Allegheny Pennsylvania Owner Financing Contract for Land is a legal agreement between a buyer and seller that allows the buyer to purchase a property in Allegheny, Pennsylvania, using financing provided by the owner of the land. This type of contract is common in real estate transactions where buyers have difficulty securing traditional bank loans or mortgages. The Allegheny Pennsylvania Owner Financing Contract for Land typically includes detailed terms and conditions tailored to the specific agreement between the buyer and seller. It outlines the purchase price of the land, the down payment amount, the interest rate, the repayment schedule, and any other relevant clauses such as penalties for late payments or default. One key advantage of an owner financing contract is that it allows buyers to acquire land without going through a traditional lending institution, bypassing lengthy loan approval processes and potential credit score requirements. This makes it an attractive option for individuals with less-than-perfect credit scores or those who do not meet the stringent criteria set by banks. There are different types of Allegheny Pennsylvania Owner Financing Contracts for Land, depending on the terms agreed upon by the parties involved. Some common variations include: 1. Installment Sales Contract: This contract sets up a structured payment plan where the buyer pays the purchase price in regular installments over a specified period. In this arrangement, the seller retains the legal ownership until the final payment is made. 2. Land Contract: Also known as a "contract for deed," a land contract grants the buyer immediate possession of the property while the seller holds the legal title. The buyer makes regular payments to the seller, and upon completion of the agreed-upon terms, the seller transfers the title to the buyer. 3. Lease Purchase Agreement: This contract combines a lease agreement with an option to purchase the land at a later date. The buyer leases the land for a predetermined period, with a portion of the lease payments going towards a down payment. At the end of the lease term, the buyer has the option to exercise the purchase option and buy the land. 4. Wraparound Mortgage: In this arrangement, the seller helps finance the purchase by creating a new mortgage, which includes the existing mortgage. The buyer makes mortgage payments to the seller, who then uses part of that payment to cover the underlying loan. 5. Contract Assignment: This type of contract allows the buyer to assign their rights and obligations under the owner financing agreement to a third party. It often comes into play when the buyer decides to sell the property before the contract is fully completed. In Allegheny Pennsylvania, owner financing contracts for land provide a flexible alternative to conventional financing methods, enabling both buyers and sellers to negotiate terms that suit their specific needs. However, it is crucial for all parties involved to seek legal advice and thoroughly understand the terms of the agreement to ensure a smooth and fair transaction.

Allegheny Pennsylvania Owner Financing Contract for Land

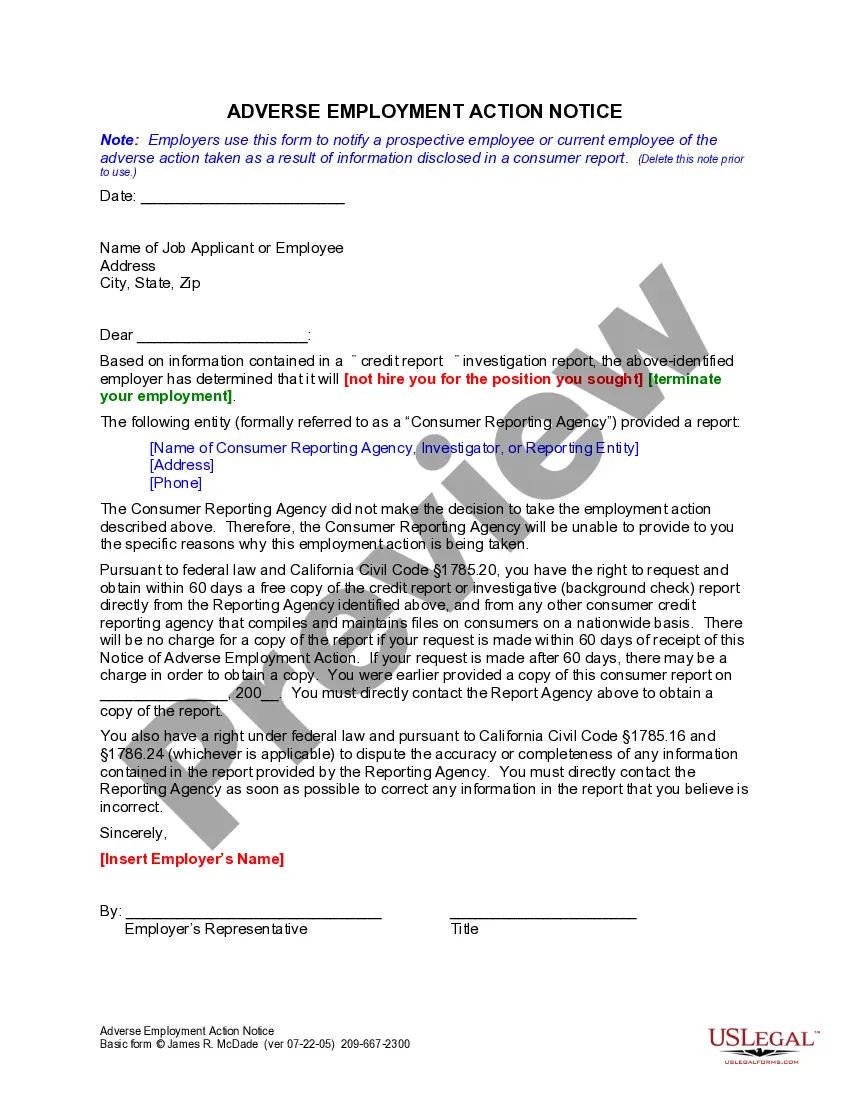

Description

How to fill out Allegheny Pennsylvania Owner Financing Contract For Land?

A document routine always accompanies any legal activity you make. Creating a company, applying or accepting a job offer, transferring property, and lots of other life situations demand you prepare official documentation that differs from state to state. That's why having it all accumulated in one place is so helpful.

US Legal Forms is the biggest online library of up-to-date federal and state-specific legal forms. Here, you can easily locate and download a document for any individual or business purpose utilized in your region, including the Allegheny Owner Financing Contract for Land.

Locating forms on the platform is amazingly simple. If you already have a subscription to our service, log in to your account, find the sample using the search bar, and click Download to save it on your device. Afterward, the Allegheny Owner Financing Contract for Land will be available for further use in the My Forms tab of your profile.

If you are using US Legal Forms for the first time, follow this simple guide to obtain the Allegheny Owner Financing Contract for Land:

- Make sure you have opened the correct page with your localised form.

- Make use of the Preview mode (if available) and scroll through the sample.

- Read the description (if any) to ensure the form corresponds to your requirements.

- Look for another document using the search option in case the sample doesn't fit you.

- Click Buy Now once you locate the required template.

- Decide on the suitable subscription plan, then sign in or create an account.

- Select the preferred payment method (with credit card or PayPal) to proceed.

- Opt for file format and download the Allegheny Owner Financing Contract for Land on your device.

- Use it as needed: print it or fill it out electronically, sign it, and file where requested.

This is the easiest and most reliable way to obtain legal paperwork. All the templates provided by our library are professionally drafted and checked for correspondence to local laws and regulations. Prepare your paperwork and run your legal affairs efficiently with the US Legal Forms!