The Franklin Ohio Bill of Transfer to a Trust is a legal document used in estate planning to transfer ownership of property or assets to a trust. This process involves assigning the ownership rights of the property to a trustee, who will manage and administer the assets on behalf of the beneficiaries designated in the trust agreement. The Bill of Transfer to a Trust serves as evidence of the transfer and provides clarity on the rights and responsibilities of the parties involved. There are several types of Franklin Ohio Bills of Transfer to a Trust, each suitable for different circumstances and objectives. Some common types include: 1. Revocable Living Trust: This type of trust allows the granter (the person creating the trust) to maintain control and make changes to the trust during their lifetime. The trust assets are not subject to probate and can be easily managed or distributed according to the granter's wishes. 2. Irrevocable Trust: Unlike a revocable living trust, an irrevocable trust cannot be altered or revoked once established. The granter relinquishes ownership and control of the assets, providing potential tax benefits and asset protection. This type of trust is often used for Medicaid planning or protecting assets from creditor claims. 3. Testamentary Trust: This trust is created through a will and comes into effect after the granter's death. The property or assets designated in the will are transferred to the trust, and a trustee is appointed to distribute them according to the granter's instructions outlined in the will. 4. Special Needs Trust: This trust is designed to provide financial support for individuals with disabilities or special needs without affecting their eligibility for government benefits. The trust assets are managed by a trustee and used to enhance the beneficiary's quality of life without jeopardizing their access to public assistance programs. 5. Charitable Remainder Trust: This trust allows the granter to donate assets to a charitable organization while retaining an income from the trust for a specified period. Upon the granter's death or at the end of the predetermined time frame, the remaining assets are transferred to the charitable organization. Regardless of the type, the Franklin Ohio Bill of Transfer to a Trust is a crucial legal document that ensures the seamless transfer of assets to a trust, providing protection, privacy, and clear directives for their management and distribution. It is recommended to consult with an experienced estate planning attorney to determine the most suitable type of trust and draft a comprehensive Bill of Transfer that adheres to applicable Ohio laws and meets the specific needs and goals of the granter.

Franklin Ohio Bill of Transfer to a Trust

Description

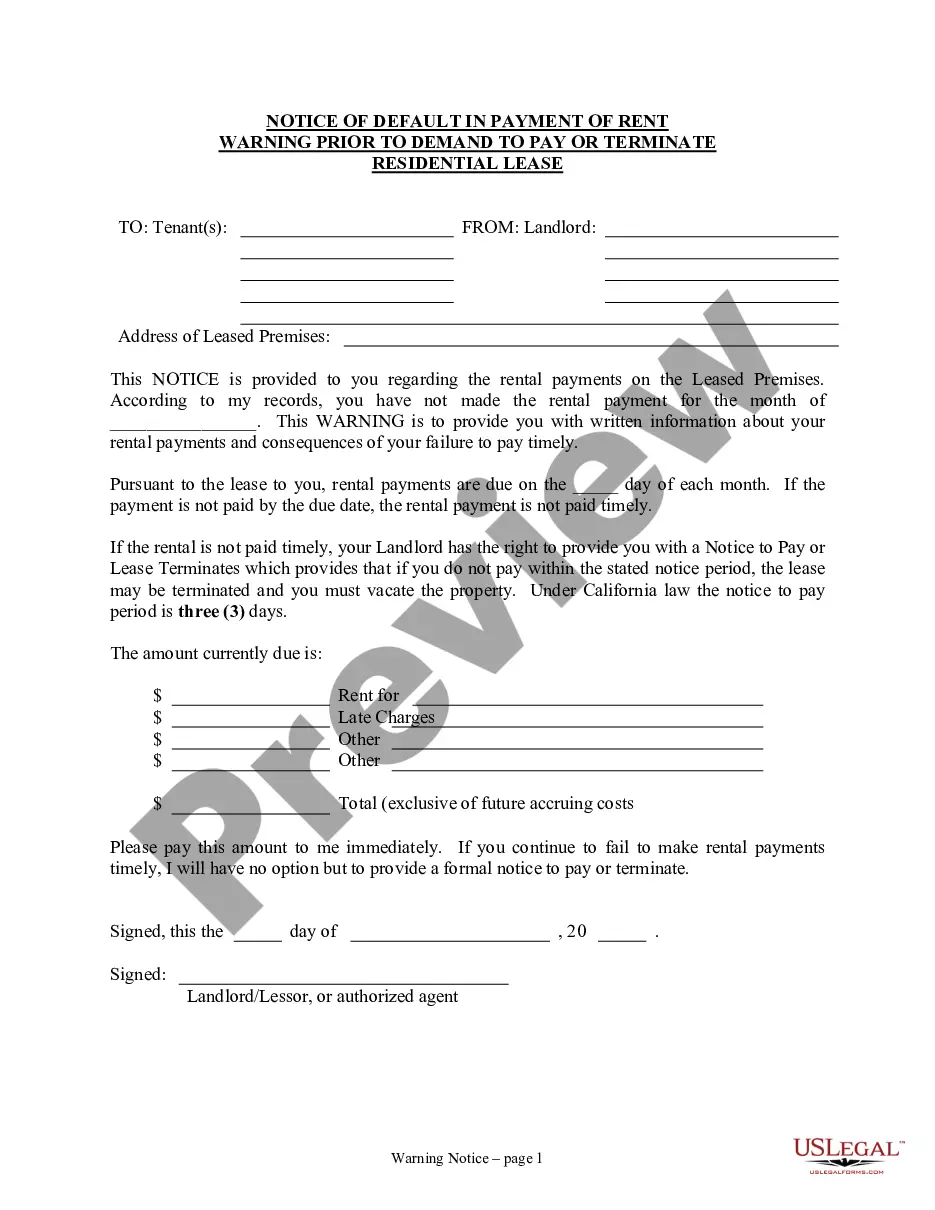

How to fill out Franklin Ohio Bill Of Transfer To A Trust?

Creating legal forms is a necessity in today's world. However, you don't always need to seek qualified assistance to create some of them from the ground up, including Franklin Bill of Transfer to a Trust, with a platform like US Legal Forms.

US Legal Forms has over 85,000 templates to pick from in various types ranging from living wills to real estate papers to divorce papers. All forms are organized based on their valid state, making the searching process less overwhelming. You can also find detailed resources and tutorials on the website to make any tasks related to document execution simple.

Here's how to locate and download Franklin Bill of Transfer to a Trust.

- Go over the document's preview and description (if provided) to get a general information on what you’ll get after downloading the form.

- Ensure that the document of your choosing is adapted to your state/county/area since state laws can affect the legality of some records.

- Check the related forms or start the search over to locate the appropriate file.

- Hit Buy now and register your account. If you already have an existing one, choose to log in.

- Choose the pricing {plan, then a suitable payment method, and purchase Franklin Bill of Transfer to a Trust.

- Choose to save the form template in any offered file format.

- Go to the My Forms tab to re-download the file.

If you're already subscribed to US Legal Forms, you can locate the appropriate Franklin Bill of Transfer to a Trust, log in to your account, and download it. Of course, our platform can’t replace a lawyer completely. If you need to cope with an exceptionally difficult situation, we recommend using the services of an attorney to check your form before executing and filing it.

With more than 25 years on the market, US Legal Forms proved to be a go-to provider for various legal forms for millions of customers. Become one of them today and get your state-specific paperwork effortlessly!