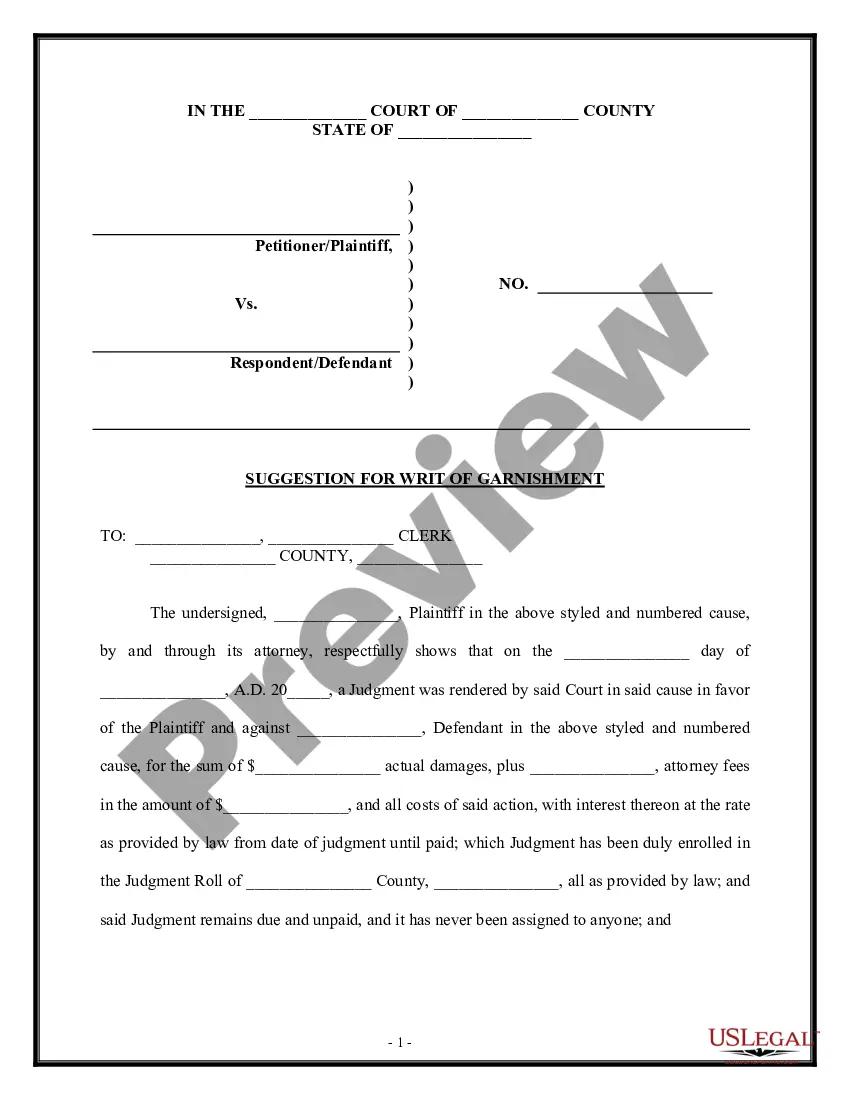

An open account is an account based on continuous dealing between the parties, which has not been closed, settled or stated, and which is kept open with the expectation of further transactions. An open account is created when the parties intend that the individual items of the account will not be considered independently, but as a connected series of transactions. In addition, the parties must intend that the account will be kept open and subject to a shifting balance as additional related entries of debits and credits are made, until either party decides to settle and close the account. This form is a complaint against a guarantor of such an account.

