Maricopa Arizona Owner Financing Contract for Car: A Comprehensive Guide In Maricopa, Arizona, the owner financing contract is a legal document that outlines the agreement between a car seller and buyer when purchasing a vehicle using a financing option provided by the owner or seller themselves. This type of contract enables individuals who may not have immediate access to conventional financing options to secure ownership of a car by paying the purchase price through installments directly to the seller. Different Types of Maricopa Arizona Owner Financing Contracts for Car: 1. Standard Owner Financing Contract: This contract type is the most common in Maricopa, Arizona. It defines the terms and conditions, including the financing term, down payment amount, interest rate, monthly payment amount, and any penalties or late fees. Parties involved must sign this agreement. 2. Lease-to-Own Contract: In this type of owner financing contract, the buyer agrees to lease the car from the seller for a fixed period with an option to purchase it at the end of the lease term. A portion of the lease payment is usually credited towards the down payment or purchase price of the vehicle. 3. Balloon Financing Contract: This contract type allows the buyer to make smaller monthly payments for a certain period, often three to five years, after which a significant balloon payment becomes due. This approach typically suits buyers who anticipate an increase in their income or have other financial arrangements to pay off the lump sum. 4. Conditional Sales Contract: In a conditional sales contract, the seller retains ownership of the car until the buyer completes all payments. The buyer gets full possession and use of the vehicle but obtains the title only after fulfilling the contractual obligations. Key Elements of a Maricopa Arizona Owner Financing Contract for Car: a. Purchase Price: Clearly states the agreed-upon price of the car. b. Financing Terms: Outlines the repayment period, interest rate, and any other financial considerations. c. Down Payment: Specifies the upfront amount the buyer must pay towards the car purchase. d. Monthly Payments: Details the installment amount, due date, and payment method. e. Title Transfer: Includes provisions regarding the transfer of ownership upon completion of the financing agreement. f. Default and Repossession: Clarifies the consequences of defaulting on payments and the seller's rights to repossess the vehicle in such cases. g. Warranties and Liabilities: Discloses any warranties provided by the seller and the buyer's responsibilities for repair and maintenance costs. h. Governing Law and Resolution of Disputes: Identifies the governing jurisdiction and outlines the procedures for dispute resolution, such as arbitration or mediation. It is essential for both parties to thoroughly review the contract, seeking legal advice if needed, to ensure all terms and conditions are fair and understood. The contract protects the interests of both the buyer and seller involved in an owner financing agreement for purchasing a car in Maricopa, Arizona.

Maricopa Arizona Owner Financing Contract for Car

Description

How to fill out Maricopa Arizona Owner Financing Contract For Car?

