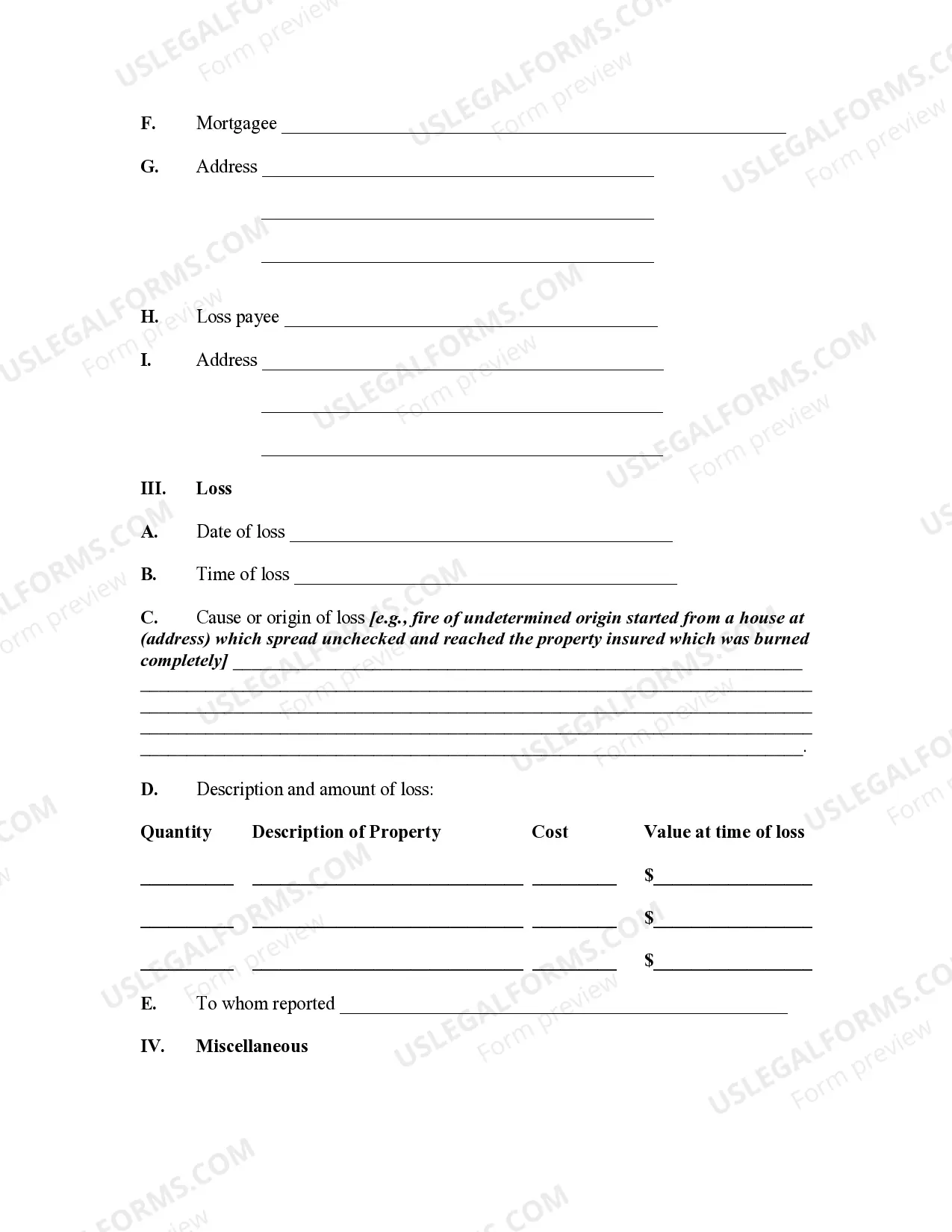

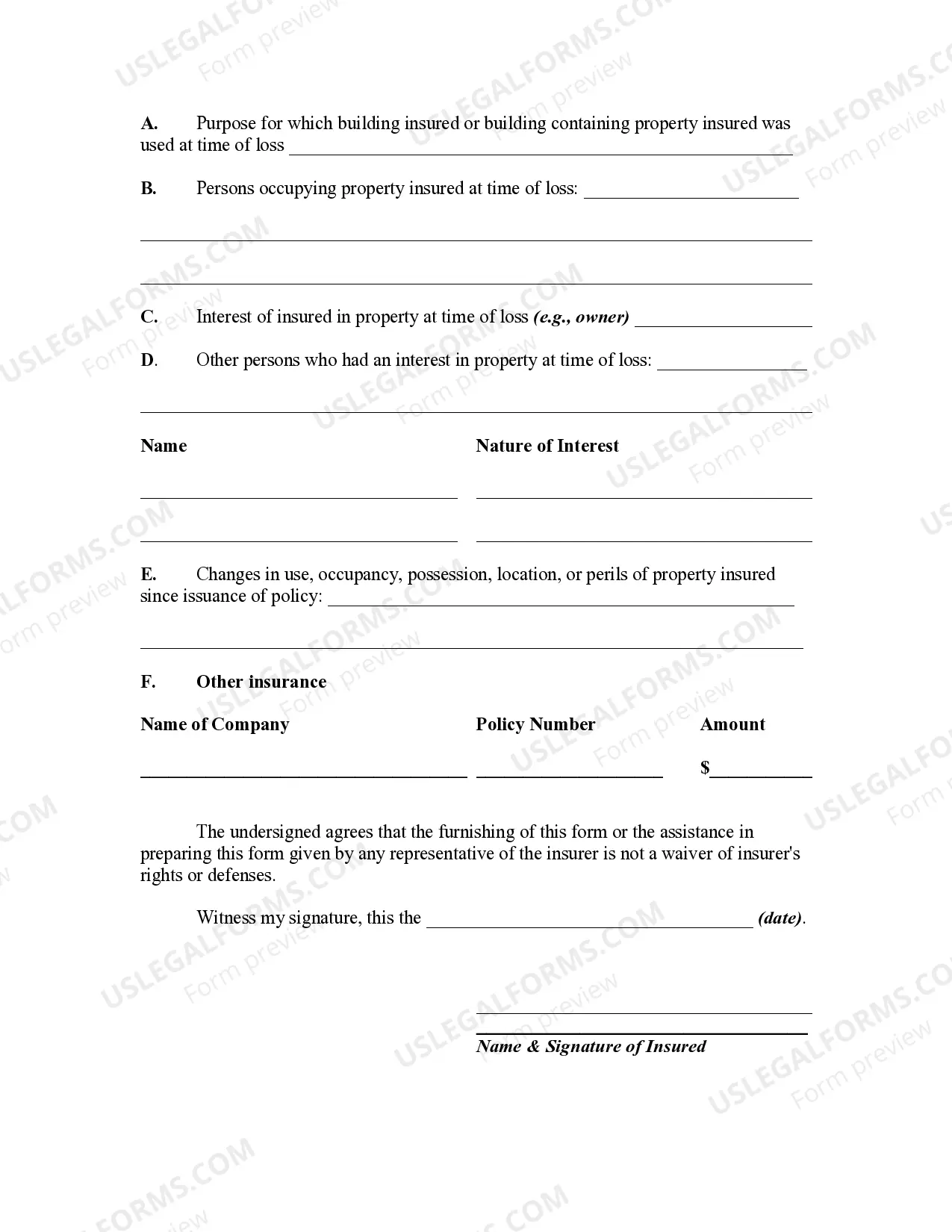

