The Tarrant Texas Bill of Transfer to a Trust is a legal document that allows individuals in Tarrant County, Texas, to transfer ownership of assets from their personal name into a trust. This transfer ensures that the assets are managed, protected, and distributed according to the wishes outlined in the trust agreement. A Bill of Transfer to a Trust in Tarrant Texas is typically used for estate planning purposes, as it helps individuals to avoid probate, minimize estate taxes, and maintain privacy concerning their assets. This document provides a clear record of the transfer, ensuring a smooth and efficient transition of ownership. There are different types of Tarrant Texas Bill of Transfer to a Trust, depending on the specific needs and goals of the individual creating the trust. Some common types include: 1. Revocable Living Trust: This type of trust allows the individual (often referred to as the settler or granter) to maintain control over their assets during their lifetime. They can modify or revoke the trust, as well as add or remove assets as needed. After the settler's death, the trust becomes irrevocable, and the assets are distributed according to the terms specified in the trust agreement. 2. Irrevocable Trust: Unlike a revocable trust, an irrevocable trust cannot be modified or revoked once created, except under certain circumstances. This type of trust is often used for estate tax planning or asset protection purposes. Once assets are transferred to an irrevocable trust, they are considered to be outside the settler's estate and may provide potential tax benefits. 3. Testamentary Trust: Unlike the previous types mentioned, a testamentary trust is created through a person's last will and testament. It only comes into effect after the individual's death. The assets are transferred to the trust, and a trustee manages and distributes them according to the probate court's instructions. 4. Special Needs Trust: This type of trust is specifically designed to provide financial support for individuals with disabilities or special needs. The assets held in this trust can supplement government benefits without affecting eligibility. It ensures that the individual receives necessary support while preserving their eligibility for assistance programs. In summary, the Tarrant Texas Bill of Transfer to a Trust is a vital legal document used in estate planning and asset protection. It allows individuals to transfer assets from their personal name into a trust, ensuring efficient asset management and distribution according to their wishes. Different types of trusts are available, including revocable living trusts, irrevocable trusts, testamentary trusts, and special needs trusts, each serving unique purposes based on the individual's goals and circumstances.

Tarrant Texas Bill of Transfer to a Trust

Description

How to fill out Tarrant Texas Bill Of Transfer To A Trust?

