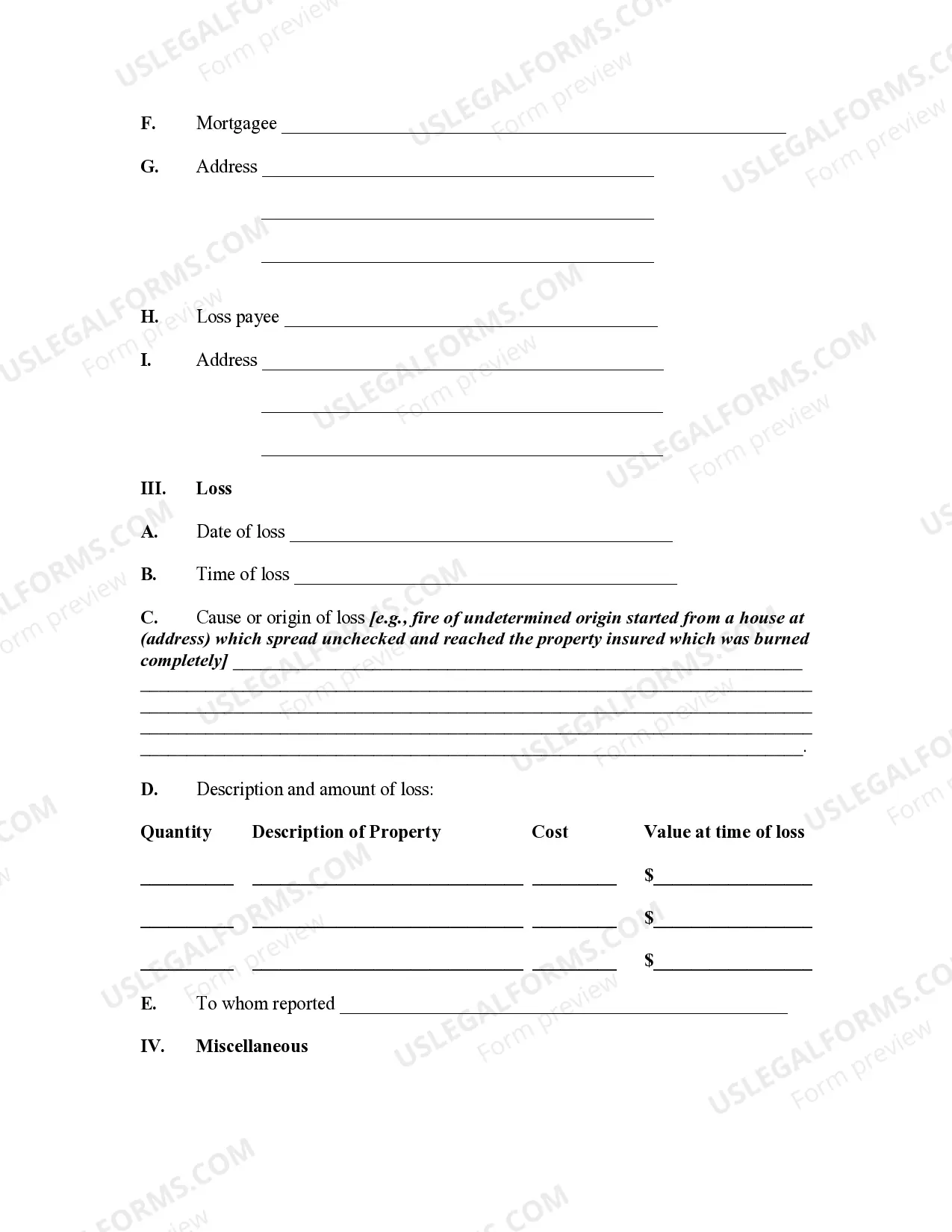

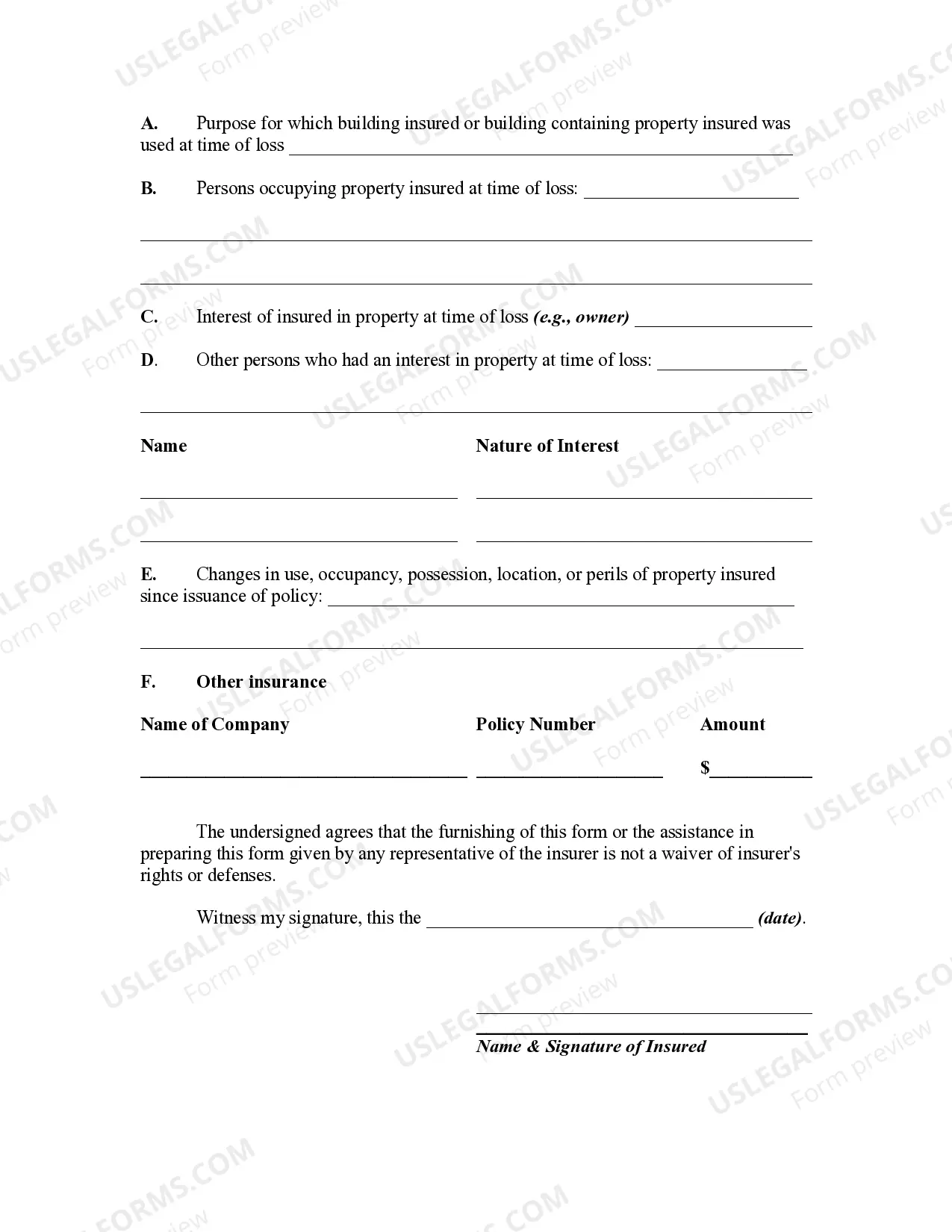

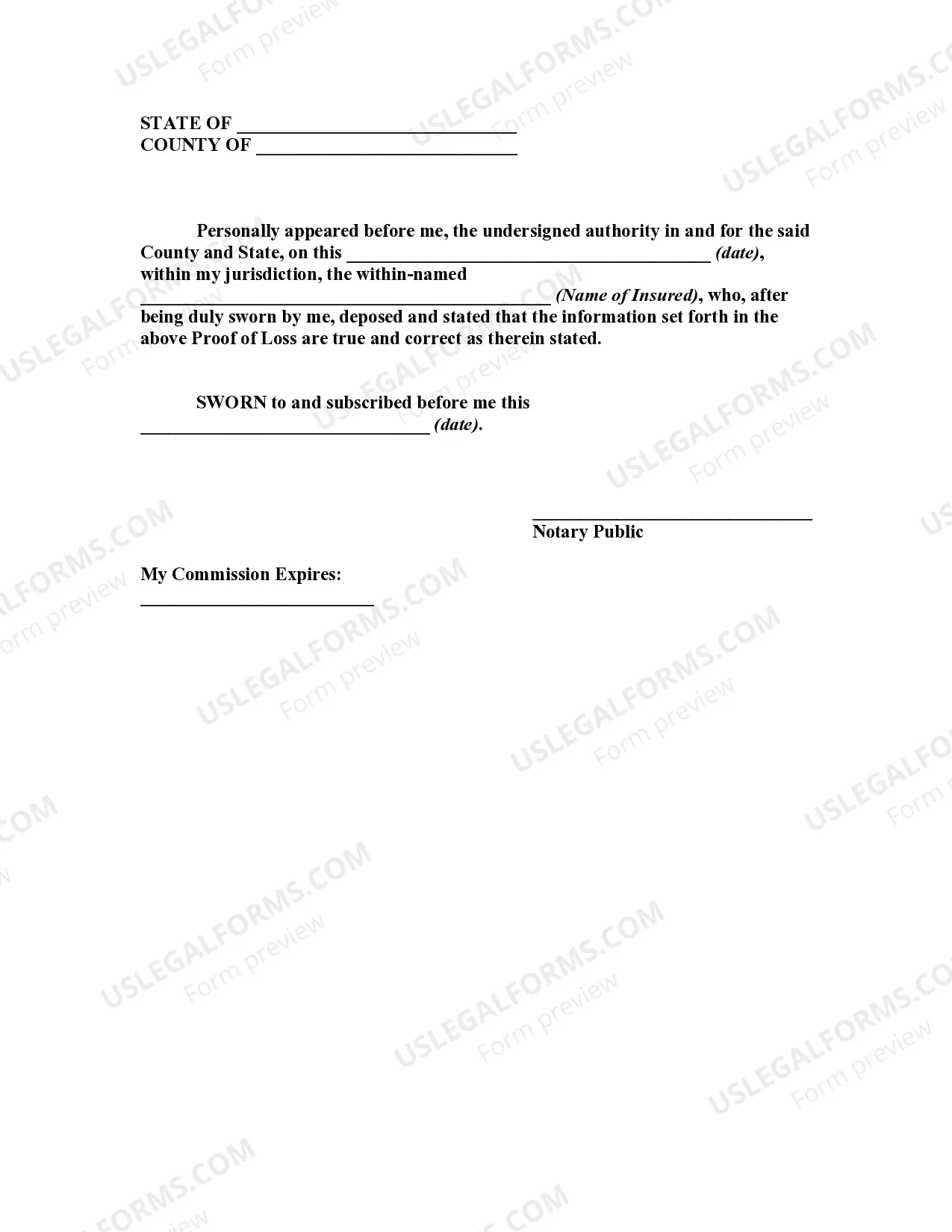

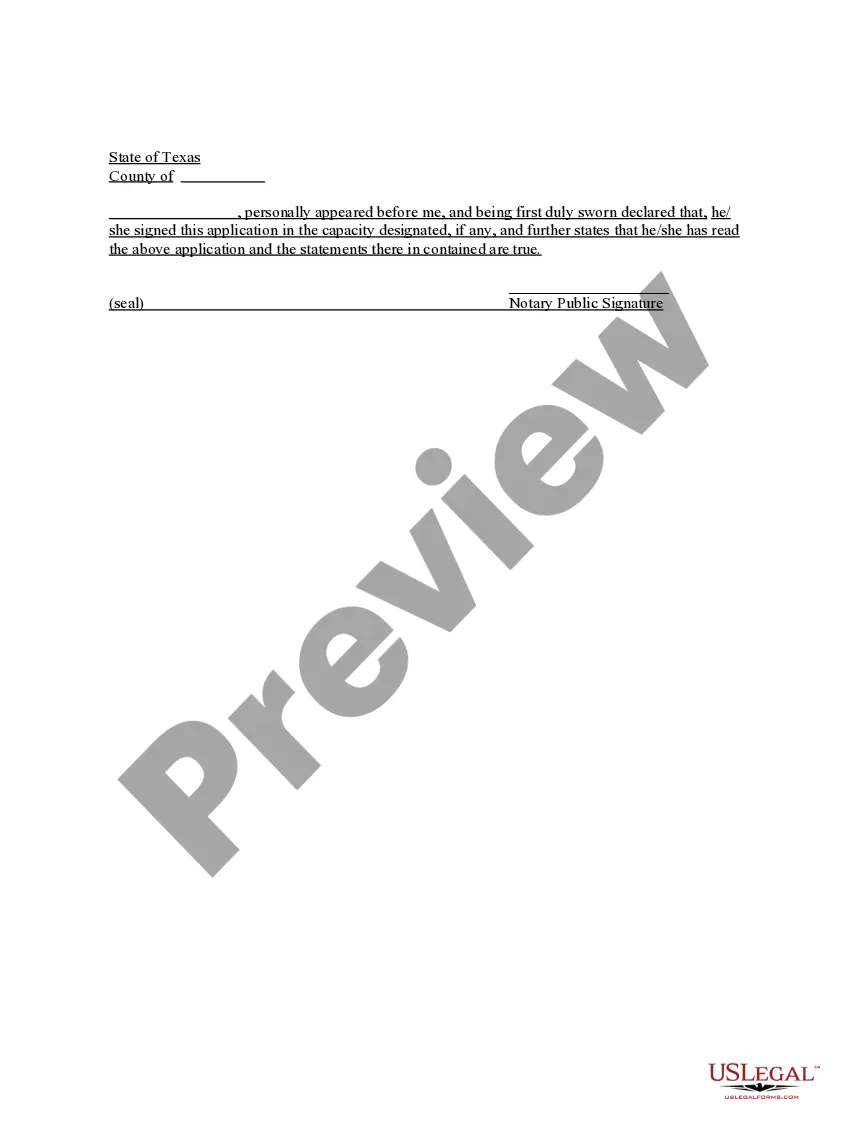

A Proof of Loss is a sworn statement that usually must be furnished by the insured to an insurer before any loss under a policy may be paid.

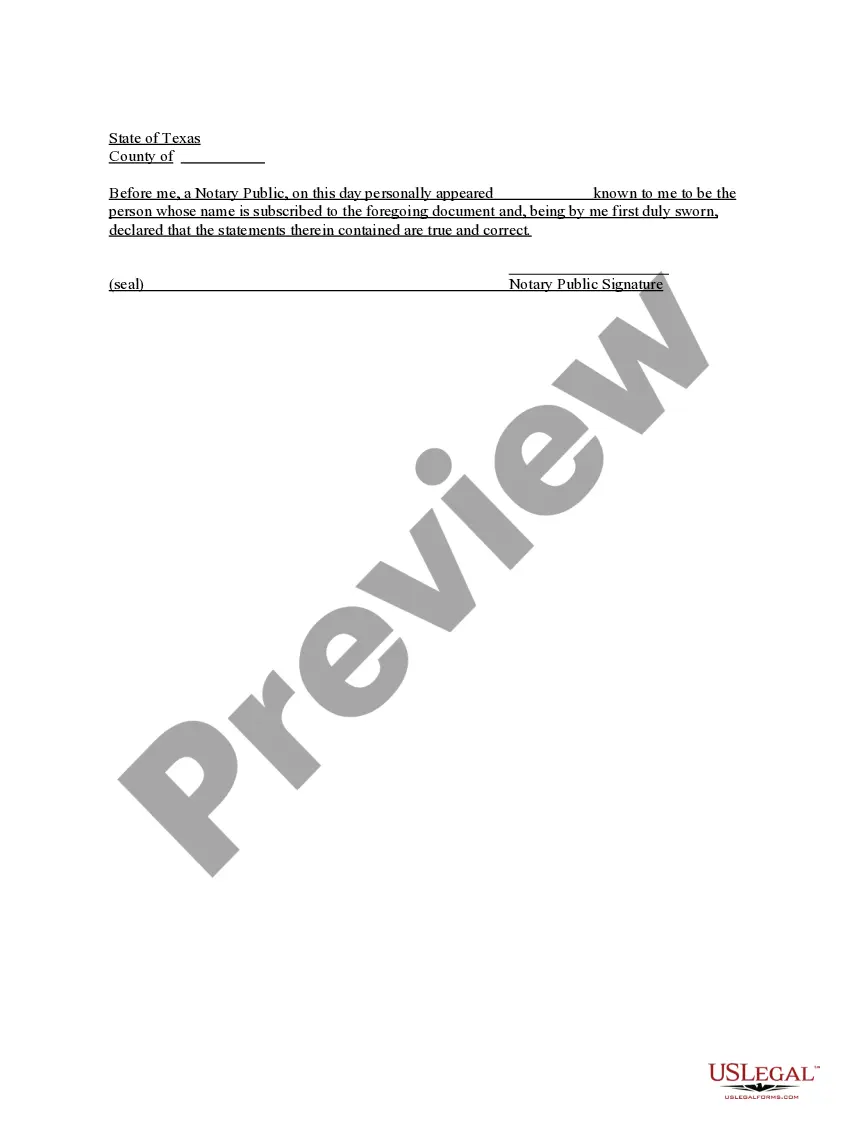

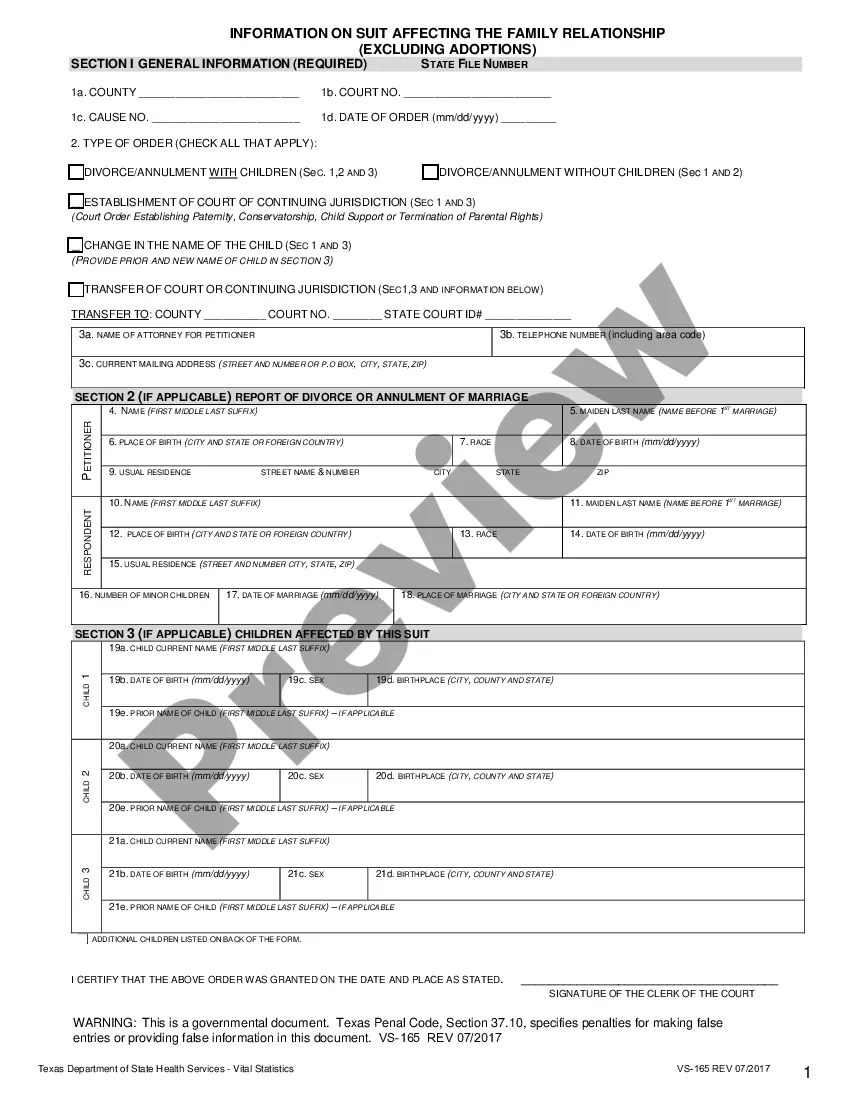

Orange California Proof of Loss for Fire Insurance Claim is a crucial document that enables policyholders to seek compensation for losses incurred due to a fire incident. It serves as evidence to substantiate the claims made by the insured party, providing the insurance company with all the necessary information regarding the damages and losses suffered. The proof of loss is a comprehensive report that details the extent of the fire-related damages and helps determine the amount of compensation owed to the insured. The Orange California Proof of Loss for Fire Insurance Claim consists of several key elements that should be included to ensure its effectiveness. These elements include: 1. Policyholder Information: The proof of loss form should begin by capturing the insured party's detailed information, including their name, address, contact details, and policy number. This information helps the insurance company identify and match the claim with the appropriate policyholder. 