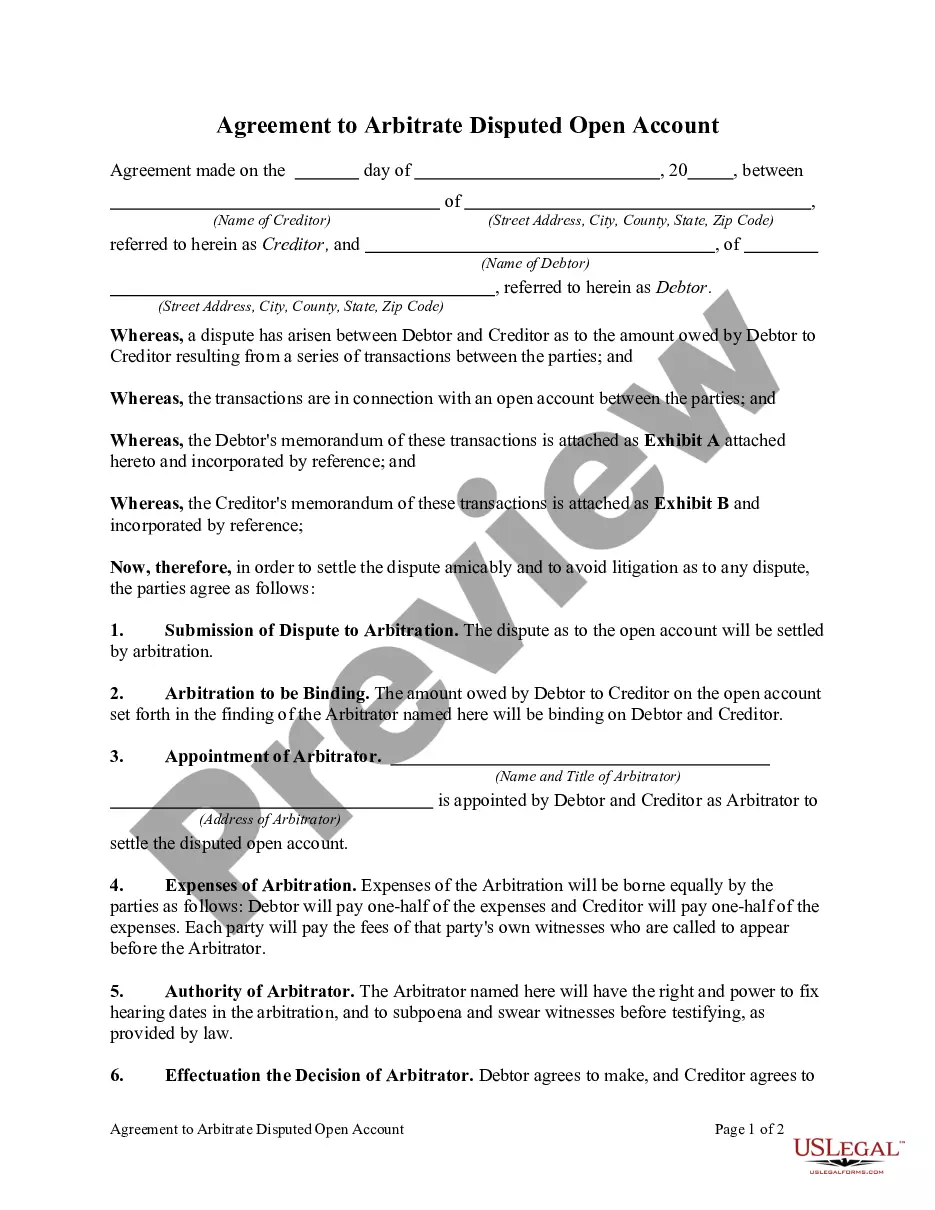

The Queens New York Agreement to Arbitrate Disputed Open Account is a legally binding agreement designed to resolve disputes related to open accounts through arbitration instead of litigation. This agreement brings together creditors and debtors in Queens, New York, to reach a mutually beneficial resolution, avoid lengthy court processes, and reduce costs. Arbitration is an alternative dispute resolution process where both parties present their case before an impartial third party, known as an arbitrator. This process is often quicker and less formal than traditional court litigation, providing a more efficient means of settling disputes. The Queens New York Agreement to Arbitrate Disputed Open Account helps ensure that both creditors and debtors have fair and equitable resolutions, maintaining healthy business relationships. By agreeing to arbitration, parties waive their rights to go to court, choosing instead to resolve their dispute through a neutral, independent arbitrator. Different types of Queens New York Agreements to Arbitrate Disputed Open Account may include: 1. Commercial Agreements: These agreements are typically entered into between businesses or companies engaged in commercial transactions. They cover various types of open accounts, such as unpaid invoices, outstanding debts, or delayed payment disagreements. 