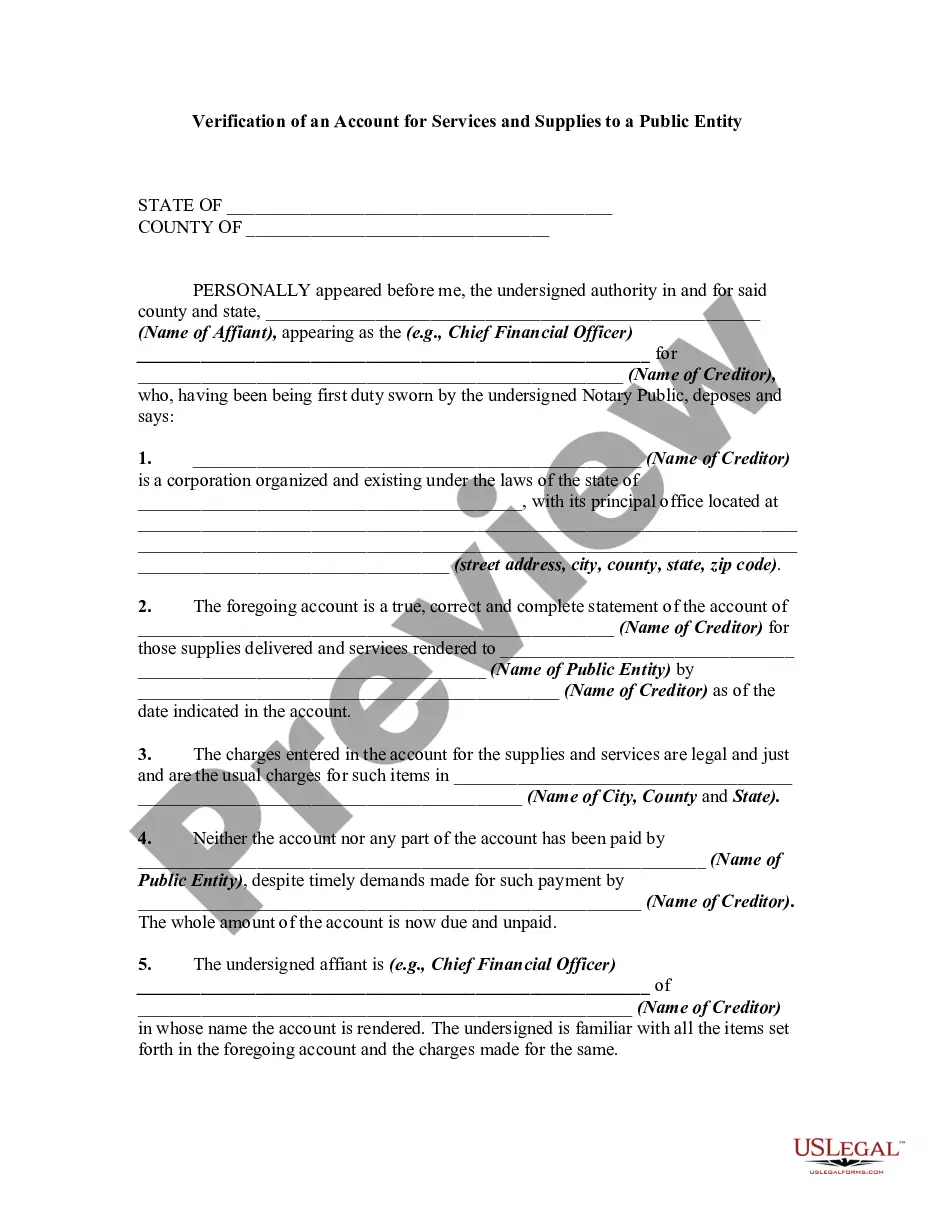

An account is an unsettled claim or demand by one person against another based on a transaction creating a debtor-creditor relationship between the parties. A verified account usually takes the form of an affidavit, in which a statement of an account is verified under oath as to the accuracy of the account. Ordinarily, where an action is based on an itemized account, the correctness of which is verified, the account is taken as true. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Travis Texas Verification of an Account for Services and Supplies to a Public Entity is a crucial process that ensures accountability and transparency in all financial transactions between service providers or supply vendors and public entities in Travis County, Texas. It is a necessary step to safeguard the interests of both parties involved and maintain the integrity of financial operations within the public sector. The Travis Texas Verification of an Account for Services and Supplies to a Public Entity involves a thorough review and verification of invoices, purchase orders, and other relevant documentation related to the services or supplies provided. This verification process ensures that all charges are accurate, legitimate, and in accordance with the agreed-upon terms and conditions. Keywords: Travis Texas, verification of account, services, supplies, public entity, financial transactions, accountability, transparency, service providers, supply vendors, Travis County, Texas, necessary step, safeguard interests, integrity, financial operations, review, invoices, purchase orders, documentation, charges, accurate, legitimate, terms and conditions. Different types of Travis Texas Verification of an Account for Services and Supplies to a Public Entity may include: 1. Initial Verification: This is the first step in the process where all relevant documents are reviewed for accuracy and completeness. It involves comparing invoices, purchase orders, and service agreements to ensure they align with the requirements set by the public entity. 2. Compliance Verification: This stage focuses on verifying whether the services or supplies provided comply with all applicable laws, regulations, and contractual obligations. It ensures that the vendor or service provider has met all the necessary compliance requirements before payment is made. 3. Price Verification: This involves verifying the pricing details provided by the vendor or service provider. It ensures that the prices charged are reasonable and consistent with prevailing market rates. Price verification helps prevent overcharging or fraudulent pricing practices. 4. Documentation Verification: This step ensures that all supporting documentation, such as delivery receipts, work performance documents, and completion certificates, are provided and accurately reflect the scope and quality of the services or supplies rendered. 5. Audit Trail Verification: This process involves ensuring the existence of a proper audit trail for all financial transactions. It includes verifying the accuracy and integrity of financial records, such as invoices, receipts, and payment documentation, to maintain a clear and transparent financial history. 