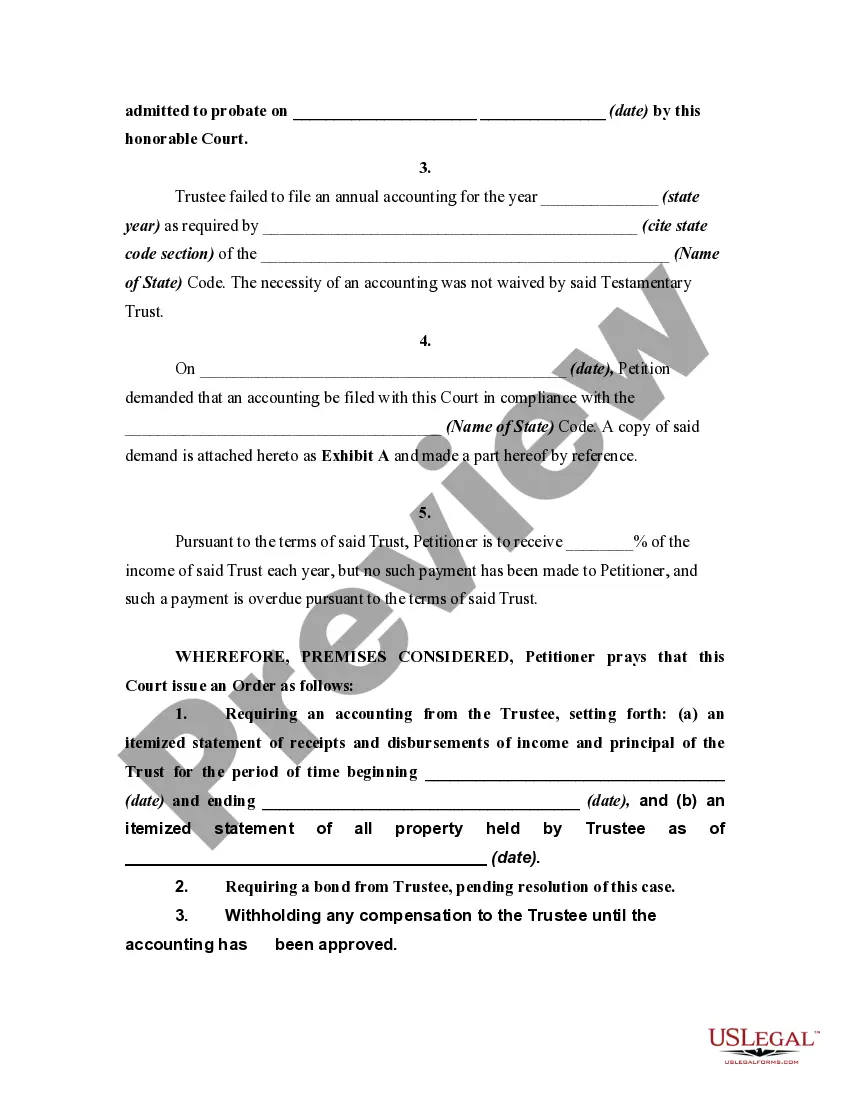

An accounting by a fiduciary usually involves an inventory of assets, debts, income, expenditures, and other items, which is submitted to a court. Such an accounting is used in various contexts, such as administration of a trust, estate, guardianship or conservatorship. Generally, a prior demand by an appropriate party for an accounting, and a refusal by the fiduciary to account, are conditions precedent to the bringing of an action for an accounting.

Title: Understanding the San Jose California Petition to Require Accounting from Testamentary Trustee Introduction: The San Jose California Petition to Require Accounting from Testamentary Trustee is a legal process that enables beneficiaries to seek transparency and accountability in the administration of a trust. This detailed description will discuss the purpose and key aspects of this petition, emphasizing its importance in ensuring the proper management of trust assets in San Jose, California. Keywords: San Jose California, petition, accounting, testamentary trustee, transparency, beneficiaries, trust assets, legal process. I. Definition and Purpose of the Petition: The San Jose California Petition to Require Accounting from Testamentary Trustee is a legal document filed by beneficiaries to compel a testamentary trustee to provide a thorough account of trust administration. Its principal aim is to ensure transparency and confirm that the trustee is acting in the best interests of the beneficiaries in managing trust assets. Keywords: testamentary trustee, beneficiaries, account, trust administration, transparency, trust assets. II. Types of San Jose California Petition to Require Accounting from Testamentary Trustee: 1. Initial Petition: This type of petition is typically filed at the beginning of the trust administration process. It requests the court to order the testamentary trustee to provide a complete and accurate account of the trust assets, income, expenses, and any distribution made to beneficiaries. Keywords: initial petition, trust administration, account, trust assets, income, expenses, distribution. 2. Subsequent Petition: Beneficiaries may file a subsequent petition if they suspect or have evidence suggesting mismanagement of trust assets, breach of fiduciary duty, or a lack of transparency. The subsequent petition aims to ensure continuous compliance by the testamentary trustee in providing updated accounting records. Keywords: subsequent petition, mismanagement, breach of fiduciary duty, transparency, accounting records. III. Key Elements of the Petition: 1. Trust Identification: The petition must provide detailed information about the trust, including its name, date of establishment, and the names of the trust or (deceased) and beneficiaries. Keywords: trust identification, trust name, establishment date, trust or, beneficiaries. 2. Reasons for the Petition: Beneficiaries should articulate their concerns, suspicions, or specific instances that prompt them to seek an accounting from the testamentary trustee. This section should include allegations of mismanagement, the trustee's failure to provide proper records, potential conflicts of interest, or any actions inconsistent with the beneficiaries' best interests. Keywords: reasons, concerns, suspicions, mismanagement, lack of records, conflicts of interest, beneficiaries' best interests. 3. Relief Sought: The petition should clearly state the desired outcome, such as a court order compelling the testamentary trustee to provide a complete accounting, review the trustee's actions, remove the trustee if necessary, or order any other appropriate relief to protect the interests of the beneficiaries. Keywords: relief sought, complete accounting, trustee review, trustee removal, beneficiary interests, appropriate relief. Conclusion: The San Jose California Petition to Require Accounting from Testamentary Trustee is a vital legal mechanism that ensures trust beneficiaries have access to accurate and thorough financial information regarding the administration of a trust. By seeking transparency and accountability, this petition plays a crucial role in safeguarding beneficiaries' interests in San Jose, California. Keywords: San Jose California, petition, accounting, testamentary trustee, transparency, beneficiaries, trust administration, legal mechanism, safeguarding.