This form can be used as a guide in preparing an agreement involving a close corporation or a Subchapter S corporation buying all of the stock of one of its shareholders.

Contra Costa California Agreement to Purchase Common Stock of a Shareholder by the Corporation with an Exhibit of a Bill of Sale and Assignment of Stock by Separate Instrument

Description

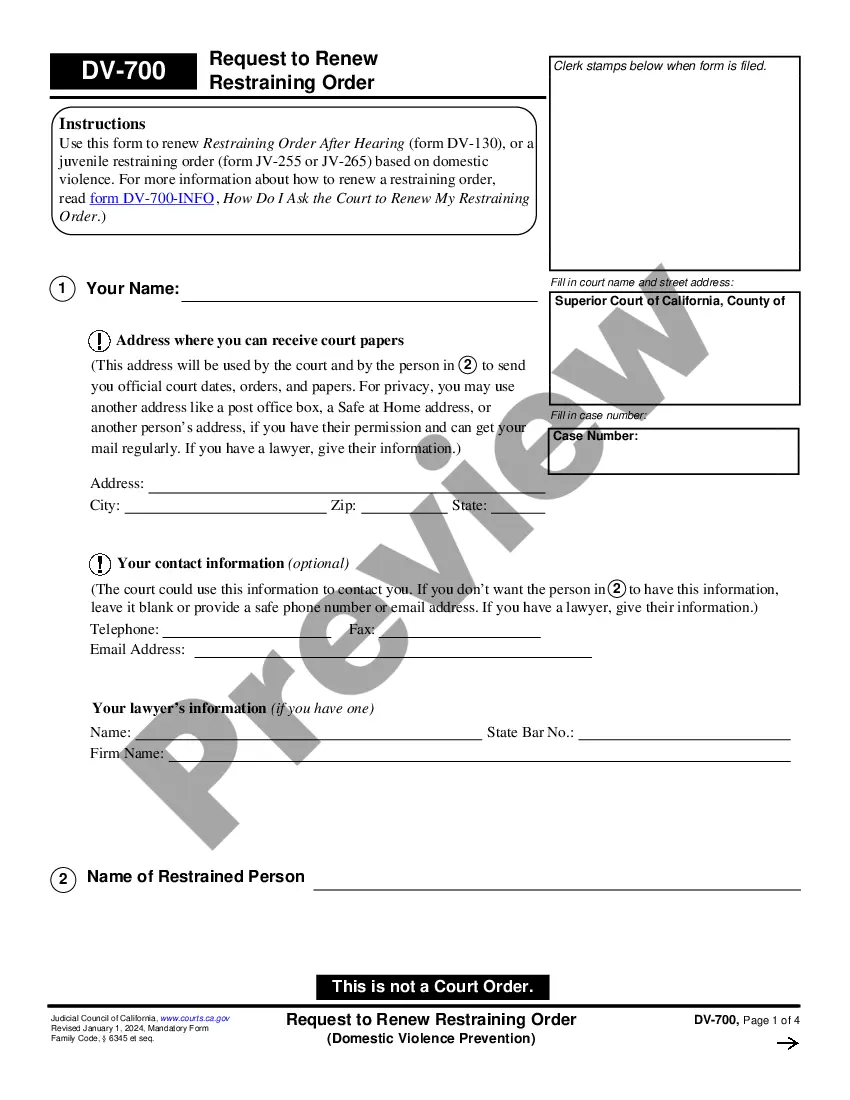

How to fill out Agreement To Purchase Common Stock Of A Shareholder By The Corporation With An Exhibit Of A Bill Of Sale And Assignment Of Stock By Separate Instrument?

Composing documents for the organization or individual requirements is always a significant obligation.

When formulating a contract, a public service inquiry, or a power of attorney, it's crucial to consider all federal and state statutes and regulations of the specific jurisdiction.

Nonetheless, small counties and even municipalities also have legislative processes that you need to take into account.

Join the platform and swiftly acquire validated legal forms for any scenario with just a few clicks!

- All these factors make it stressful and time-intensive to draft the Contra Costa Agreement to Acquire Common Stock of a Shareholder by the Corporation with an Exhibit of a Bill of Sale and Assignment of Stock by Separate Instrument without expert help.

- It's simple to prevent wasting money on attorneys creating your documents and produce a legally binding Contra Costa Agreement to Acquire Common Stock of a Shareholder by the Corporation with an Exhibit of a Bill of Sale and Assignment of Stock by Separate Instrument independently, using the US Legal Forms online library.

- It is the largest digital collection of state-specific legal templates that are professionally authenticated, so you can be ensured of their legitimacy when selecting a template for your county.

- Previously subscribed users simply need to Log In to their accounts to preserve the required document.

- If you do not have a subscription yet, follow the step-by-step guide below to obtain the Contra Costa Agreement to Acquire Common Stock of a Shareholder by the Corporation with an Exhibit of a Bill of Sale and Assignment of Stock by Separate Instrument.

- Review the webpage you've opened and verify if it contains the template you require.

