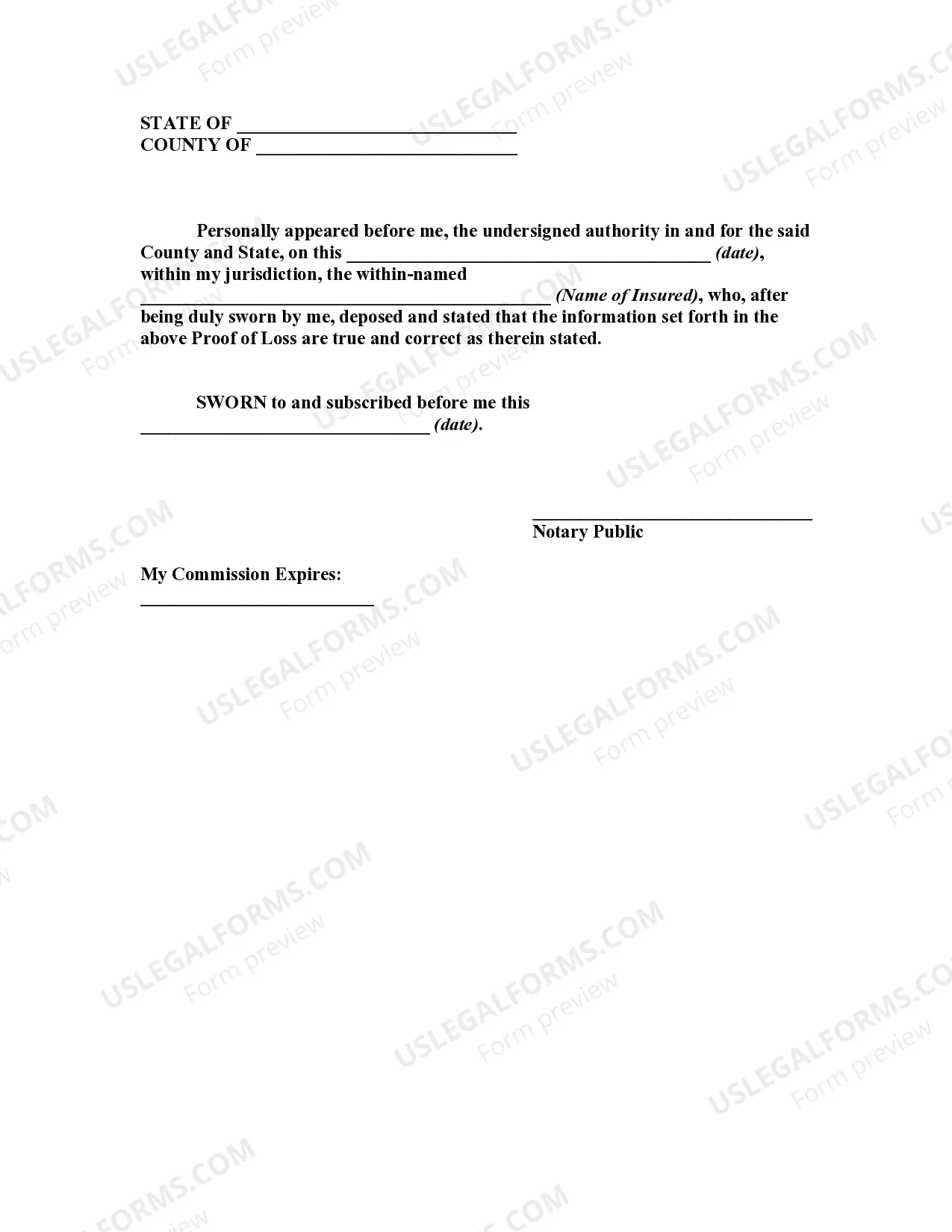

A Proof of Loss is a sworn statement that usually must be furnished by the insured to an insurer before any loss under a policy may be paid.

