The Bexar Texas Agreement to Incorporate by Partners Incorporating Existing Partnership is a legal document that outlines the process by which a partnership is converted into a corporation. By incorporating their partnership, partners gain the advantage of limited liability protection, potential tax benefits, and increased opportunities for growth and expansion. In order to create a Bexar Texas Agreement to Incorporate, partners must agree on various aspects such as the name and purpose of the new corporation, the allocation of shares, the roles and responsibilities of directors and officers, and the handling of assets and liabilities during the transition period. The Agreement to Incorporate by Partners Incorporating Existing Partnership offers flexibility, as it allows partners to maintain their existing business relationships, while adapting to the changing needs and requirements of a corporation. It ensures a smooth transition by providing a clear roadmap for the conversion process, including the steps to be taken, the necessary documentation, and the timeline for completion. There are different types of Bexar Texas Agreements to Incorporate by Partners Incorporating Existing Partnership, each tailored to suit the specific needs and goals of the partners. These include: 1. Basic Agreement to Incorporate: This type of agreement covers the fundamental aspects of the conversion process, such as the allocation of shares, management structure, and the treatment of assets and liabilities. 2. Advanced Agreement to Incorporate: For partnerships with more complex structures or specific requirements, an advanced agreement may be necessary. This includes clauses that address additional considerations like intellectual property rights, non-compete agreements, or special distribution of profits. 3. Merger Agreement: In some cases, partners may choose to merge their existing partnership with another company or entity. The Merger Agreement outlines the terms and conditions of the merger, including the exchange of shares, the integration of business operations, and the reorganization of management. 4. Buyout Agreement: If one or more partners wish to leave the partnership during the incorporation process, a Buyout Agreement can be utilized. It details the buyout terms, including the valuation of the partner's shares and the terms of payment. When entering into a Bexar Texas Agreement to Incorporate by Partners Incorporating Existing Partnership, it is essential to consult with a legal professional to ensure compliance with state laws and to customize the agreement according to the specific needs and goals of the partnership.

Bexar Texas Agreement to Incorporate by Partners Incorporating Existing Partnership

Description

How to fill out Bexar Texas Agreement To Incorporate By Partners Incorporating Existing Partnership?

Preparing legal documentation can be difficult. Besides, if you decide to ask a legal professional to write a commercial agreement, documents for proprietorship transfer, pre-marital agreement, divorce paperwork, or the Bexar Agreement to Incorporate by Partners Incorporating Existing Partnership, it may cost you a lot of money. So what is the most reasonable way to save time and money and create legitimate documents in total compliance with your state and local laws? US Legal Forms is a perfect solution, whether you're looking for templates for your individual or business needs.

US Legal Forms is largest online catalog of state-specific legal documents, providing users with the up-to-date and professionally checked forms for any scenario gathered all in one place. Therefore, if you need the latest version of the Bexar Agreement to Incorporate by Partners Incorporating Existing Partnership, you can easily find it on our platform. Obtaining the papers takes a minimum of time. Those who already have an account should check their subscription to be valid, log in, and select the sample using the Download button. If you haven't subscribed yet, here's how you can get the Bexar Agreement to Incorporate by Partners Incorporating Existing Partnership:

- Glance through the page and verify there is a sample for your region.

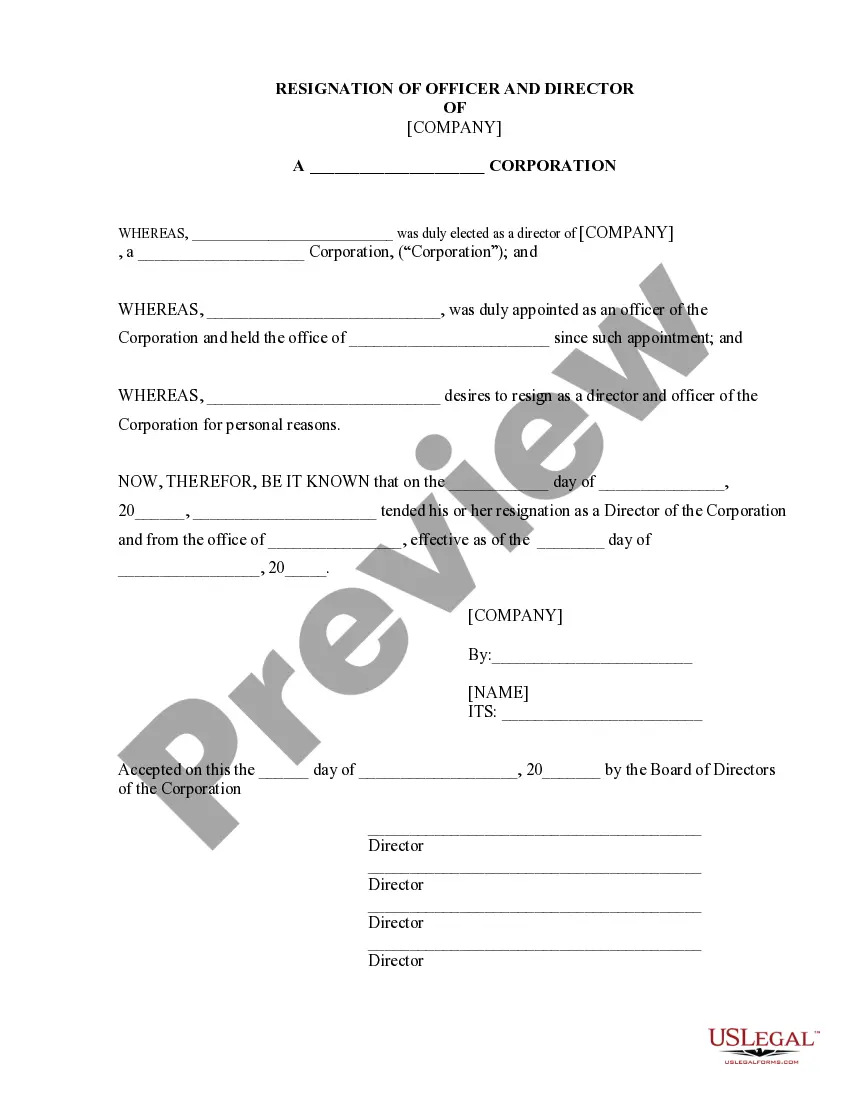

- Check the form description and use the Preview option, if available, to ensure it's the template you need.

- Don't worry if the form doesn't satisfy your requirements - search for the right one in the header.

- Click Buy Now when you find the required sample and select the best suitable subscription.

- Log in or sign up for an account to pay for your subscription.

- Make a transaction with a credit card or through PayPal.

- Opt for the document format for your Bexar Agreement to Incorporate by Partners Incorporating Existing Partnership and download it.

When finished, you can print it out and complete it on paper or import the template to an online editor for a faster and more convenient fill-out. US Legal Forms enables you to use all the paperwork ever purchased many times - you can find your templates in the My Forms tab in your profile. Try it out now!