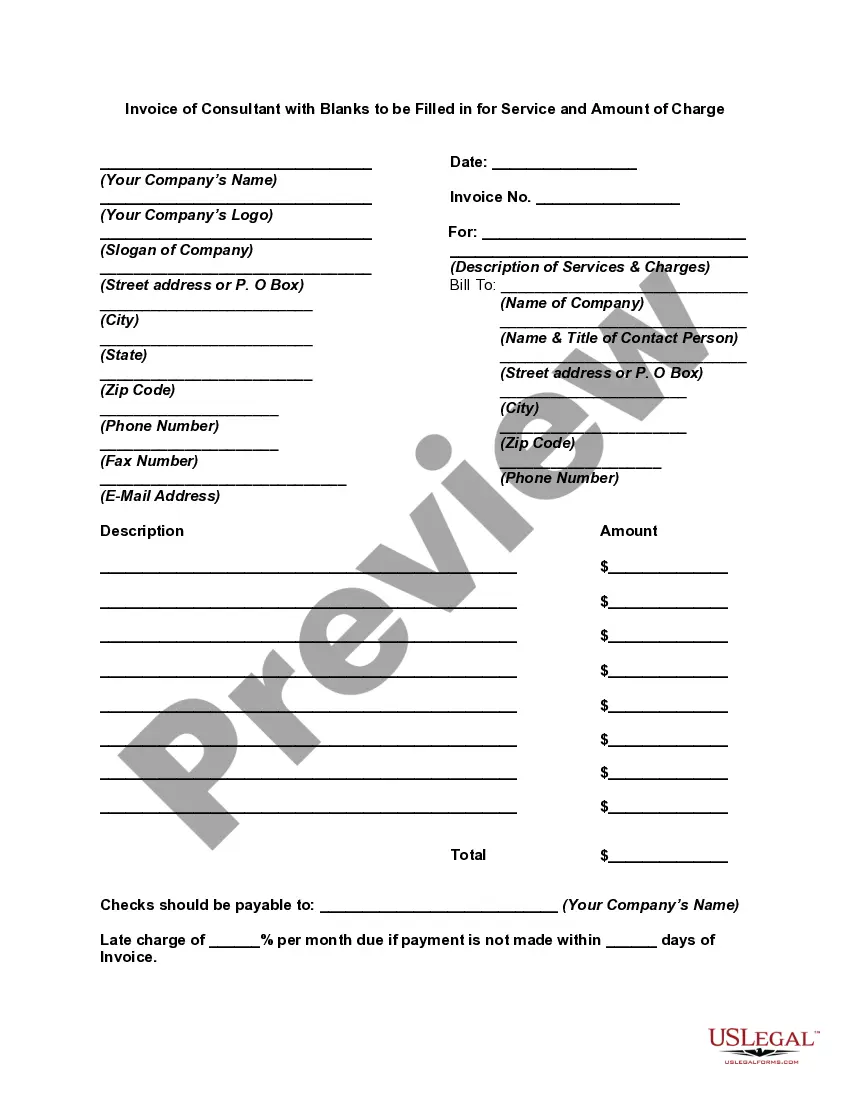

An invoice is a document or electronic statement stating the items sold and the amount payable. It is also called a bill. Invoicing is when invoices are produced and sent to customers. It is used to communicate to a buyer the specific items, price, and quantities they have delivered and now must be paid for by the buyer. Payment terms will usually accompany the billing information. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Houston Texas Invoice of Consultant with Blanks to be Filled in for Service and Amount of Charge

Description

How to fill out Invoice Of Consultant With Blanks To Be Filled In For Service And Amount Of Charge?

Handling legal documents is essential in the modern era. However, it's not always necessary to seek professional help to create some of them from the ground up, such as the Houston Invoice of Consultant with Blanks to be Filled in for Service and Amount of Charge, using a platform like US Legal Forms.

