Maricopa, Arizona Agreement to Incorporate by Partners Incorporating Existing Partnership is a legal document that allows partners of an existing partnership in Maricopa, Arizona to incorporate their business. This agreement serves as a blueprint for partners who want to transform their partnership into a legally recognized and separate entity, known as a corporation. Incorporating a partnership offers numerous benefits, including limited liability protection and potential tax advantages. Keywords: Maricopa, Arizona, Agreement to Incorporate, Partners, Incorporating, Existing Partnership, transform, separate entity, corporation, limited liability, tax advantages. There are no specific types of Maricopa Arizona Agreements to Incorporate by Partners Incorporating Existing Partnership, as it refers to the general process of incorporating an existing partnership in Maricopa, Arizona. However, it is important to note that the agreement may vary depending on the specific requirements and preferences of the partners involved. Some common variations may include: 1. Standard Maricopa Arizona Agreement to Incorporate by Partners Incorporating Existing Partnership: This is the most common form of the agreement, covering the essential aspects of the incorporation process. It typically includes sections on the partners' roles and responsibilities, the name and purpose of the new corporation, the allocation of shares, and the transfer of assets and liabilities from the partnership to the corporation. 2. Detailed Maricopa Arizona Agreement to Incorporate by Partners Incorporating Existing Partnership: This type of agreement provides more comprehensive information about the rights, obligations, and governance structure of the new corporation. It may include additional provisions on the management of the corporation, decision-making processes, capital contributions, shareholder rights, and dispute resolution mechanisms. 3. Customized Maricopa Arizona Agreement to Incorporate by Partners Incorporating Existing Partnership: In some cases, partners may require a tailored agreement that accommodates their specific needs and circumstances. This may involve special provisions related to intellectual property rights, non-compete agreements, buyout options, or other unique considerations relevant to their business. It is crucial for partners who wish to incorporate their existing partnership to consult with a legal professional familiar with Arizona state laws and regulations. This will ensure that the Agreement to Incorporate accurately reflects the partners' intentions and abides by all legal requirements.

Maricopa Arizona Agreement to Incorporate by Partners Incorporating Existing Partnership

Description

How to fill out Maricopa Arizona Agreement To Incorporate By Partners Incorporating Existing Partnership?

Creating legal forms is a necessity in today's world. However, you don't always need to seek qualified assistance to draft some of them from scratch, including Maricopa Agreement to Incorporate by Partners Incorporating Existing Partnership, with a platform like US Legal Forms.

US Legal Forms has over 85,000 templates to select from in various types ranging from living wills to real estate paperwork to divorce documents. All forms are arranged according to their valid state, making the searching process less overwhelming. You can also find information resources and tutorials on the website to make any activities associated with paperwork completion straightforward.

Here's how you can purchase and download Maricopa Agreement to Incorporate by Partners Incorporating Existing Partnership.

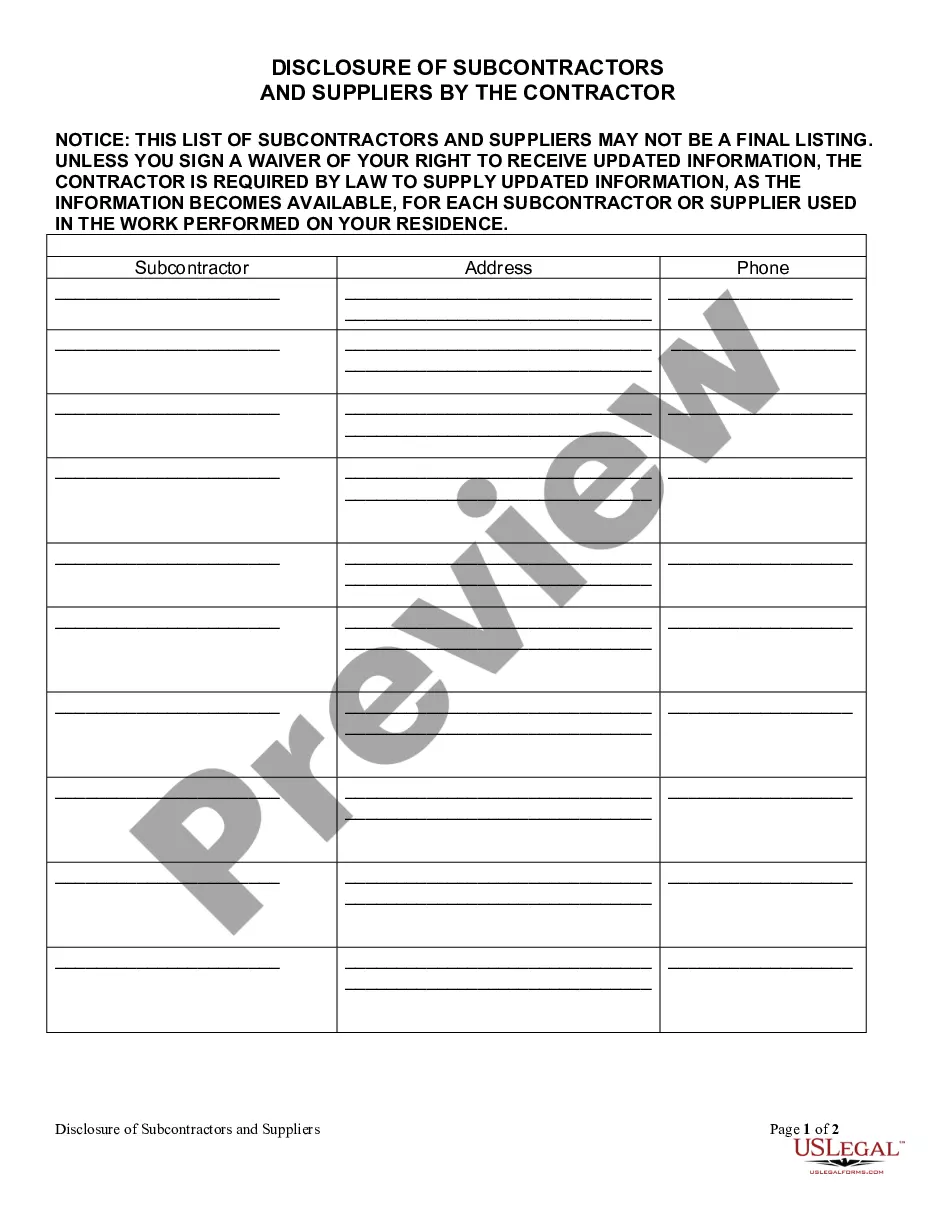

- Go over the document's preview and description (if provided) to get a basic information on what you’ll get after downloading the document.

- Ensure that the document of your choice is specific to your state/county/area since state regulations can impact the validity of some documents.

- Check the related document templates or start the search over to locate the appropriate file.

- Hit Buy now and create your account. If you already have an existing one, select to log in.

- Choose the pricing {plan, then a suitable payment gateway, and purchase Maricopa Agreement to Incorporate by Partners Incorporating Existing Partnership.

- Choose to save the form template in any offered file format.

- Visit the My Forms tab to re-download the file.

If you're already subscribed to US Legal Forms, you can locate the appropriate Maricopa Agreement to Incorporate by Partners Incorporating Existing Partnership, log in to your account, and download it. Of course, our website can’t replace an attorney entirely. If you have to cope with an extremely challenging situation, we advise using the services of a lawyer to examine your form before signing and filing it.

With more than 25 years on the market, US Legal Forms became a go-to provider for many different legal forms for millions of users. Become one of them today and get your state-compliant paperwork effortlessly!