2. Consumer Agreements: These agreements involve open accounts between businesses and individual consumers. They may encompass disputes related to unpaid credit card bills, personal loans, or other types of credit arrangements. 3. Service Agreements: These agreements revolve around disputes arising from service-related open accounts, such as outstanding payments for professional services, repairs, or maintenance work. 4. Contractual Agreements: These agreements involve disputes related to open accounts specified in a written contract between two parties. It may encompass situations where payment terms, delivery schedules, or other financial arrangements are not met. By incorporating relevant keywords such as "Queens New York," "agreement," "arbitration," "disputed open account," and mentioning the different types of agreements within the description, the content becomes focused on the specific topic required.

Queens New York Agreement to Arbitrate Disputed Open Account

Description

How to fill out Queens New York Agreement To Arbitrate Disputed Open Account?

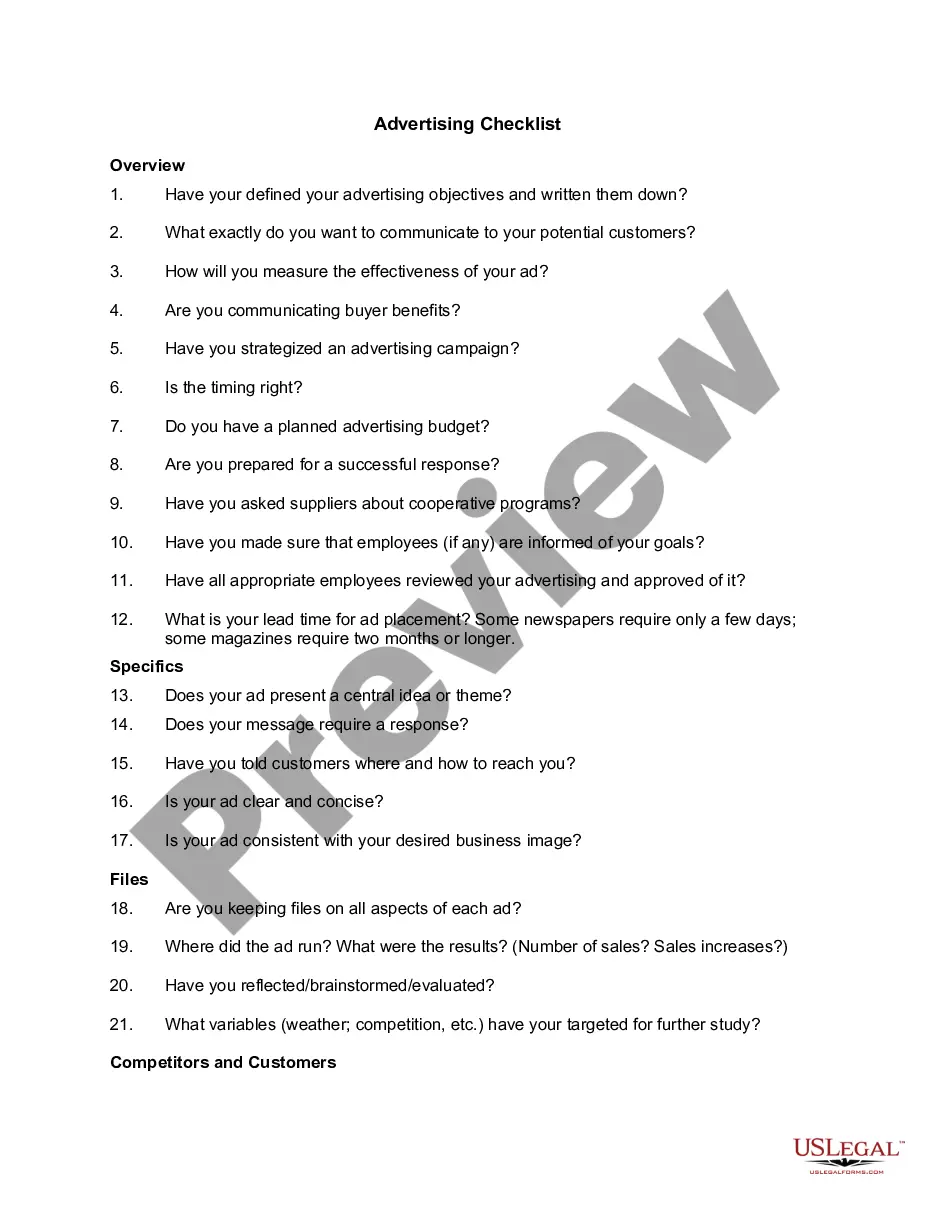

Whether you intend to start your company, enter into a deal, apply for your ID renewal, or resolve family-related legal concerns, you need to prepare specific paperwork corresponding to your local laws and regulations. Finding the right papers may take a lot of time and effort unless you use the US Legal Forms library.

