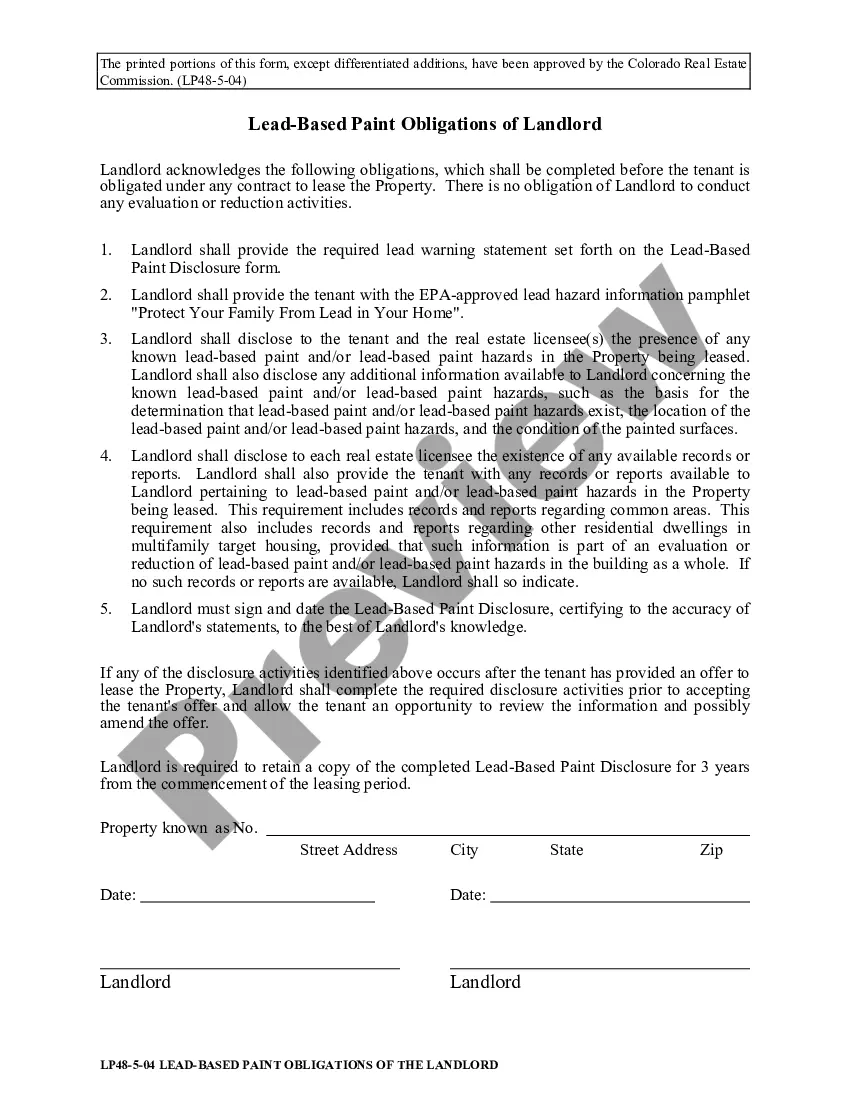

An agreement that creates an interest in real property as security for an obligation, such as the payment of a note, and that is to cease upon the performance of the obligation, is called a mortgage. The person whose interest in the property is given as security is the mortgagor. The person who receives the security is the mortgagee (e.g., lender). A release, deed of reconveyance, deed of release, or authority to cancel is used by a mortgagee to renounce a claim upon a person's real property subject to the mortgage.

Collin Texas, located in the northern part of the state, is a vibrant and rapidly growing city. Known for its strong economy, excellent schools, and family-friendly atmosphere, Collin Texas offers a high quality of life to its residents. In the context of real estate, a "Letter Tendering Final Payment of Amount Due Pursuant to a Promissory Note Secured by a Mortgage in Order to Obtain a Release of the Mortgaged Premises" is a legal document used when a borrower has fully repaid their mortgage loan and wants to obtain a release of the property from the mortgage. This letter serves as written proof that the borrower has satisfied all of their financial obligations and is entitled to have the mortgage removed from their property's title. There are a few different types of Collin Texas Letter Tendering Final Payment, depending on the specific circumstances: 1. Collin Texas Letter Tendering Final Payment for Residential Property: This type of letter is used when the property in question is a residential home, such as a single-family house or a condominium. It outlines the details of the mortgage loan, including the amount borrowed, the interest rate, and the repayment terms. The letter also includes the final payment amount and the request for a release of the mortgage. 2. Collin Texas Letter Tendering Final Payment for Commercial Property: When the mortgaged property is a commercial building, such as an office space or retail store, a different type of letter is used. This letter typically includes additional information tailored to the specific commercial property, such as the purpose of the property, any business zoning requirements, and applicable lease agreements. 3. Collin Texas Letter Tendering Final Payment for Land: In cases where the mortgage is secured by vacant land or a plot for future development, a specialized letter is necessary. This type of letter may include details about any zoning or planning permits required for the land's use in addition to the standard mortgage information. Regardless of the specific type, a Collin Texas Letter Tendering Final Payment of Amount Due Pursuant to a Promissory Note Secured by a Mortgage in Order to Obtain a Release of the Mortgaged Premises is a crucial document that finalizes the borrower's mortgage repayment journey and allows them to fully own their property, free from any encumbrances.