Montgomery Maryland Agreement to Incorporate by Partners Incorporating Existing Partnership is a legal document that outlines the process and terms for converting an existing partnership into a corporation in Montgomery, Maryland. This agreement serves as an official record of the partners' decision to incorporate and lays out the guidelines for the transition. In Montgomery, Maryland, there may be several types of Agreement to Incorporate by Partners Incorporating Existing Partnership. These can include: 1. General Montgomery Maryland Agreement to Incorporate by Partners: This agreement is applicable to general partnerships intending to convert into a corporation. It outlines the roles and responsibilities of each partner during the transition process. 2. Limited Montgomery Maryland Agreement to Incorporate by Partners: Limited partnerships looking to incorporate will have a specific set of guidelines tailored to their unique structure. This agreement will address the rights and limitations of limited partners during the incorporation process. 3. Professional Montgomery Maryland Agreement to Incorporate by Partners: Professional partnerships, such as law firms or medical practices, might require a specialized agreement for incorporating. This document will include provisions relevant to the nature of their professional services. Incorporating an existing partnership in Montgomery, Maryland, involves specific steps and legal considerations. The Agreement to Incorporate by Partners Incorporating Existing Partnership should cover the following aspects: 1. Purpose: Clearly state the intention of the partners to incorporate and the objectives they wish to achieve through this process. 2. Conversion: Outline the steps involved in converting the partnership into a corporation, including obtaining necessary permits, licenses, and certificates as required by Montgomery, Maryland laws. 3. Shareholders: Define the ownership structure of the corporation, including the allocation and distribution of shares among the partners-turned-shareholders. Specify any voting rights and limitations associated with share ownership. 4. Management: Establish the management structure of the newly formed corporation, including the roles and responsibilities of directors, officers, and any management committees. 5. Financial Matters: Detail the financial aspects of the incorporation, such as the valuation of partnership assets, allocation of profits and losses, and the handling of any outstanding debts or liabilities. 6. Dissolution of Partnership: Specify the process for dissolving the existing partnership, including the transfer of assets, settlement of debts, and distribution of remaining funds among the partners. 7. Governing Law: Identify that the agreement shall be governed by the laws of Montgomery, Maryland, ensuring compliance with local regulations and any specific incorporation requirements. It is advisable to consult legal professionals experienced in Montgomery, Maryland, partnership incorporation to ensure the accuracy and legality of the Agreement to Incorporate by Partners. These experts can provide guidance on tailoring the agreement to meet the specific needs and circumstances of the partnership.

Montgomery Maryland Agreement to Incorporate by Partners Incorporating Existing Partnership

