With regard to the collection part of this form agreement, the Federal Fair Debt Collection Practices Act prohibits harassment or abuse in collecting a debt such as threatening violence, use of obscene or profane language, publishing lists of debtors who refuse to pay debts, or even harassing a debtor by repeatedly calling the debtor on the phone. Also, certain false or misleading representations are forbidden, such as representing that the debt collector is associated with the state or federal government, stating that the debtor will go to jail if he does not pay the debt. This Act also sets out strict rules regarding communicating with the debtor.

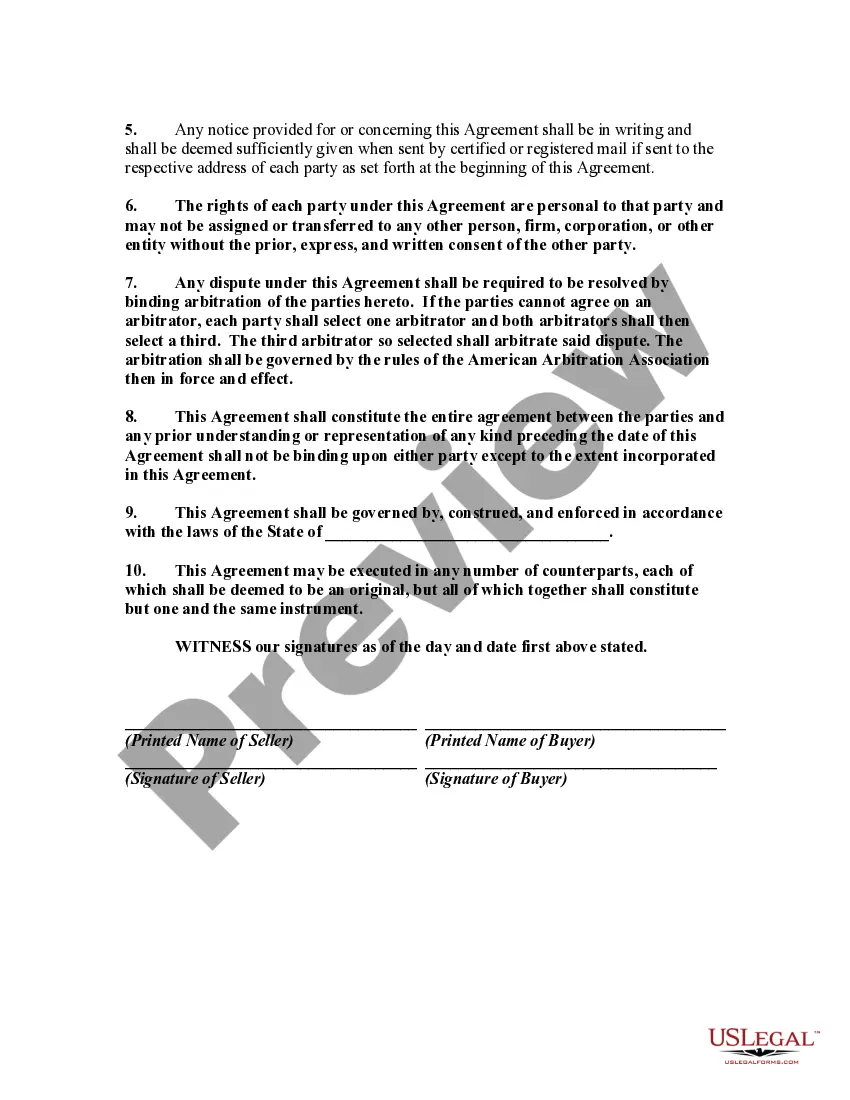

The Franklin Ohio Agreement for Sale and Purchase of Accounts Receivable of Business with Seller Agreeing to Collect the Accounts Receivable is a legally binding contract that outlines the terms and conditions for the sale and purchase of accounts receivable between a seller and a buyer. This agreement is intended to ensure a smooth transaction and provide clarity on both parties' rights and obligations. Keywords: Franklin Ohio Agreement, Sale and Purchase of Accounts Receivable, Business, Seller, Buyer, Collect, Terms and Conditions, Transaction, Legal Contract. There may be variations of the Franklin Ohio Agreement for Sale and Purchase of Accounts Receivable of Business with Seller Agreeing to Collect the Accounts Receivable, which can include: 1. Simple Purchase Agreement: This type of agreement is generally used for straightforward transactions involving the sale and purchase of accounts receivable. It defines the terms of the sale, the purchase price, payment terms, and the obligations of both parties. 2. Factoring Agreement: A factoring agreement is a specific type of accounts receivable purchase agreement. In this arrangement, the seller (also known as the "factor") sells its accounts receivable to a buyer (the "factor"). The factor assumes the responsibility for collecting the receivables, usually providing upfront cash to the seller in exchange for a fee or discount. 3. Recourse vs. Non-Recourse Agreement: These agreements differ based on the buyer's responsibility if the accounts receivable are not collectible. In a recourse agreement, the seller retains liability for any uncollected receivables, while in a non-recourse agreement, the buyer assumes the risk and cannot seek reimbursement from the seller. 4. Bulk Account Purchase Agreement: This type of agreement is suitable when a buyer intends to purchase a large volume of accounts receivable from a seller. It typically encompasses additional provisions, such as warranties, representations, and dispute resolution mechanisms, to protect both parties' interests. 5. International Accounts Receivable Purchase Agreement: This agreement variant is used when the buyer and seller are based in different countries. It considers additional considerations associated with cross-border transactions, such as provisions related to currency exchange rates, international trade laws, and cross-border collections. 