Palm Beach Florida Owner Financing Contract for Vehicle is a specialized financial agreement that allows individuals to purchase a vehicle without traditional bank financing. This contract is designed to facilitate a mutually beneficial arrangement between the vehicle owner and the buyer, allowing the buyer to make regular payments directly to the owner, thereby eliminating the need for third-party lending institutions. One of the primary advantages of a Palm Beach Florida Owner Financing Contract for Vehicle is the flexibility it offers to both parties involved. This agreement allows the buyer to negotiate terms such as down payment, interest rate, and repayment period directly with the vehicle owner, potentially leading to more favorable conditions than those offered by traditional lenders. Moreover, this financing option enables individuals with limited credit history or poor credit scores to secure vehicle ownership without facing rejection typical in standard loan procedures. It can be a great opportunity for those who struggle to obtain vehicle financing due to their financial situation or creditworthiness. In Palm Beach Florida, there are various types of Owner Financing Contracts for Vehicle. These might include: 1. Installment Sales Contract: This type of contract is a common form of owner financing where the buyer agrees to pay the purchase price in fixed installments over a specific period, usually with interest added. Monthly payments are made directly to the seller until the full amount is paid off. 2. Lease-to-Own Contract: This contract allows the buyer to lease the vehicle for a predetermined period with an option to purchase it at the end of the lease term. A portion of the monthly lease payments is applied toward the eventual purchase price of the vehicle. 3. Balloon Payment Contract: This contract enables the buyer to make smaller monthly payments for a set period, with a larger lump sum payment (balloon payment) due at the end of the contract term. This option may provide lower monthly payments but requires careful financial planning to ensure the buyer can meet the balloon payment obligation. 4. Rent-to-Own Contract: In this type of contract, the buyer agrees to rent the vehicle for a specified period with the intention of eventually owning it. Some monthly rental payments may be applied towards the purchase price at the end of the contract. When entering into a Palm Beach Florida Owner Financing Contract for Vehicle, it is important for both parties to carefully review the terms and conditions outlined in the agreement. Seeking legal advice and conducting thorough due diligence are recommended to protect the rights and interests of both the buyer and vehicle owner.

Palm Beach Florida Owner Financing Contract for Vehicle

Description

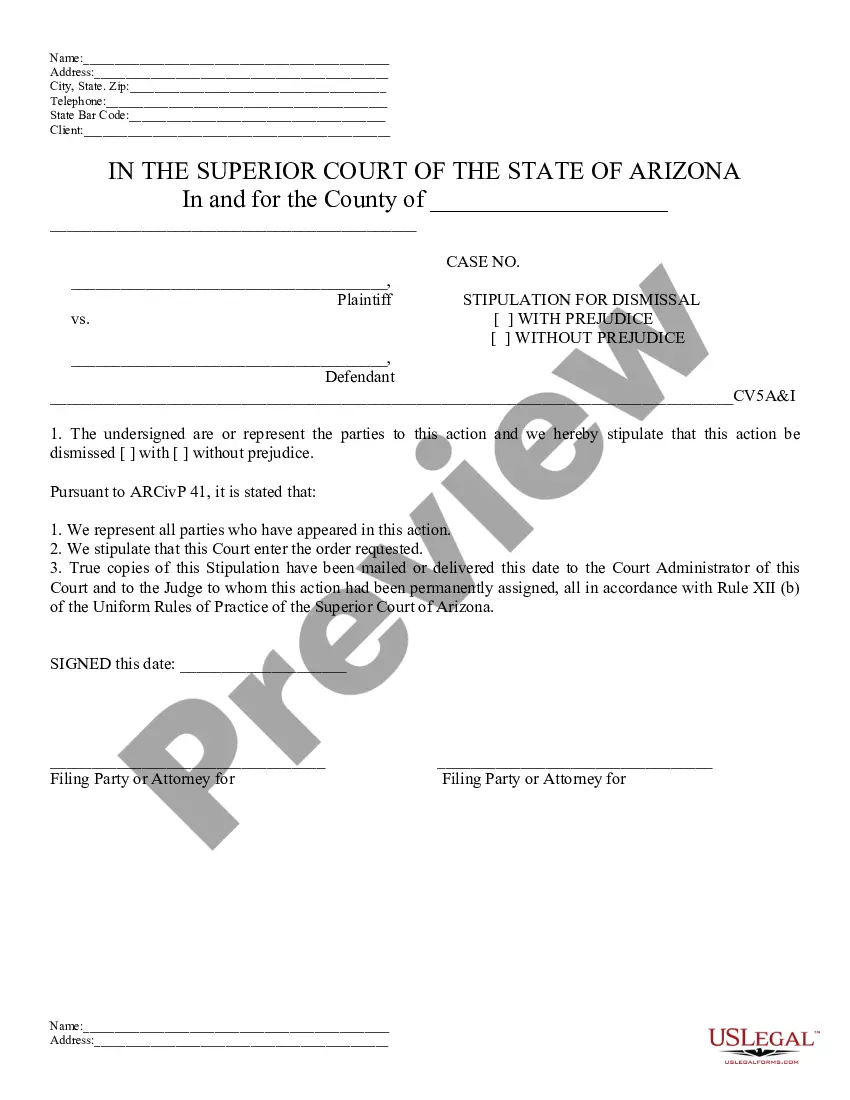

How to fill out Palm Beach Florida Owner Financing Contract For Vehicle?

Are you looking to quickly draft a legally-binding Palm Beach Owner Financing Contract for Vehicle or probably any other document to manage your own or corporate affairs? You can go with two options: hire a professional to draft a valid paper for you or draft it entirely on your own. Luckily, there's an alternative option - US Legal Forms. It will help you get professionally written legal paperwork without having to pay sky-high fees for legal services.

US Legal Forms offers a rich collection of over 85,000 state-specific document templates, including Palm Beach Owner Financing Contract for Vehicle and form packages. We provide templates for an array of life circumstances: from divorce paperwork to real estate documents. We've been on the market for over 25 years and gained a spotless reputation among our clients. Here's how you can become one of them and get the necessary template without extra hassles.

- First and foremost, double-check if the Palm Beach Owner Financing Contract for Vehicle is adapted to your state's or county's laws.

- In case the document comes with a desciption, make sure to verify what it's suitable for.

- Start the searching process over if the template isn’t what you were seeking by utilizing the search box in the header.

- Select the plan that best suits your needs and proceed to the payment.

- Select the file format you would like to get your document in and download it.

- Print it out, complete it, and sign on the dotted line.

If you've already registered an account, you can easily log in to it, find the Palm Beach Owner Financing Contract for Vehicle template, and download it. To re-download the form, simply head to the My Forms tab.

It's stressless to buy and download legal forms if you use our catalog. Additionally, the documents we offer are reviewed by law professionals, which gives you greater peace of mind when dealing with legal matters. Try US Legal Forms now and see for yourself!