Montgomery Maryland Owner Financing Contract for Home is a legally-binding agreement between a home seller and a buyer, where the seller acts as the lender and provides financing for the purchase of the property. This type of contract encompasses various terms and conditions that outline the specific arrangements for the repayment of the loan, interest rates, and other important details. In Montgomery County, Maryland, there are primarily two types of Owner Financing Contracts for Homes: 1. Installment Land Contract: The installment land contract, also known as a land contract or contract for deed, allows the buyer to occupy and use the property while making installment payments to the seller over a specified period. The agreement typically includes the purchase price, down payment amount, interest rate, duration of the contract, and consequences of non-payment or default. 2. Lease Option Agreement with Seller Financing: This type of contract is suitable for buyers who may not qualify for traditional mortgage financing but want to secure a property with the option to buy it in the future. The agreement combines a lease and an option to purchase, with the added benefit of seller financing. The buyer can lease the property for a specified period, paying monthly rent with a portion going towards the potential purchase price, while also agreeing on the terms for future financing. Both types of Montgomery Maryland Owner Financing Contracts for Homes offer unique advantages for both buyers and sellers. Buyers have the opportunity to secure homeownership despite credit challenges or limited access to traditional financing, while sellers can attract potential buyers who might otherwise be unable to purchase a home. These contracts can also provide flexibility in negotiating terms and conditions not typically available through conventional mortgage lenders. It is crucial for both parties involved in a Montgomery Maryland Owner Financing Contract for Home to seek legal advice to ensure compliance with local regulations and to protect their respective interests. Additionally, buyers should conduct thorough due diligence, including property inspections and title searches, to ensure the property's condition and ownership status before finalizing the agreement and committing to regular payments.

Montgomery Maryland Owner Financing Contract for Home

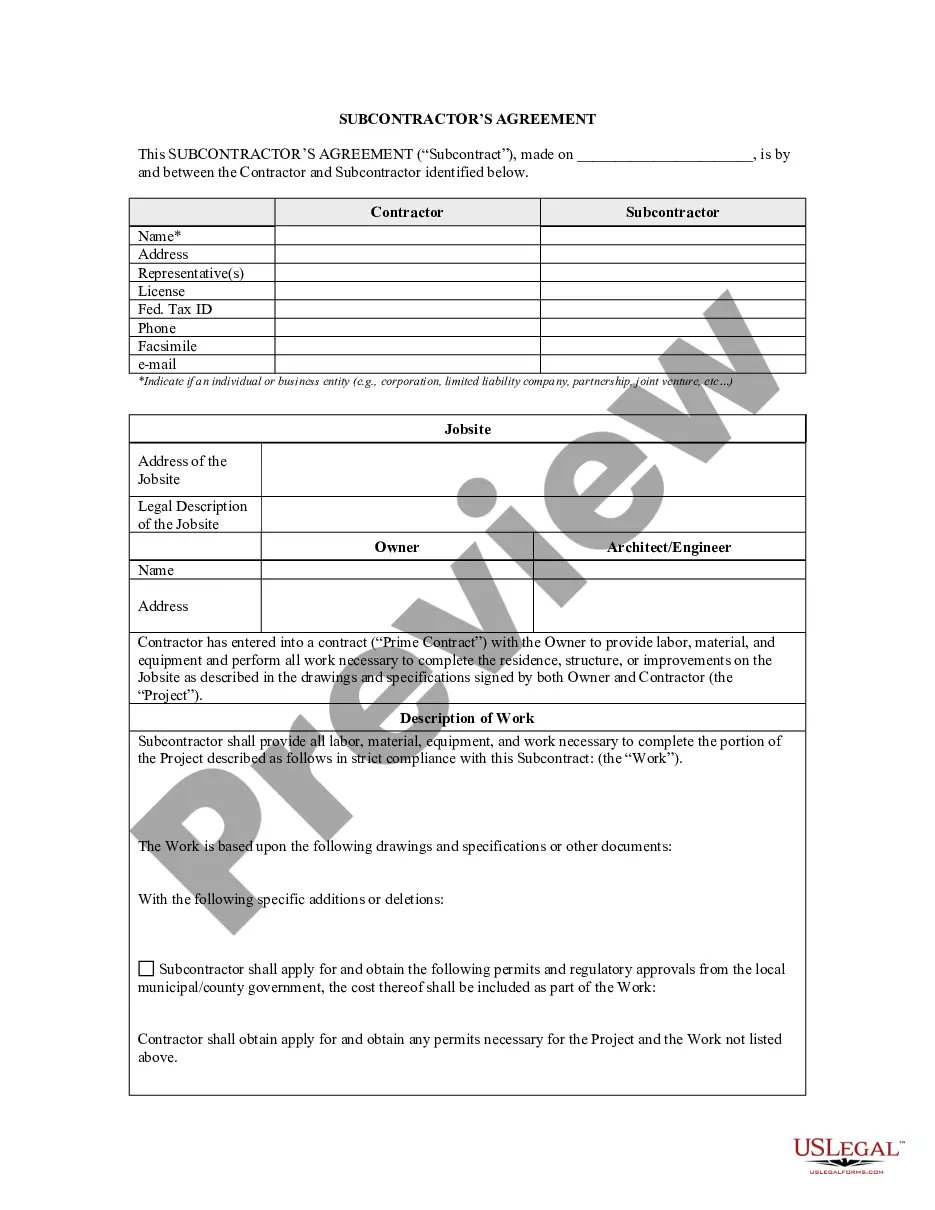

Description

How to fill out Montgomery Maryland Owner Financing Contract For Home?

Whether you plan to open your company, enter into an agreement, apply for your ID renewal, or resolve family-related legal issues, you must prepare specific documentation corresponding to your local laws and regulations. Finding the right papers may take a lot of time and effort unless you use the US Legal Forms library.

The platform provides users with more than 85,000 professionally drafted and checked legal documents for any individual or business case. All files are collected by state and area of use, so opting for a copy like Montgomery Owner Financing Contract for Home is quick and easy.

The US Legal Forms library users only need to log in to their account and click the Download button next to the required template. If you are new to the service, it will take you a couple of more steps to obtain the Montgomery Owner Financing Contract for Home. Follow the guide below:

- Make sure the sample meets your personal needs and state law requirements.

- Look through the form description and check the Preview if available on the page.

- Make use of the search tab specifying your state above to find another template.

- Click Buy Now to get the sample once you find the proper one.

- Choose the subscription plan that suits you most to continue.

- Log in to your account and pay the service with a credit card or PayPal.

- Download the Montgomery Owner Financing Contract for Home in the file format you require.

- Print the copy or fill it out and sign it electronically via an online editor to save time.

Documents provided by our library are multi-usable. Having an active subscription, you can access all of your earlier acquired paperwork whenever you need in the My Forms tab of your profile. Stop wasting time on a endless search for up-to-date official documents. Sign up for the US Legal Forms platform and keep your paperwork in order with the most extensive online form collection!