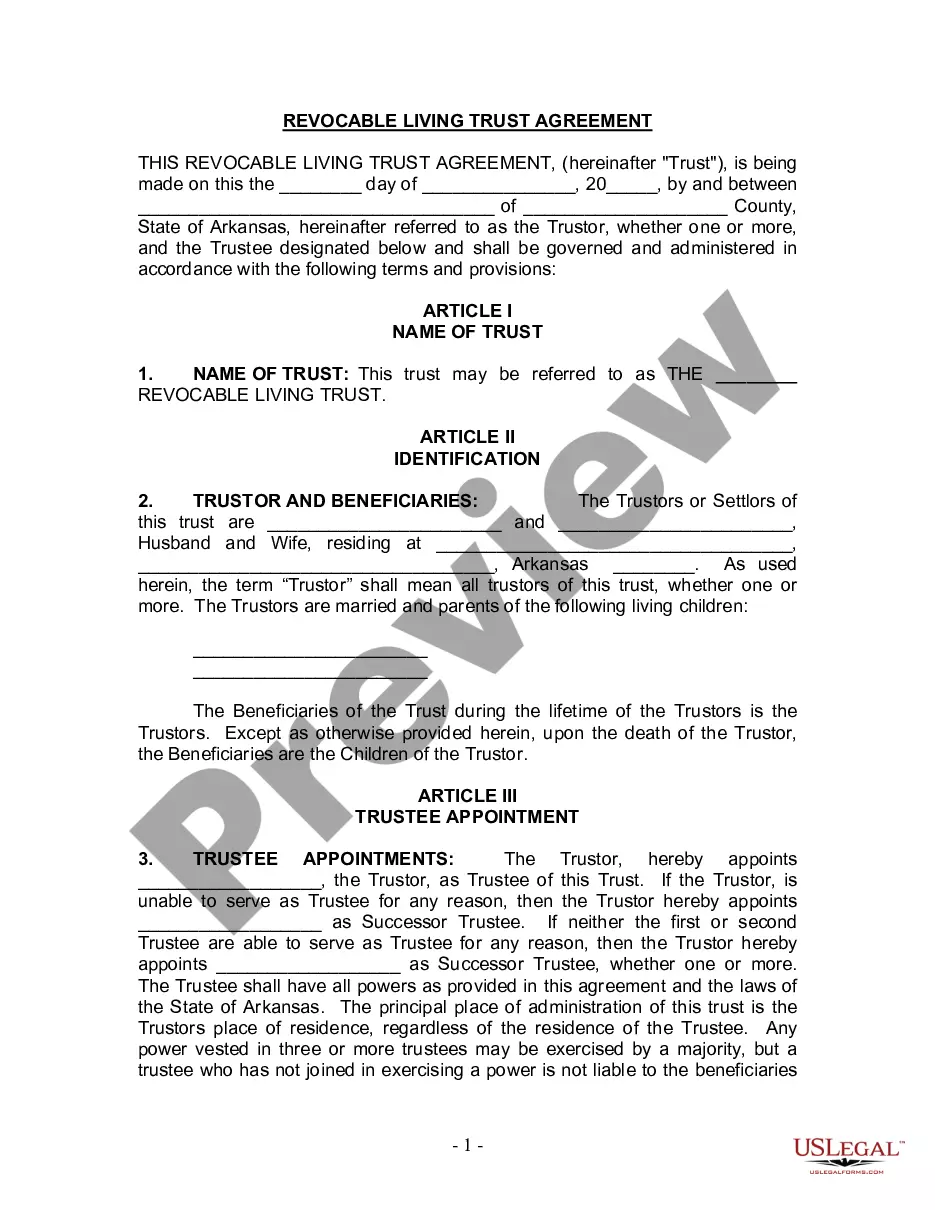

US Legal Forms offers over 85,000 documents to choose from in various categories, including living wills, real estate forms, and divorce papers. All documents are classified according to their respective state, simplifying the search process.

You can also access comprehensive materials and guides on the site to make any tasks related to form completion straightforward.

If you are already a member of US Legal Forms, you can find the required Houston Invoice of Consultant with Blanks to be Filled in for Service and Amount of Charge, Log In to your account, and download it. Of course, our website cannot entirely replace a lawyer. If you face a particularly complex situation, we recommend consulting with an attorney to verify your form before executing and filing it.

With over 25 years in the industry, US Legal Forms has demonstrated to be a trusted resource for numerous types of legal documents for millions of users. Join today and acquire your state-specific paperwork with ease!

- View the document's preview and description (if available) to gain a general understanding of what you will receive upon downloading the document.

- Ensure that the document you select is tailored to your state/county/area, as state laws can affect the legality of certain records.

- Review related documents or restart your search to find the appropriate form.

- Click Buy now and create your account. If you already have one, opt to Log In.

- Select the payment method and purchase the Houston Invoice of Consultant with Blanks to be Filled in for Service and Amount of Charge.

- Choose to save the form template in any available format.

- Navigate to the My documents section to re-download the document.

Form popularity

FAQ

The most polite way to ask for payment is an invoice email as a gentle reminder. Businesses get these regularly, and accept them as part of life. Send a simple payment request email and follow it up with another one if payment is not made for the late invoice. Always remain polite in your communication.

How to Invoice for Services Develop a Service-Based Invoice Template.List Your Business Name and Contact Information.Include Your Client's Name and Contact Details.Assign a Service Invoice Number.Write the Issuing Date for Your Service Invoice.List All Services Rendered.Include Applicable Taxes for Your Services.

Here's a simple guide that shows you how to invoice clients as a consultant: Track Your Hours.Include A Header.Add Your Client's Contact Details.Include The Invoice Date.Number Your Invoices.Clearly List Your Services.State Your Payment Terms.List the Payment Due Date.

What should be included in an invoice? 1. ' Invoice'A unique invoice number.Your company name and address.The company name and address of the customer.A description of the goods/services.The date of supply.The date of the invoice.The amount of the individual goods or services to be paid.

A consulting invoice is a document that allows a professional consultant to provide a client with an itemized statement of services rendered.

How to create an invoice: step-by-step Make your invoice look professional. The first step is to put your invoice together.Clearly mark your invoice.Add company name and information.Write a description of the goods or services you're charging for.Don't forget the dates.Add up the money owed.Mention payment terms.

Invoicing process for consultants Keep track of consulting hours for every client.Comply with the tax laws applicable to your consultancy business.Assign invoice number and Invoice date for every billing document.Use business or professional header.Add the details of client and contact.

How to create an invoice: step-by-step Make your invoice look professional. The first step is to put your invoice together.Clearly mark your invoice.Add company name and information.Write a description of the goods or services you're charging for.Don't forget the dates.Add up the money owed.Mention payment terms.

To create an invoice in Word from scratch, businesses can follow these invoicing steps: Open a New Blank Document.Create an Invoice Header.Add the Invoice Date.Include a Unique Invoice Number.Include Your Client's Contact Details.Create an Itemized List of Services.Display the Total Amount Due.