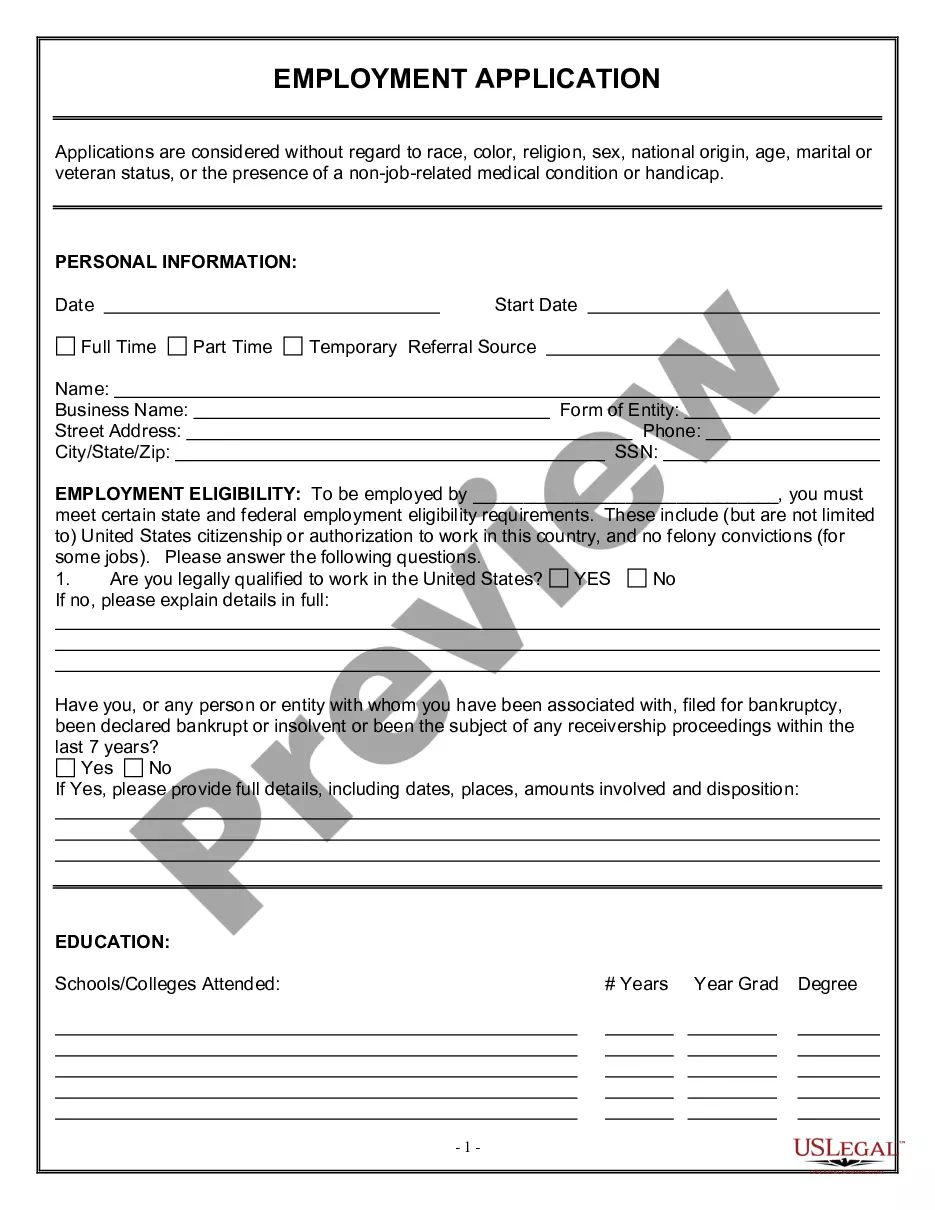

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Houston, Texas Complaint Against Guarantor of Open Account Credit Transactions — Breach of Oral or Implied Contracts In Houston, Texas, individuals and businesses often engage in open account credit transactions, where a creditor extends credit to a debtor for the purchase of goods or services. In these transactions, it is common for a guarantor to be involved, providing a promise to pay the debt in the event the debtor fails to do so. However, there are instances where the guarantor breaches their oral or implied contracts, leading to disputes and potential legal actions. Breach of oral or implied contracts can occur in different scenarios within open account credit transactions, and the nature of the complaint may vary accordingly. Here are a few notable examples: 1. Failure to fulfill payment obligations: The most common complaint against a guarantor is their failure to fulfill their promise of payment. When the debtor defaults on the debt, the creditor may turn to the guarantor to seek repayment. However, if the guarantor fails to honor their commitment, a complaint can be filed against them for breaching the oral or implied contract. 2. Fraudulent misrepresentation: In some cases, a guarantor may provide false or misleading information when entering into the guarantee agreement. This can include misrepresenting their financial capacity, assets, or creditworthiness. If the creditor relies on these misrepresentations and suffers financial harm as a result, they can file a complaint against the guarantor for breaching the implied contract of good faith and fair dealing. 3. Modification of the guarantee agreement: Occasionally, a guarantor may attempt to modify the terms of the guarantee agreement without the creditor's consent. This can involve reducing the scope of their obligation, requesting an early termination, or altering the payment schedule. If such modifications are made without proper agreement or consent, a complaint for breach of the oral or implied contract can be filed against the guarantor. To file a complaint against a guarantor for breach of oral or implied contracts in Houston, Texas, several steps must be taken. Initially, the creditor should gather any written evidence of the original agreement, as well as any correspondence or records indicating the guarantor's breach. Consulting with an attorney experienced in contract law is highly advised to ensure the complaint is filed correctly and effectively. Overall, when a guarantor breaches their oral or implied contract within an open account credit transaction in Houston, Texas, it is essential for the creditor to act promptly and seek legal recourse. By filing a complaint against the guarantor, the creditor can aim to recover the outstanding debt owed and potentially seek additional damages arising from the breach.