Collin Texas Owner Financing Contract for Land is an agreement between the owner of a property and a buyer, wherein the owner provides financing for the purchase of the land. This type of contract is particularly beneficial for buyers who may not qualify for traditional bank loans or prefer a more flexible payment arrangement. The Collin Texas Owner Financing Contract for Land typically outlines the terms and conditions of the agreement, including the purchase price, down payment, interest rate, payment schedule, and any additional provisions or contingencies. It is crucial to note that these contracts can vary depending on the specific requirements and preferences of both the buyer and the seller. In Collin County, Texas, there are generally two common types of Owner Financing Contracts for Land: 1. Contract for Deed: Also known as a Land Contract or an Installment Sale Agreement, this type of contract allows the buyer to possess and use the land while making payments to the seller. The seller retains legal title to the property until the buyer fulfills all obligations, such as paying off the contract balance. Once the buyer completes the payment, the seller transfers the title to the buyer. 2. Promissory Note and Deed of Trust: This type of agreement involves the buyer executing a promissory note, which states their promise to repay the loan, and a deed of trust, which gives the seller a security interest in the property. The buyer receives equitable title to the land, allowing them to use and occupy it, while the seller holds the deed as a security until the loan is fully repaid. Both types of Collin Texas Owner Financing Contracts for Land offer advantages for the buyer, including more accessible financing options, quicker closing processes, and potential flexibility in negotiating terms. For sellers, these contracts can attract a larger pool of potential buyers and provide reliable income through interest payments. In conclusion, the Collin Texas Owner Financing Contract for Land provides an alternative method for buyers to acquire land without the need for traditional bank loans. The specific terms and types of these contracts can vary, so it is crucial for both buyers and sellers to carefully review and negotiate the terms to ensure a mutually beneficial agreement.

Collin Texas Owner Financing Contract for Land

Description

How to fill out Collin Texas Owner Financing Contract For Land?

Laws and regulations in every sphere vary around the country. If you're not an attorney, it's easy to get lost in a variety of norms when it comes to drafting legal documents. To avoid pricey legal assistance when preparing the Collin Owner Financing Contract for Land, you need a verified template valid for your county. That's when using the US Legal Forms platform is so helpful.

US Legal Forms is a trusted by millions online collection of more than 85,000 state-specific legal forms. It's an excellent solution for professionals and individuals searching for do-it-yourself templates for various life and business situations. All the forms can be used multiple times: once you pick a sample, it remains accessible in your profile for further use. Therefore, if you have an account with a valid subscription, you can simply log in and re-download the Collin Owner Financing Contract for Land from the My Forms tab.

For new users, it's necessary to make a couple of more steps to obtain the Collin Owner Financing Contract for Land:

- Examine the page content to make sure you found the appropriate sample.

