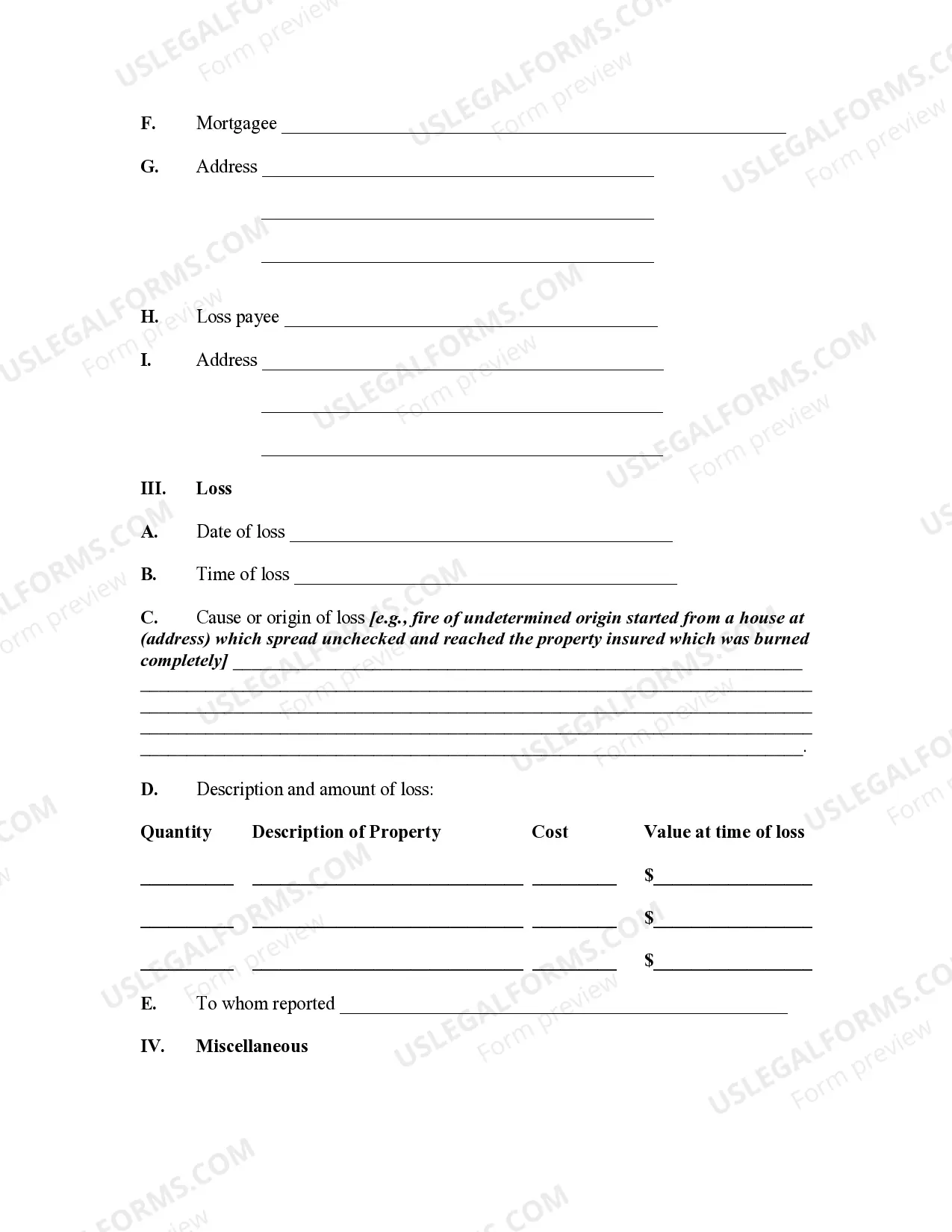

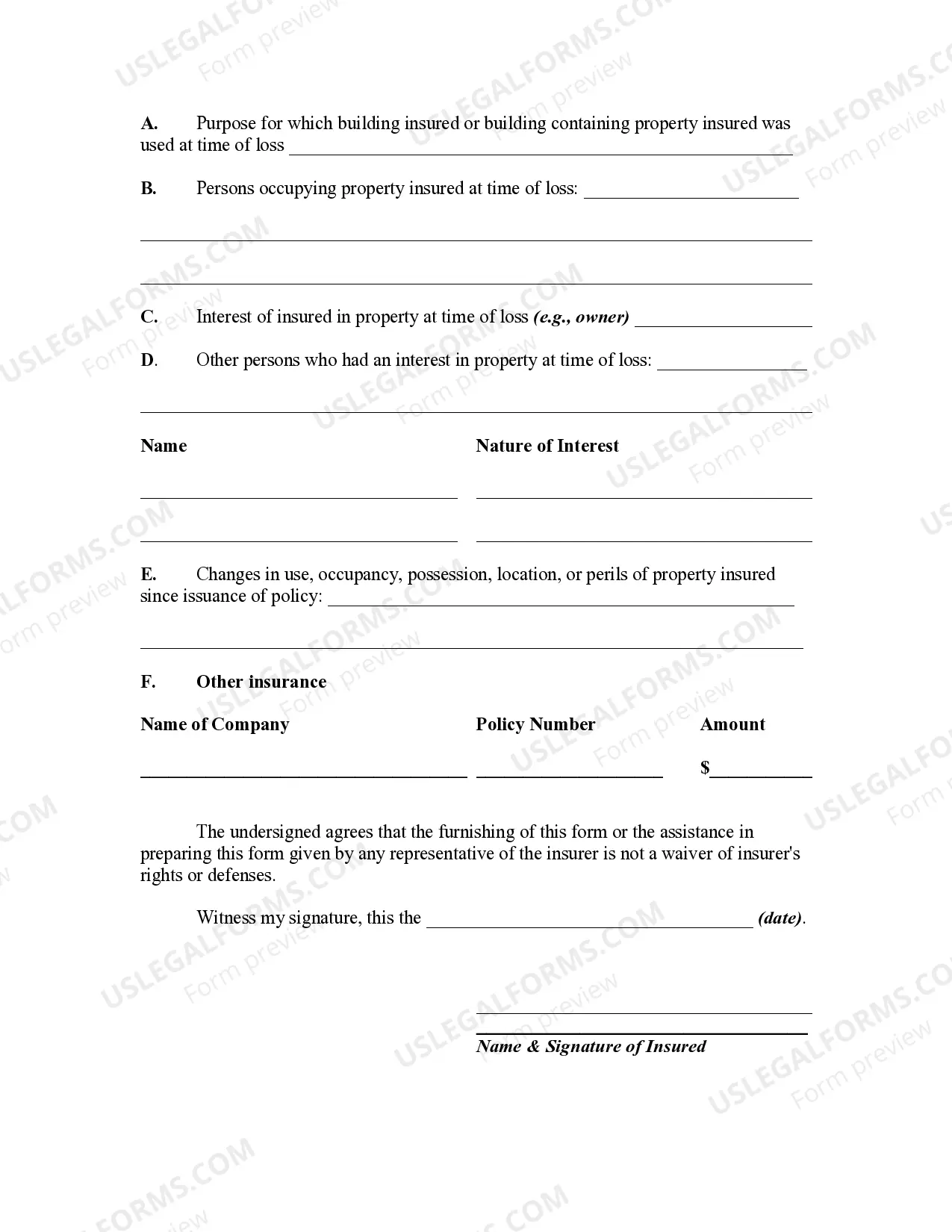