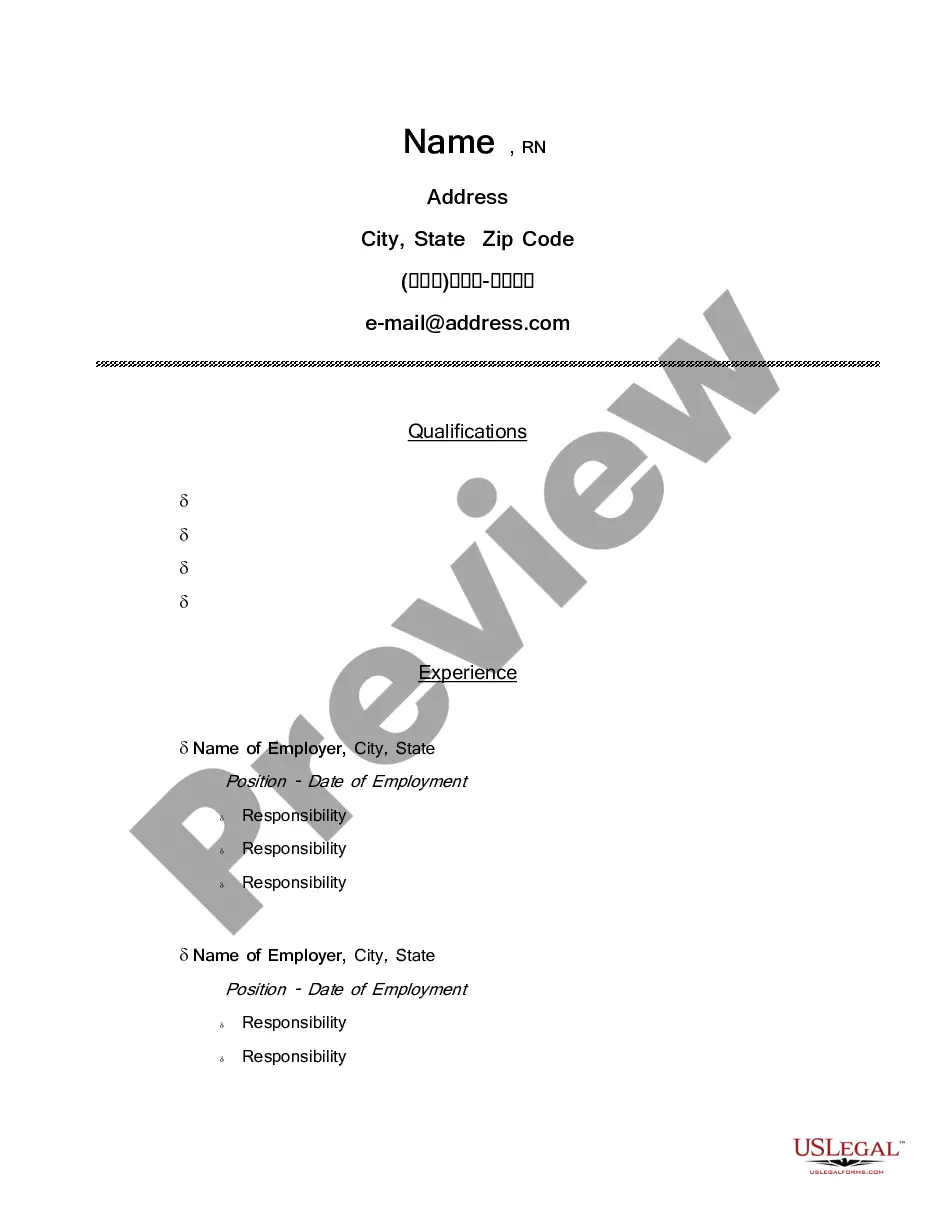

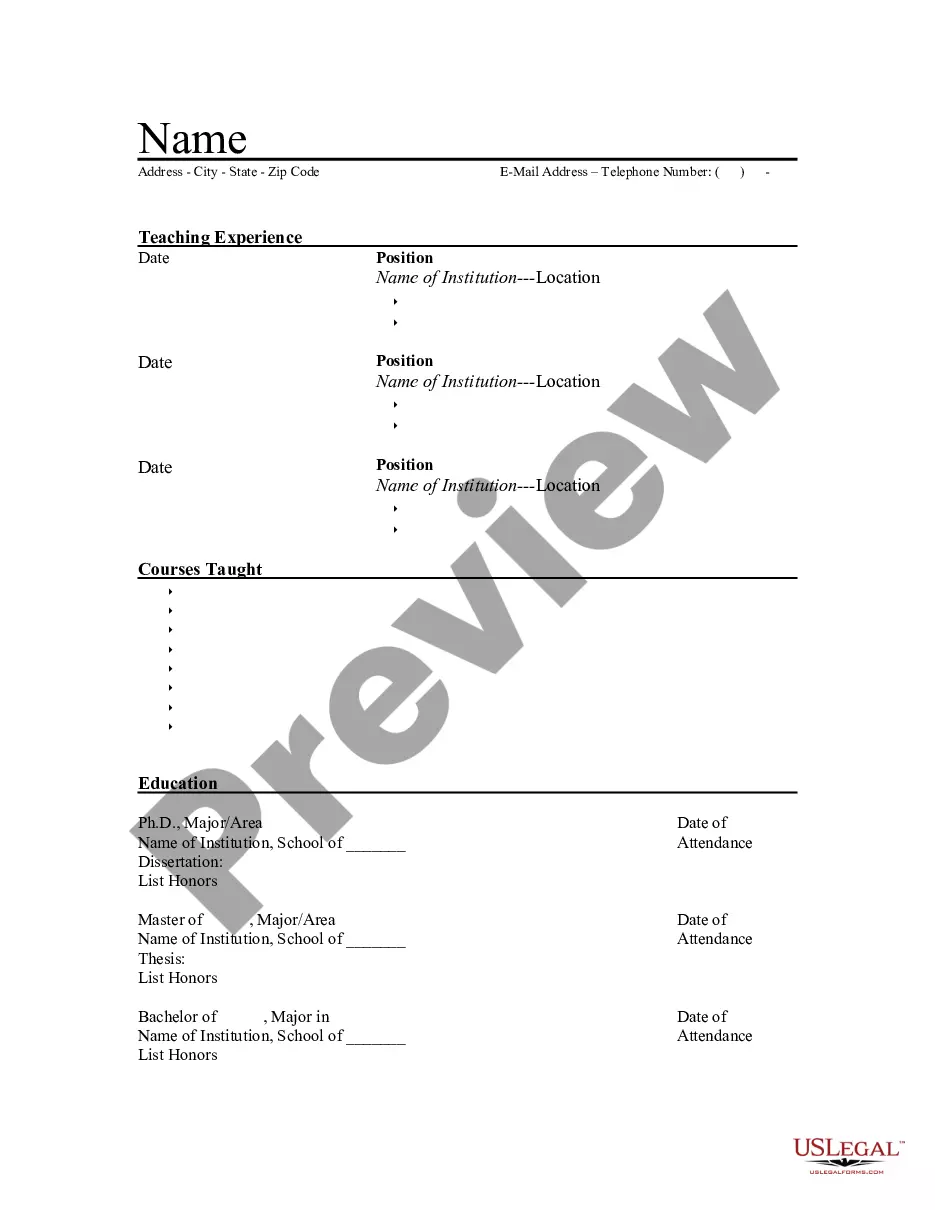

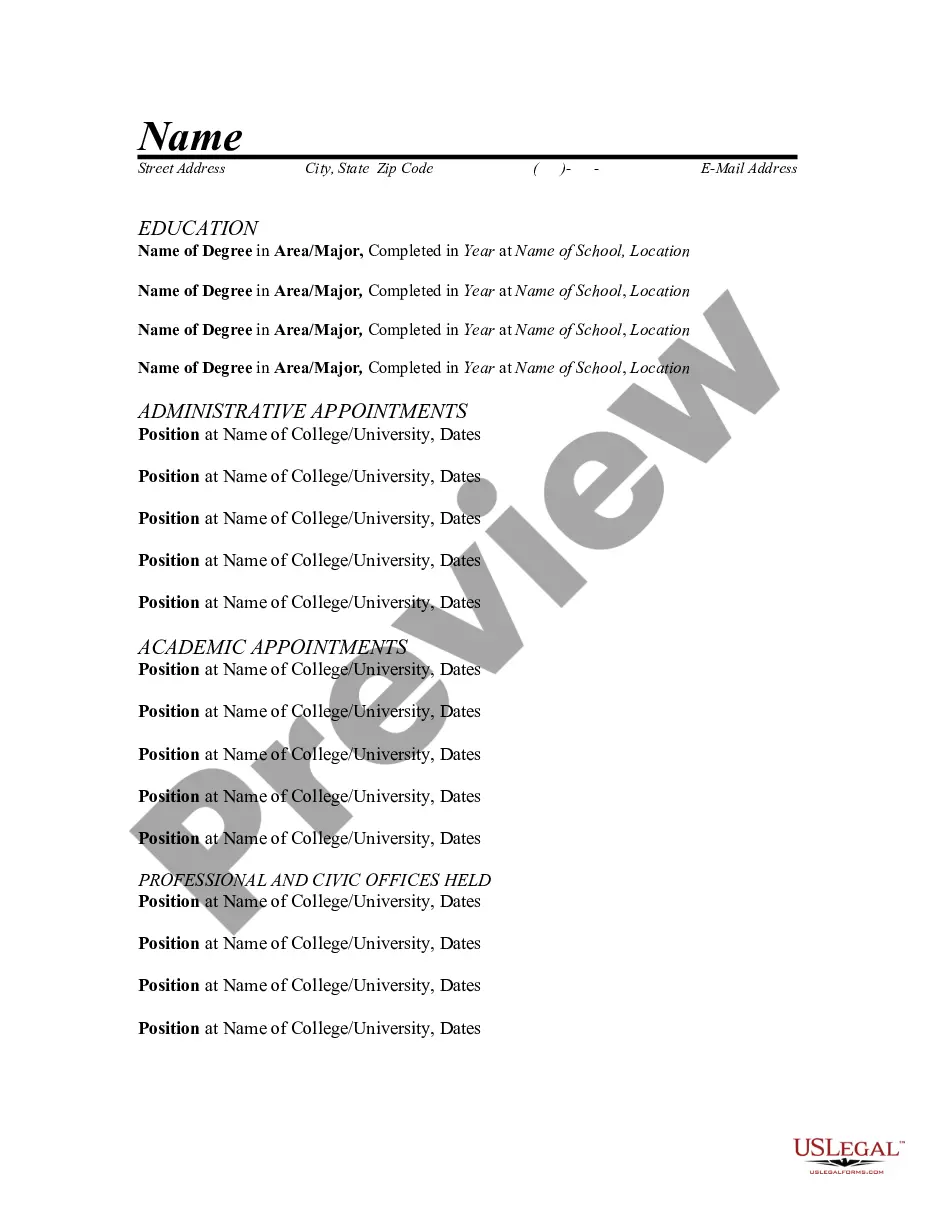

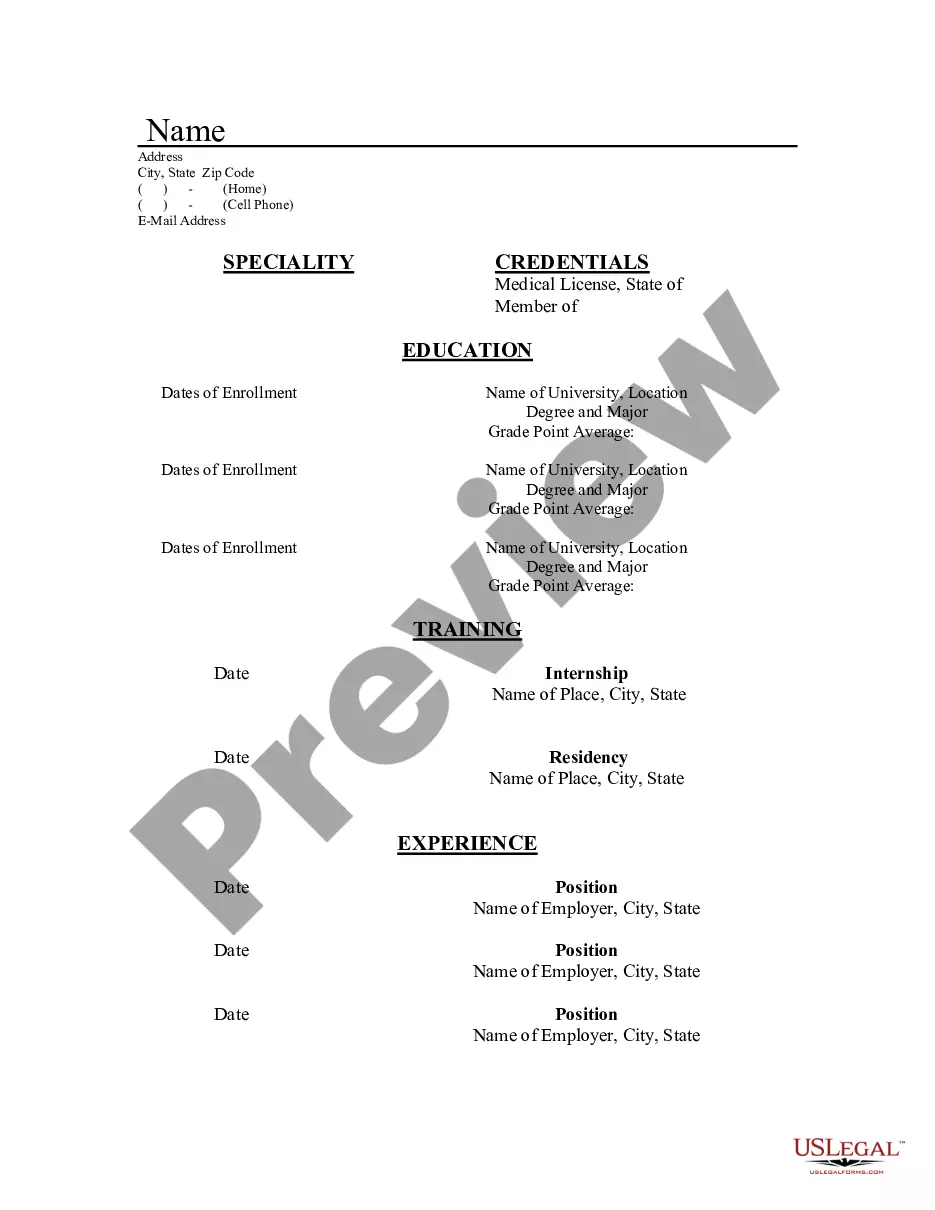

If you need to find a trustworthy legal paperwork supplier to obtain the Tarrant Bill of Transfer to a Trust, look no further than US Legal Forms. Whether you need to launch your LLC business or manage your belongings distribution, we got you covered. You don't need to be well-versed in in law to locate and download the appropriate template.

- You can browse from more than 85,000 forms arranged by state/county and situation.

- The self-explanatory interface, variety of supporting materials, and dedicated support make it simple to get and complete various papers.

- US Legal Forms is a reliable service offering legal forms to millions of users since 1997.

You can simply select to search or browse Tarrant Bill of Transfer to a Trust, either by a keyword or by the state/county the form is intended for. After locating necessary template, you can log in and download it or save it in the My Forms tab.

Don't have an account? It's effortless to start! Simply locate the Tarrant Bill of Transfer to a Trust template and take a look at the form's preview and description (if available). If you're confident about the template’s terminology, go ahead and hit Buy now. Register an account and choose a subscription option. The template will be immediately ready for download once the payment is completed. Now you can complete the form.

Taking care of your law-related matters doesn’t have to be pricey or time-consuming. US Legal Forms is here to demonstrate it. Our rich collection of legal forms makes this experience less pricey and more affordable. Set up your first company, arrange your advance care planning, create a real estate contract, or complete the Tarrant Bill of Transfer to a Trust - all from the convenience of your sofa.

Join US Legal Forms now!