With regard to the collection part of this form agreement, the Federal Fair Debt Collection Practices Act prohibits harassment or abuse in collecting a debt such as threatening violence, use of obscene or profane language, publishing lists of debtors who refuse to pay debts, or even harassing a debtor by repeatedly calling the debtor on the phone. Also, certain false or misleading representations are forbidden, such as representing that the debt collector is associated with the state or federal government, stating that the debtor will go to jail if he does not pay the debt. This Act also sets out strict rules regarding communicating with the debtor.

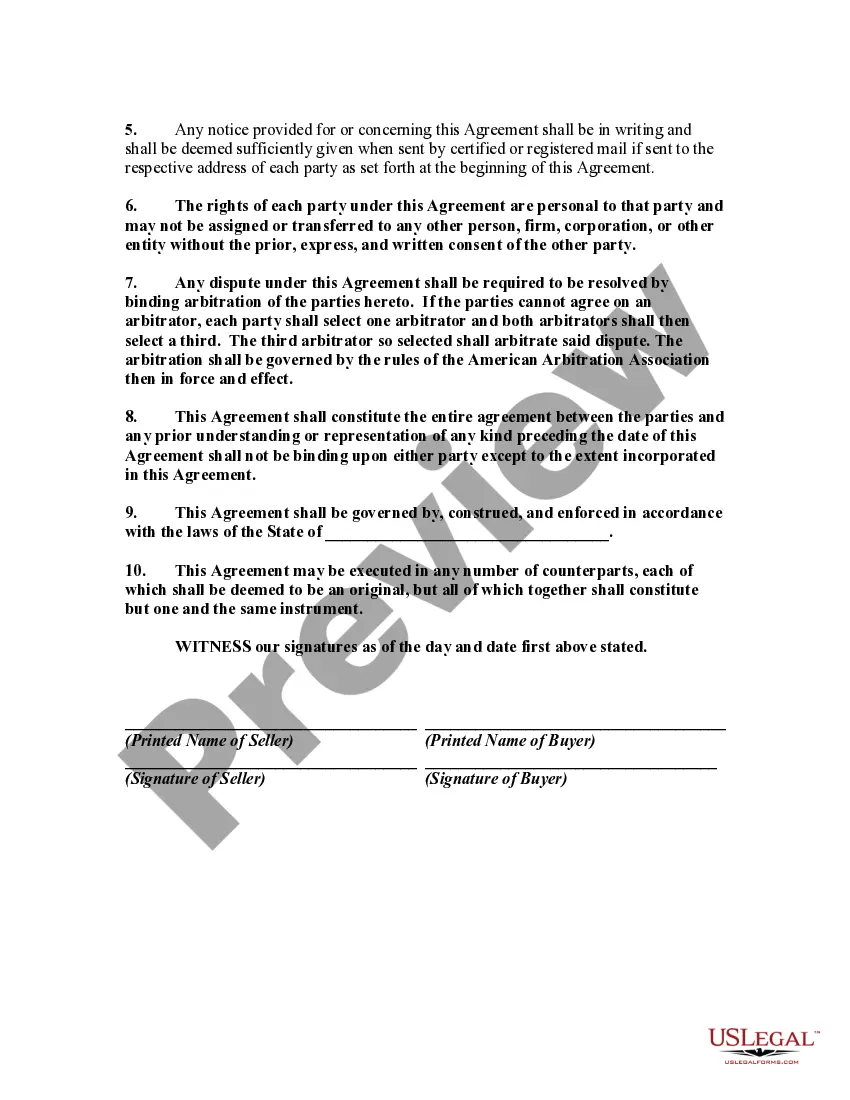

The Bexar Texas Agreement for Sale and Purchase of Accounts Receivable of Business with Seller Agreeing to Collect the Accounts Receivable is a legal document that outlines the terms and conditions under which accounts receivable of a business are sold and purchased. In this agreement, the seller agrees to transfer their accounts receivable to the buyer in exchange for an agreed-upon purchase price. The seller also agrees to collect the accounts receivable on behalf of the buyer and remit the collected funds to them. There are several types of Bexar Texas Agreement for Sale and Purchase of Accounts Receivable of Business with Seller Agreeing to Collect the Accounts Receivable that may exist: 1. Standard Agreement: This is a typical agreement where a business owner sells their accounts receivable to a buyer who takes over the responsibility of collection. 2. Recourse Agreement: In this type of agreement, the seller retains liability for any uncollectible accounts and is required to reimburse the buyer for any losses incurred. 3. Non-Recourse Agreement: Unlike the recourse agreement, in a non-recourse agreement, the seller is not held responsible for any uncollectible accounts, and the risk of non-payment is borne solely by the buyer. 4. Factoring Agreement: This agreement involves the sale of accounts receivable by the seller, usually to a financial institution called a factor. The factor purchases the accounts receivable at a discounted price and assumes the responsibility of collection. 5. Reverse Factoring Agreement: In this agreement, the buyer takes on the responsibility of the seller's accounts receivable, ensuring timely payment to the seller's suppliers or creditors. It's essential for all parties involved to carefully review and understand the terms and conditions stipulated in the specific type of Bexar Texas Agreement for Sale and Purchase of Accounts Receivable of Business with Seller Agreeing to Collect the Accounts Receivable they are entering into. Seeking professional legal advice is recommended to ensure compliance with local laws and to protect the interests of all parties involved.The Bexar Texas Agreement for Sale and Purchase of Accounts Receivable of Business with Seller Agreeing to Collect the Accounts Receivable is a legal document that outlines the terms and conditions under which accounts receivable of a business are sold and purchased. In this agreement, the seller agrees to transfer their accounts receivable to the buyer in exchange for an agreed-upon purchase price. The seller also agrees to collect the accounts receivable on behalf of the buyer and remit the collected funds to them. There are several types of Bexar Texas Agreement for Sale and Purchase of Accounts Receivable of Business with Seller Agreeing to Collect the Accounts Receivable that may exist: 1. Standard Agreement: This is a typical agreement where a business owner sells their accounts receivable to a buyer who takes over the responsibility of collection. 2. Recourse Agreement: In this type of agreement, the seller retains liability for any uncollectible accounts and is required to reimburse the buyer for any losses incurred. 3. Non-Recourse Agreement: Unlike the recourse agreement, in a non-recourse agreement, the seller is not held responsible for any uncollectible accounts, and the risk of non-payment is borne solely by the buyer. 4. Factoring Agreement: This agreement involves the sale of accounts receivable by the seller, usually to a financial institution called a factor. The factor purchases the accounts receivable at a discounted price and assumes the responsibility of collection. 5. Reverse Factoring Agreement: In this agreement, the buyer takes on the responsibility of the seller's accounts receivable, ensuring timely payment to the seller's suppliers or creditors. It's essential for all parties involved to carefully review and understand the terms and conditions stipulated in the specific type of Bexar Texas Agreement for Sale and Purchase of Accounts Receivable of Business with Seller Agreeing to Collect the Accounts Receivable they are entering into. Seeking professional legal advice is recommended to ensure compliance with local laws and to protect the interests of all parties involved.