Cook Illinois Owner Financing Contract for Homes: A Comprehensive Guide Keywords: Cook Illinois, Owner Financing Contract, Home, Types Introduction: Cook Illinois Owner Financing Contract for Home refers to an alternative financing arrangement for purchasing property in Cook County, Illinois. This contract allows buyers to secure a home without traditional bank loans, enabling greater flexibility and accessibility. In this article, we delve into the details of Cook Illinois Owner Financing Contracts, covering their features, benefits, and different types available to prospective homeowners. 1. What is Cook Illinois Owner Financing Contract for Home? Cook Illinois Owner Financing Contract for Home is a legally binding agreement between a property seller (the current owner) and a buyer, whereby the buyer assumes the role of the lender. This contract allows the buyer to purchase a home directly from the seller, affording them the opportunity to make affordable monthly payments, usually with interest, over a specified period. 2. Key Features of Cook Illinois Owner Financing Contract for Home: — No Bank Involvement: The buyer bypasses traditional lenders such as banks, as the seller directly funds the purchase. — Negotiable Terms: The seller and buyer can negotiate various terms, including the sales price, interest rates, down payments, and repayment periods. — Flexible Qualifications: Owner financing contracts often have more lenient qualification criteria, making homeownership accessible to individuals with less than perfect credit. — Faster Closing: Unlike traditional mortgages, owner financing contracts may offer quicker closing periods, facilitating a seamless home purchase process. 3. Benefits of Cook Illinois Owner Financing Contract for Home: — Increased Accessibility: Buyers with insufficient credit or limited savings can still become homeowners. — Flexible Terms: Buyers can negotiate terms that suit their financial situation and repayment capabilities. — Faster Closing Time: This financing method avoids lengthy mortgage approval processes, allowing for quicker transfers of property ownership. — Potential Tax Benefits: Depending on the buyer's tax situation, deducting mortgage interest and property tax payments may be possible. Types of Cook Illinois Owner Financing Contracts for Home: 1. Installment Contracts: Buyers make regular installments (often monthly) to the seller, typically including principal and interest. Ownership is transferred upon completing all payments. 2. Lease-to-Own Contracts: Buyers agree to lease the property for a specific period with an option to purchase at a predetermined price. A portion of the rent paid may be credited toward the final purchase price. 3. Contract for Deed: The seller retains legal title while granting the buyer equitable title. The buyer makes regular payments, gradually building equity until full payment is made, at which point ownership is officially transferred. Conclusion: Cook Illinois Owner Financing Contract for Home offers an alternative path to homeownership, providing greater accessibility and flexibility to aspiring homeowners. With negotiable terms, simplified qualification criteria, and various contract types, buyers in Cook County can find a suitable owner financing arrangement that aligns with their financial goals.

Cook Illinois Owner Financing Contract for Home

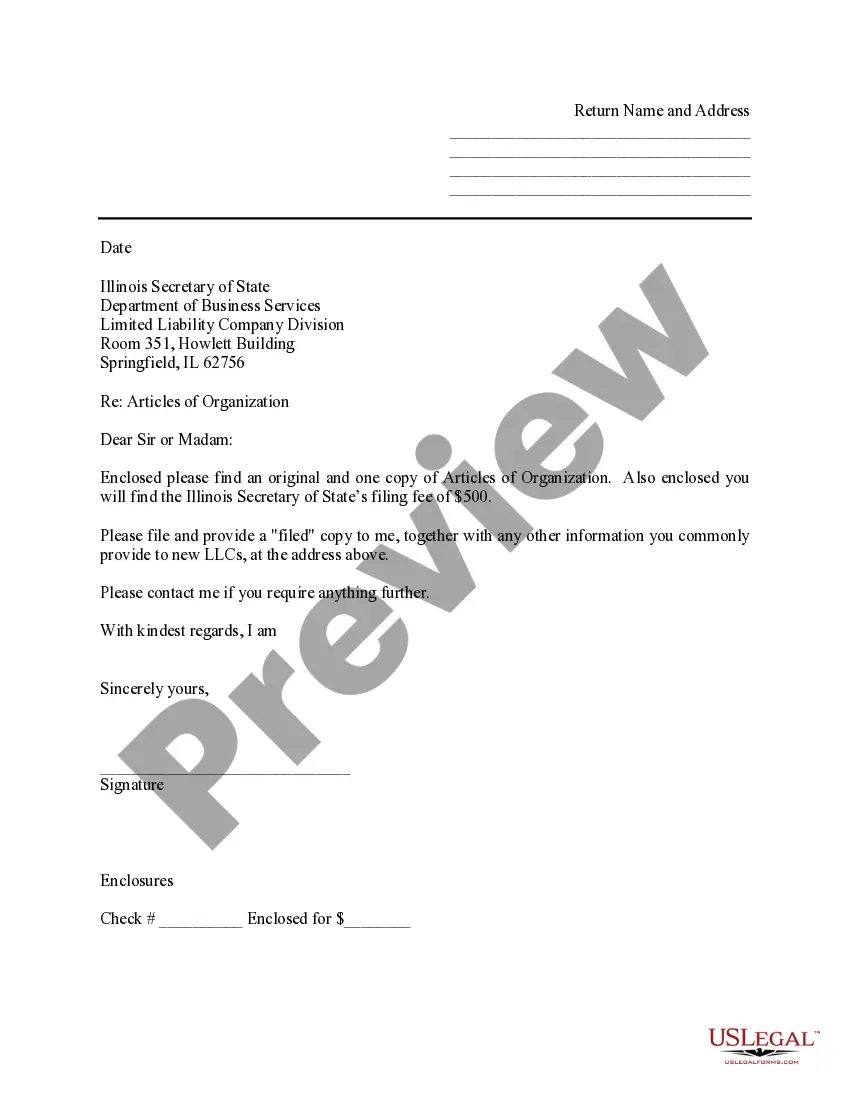

Description

How to fill out Cook Illinois Owner Financing Contract For Home?

Do you need to quickly draft a legally-binding Cook Owner Financing Contract for Home or probably any other document to take control of your own or business matters? You can select one of the two options: contact a legal advisor to write a legal paper for you or draft it completely on your own. The good news is, there's another solution - US Legal Forms. It will help you get professionally written legal documents without having to pay unreasonable fees for legal services.

US Legal Forms offers a huge catalog of over 85,000 state-compliant document templates, including Cook Owner Financing Contract for Home and form packages. We provide documents for an array of life circumstances: from divorce paperwork to real estate documents. We've been on the market for more than 25 years and gained a spotless reputation among our customers. Here's how you can become one of them and get the needed template without extra hassles.

- To start with, double-check if the Cook Owner Financing Contract for Home is tailored to your state's or county's laws.

- If the document comes with a desciption, make sure to verify what it's intended for.

- Start the searching process over if the document isn’t what you were looking for by utilizing the search box in the header.

- Select the subscription that is best suited for your needs and move forward to the payment.

- Select the format you would like to get your document in and download it.

- Print it out, complete it, and sign on the dotted line.

If you've already registered an account, you can easily log in to it, locate the Cook Owner Financing Contract for Home template, and download it. To re-download the form, simply head to the My Forms tab.

It's stressless to buy and download legal forms if you use our catalog. In addition, the paperwork we offer are reviewed by industry experts, which gives you greater peace of mind when dealing with legal affairs. Try US Legal Forms now and see for yourself!