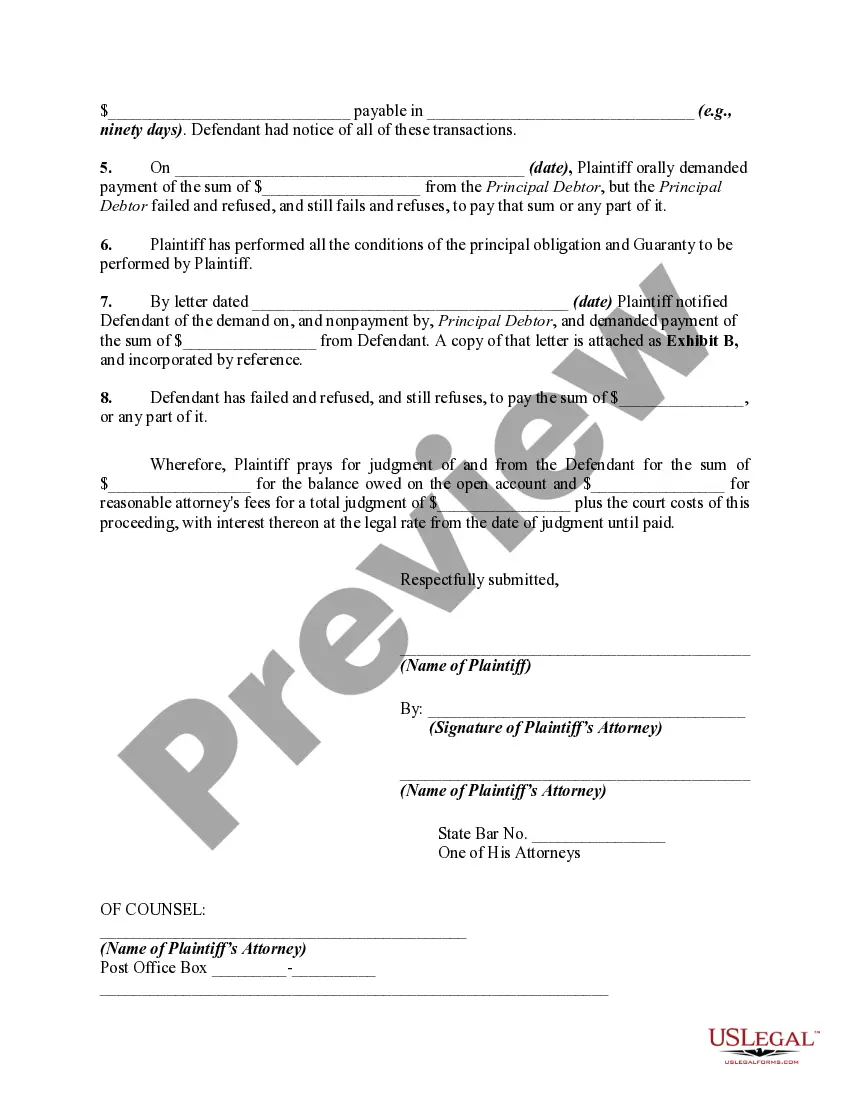

An open account is an account based on continuous dealing between the parties, which has not been closed, settled or stated, and which is kept open with the expectation of further transactions. An open account is created when the parties intend that the individual items of the account will not be considered independently, but as a connected series of transactions. In addition, the parties must intend that the account will be kept open and subject to a shifting balance as additional related entries of debits and credits are made, until either party decides to settle and close the account. This form is a complaint against a guarantor of such an account.