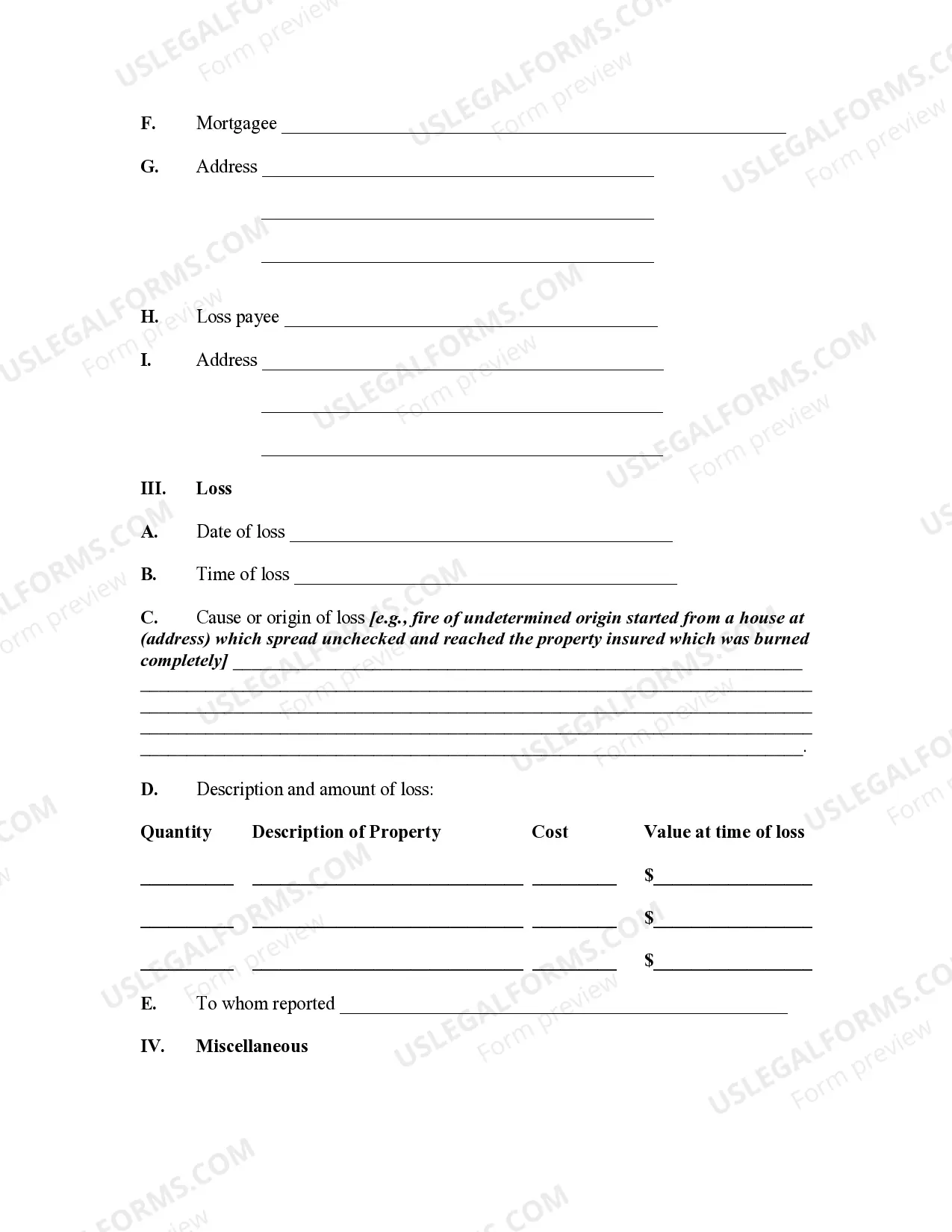

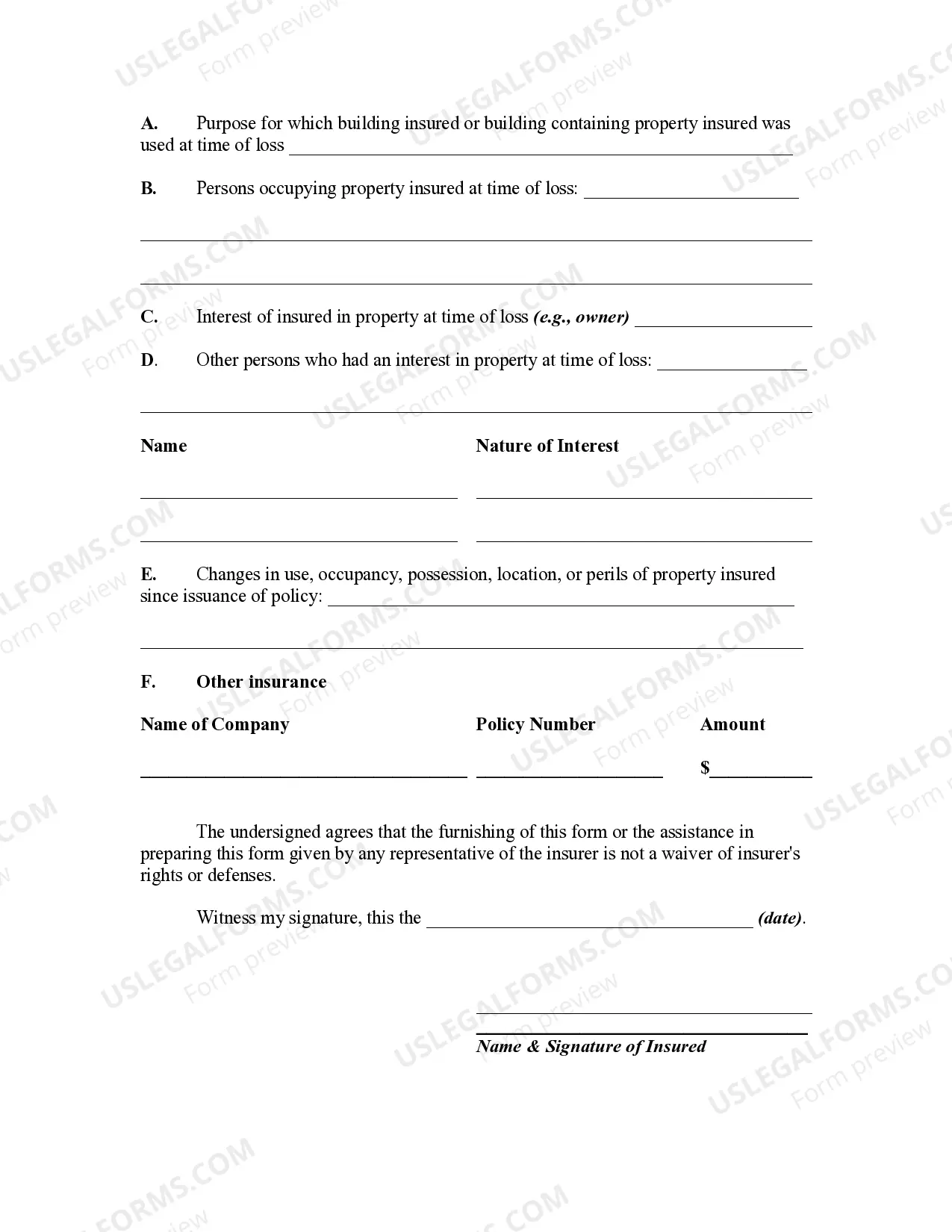

Los Angeles California Proof of Loss for Fire Insurance Claim is a crucial document that property owners in Los Angeles, California must submit to their insurance company when filing a fire insurance claim. This document serves as evidence of the amount of loss incurred due to fire damage to the insured property. It is vital to provide a detailed and accurate description in the Proof of Loss to ensure a fair and timely settlement from the insurance company. The Proof of Loss for Fire Insurance Claim typically consists of various sections, including: 1. Contact Information: This section requires the policyholder to provide their name, address, phone number, and email address for communication purposes. Additionally, the insurance policy number and claim number should be included for easy identification. 2. Description of Property: This part necessitates a detailed description of the insured property, such as the address, type of structure (residential or commercial), its size, number of floors, and any unique features or improvements. 3. Date and Time of Fire: The Proof of Loss must include the exact date and time of the fire incident. A detailed account of how the fire occurred, its causes, and circumstances leading to the damage should be included. Photographs or other supporting evidence may be attached to provide a visual representation. 4. List of Damaged or Destroyed Items: A comprehensive inventory of all damaged or destroyed items should be included. This includes furniture, appliances, electronics, personal belongings, valuable assets, and any other items affected by the fire. Each item should be specified with its estimated value and the cost of replacement or repair. 