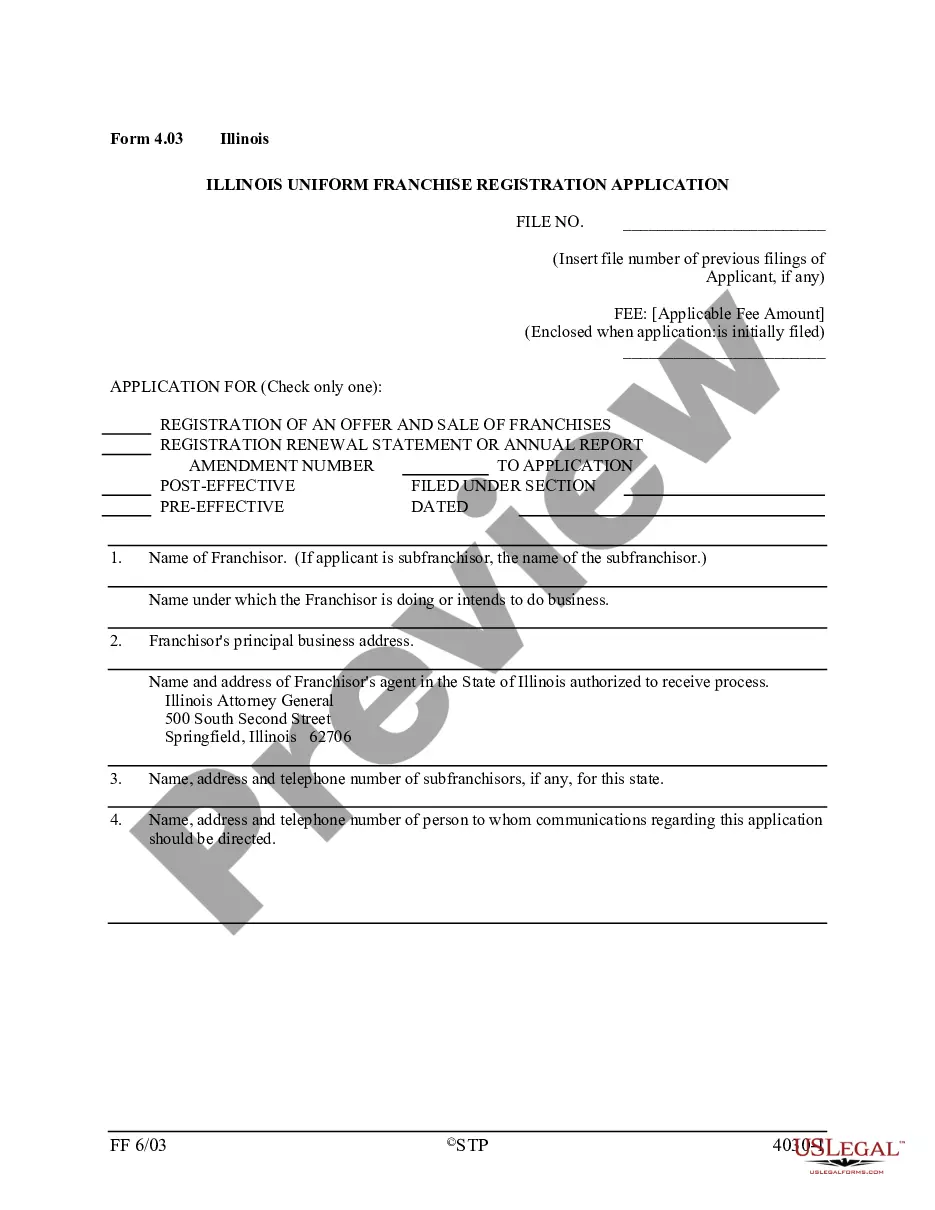

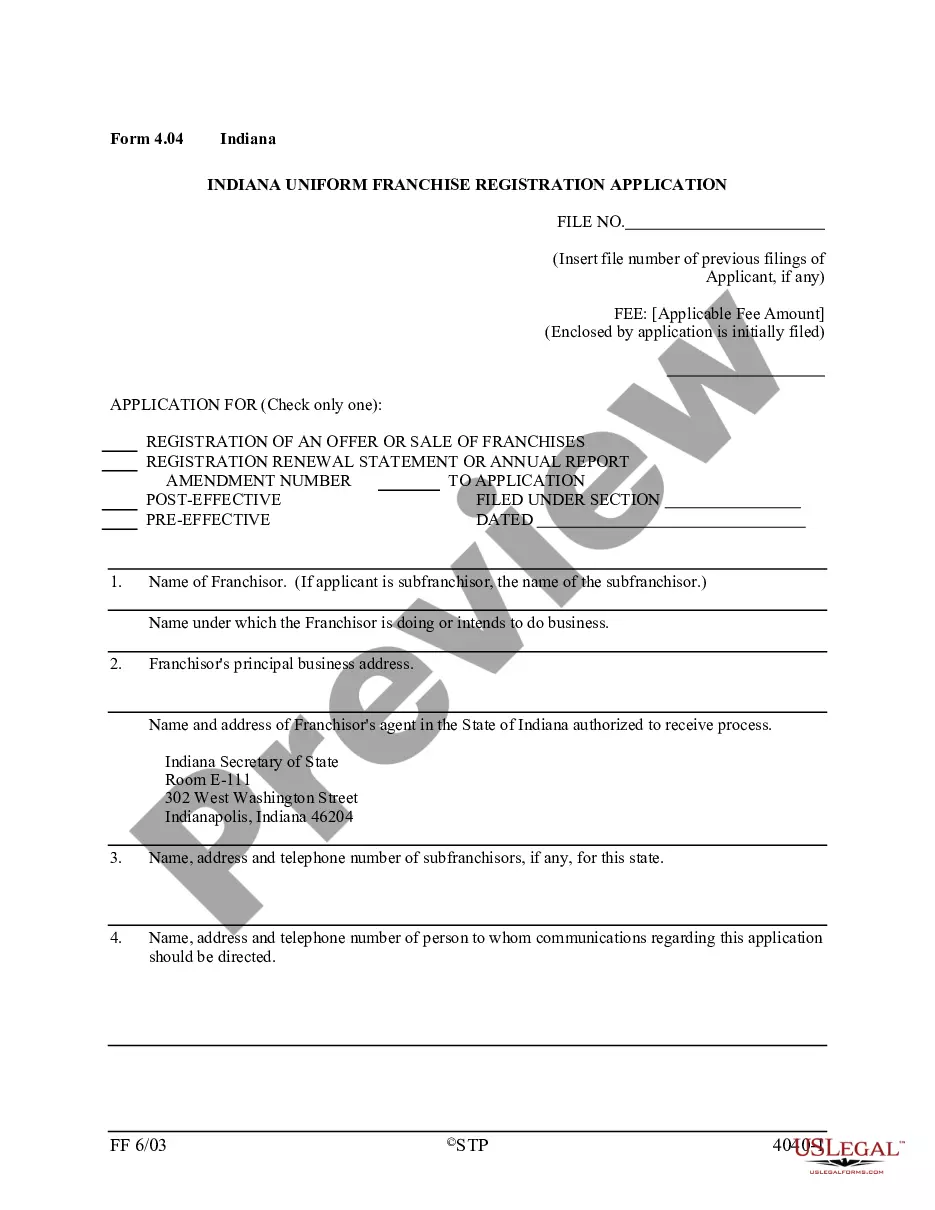

The platform provides users with more than 85,000 expertly drafted and checked legal documents for any individual or business occasion. All files are grouped by state and area of use, so opting for a copy like Queens Agreement to Arbitrate Disputed Open Account is fast and easy.

The US Legal Forms library users only need to log in to their account and click the Download key next to the required template. If you are new to the service, it will take you several more steps to obtain the Queens Agreement to Arbitrate Disputed Open Account. Follow the guidelines below:

- Make certain the sample meets your personal needs and state law requirements.

- Read the form description and check the Preview if there’s one on the page.

- Utilize the search tab specifying your state above to find another template.

- Click Buy Now to get the file when you find the correct one.

- Choose the subscription plan that suits you most to continue.

- Log in to your account and pay the service with a credit card or PayPal.

- Download the Queens Agreement to Arbitrate Disputed Open Account in the file format you prefer.

- Print the copy or fill it out and sign it electronically via an online editor to save time.

Forms provided by our library are multi-usable. Having an active subscription, you can access all of your earlier acquired paperwork at any time in the My Forms tab of your profile. Stop wasting time on a endless search for up-to-date official documents. Join the US Legal Forms platform and keep your paperwork in order with the most comprehensive online form collection!