6. Partial Purchase Agreement: This type of agreement allows the buyer to purchase only a portion of the seller's accounts receivable. It provides flexibility for the seller to retain some receivables for self-collection while selling others to meet immediate financial needs. In conclusion, the Franklin Ohio Agreement for Sale and Purchase of Accounts Receivable of Business with Seller Agreeing to Collect the Accounts Receivable is a crucial legal document that governs the transfer of accounts receivable from a seller to a buyer. The agreement may have various types or variations, each catering to different circumstances and needs of the parties involved.The Franklin Ohio Agreement for Sale and Purchase of Accounts Receivable of Business with Seller Agreeing to Collect the Accounts Receivable is a legally binding contract that outlines the terms and conditions for the sale and purchase of accounts receivable between a seller and a buyer. This agreement is intended to ensure a smooth transaction and provide clarity on both parties' rights and obligations. Keywords: Franklin Ohio Agreement, Sale and Purchase of Accounts Receivable, Business, Seller, Buyer, Collect, Terms and Conditions, Transaction, Legal Contract. There may be variations of the Franklin Ohio Agreement for Sale and Purchase of Accounts Receivable of Business with Seller Agreeing to Collect the Accounts Receivable, which can include: 1. Simple Purchase Agreement: This type of agreement is generally used for straightforward transactions involving the sale and purchase of accounts receivable. It defines the terms of the sale, the purchase price, payment terms, and the obligations of both parties. 2. Factoring Agreement: A factoring agreement is a specific type of accounts receivable purchase agreement. In this arrangement, the seller (also known as the "factor") sells its accounts receivable to a buyer (the "factor"). The factor assumes the responsibility for collecting the receivables, usually providing upfront cash to the seller in exchange for a fee or discount. 3. Recourse vs. Non-Recourse Agreement: These agreements differ based on the buyer's responsibility if the accounts receivable are not collectible. In a recourse agreement, the seller retains liability for any uncollected receivables, while in a non-recourse agreement, the buyer assumes the risk and cannot seek reimbursement from the seller. 4. Bulk Account Purchase Agreement: This type of agreement is suitable when a buyer intends to purchase a large volume of accounts receivable from a seller. It typically encompasses additional provisions, such as warranties, representations, and dispute resolution mechanisms, to protect both parties' interests. 5. International Accounts Receivable Purchase Agreement: This agreement variant is used when the buyer and seller are based in different countries. It considers additional considerations associated with cross-border transactions, such as provisions related to currency exchange rates, international trade laws, and cross-border collections. 6. Partial Purchase Agreement: This type of agreement allows the buyer to purchase only a portion of the seller's accounts receivable. It provides flexibility for the seller to retain some receivables for self-collection while selling others to meet immediate financial needs. In conclusion, the Franklin Ohio Agreement for Sale and Purchase of Accounts Receivable of Business with Seller Agreeing to Collect the Accounts Receivable is a crucial legal document that governs the transfer of accounts receivable from a seller to a buyer. The agreement may have various types or variations, each catering to different circumstances and needs of the parties involved.