5. Cost Estimation: Here, the policyholder should calculate the cost of repairing or rebuilding the damaged property. If necessary, professional contractors, engineers, or appraisers' opinions can be obtained to ensure accurate estimations. Additionally, costs related to temporary housing, debris removal, and other necessary expenses should be included. 6. Previous Claims: A section where any previous claims related to the property or any outstanding insurance issues should be disclosed for transparency and completeness. It is essential to consult with an insurance professional or a public adjuster before submitting the Proof of Loss to ensure accuracy and completeness. Different types of Proof of Loss may vary based on specific insurance policies or unique circumstances of the fire. Examples could include Proof of Loss for residential properties, commercial properties, rental properties, and personal belongings claims. Submitting a well-documented and detailed Proof of Loss is crucial for an efficient and fair settlement process. It helps insurance companies assess the extent of the damage and determine the amount of compensation owed to the policyholder.Los Angeles California Proof of Loss for Fire Insurance Claim is a crucial document that property owners in Los Angeles, California must submit to their insurance company when filing a fire insurance claim. This document serves as evidence of the amount of loss incurred due to fire damage to the insured property. It is vital to provide a detailed and accurate description in the Proof of Loss to ensure a fair and timely settlement from the insurance company. The Proof of Loss for Fire Insurance Claim typically consists of various sections, including: 1. Contact Information: This section requires the policyholder to provide their name, address, phone number, and email address for communication purposes. Additionally, the insurance policy number and claim number should be included for easy identification. 