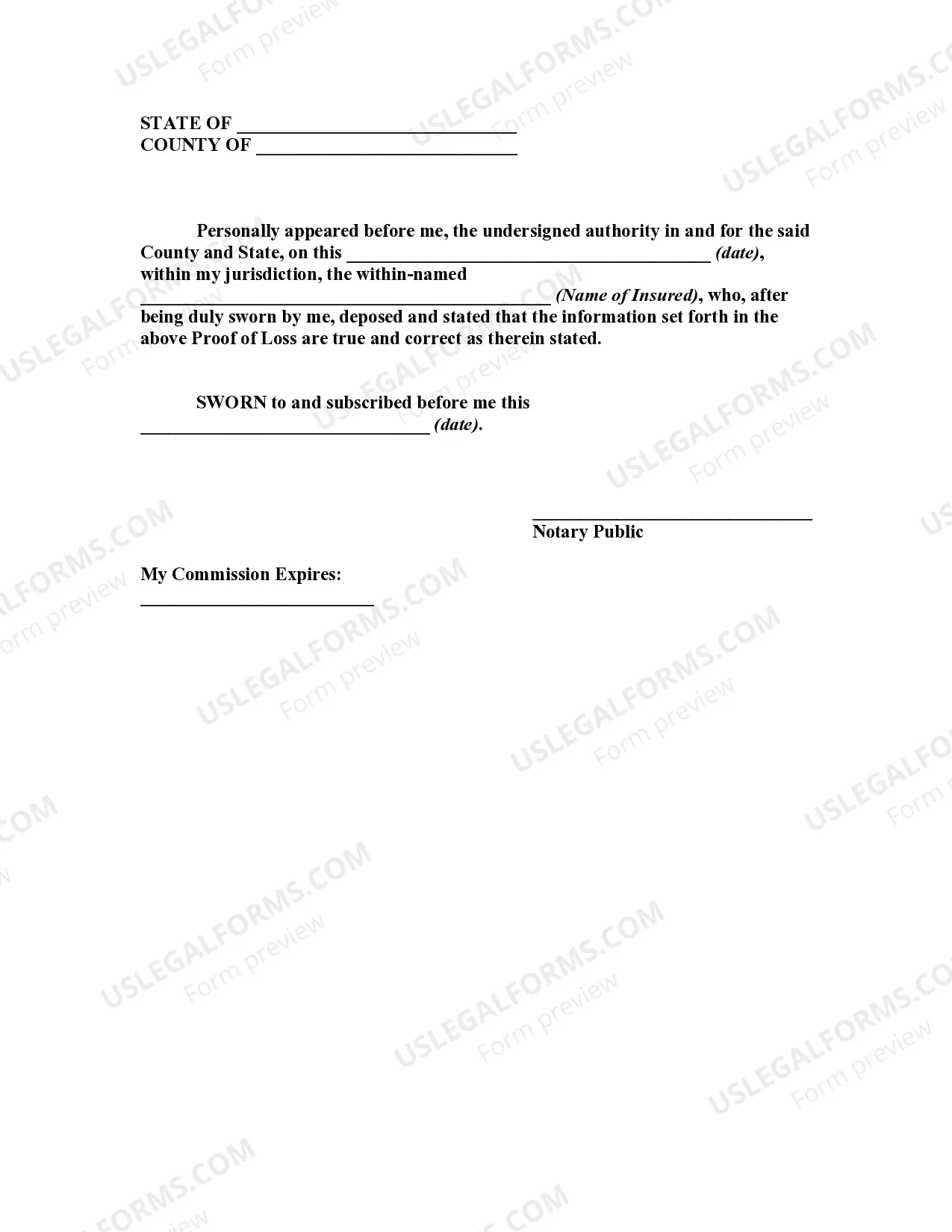

A Proof of Loss is a sworn statement that usually must be furnished by the insured to an insurer before any loss under a policy may be paid.