2. Description of Property: This section requires a detailed description of the property affected by the fire incident. It should include the property's address, type (residential or commercial), square footage, number of rooms, and any additional features or amenities. 3. Date, Time, and Cause of the Loss: The proof of loss form must mention the exact date and time when the fire incident occurred. Additionally, it should describe the cause of the loss, whether it was accidental, natural, or caused by an act of negligence. 4. Detailed Description of Damages: This section is crucial, as it requires a detailed and comprehensive description of all damages and losses incurred. It should list all affected areas, such as rooms, structures, and belongings. Including photographs, videos, or any other form of visual evidence is highly recommended supporting the claim. 5. Estimated Cost of Repairs or Replacement: Insured parties must provide an accurate estimation of the cost required to repair or replace the damaged property, including both the structure and personal belongings. Supporting documentation, such as repair quotes or receipts, should be attached to validate the figures provided. 6. Proof of Ownership: To verify ownership of the damaged property and possessions, relevant documents like purchase receipts, appraisals, or photographs should be included. This helps in preventing fraudulent claims. 7. Additional Expenses: If additional expenses were incurred as a result of the fire incident, such as temporary accommodations, storage, or transportation costs, they should be detailed in this section. 8. Signature and Date: The policyholder must sign and date the proof of loss form to authenticate the information provided. Different types of Orange California Proof of Loss for Fire Insurance Claim may exist based on the specific requirements of different insurance companies or policyholders. These might include electronic versions of the form, online submission portals, or variations in the layout and format. It is always best to consult with the specific insurance company to obtain the correct and most up-to-date version of the form. In summary, the Orange California Proof of Loss for Fire Insurance Claim is a vital document serving as a comprehensive record of damages and