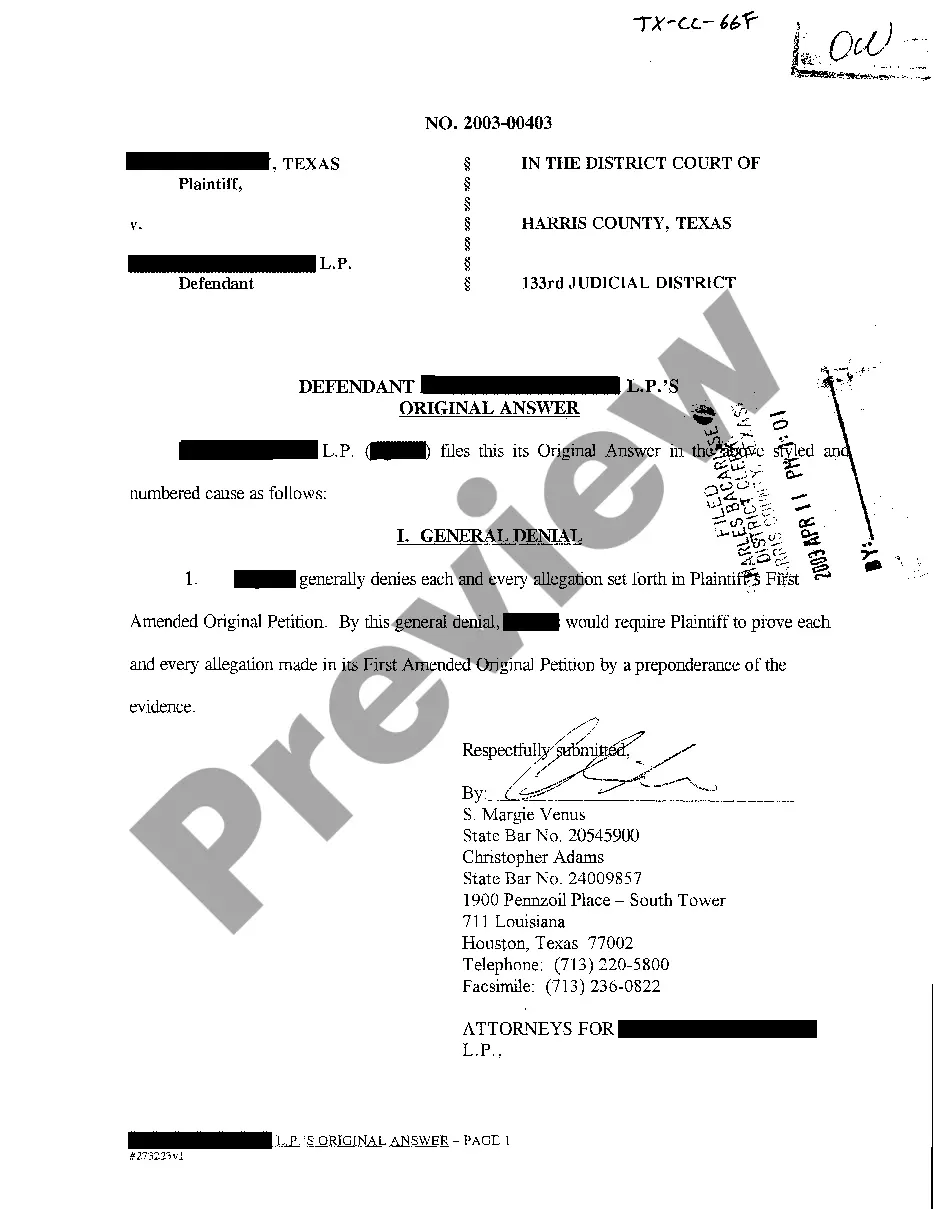

- Use the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your requirements.

- Click on the Buy Now button to get the template once you find the appropriate one.

- Choose one of the subscription plans and log in or create an account.

- Choose how you prefer to pay for your subscription (with a credit card or PayPal).

- Pick the format you want to save the file in and click Download.

- Complete and sign the template on paper after printing it or do it all electronically.

That's the easiest and most cost-effective way to get up-to-date templates for any legal purposes. Find them all in clicks and keep your paperwork in order with the US Legal Forms!

Form popularity

FAQ

In an owner financing arrangement, you borrow from the seller instead of a conventional lender such as bank. You pay a fixed amount of monthly installment to the owner for a fixed number of years. The seller can foreclose if you don't pay off the loan, just like a bank does.

Since traditional owner finance transactions, wraps, and land trusts are all forms of owner finance, the SAFE Act applies; however, the seller is required to be licensed only if the property is not the seller's homestead and/or the sale is not to a family member.

Owner financed land (also called seller financed or owner will carry) is a form of land purchase where instead of getting a loan from the bank, you make payments directly to the seller until the loan is paid off. There are several advantages to you, as the buyer, of going the route of owner financed land.

Owner financed land (also called seller financed or owner will carry) is a form of land purchase where instead of getting a loan from the bank, you make payments directly to the seller until the loan is paid off. There are several advantages to you, as the buyer, of going the route of owner financed land.

The down payment for land financing typically begins at a minimum of 20%. The interest rate can be locked in for anywhere from 1 to 20 years. Interest rates on raw land will differ from conventional mortgage rates. Borrowing money from a co-op could help lower your borrowing costs through a cash-back dividend.

Owner-financed contracts begin with a down payment, followed by scheduled payments to the seller (instead of the bank) according to terms that the seller and the buyer agree upon. Owner financed terms are offered for almost all of our rural Texas properties for sale.

A Bond for Deed arrangement, also known as a Contract for Deed, is actually a form of owner financing, but with one important exception: the seller retains the Deed and legal title to the house while transferring the physical possession of the house to the buyer.

Texas no longer allows owner-financing under last year's Texas House Bill 10 the SAFE Act unless the seller has a license. SAFE (which stands for Secure and Fair Enforcement for Mortgage Licensing Act) was passed in order to comply with a federal law of the same name.

Yes. However, seller financing is subject to state and federal laws. The Texas Real Estate Commission promulgates the Seller Financing Addendum (TXR 1914) for seller financed transactions. If the seller finance box in a TREC contract is checked, you must fill out and attach this addendum to the contract.

Texas no longer allows owner-financing under last year's Texas House Bill 10 the SAFE Act unless the seller has a license. SAFE (which stands for Secure and Fair Enforcement for Mortgage Licensing Act) was passed in order to comply with a federal law of the same name.