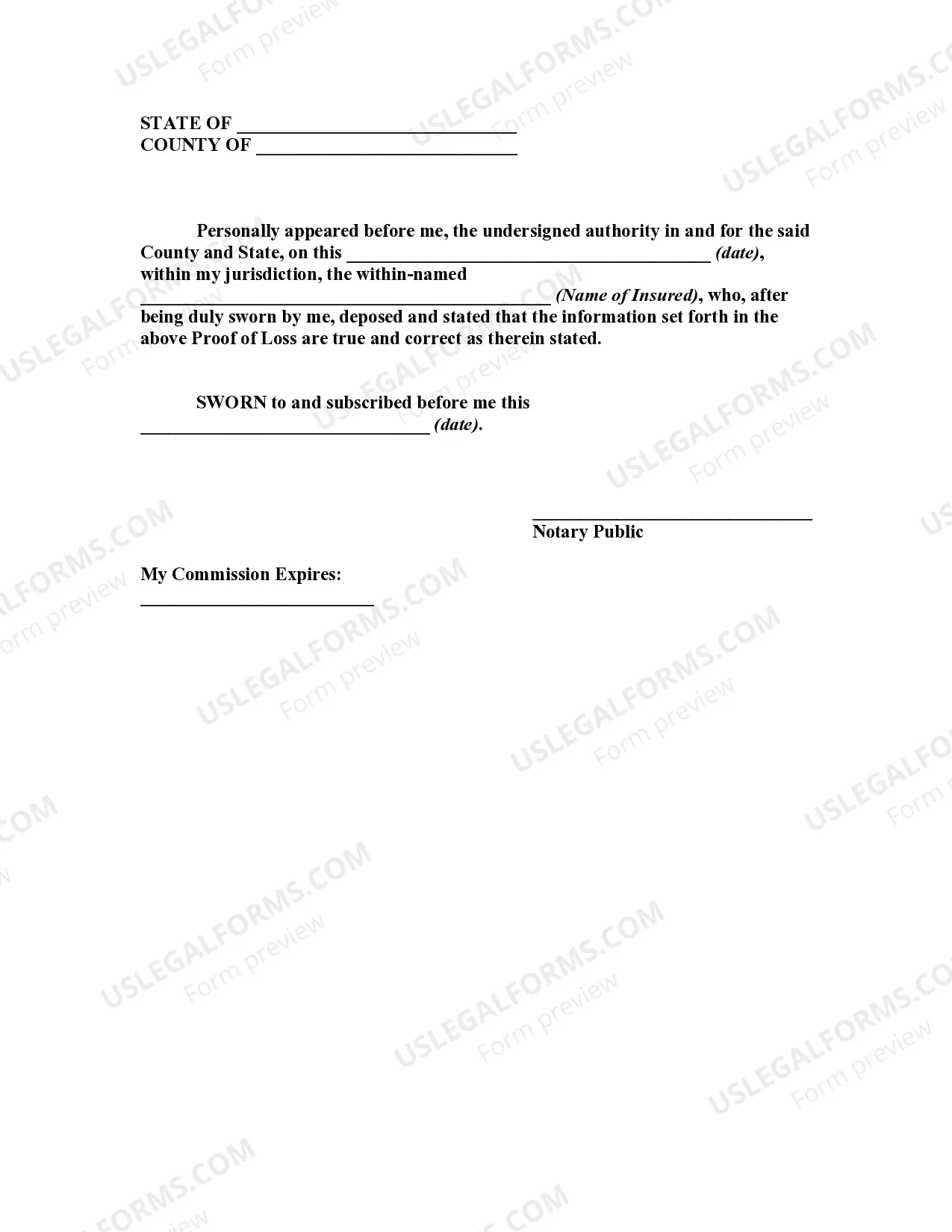

A Proof of Loss is a sworn statement that usually must be furnished by the insured to an insurer before any loss under a policy may be paid.