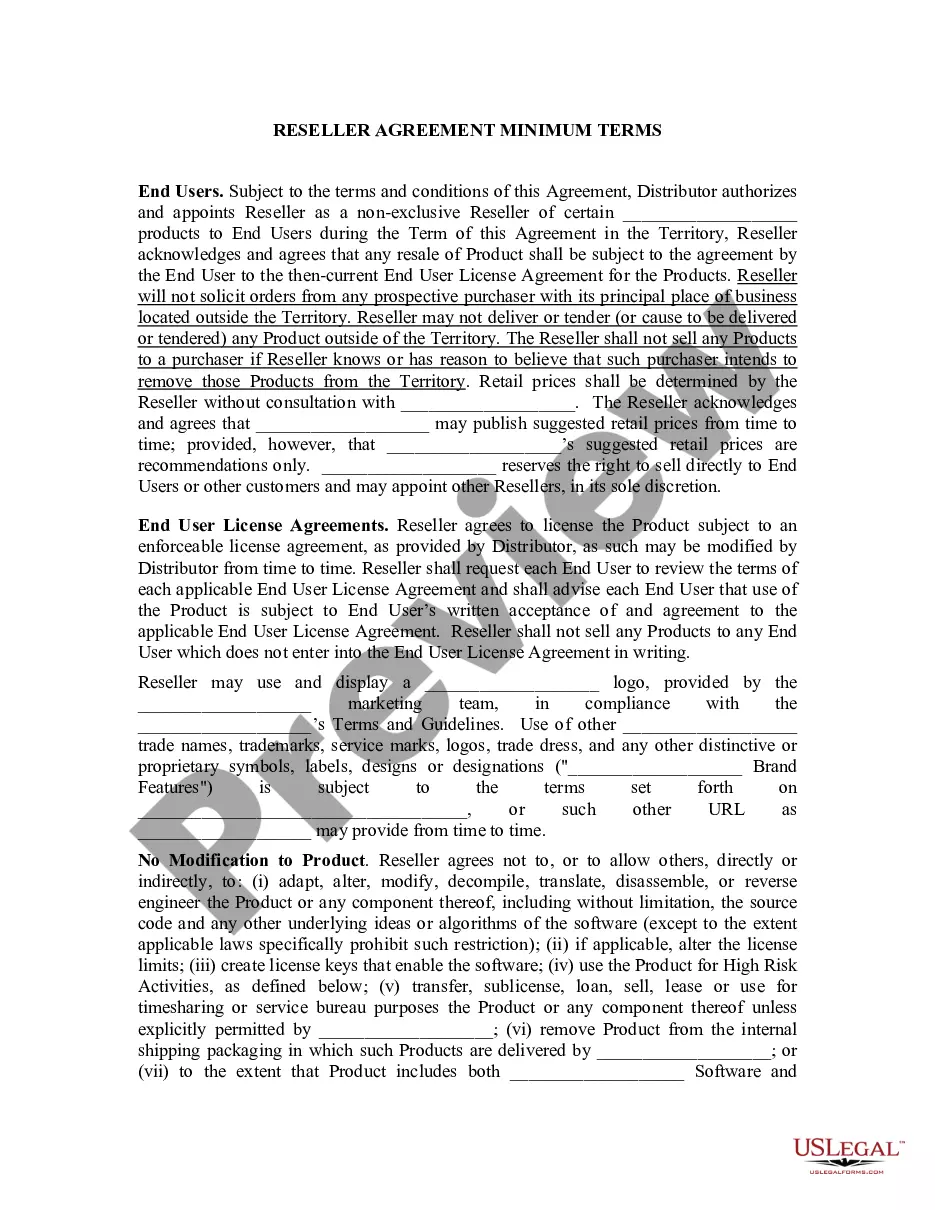

Whether you plan to start your business, enter into a deal, apply for your ID update, or resolve family-related legal concerns, you must prepare specific documentation corresponding to your local laws and regulations. Locating the correct papers may take a lot of time and effort unless you use the US Legal Forms library.

The platform provides users with more than 85,000 expertly drafted and checked legal templates for any individual or business case. All files are collected by state and area of use, so picking a copy like Maricopa Owner Financing Contract for Car is fast and simple.

The US Legal Forms website users only need to log in to their account and click the Download key next to the required form. If you are new to the service, it will take you a few more steps to get the Maricopa Owner Financing Contract for Car. Adhere to the guide below:

- Make certain the sample fulfills your individual needs and state law regulations.

- Look through the form description and check the Preview if available on the page.

- Use the search tab providing your state above to locate another template.

- Click Buy Now to obtain the file once you find the correct one.

- Opt for the subscription plan that suits you most to continue.

- Log in to your account and pay the service with a credit card or PayPal.

- Download the Maricopa Owner Financing Contract for Car in the file format you require.

- Print the copy or complete it and sign it electronically via an online editor to save time.

Forms provided by our website are reusable. Having an active subscription, you are able to access all of your previously acquired paperwork whenever you need in the My Forms tab of your profile. Stop wasting time on a endless search for up-to-date formal documents. Join the US Legal Forms platform and keep your paperwork in order with the most extensive online form library!