Description

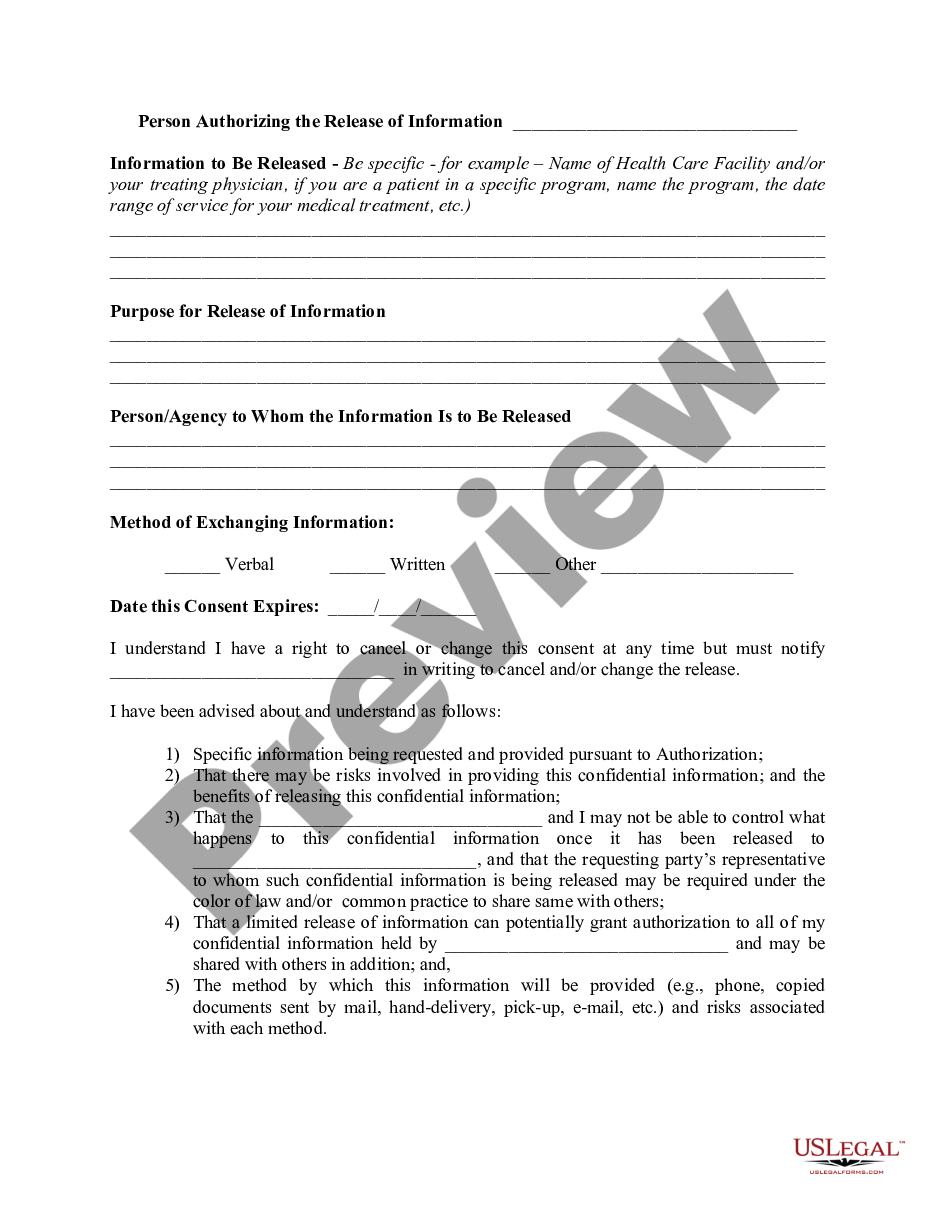

How to fill out Montgomery Maryland Agreement To Incorporate By Partners Incorporating Existing Partnership?

Creating legal forms is a must in today's world. However, you don't always need to seek qualified assistance to create some of them from scratch, including Montgomery Agreement to Incorporate by Partners Incorporating Existing Partnership, with a platform like US Legal Forms.

US Legal Forms has over 85,000 templates to select from in various categories varying from living wills to real estate papers to divorce papers. All forms are organized based on their valid state, making the searching process less overwhelming. You can also find detailed resources and guides on the website to make any activities related to paperwork completion straightforward.

Here's how you can find and download Montgomery Agreement to Incorporate by Partners Incorporating Existing Partnership.

- Go over the document's preview and description (if provided) to get a general idea of what you’ll get after getting the document.

- Ensure that the template of your choosing is specific to your state/county/area since state regulations can impact the validity of some records.

- Check the similar forms or start the search over to find the appropriate document.

- Click Buy now and create your account. If you already have an existing one, select to log in.

- Pick the option, then a needed payment method, and purchase Montgomery Agreement to Incorporate by Partners Incorporating Existing Partnership.

- Select to save the form template in any offered file format.

- Visit the My Forms tab to re-download the document.

If you're already subscribed to US Legal Forms, you can find the appropriate Montgomery Agreement to Incorporate by Partners Incorporating Existing Partnership, log in to your account, and download it. Of course, our website can’t replace an attorney entirely. If you have to deal with an exceptionally difficult situation, we advise using the services of a lawyer to review your form before executing and filing it.

With over 25 years on the market, US Legal Forms became a go-to platform for various legal forms for millions of customers. Join them today and get your state-specific paperwork effortlessly!