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Los Angeles, California Complaint Against Guarantor of Open Account Credit Transactions — Breach of Oral or Implied Contracts: Explained In Los Angeles, California, individuals and businesses engaging in open account credit transactions may find themselves facing a potential breach of oral or implied contracts by the guarantor. When such situations arise, individuals have the right to file a complaint to seek resolution and potential redress. Open account credit transactions involve a business extending credit to a customer without a specified payment plan, often resulting in a revolving credit agreement. In these agreements, a guarantor may promise to be financially liable for the customer's debts and obligations if they fail to fulfill them. However, when a guarantor breaches their oral or implied contract, failing to fulfill their obligations, legal action can be pursued through a complaint in Los Angeles, California. Here, we explore the different types of complaints that can be filed against guarantors in such scenarios. 1. Complaint for Breach of Oral Contract: In cases where an oral agreement was made between the creditor, debtor, and guarantor, and the guarantor fails to fulfill their promise, a complaint can be filed specifically addressing the breach of the oral contract. This type of complaint aims to seek remedies for damages caused by the guarantor's breach. 2. Complaint for Breach of Implied Contract: Implied contracts refer to agreements that are not explicitly stated but are assumed to exist based on the conduct and actions of the parties involved. In situations where there is no written agreement or oral contract, a complainant can file a complaint for breach of the implied contract against the guarantor. This type of complaint highlights the expectation of the guarantor's financial responsibility and their subsequent breach. 3. Complaint for Damages: When a guarantor breaches their obligation, resulting in financial losses or damages to the creditor, a complaint for damages can be filed. In this type of complaint, the complainant seeks compensation for the actual financial harm suffered as a result of the guarantor's breach. Damages may include unpaid debts, interest payments, late fees, or any other losses incurred due to the guarantor's non-compliance. 4. Complaint for Specific Performance: In certain cases, the creditor may choose to seek a specific performance remedy. This means they demand the guarantor fulfill their obligations as agreed upon. By filing a complaint for specific performance, the complainant seeks a court order compelling the guarantor to fulfill their promises as outlined in the open account credit agreement. 5. Complaint for Injunctive Relief: In rare instances, a complainant may file a complaint seeking injunctive relief. This legal remedy requests a court order to prevent further harm or breaches by the guarantor. The goal of this type of complaint is to obtain an injunction that compels the guarantor to fulfill their obligations or refrain from further damage-causing actions. In summary, a Los Angeles, California complaint against a guarantor for breaches of oral or implied contracts in open account credit transactions can take various forms. These complaints aim to address the specific nature of the breach and seek appropriate remedies to rectify the situation. It is essential for individuals or businesses facing such breaches to consult with legal professionals specializing in contract law to navigate the complaint process effectively.Los Angeles, California Complaint Against Guarantor of Open Account Credit Transactions — Breach of Oral or Implied Contracts: Explained In Los Angeles, California, individuals and businesses engaging in open account credit transactions may find themselves facing a potential breach of oral or implied contracts by the guarantor. When such situations arise, individuals have the right to file a complaint to seek resolution and potential redress. Open account credit transactions involve a business extending credit to a customer without a specified payment plan, often resulting in a revolving credit agreement. In these agreements, a guarantor may promise to be financially liable for the customer's debts and obligations if they fail to fulfill them. However, when a guarantor breaches their oral or implied contract, failing to fulfill their obligations, legal action can be pursued through a complaint in Los Angeles, California. Here, we explore the different types of complaints that can be filed against guarantors in such scenarios. 1. Complaint for Breach of Oral Contract: In cases where an oral agreement was made between the creditor, debtor, and guarantor, and the guarantor fails to fulfill their promise, a complaint can be filed specifically addressing the breach of the oral contract. This type of complaint aims to seek remedies for damages caused by the guarantor's breach. 2. Complaint for Breach of Implied Contract: Implied contracts refer to agreements that are not explicitly stated but are assumed to exist based on the conduct and actions of the parties involved. In situations where there is no written agreement or oral contract, a complainant can file a complaint for breach of the implied contract against the guarantor. This type of complaint highlights the expectation of the guarantor's financial responsibility and their subsequent breach. 3. Complaint for Damages: When a guarantor breaches their obligation, resulting in financial losses or damages to the creditor, a complaint for damages can be filed. In this type of complaint, the complainant seeks compensation for the actual financial harm suffered as a result of the guarantor's breach. Damages may include unpaid debts, interest payments, late fees, or any other losses incurred due to the guarantor's non-compliance. 4. Complaint for Specific Performance: In certain cases, the creditor may choose to seek a specific performance remedy. This means they demand the guarantor fulfill their obligations as agreed upon. By filing a complaint for specific performance, the complainant seeks a court order compelling the guarantor to fulfill their promises as outlined in the open account credit agreement. 5. Complaint for Injunctive Relief: In rare instances, a complainant may file a complaint seeking injunctive relief. This legal remedy requests a court order to prevent further harm or breaches by the guarantor. The goal of this type of complaint is to obtain an injunction that compels the guarantor to fulfill their obligations or refrain from further damage-causing actions. In summary, a Los Angeles, California complaint against a guarantor for breaches of oral or implied contracts in open account credit transactions can take various forms. These complaints aim to address the specific nature of the breach and seek appropriate remedies to rectify the situation. It is essential for individuals or businesses facing such breaches to consult with legal professionals specializing in contract law to navigate the complaint process effectively.