6. Payment Verification: This final stage involves confirming the accuracy of payment details, such as the amount, payment terms, and recipient. It ensures that the payment is made in a timely manner and to the correct entity or individual. In summary, Travis Texas Verification of an Account for Services and Supplies to a Public Entity is a comprehensive process that evaluates the accuracy, compliance, pricing, documentation, and payment aspects of transactions between service providers or supply vendors and public entities. Through various verification steps, it ensures transparency, accountability, and efficient financial management in the public sector.Travis Texas Verification of an Account for Services and Supplies to a Public Entity is a crucial process that ensures accountability and transparency in all financial transactions between service providers or supply vendors and public entities in Travis County, Texas. It is a necessary step to safeguard the interests of both parties involved and maintain the integrity of financial operations within the public sector. The Travis Texas Verification of an Account for Services and Supplies to a Public Entity involves a thorough review and verification of invoices, purchase orders, and other relevant documentation related to the services or supplies provided. This verification process ensures that all charges are accurate, legitimate, and in accordance with the agreed-upon terms and conditions. Keywords: Travis Texas, verification of account, services, supplies, public entity, financial transactions, accountability, transparency, service providers, supply vendors, Travis County, Texas, necessary step, safeguard interests, integrity, financial operations, review, invoices, purchase orders, documentation, charges, accurate, legitimate, terms and conditions. Different types of Travis Texas Verification of an Account for Services and Supplies to a Public Entity may include: 1. Initial Verification: This is the first step in the process where all relevant documents are reviewed for accuracy and completeness. It involves comparing invoices, purchase orders, and service agreements to ensure they align with the requirements set by the public entity. 2. Compliance Verification: This stage focuses on verifying whether the services or supplies provided comply with all applicable laws, regulations, and contractual obligations. It ensures that the vendor or service provider has met all the necessary compliance requirements before payment is made. 3. Price Verification: This involves verifying the pricing details provided by the vendor or service provider. It ensures that the prices charged are reasonable and consistent with prevailing market rates. Price verification helps prevent overcharging or fraudulent pricing practices. 4. Documentation Verification: This step ensures that all supporting documentation, such as delivery receipts, work performance documents, and completion certificates, are provided and accurately reflect the scope and quality of the services or supplies rendered. 5. Audit Trail Verification: This process involves ensuring the existence of a proper audit trail for all financial transactions. It includes verifying the accuracy and integrity of financial records, such as invoices, receipts, and payment documentation, to maintain a clear and transparent financial history. 6. Payment Verification: This final stage involves confirming the accuracy of payment details, such as the amount, payment terms, and recipient. It ensures that the payment is made in a timely manner and to the correct entity or individual. In summary, Travis Texas Verification of an Account for Services and Supplies to a Public Entity is a comprehensive process that evaluates the accuracy, compliance, pricing, documentation, and payment aspects of transactions between service providers or supply vendors and public entities. Through various verification steps, it ensures transparency, accountability, and efficient financial management in the public sector.