Houston Texas Proof of Loss for Fire Insurance Claim is a crucial document that serves as evidence to support a policyholder's claim for damages caused by a fire incident. This official statement outlines the details of the loss, including the extent of damage, estimated cost of repairs or replacement, and other pertinent information needed to process a fire insurance claim. When filing a fire insurance claim in Houston, Texas, it is imperative to submit a comprehensive Proof of Loss to ensure a smoother and more efficient claims process. This document helps demonstrate the extent of financial loss suffered due to the fire by providing an itemized list of damaged or destroyed property, along with their corresponding values. The Proof of Loss for Fire Insurance Claim in Houston, Texas typically consists of the following key components: 1. Claimant Information: Include the policyholder's name, contact details, policy number, and relevant insurance information. 2. Fire Incident Details: Describe the circumstances of the fire incident, including the date, time, and location of the event. It is essential to provide a detailed account of the fire's cause, origin, and any relevant supporting evidence, such as police or fire department reports. 3. Property Inventory: Prepare a comprehensive inventory of all damaged or destroyed items. List each item individually, including its description, age, quantity, and value at the time of the fire. If possible, include purchase receipts, photographs, or any other documentation that can substantiate the item's existence and value. 4. Structural and Building Damage: In cases where the fire caused structural damage to buildings, include detailed descriptions of the affected areas, materials, construction type, and repair estimates or contractor's evaluation reports. 5. Personal Belongings: If personal belongings were damaged or destroyed in the fire, provide a detailed list of these items, including their value. Categorize them based on furniture, electronics, clothing, jewelry, etc. Attach supporting documentation like purchase receipts, appraisals, or photographs to validate their existence. 6. Business Interruption and Additional Living Expenses: If the fire resulted in business interruption or the necessity to find alternative living arrangements, include these expenses with relevant documentation such as lease agreements, utility bills, or financial statements. Different types of Proof of Loss for Fire Insurance Claim in Houston, Texas may also include: — Sworn Proof of Loss: A notarized statement signed by the claimant to affirm the accuracy and truthfulness of the claim. — Fire Department Report: A report provided by the local fire department detailing the fire incident, response, and findings. This report acts as supplementary evidence for the insurance claim. — Estimates and Appraisals: Written evaluations from contractors, adjusters, or professional appraisers providing estimated costs of repair or replacement for damaged property. These estimates help support the requested amount in the claim. Ensuring the accuracy and completeness of the Houston Texas Proof of Loss for Fire Insurance Claim is vital for a successful claim settlement. Policyholders should thoroughly review their insurance policy and consult with their insurance company or a licensed insurance adjuster for specific requirements and guidance on preparing the Proof of Loss document.Houston Texas Proof of Loss for Fire Insurance Claim is a crucial document that serves as evidence to support a policyholder's claim for damages caused by a fire incident. This official statement outlines the details of the loss, including the extent of damage, estimated cost of repairs or replacement, and other pertinent information needed to process a fire insurance claim. When filing a fire insurance claim in Houston, Texas, it is imperative to submit a comprehensive Proof of Loss to ensure a smoother and more efficient claims process. This document helps demonstrate the extent of financial loss suffered due to the fire by providing an itemized list of damaged or destroyed property, along with their corresponding values. The Proof of Loss for Fire Insurance Claim in Houston, Texas typically consists of the following key components: 1. Claimant Information: Include the policyholder's name, contact details, policy number, and relevant insurance information. 2. Fire Incident Details: Describe the circumstances of the fire incident, including the date, time, and location of the event. It is essential to provide a detailed account of the fire's cause, origin, and any relevant supporting evidence, such as police or fire department reports. 3. Property Inventory: Prepare a comprehensive inventory of all damaged or destroyed items. List each item individually, including its description, age, quantity, and value at the time of the fire. If possible, include purchase receipts, photographs, or any other documentation that can substantiate the item's existence and value. 4. Structural and Building Damage: In cases where the fire caused structural damage to buildings, include detailed descriptions of the affected areas, materials, construction type, and repair estimates or contractor's evaluation reports. 5. Personal Belongings: If personal belongings were damaged or destroyed in the fire, provide a detailed list of these items, including their value. Categorize them based on furniture, electronics, clothing, jewelry, etc. Attach supporting documentation like purchase receipts, appraisals, or photographs to validate their existence. 6. Business Interruption and Additional Living Expenses: If the fire resulted in business interruption or the necessity to find alternative living arrangements, include these expenses with relevant documentation such as lease agreements, utility bills, or financial statements. Different types of Proof of Loss for Fire Insurance Claim in Houston, Texas may also include: — Sworn Proof of Loss: A notarized statement signed by the claimant to affirm the accuracy and truthfulness of the claim. — Fire Department Report: A report provided by the local fire department detailing the fire incident, response, and findings. This report acts as supplementary evidence for the insurance claim. — Estimates and Appraisals: Written evaluations from contractors, adjusters, or professional appraisers providing estimated costs of repair or replacement for damaged property. These estimates help support the requested amount in the claim. Ensuring the accuracy and completeness of the Houston Texas Proof of Loss for Fire Insurance Claim is vital for a successful claim settlement. Policyholders should thoroughly review their insurance policy and consult with their insurance company or a licensed insurance adjuster for specific requirements and guidance on preparing the Proof of Loss document.