The Montgomery Maryland Bill of Transfer to a Trust is a legal document used in Montgomery County, Maryland, to transfer ownership of property from an individual to a trust. This process involves the creation of a trust agreement, which designates the trust as the new owner of the property. A Bill of Transfer to a Trust is typically used in estate planning to transfer assets, such as real estate, investments, or personal property, into a trust for the benefit of the trust beneficiaries. By transferring the assets to a trust, individuals can avoid probate, maintain privacy, and ensure the smooth transition of their assets upon incapacity or death. There are several types of Montgomery Maryland Bills of Transfer to a Trust that individuals may utilize based on their specific needs and circumstances: 1. Revocable Trust Bill of Transfer: This type of agreement allows the trust creator to retain control of the trust assets during their lifetime. The trust can be modified, revoked, or terminated at any time by the creator, offering flexibility and the ability to make changes as needed. 2. Irrevocable Trust Bill of Transfer: In contrast to a revocable trust, an irrevocable trust cannot be easily modified, revoked, or terminated without the consent of the beneficiaries. This type of trust often provides more substantial asset protection and can be a powerful tool for minimizing estate taxes. 3. Testamentary Trust Bill of Transfer: Unlike revocable and irrevocable trusts, a testamentary trust is created through a will and only becomes operational upon the death of the individual. This type of trust allows for the transfer of assets to beneficiaries according to the specific instructions outlined in the will. 4. Special Needs Trust Bill of Transfer: This type of trust is created to provide for the ongoing care and financial support of an individual with special needs. By transferring assets to a special needs trust, individuals can ensure that their loved ones with disabilities continue to receive government benefits while accessing additional funds for their well-being. It is essential to consult with an experienced attorney specializing in estate planning and trust law to create a comprehensive and legally binding Bill of Transfer to a Trust that suits one's unique circumstances. This will ensure that the property transfer process is effectively executed and all legal requirements are met.

Montgomery Maryland Bill of Transfer to a Trust

Description

How to fill out Montgomery Maryland Bill Of Transfer To A Trust?

Preparing legal paperwork can be difficult. In addition, if you decide to ask an attorney to write a commercial contract, papers for proprietorship transfer, pre-marital agreement, divorce paperwork, or the Montgomery Bill of Transfer to a Trust, it may cost you a fortune. So what is the most reasonable way to save time and money and create legitimate documents in total compliance with your state and local laws and regulations? US Legal Forms is a perfect solution, whether you're looking for templates for your personal or business needs.

US Legal Forms is biggest online collection of state-specific legal documents, providing users with the up-to-date and professionally checked forms for any use case accumulated all in one place. Therefore, if you need the latest version of the Montgomery Bill of Transfer to a Trust, you can easily find it on our platform. Obtaining the papers requires a minimum of time. Those who already have an account should check their subscription to be valid, log in, and pick the sample by clicking on the Download button. If you haven't subscribed yet, here's how you can get the Montgomery Bill of Transfer to a Trust:

- Look through the page and verify there is a sample for your area.

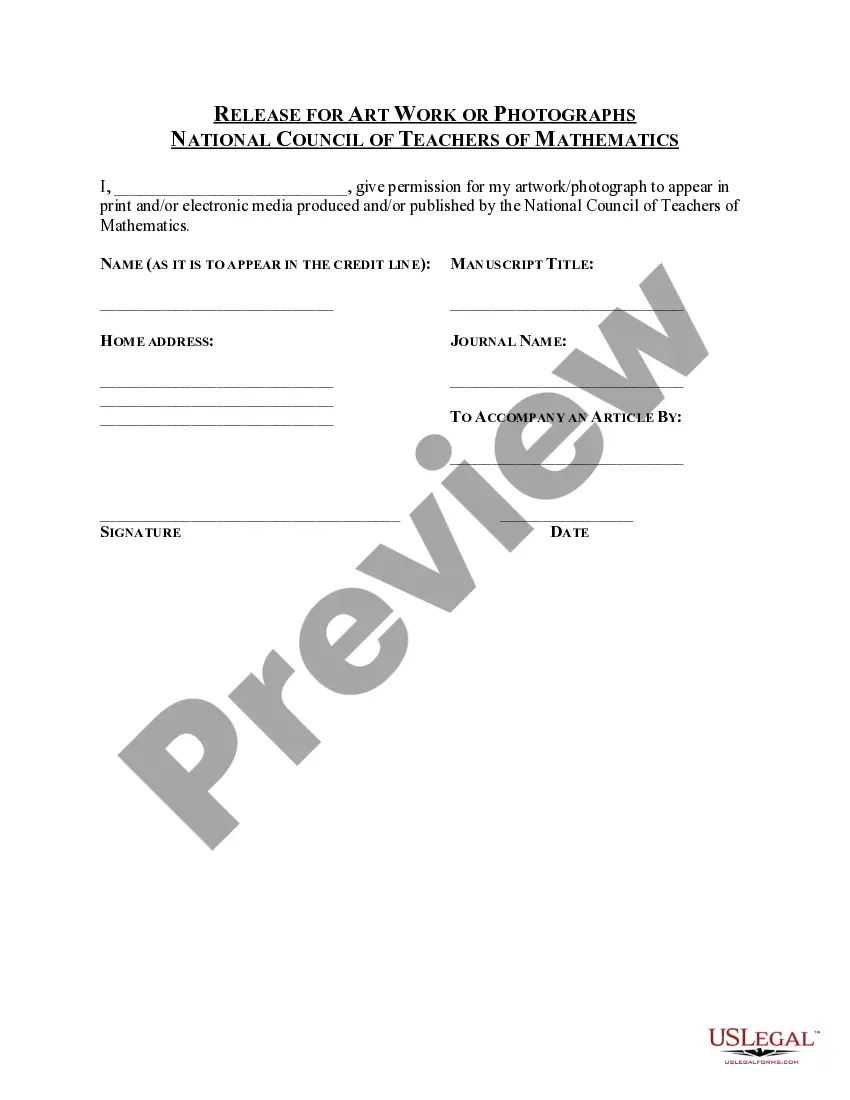

- Examine the form description and use the Preview option, if available, to ensure it's the template you need.

- Don't worry if the form doesn't suit your requirements - look for the correct one in the header.

- Click Buy Now when you find the required sample and pick the best suitable subscription.

- Log in or register for an account to purchase your subscription.

- Make a payment with a credit card or via PayPal.

- Opt for the document format for your Montgomery Bill of Transfer to a Trust and save it.

Once done, you can print it out and complete it on paper or import the template to an online editor for a faster and more practical fill-out. US Legal Forms enables you to use all the documents ever acquired many times - you can find your templates in the My Forms tab in your profile. Try it out now!