2. Description of Property: This part necessitates a detailed description of the insured property, such as the address, type of structure (residential or commercial), its size, number of floors, and any unique features or improvements. 3. Date and Time of Fire: The Proof of Loss must include the exact date and time of the fire incident. A detailed account of how the fire occurred, its causes, and circumstances leading to the damage should be included. Photographs or other supporting evidence may be attached to provide a visual representation. 4. List of Damaged or Destroyed Items: A comprehensive inventory of all damaged or destroyed items should be included. This includes furniture, appliances, electronics, personal belongings, valuable assets, and any other items affected by the fire. Each item should be specified with its estimated value and the cost of replacement or repair. 5. Cost Estimation: Here, the policyholder should calculate the cost of repairing or rebuilding the damaged property. If necessary, professional contractors, engineers, or appraisers' opinions can be obtained to ensure accurate estimations. Additionally, costs related to temporary housing, debris removal, and other necessary expenses should be included. 6. Previous Claims: A section where any previous claims related to the property or any outstanding insurance issues should be disclosed for transparency and completeness. It is essential to consult with an insurance professional or a public adjuster before submitting the Proof of Loss to ensure accuracy and completeness. Different types of Proof of Loss may vary based on specific insurance policies or unique circumstances of the fire. Examples could include Proof of Loss for residential properties, commercial properties, rental properties, and personal belongings claims. Submitting a well-documented and detailed Proof of Loss is crucial for an efficient and fair settlement process. It helps insurance companies assess the extent of the damage and determine the amount of compensation owed to the policyholder.