Phoenix Arizona Owner Financing Contract for Vehicle is a legally binding agreement between a buyer and a seller in which the seller provides financing for the purchase of a vehicle. In this arrangement, the seller takes on the role of the lender and allows the buyer to make monthly payments over a specified period of time instead of paying the full price of the vehicle upfront. The contract outlines the terms and conditions of the financing agreement, such as the purchase price, the down payment, the interest rate, and repayment schedule. The Phoenix Arizona Owner Financing Contract for Vehicle offers various types of contracts, including: 1. Installment Sales Contract: This type of contract allows the buyer to make regular payments, typically monthly, until the total purchase price of the vehicle is paid off. The contract specifies the length of the repayment period and the amount of each payment, including any interest charges. 2. Lease-to-Own Agreement: In this type of agreement, the buyer leases the vehicle from the seller for a specified period of time and has the option to purchase it at the end of the lease term. A portion of the monthly lease payments is applied towards the purchase price, which is determined upfront. 3. Conditional Sales Contract: This contract is similar to an installment sales contract, but it includes a condition where the ownership of the vehicle remains with the seller until the buyer fulfills all contractual obligations, such as making all payments and complying with maintenance and insurance requirements. 4. Buy Here Pay (BHP) Agreement: BHP agreements are typically offered by independent car dealerships and are designed for individuals with bad credit or no credit history. This type of contract allows the buyer to finance a vehicle directly from the dealership, bypassing traditional lenders. It often includes higher interest rates and stricter terms. In Phoenix, Arizona, owner financing contracts for vehicles provide an alternative financing option for individuals who may not qualify for traditional auto loans or who prefer a more flexible payment arrangement. These contracts allow buyers to obtain a vehicle while spreading out the purchase price over time, making vehicle ownership more accessible for a wider range of buyers.

Phoenix Arizona Owner Financing Contract for Vehicle

Description

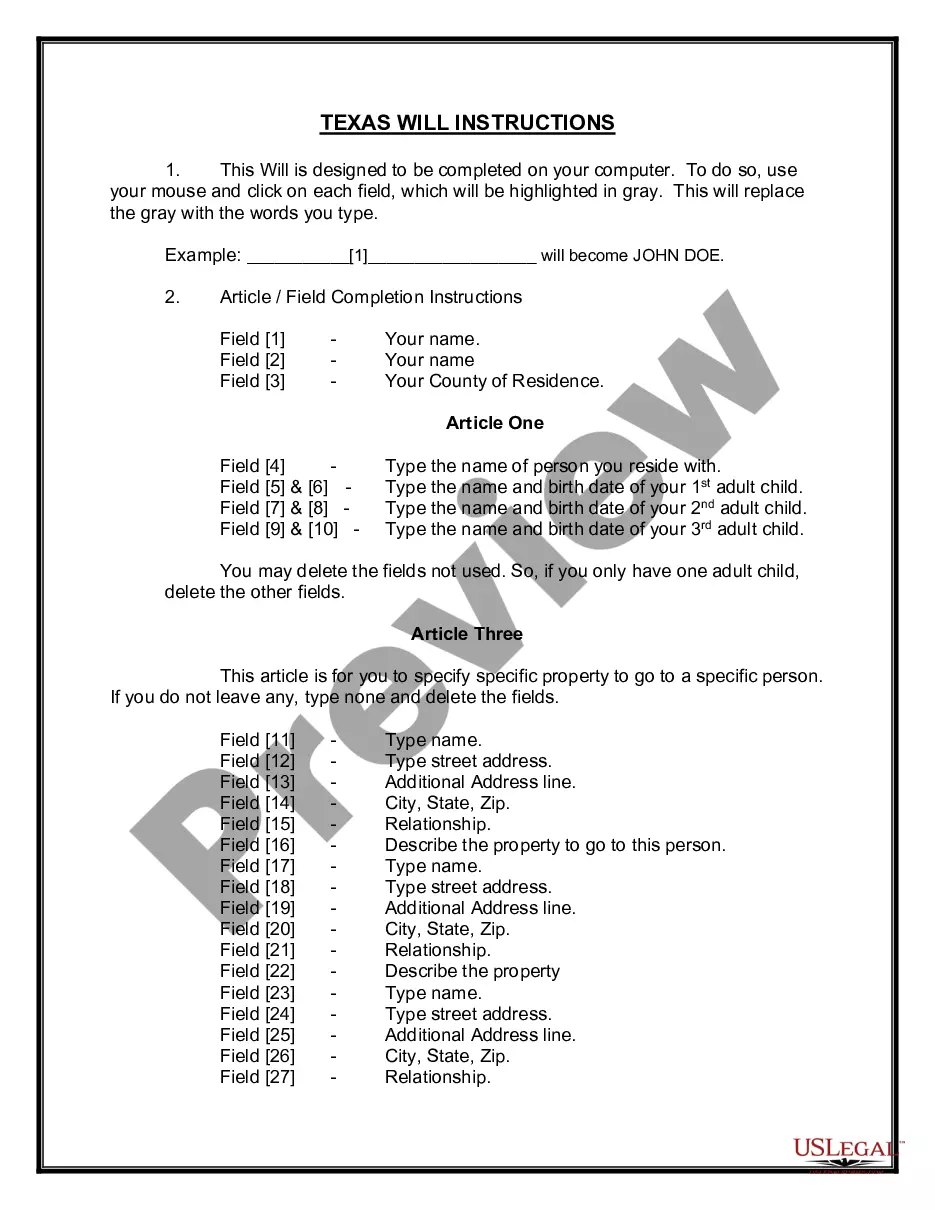

How to fill out Phoenix Arizona Owner Financing Contract For Vehicle?

Preparing legal paperwork can be difficult. Besides, if you decide to ask a lawyer to write a commercial contract, papers for proprietorship transfer, pre-marital agreement, divorce papers, or the Phoenix Owner Financing Contract for Vehicle, it may cost you a fortune. So what is the best way to save time and money and draft legitimate forms in total compliance with your state and local laws and regulations? US Legal Forms is an excellent solution, whether you're looking for templates for your individual or business needs.

US Legal Forms is the most extensive online library of state-specific legal documents, providing users with the up-to-date and professionally checked forms for any scenario gathered all in one place. Therefore, if you need the recent version of the Phoenix Owner Financing Contract for Vehicle, you can easily locate it on our platform. Obtaining the papers requires a minimum of time. Those who already have an account should check their subscription to be valid, log in, and pick the sample by clicking on the Download button. If you haven't subscribed yet, here's how you can get the Phoenix Owner Financing Contract for Vehicle:

- Glance through the page and verify there is a sample for your region.

- Examine the form description and use the Preview option, if available, to ensure it's the template you need.

- Don't worry if the form doesn't suit your requirements - look for the correct one in the header.

- Click Buy Now once you find the required sample and choose the best suitable subscription.

- Log in or sign up for an account to purchase your subscription.

- Make a transaction with a credit card or through PayPal.

- Opt for the document format for your Phoenix Owner Financing Contract for Vehicle and save it.

Once done, you can print it out and complete it on paper or import the samples to an online editor for a faster and more convenient fill-out. US Legal Forms enables you to use all the documents ever acquired multiple times - you can find your templates in the My Forms tab in your profile. Try it out now!