Contra Costa California Proof of Loss for Fire Insurance Claim is a vital document required by insurance companies to initiate the claim settlement process after a fire incident. This detailed description focuses on explaining the purpose and components of the Proof of Loss document, along with the different types that may exist in Contra Costa, California. The Proof of Loss serves as a formal declaration by the policyholder to the insurance company, detailing the extent of the damage caused by the fire and the value of the property or belongings lost. It acts as a comprehensive inventory list, highlighting the items that require compensation according to the policy terms. Submitting an accurate and timely Proof of Loss is crucial for ensuring a smooth and fair claim settlement process. The contents of a Contra Costa California Proof of Loss for Fire Insurance Claim typically include essential details such as: 1. Policyholder Information: This includes the insured's name, contact information, policy number, and other relevant identification details. 2. Incident Details: A thorough description of the fire incident, including the date, time, and location of the event. 3. List of Damaged Property: A comprehensive inventory that details all the damaged or destroyed property, such as buildings, structures, personal belongings, appliances, furniture, electronics, and any other relevant assets. The list should include item descriptions, quantities, original costs, and replacement costs. 4. Valuation of Losses: This section estimates the monetary value of the damages suffered due to the fire incident. It may require the policyholder to provide supporting documents, such as receipts, photographs, appraisals, or expert opinions to substantiate the claimed values. 5. Additional Supporting Documents: Depending on the circumstances and the specific requirements of the insurance company, additional documents may need to be attached. These can include incident reports, fire department reports, police reports, witness statements, and any other evidence of the damage caused. In Contra Costa California, there can be different variations of the Proof of Loss for Fire Insurance Claim based on the specific policy type or insurance company. Some possible types include: 1. Residential Proof of Loss: Used for claims related to fire damage suffered by homeowners or tenants of residential properties in Contra Costa County. 2. Commercial Proof of Loss: Specifically designed for businesses or property owners who have experienced fire-related losses in commercial properties within Contra Costa County. 3. Personal Property Proof of Loss: Tailored to address claims related to personal belongings, such as furniture, clothing, appliances, electronics, and other valuable items damaged or destroyed in a fire incident. In conclusion, submitting a Contra Costa California Proof of Loss for Fire Insurance Claim is an essential step in the fire insurance claim settlement process. It ensures that all losses are properly documented, enabling the insurance company to assess and process the claim efficiently. Having a comprehensive understanding of the requirements and different types of Proof of Loss documents can significantly facilitate the claim settlement process for policyholders in Contra Costa, California.Contra Costa California Proof of Loss for Fire Insurance Claim is a vital document required by insurance companies to initiate the claim settlement process after a fire incident. This detailed description focuses on explaining the purpose and components of the Proof of Loss document, along with the different types that may exist in Contra Costa, California. The Proof of Loss serves as a formal declaration by the policyholder to the insurance company, detailing the extent of the damage caused by the fire and the value of the property or belongings lost. It acts as a comprehensive inventory list, highlighting the items that require compensation according to the policy terms. Submitting an accurate and timely Proof of Loss is crucial for ensuring a smooth and fair claim settlement process. The contents of a Contra Costa California Proof of Loss for Fire Insurance Claim typically include essential details such as: 1. Policyholder Information: This includes the insured's name, contact information, policy number, and other relevant identification details. 2. Incident Details: A thorough description of the fire incident, including the date, time, and location of the event. 3. List of Damaged Property: A comprehensive inventory that details all the damaged or destroyed property, such as buildings, structures, personal belongings, appliances, furniture, electronics, and any other relevant assets. The list should include item descriptions, quantities, original costs, and replacement costs. 4. Valuation of Losses: This section estimates the monetary value of the damages suffered due to the fire incident. It may require the policyholder to provide supporting documents, such as receipts, photographs, appraisals, or expert opinions to substantiate the claimed values. 5. Additional Supporting Documents: Depending on the circumstances and the specific requirements of the insurance company, additional documents may need to be attached. These can include incident reports, fire department reports, police reports, witness statements, and any other evidence of the damage caused. In Contra Costa California, there can be different variations of the Proof of Loss for Fire Insurance Claim based on the specific policy type or insurance company. Some possible types include: 1. Residential Proof of Loss: Used for claims related to fire damage suffered by homeowners or tenants of residential properties in Contra Costa County. 2. Commercial Proof of Loss: Specifically designed for businesses or property owners who have experienced fire-related losses in commercial properties within Contra Costa County. 3. Personal Property Proof of Loss: Tailored to address claims related to personal belongings, such as furniture, clothing, appliances, electronics, and other valuable items damaged or destroyed in a fire incident. In conclusion, submitting a Contra Costa California Proof of Loss for Fire Insurance Claim is an essential step in the fire insurance claim settlement process. It ensures that all losses are properly documented, enabling the insurance company to assess and process the claim efficiently. Having a comprehensive understanding of the requirements and different types of Proof of Loss documents can significantly facilitate the claim settlement process for policyholders in Contra Costa, California.