are no longer enforceable. 2. Partial Disclaimer: Alternatively, a beneficiary may choose to partially disclaim their interest, relinquishing some specific assets or a portion of their entitlement. The remaining assets will be distributed according to the trust terms. 3. Conditional Disclaimer: This type of disclaimer is executed with specific conditions or contingencies. Conditions could be related to events such as the occurrence of a particular circumstance, the approval of certain individuals, or other criteria defined within the disclaimer itself. Conclusion: The Wayne Michigan Disclaimer by Beneficiary of all Rights under Trust, combined with the acceptance by the trustee, offers significant flexibility and benefits in estate planning. By renouncing or partially disclaiming their rights, beneficiaries can shape the distribution of trust assets in a manner that aligns with their unique circumstances. It is crucial for both beneficiaries and trustees to fully comprehend the implications of these disclaimers and consult with legal professionals to ensure compliance with Michigan state laws.