The Allegheny Pennsylvania Agreement to Incorporate by Partners Incorporating Existing Partnership is a legally binding document that outlines the process through which a partnership can be transformed into a corporation. This agreement serves as a roadmap for partners looking to restructure their business entity and adapt to the changing needs of their growing enterprise. Partnerships often find it necessary to evolve into corporations to enjoy various benefits, including limited liability protection and ease of raising capital. The Allegheny Pennsylvania Agreement to Incorporate by Partners provides a structured framework for this conversion, ensuring a smooth transition while safeguarding the interests of all partners involved. Key elements covered in the agreement include: 1. Purpose: This section explains the reason behind the decision to incorporate and outlines the objectives the partners aim to achieve through this process. It may discuss factors such as growth opportunities, liability protection, or improved access to financing. 2. Partner Consent: All partners must provide their explicit consent to the incorporation process. This shows their agreement to relinquish their current partnership status and transition into shareholders of the newly formed corporation. 3. Articles of Incorporation: The agreement specifies that partners must jointly prepare and file the Articles of Incorporation with the relevant state authorities. This document establishes the corporation's existence and includes essential details such as the company name, business purpose, registered agent, and initial shareholder information. 4. Allocation of Shares: The agreement details how the partners' ownership interests will be converted into shares of stock in the new corporation. It may outline the methodology for determining the number of shares each partner will receive, taking into account factors like capital contributions, profit sharing, or other agreed-upon criteria. 5. Management and Governance: This section covers the transfer of decision-making power from the partnership to the newly formed corporation. It defines the roles and responsibilities of directors, officers, and shareholders and may establish guidelines for electing or appointing individuals to these positions. 6. Assets and Liabilities: The agreement outlines how the partnership's assets, liabilities, and contracts will be transferred to the corporation. It may specify a valuation process for determining the fair market value of the partnership's assets and any associated tax implications. The Allegheny Pennsylvania Agreement to Incorporate by Partners Incorporating Existing Partnership can be tailored to different types of partnerships or scenarios. For example, variations of this agreement may exist for general partnerships, limited partnerships, or limited liability partnerships, as the specific requirements for each type of partnership may differ. Additionally, partnerships with unique circumstances, such as those with complex ownership or contractual arrangements, may require tailored agreements to address their specific needs. In conclusion, the Allegheny Pennsylvania Agreement to Incorporate by Partners Incorporating Existing Partnership is a comprehensive legal document that provides a detailed roadmap for transitioning from a partnership to a corporation. By engaging in this process, partnerships can unlock various benefits associated with incorporation while ensuring a fair and equitable distribution of ownership and responsibilities among partners.

Allegheny Pennsylvania Agreement to Incorporate by Partners Incorporating Existing Partnership

Description

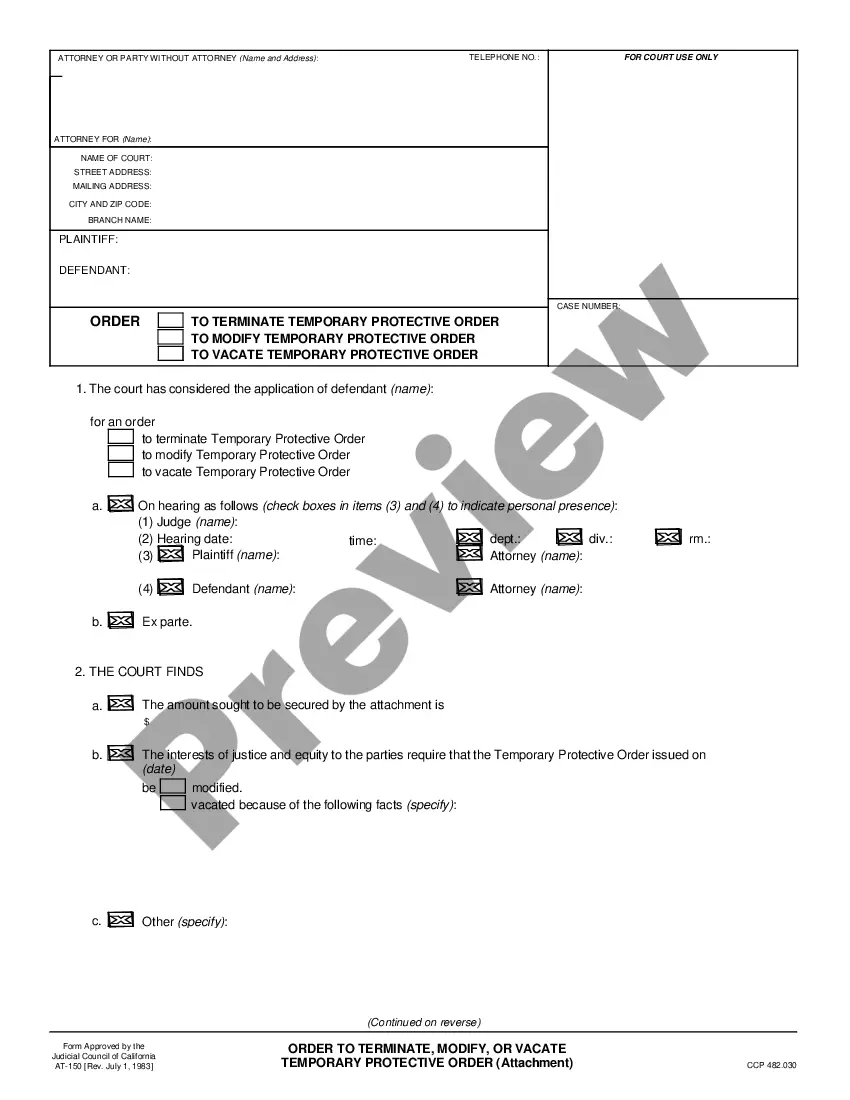

How to fill out Allegheny Pennsylvania Agreement To Incorporate By Partners Incorporating Existing Partnership?

Preparing legal paperwork can be difficult. In addition, if you decide to ask a lawyer to draft a commercial agreement, papers for ownership transfer, pre-marital agreement, divorce paperwork, or the Allegheny Agreement to Incorporate by Partners Incorporating Existing Partnership, it may cost you a fortune. So what is the best way to save time and money and draft legitimate forms in total compliance with your state and local laws? US Legal Forms is a perfect solution, whether you're looking for templates for your personal or business needs.

US Legal Forms is largest online collection of state-specific legal documents, providing users with the up-to-date and professionally checked templates for any scenario accumulated all in one place. Therefore, if you need the recent version of the Allegheny Agreement to Incorporate by Partners Incorporating Existing Partnership, you can easily find it on our platform. Obtaining the papers requires a minimum of time. Those who already have an account should check their subscription to be valid, log in, and pick the sample with the Download button. If you haven't subscribed yet, here's how you can get the Allegheny Agreement to Incorporate by Partners Incorporating Existing Partnership:

- Glance through the page and verify there is a sample for your region.

- Examine the form description and use the Preview option, if available, to ensure it's the sample you need.

- Don't worry if the form doesn't satisfy your requirements - search for the right one in the header.

- Click Buy Now once you find the needed sample and select the best suitable subscription.

- Log in or register for an account to pay for your subscription.

- Make a transaction with a credit card or via PayPal.

- Choose the file format for your Allegheny Agreement to Incorporate by Partners Incorporating Existing Partnership and save it.

Once done, you can print it out and complete it on paper or upload the samples to an online editor for a faster and more convenient fill-out. US Legal Forms enables you to use all the paperwork ever acquired many times - you can find your templates in the My Forms tab in your profile. Give it a try now!