losses suffered due to a fire incident. By providing accurate and thorough information, policyholders can maximize their chances of receiving full and fair compensation from their insurance company.Orange California Proof of Loss for Fire Insurance Claim is a crucial document that enables policyholders to seek compensation for losses incurred due to a fire incident. It serves as evidence to substantiate the claims made by the insured party, providing the insurance company with all the necessary information regarding the damages and losses suffered. The proof of loss is a comprehensive report that details the extent of the fire-related damages and helps determine the amount of compensation owed to the insured. The Orange California Proof of Loss for Fire Insurance Claim consists of several key elements that should be included to ensure its effectiveness. These elements include: 1. Policyholder Information: The proof of loss form should begin by capturing the insured party's detailed information, including their name, address, contact details, and policy number. This information helps the insurance company identify and match the claim with the appropriate policyholder. 2. Description of Property: This section requires a detailed description of the property affected by the fire incident. It should include the property's address, type (residential or commercial), square footage, number of rooms, and any additional features or amenities. 3. Date, Time, and Cause of the Loss: The proof of loss form must mention the exact date and time when the fire incident occurred. Additionally, it should describe the cause of the loss, whether it was accidental, natural, or caused by an act of negligence. 4. Detailed Description of Damages: This section is crucial, as it requires a detailed and comprehensive description of all damages and losses incurred. It should list all affected areas, such as rooms, structures, and belongings. Including photographs, videos, or any other form of visual evidence is highly recommended supporting the claim. 5. Estimated Cost of Repairs or Replacement: Insured parties must provide an accurate estimation of the cost required to repair or replace the damaged property, including both the structure and personal belongings. Supporting documentation, such as repair quotes or receipts, should be attached to validate the figures provided. 6. Proof of Ownership: To verify ownership of the damaged property and possessions, relevant documents like purchase receipts, appraisals, or photographs should be included. This helps in preventing fraudulent claims. 7. Additional Expenses: If additional expenses were incurred as a result of the fire incident, such as temporary accommodations, storage, or transportation costs, they should be detailed in this section. 8. Signature and Date: The policyholder must sign and date the proof of loss form to authenticate the information provided. Different types of Orange California Proof of Loss for Fire Insurance Claim may exist based on the specific requirements of different insurance companies or policyholders. These might include electronic versions of the form, online submission portals, or variations in the layout and format. It is always best to consult with the specific insurance company to obtain the correct and most up-to-date version of the form. In summary, the Orange California Proof of Loss for Fire Insurance Claim is a vital document serving as a comprehensive record of damages and losses suffered due to a fire incident. By providing accurate and thorough information, policyholders can maximize their chances of receiving full and fair compensation from their insurance company.