- To do this, utilize the form description and preview if these features are available.

Form popularity

FAQ

What is a Business Purchase Agreement? Business purchase agreements , also called BPAs or business transfer agreements , are legal contracts that transfer ownership from the seller of a business entity to a buyer. This type of agreement contains provisions that govern the terms of sale.

Stock purchase agreements (SPAs) are legally binding contracts between shareholders and companies. Also known as share purchase agreements, these contracts establish all of the terms and conditions related to the sale of a company's stocks.

A stock purchase agreement is an agreement that two parties sign when shares of a company are being bought or sold. These agreements are often used by small corporations who sell stock. Either the company or shareholders in the organization can sell stock to buyers.

Common stock is a type of stock issued to the majority of shareholders in a company. Holders of common stock enjoy certain rights that their counterparts in preferred stock holders do not. Rather than receiving regular payouts, common stock holders derive value from their shares when the company grows.

Stock purchase agreements (SPAs) are legally binding contracts between shareholders and companies. Also known as share purchase agreements, these contracts establish all of the terms and conditions related to the sale of a company's stocks.

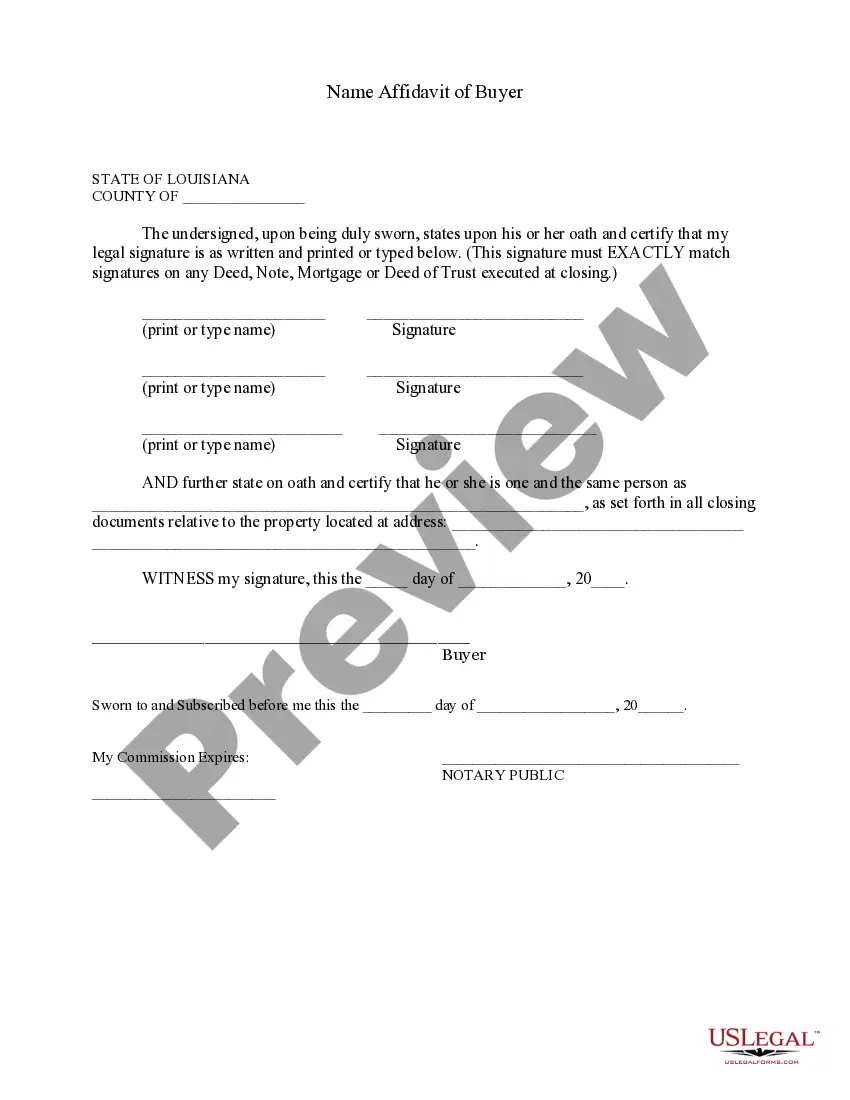

A stock assignment agreement is the transfer of ownership of stock shares. It occurs when one party legally transfers their shares of stock property to another party or to a business.

A stock transfer agreement is a legal document between shareholders and another party that provides the right to sell or transfer shares of stock at a predetermined price.

A stock purchase agreement, also known as an SPA, is a contract between buyers and sellers of company shares. This legal document transfers the ownership of stock and detail the terms of shares bought and sold by both parties.

A stock purchase agreement (SPA) is the contract that two parties, the buyers and the company or shareholders, written consent is required by law when shares of the company are being bought or sold for any dollar amount. In a stock deal, the buyer purchases shares directly from the shareholder.

A stock certificate must be assigned through a contract of assignment, which must be sent to the transfer agent a person or company responsible for keeping track of the securities issued by a corporation or government along with the stock certificate.