With regard to the collection part of this form agreement, the Federal Fair Debt Collection Practices Act prohibits harassment or abuse in collecting a debt such as threatening violence, use of obscene or profane language, publishing lists of debtors who refuse to pay debts, or even harassing a debtor by repeatedly calling the debtor on the phone. Also, certain false or misleading representations are forbidden, such as representing that the debt collector is associated with the state or federal government, stating that the debtor will go to jail if he does not pay the debt. This Act also sets out strict rules regarding communicating with the debtor.

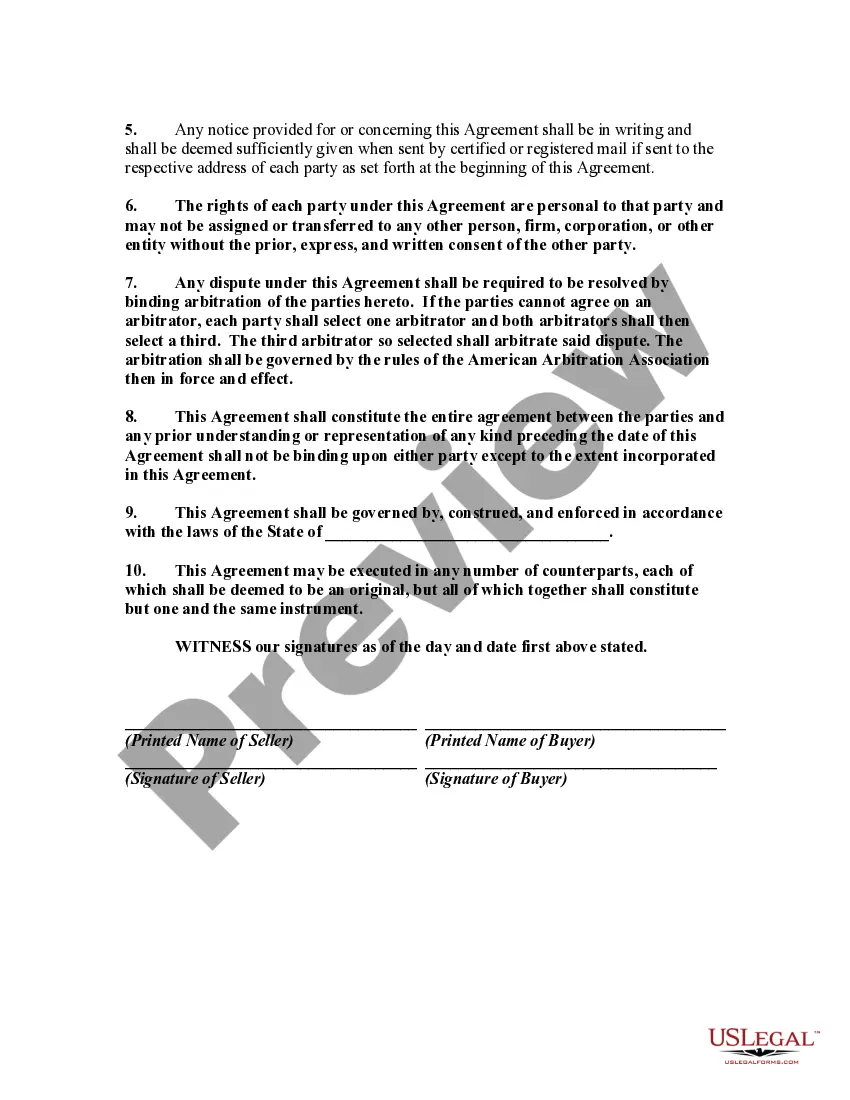

Cook Illinois Agreement for Sale and Purchase of Accounts Receivable of Business with Seller Agreeing to Collect the Accounts Receivable is a legal document that outlines the terms and conditions regarding the purchase and sale of accounts receivable by Cook Illinois, an Illinois-based company. This agreement is commonly used by businesses looking to improve cash flow by selling their outstanding invoices or accounts receivable to a third party. The Cook Illinois Agreement for Sale and Purchase of Accounts Receivable of Business with Seller Agreeing to Collect the Accounts Receivable is designed to protect the interests of both the seller (the business) and the buyer (Cook Illinois). It specifies the rights, responsibilities, and obligations of both parties involved in the transaction. The agreement typically includes specific details such as the purchase price, the percentage of the accounts receivable being sold, and the time period in which the seller must collect the accounts receivable on behalf of Cook Illinois. It may also outline any fees or commissions that the seller may receive for the collection services provided. There may be different types or variations of the Cook Illinois Agreement for Sale and Purchase of Accounts Receivable of Business with Seller Agreeing to Collect the Accounts Receivable, depending on the specific circumstances of the transaction. For example: 1. Recourse Agreement: This type of agreement states that if the accounts receivable cannot be collected by the seller within a specified period, the seller will be held responsible for repurchasing the unpaid accounts from Cook Illinois. 2. Non-Recourse Agreement: In contrast to the recourse agreement, the non-recourse agreement places the risk of non-payment on Cook Illinois. If the accounts receivable cannot be collected, Cook Illinois is responsible for the loss and cannot seek compensation from the seller. 3. Gradual Payment Agreement: This agreement allows the seller to receive payment for the accounts receivable in installments over a specified period, rather than receiving a lump sum upfront. Regardless of the specific type, the Cook Illinois Agreement for Sale and Purchase of Accounts Receivable of Business with Seller Agreeing to Collect the Accounts Receivable plays a critical role in enabling businesses to optimize their cash flow and meet their financial needs.Cook Illinois Agreement for Sale and Purchase of Accounts Receivable of Business with Seller Agreeing to Collect the Accounts Receivable is a legal document that outlines the terms and conditions regarding the purchase and sale of accounts receivable by Cook Illinois, an Illinois-based company. This agreement is commonly used by businesses looking to improve cash flow by selling their outstanding invoices or accounts receivable to a third party. The Cook Illinois Agreement for Sale and Purchase of Accounts Receivable of Business with Seller Agreeing to Collect the Accounts Receivable is designed to protect the interests of both the seller (the business) and the buyer (Cook Illinois). It specifies the rights, responsibilities, and obligations of both parties involved in the transaction. The agreement typically includes specific details such as the purchase price, the percentage of the accounts receivable being sold, and the time period in which the seller must collect the accounts receivable on behalf of Cook Illinois. It may also outline any fees or commissions that the seller may receive for the collection services provided. There may be different types or variations of the Cook Illinois Agreement for Sale and Purchase of Accounts Receivable of Business with Seller Agreeing to Collect the Accounts Receivable, depending on the specific circumstances of the transaction. For example: 1. Recourse Agreement: This type of agreement states that if the accounts receivable cannot be collected by the seller within a specified period, the seller will be held responsible for repurchasing the unpaid accounts from Cook Illinois. 2. Non-Recourse Agreement: In contrast to the recourse agreement, the non-recourse agreement places the risk of non-payment on Cook Illinois. If the accounts receivable cannot be collected, Cook Illinois is responsible for the loss and cannot seek compensation from the seller. 3. Gradual Payment Agreement: This agreement allows the seller to receive payment for the accounts receivable in installments over a specified period, rather than receiving a lump sum upfront. Regardless of the specific type, the Cook Illinois Agreement for Sale and Purchase of Accounts Receivable of Business with Seller Agreeing to Collect the Accounts Receivable plays a critical role in enabling businesses to optimize their cash flow and meet their financial needs.