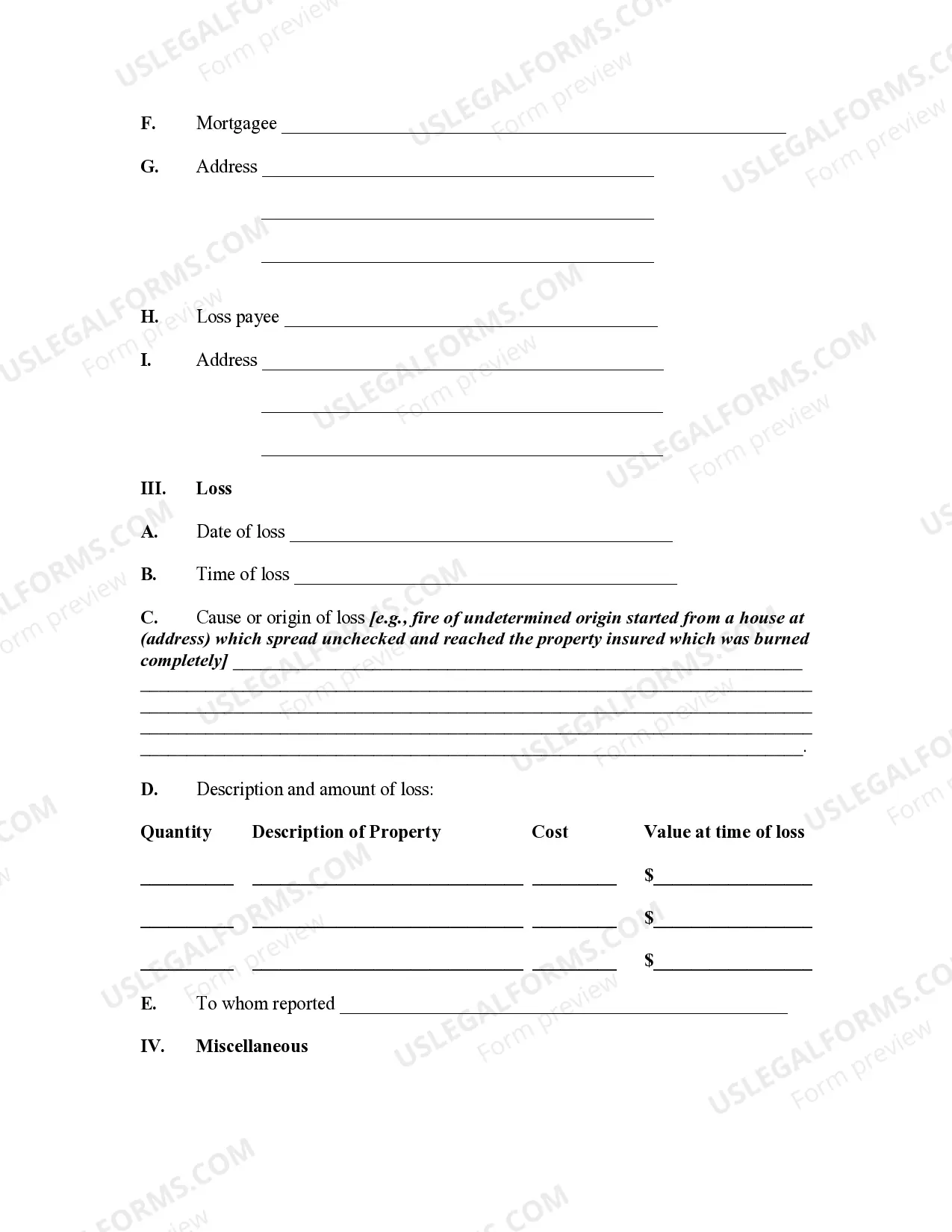

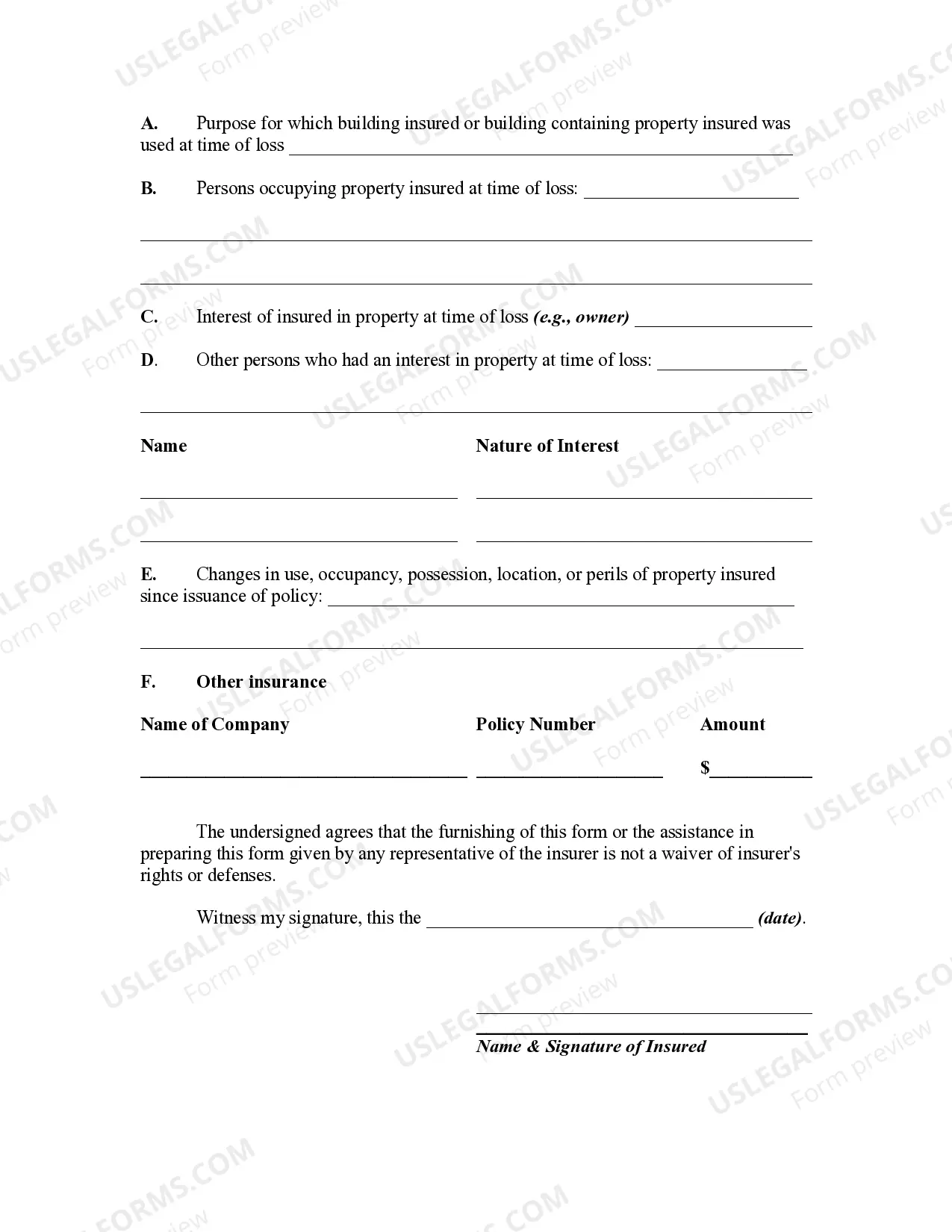

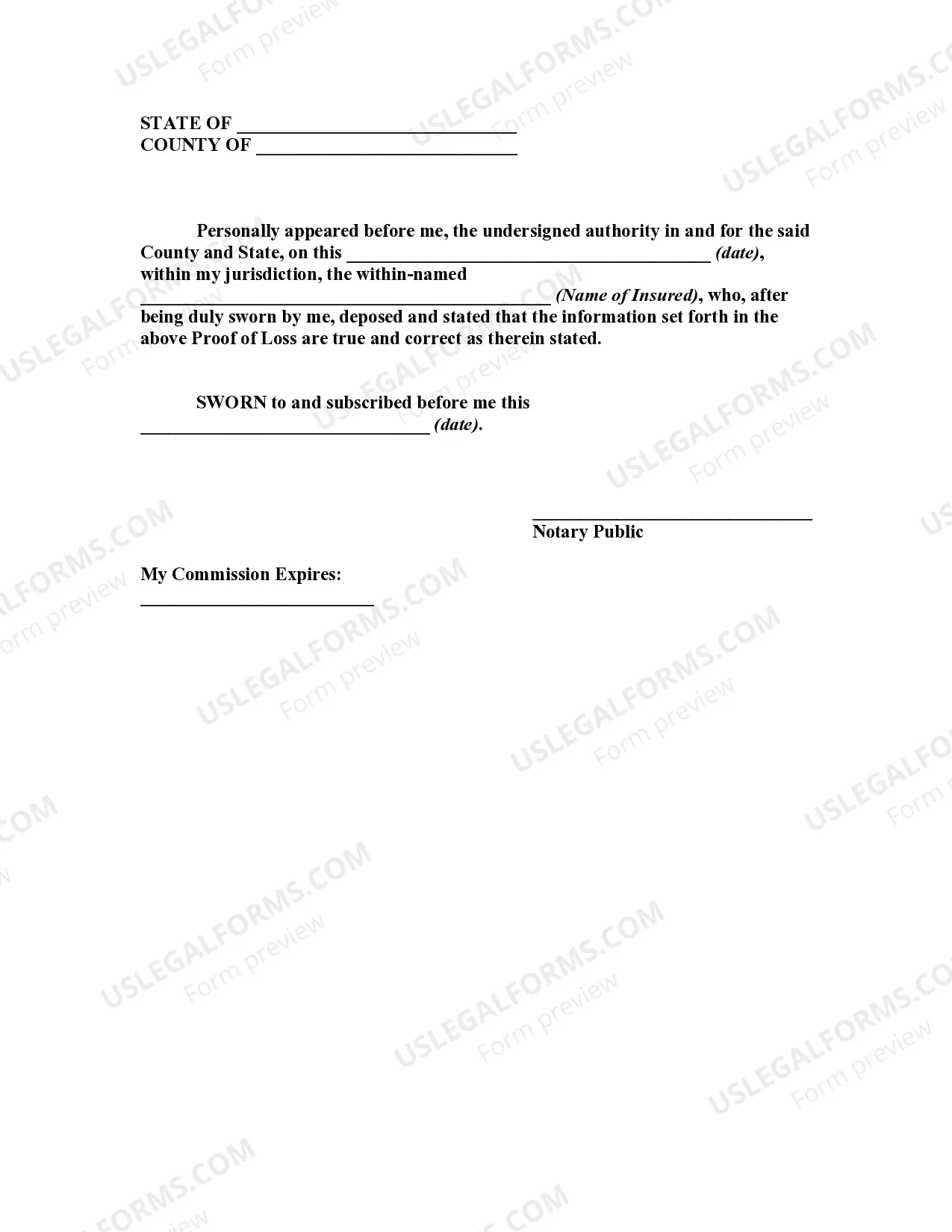

A Proof of Loss is a sworn statement that usually must be furnished by the insured to an insurer before any loss under a policy may be paid.

Salt Lake Utah Proof of Loss for Fire Insurance Claim is a comprehensive document that provides detailed information about the damages incurred due to a fire incident in Salt Lake City, Utah. It serves as evidence for the insurance company to assess the extent of losses and process the claim accordingly. This proof of loss document is crucial in ensuring a smooth and fair claims settlement process for both the insured and the insurer. It outlines the necessary information and supporting documentation required to substantiate the fire-related damages, aiding in the accurate evaluation of the claim. The essential details that should be included in a Salt Lake Utah Proof of Loss for Fire Insurance Claim are as follows: 1. Policyholder Information: Begin the document by providing the insured's name, contact information, and policy number. This ensures that the insurer can easily identify and locate the policyholder's records. 2. Incident Date and Location: Clearly state the date when the fire incident occurred and provide the precise location, including the address of the damaged property in Salt Lake City, Utah. 3. Description of Damages: Provide a comprehensive inventory of the damaged items, including personal belongings, structures, contents, and other relevant properties affected by the fire. Ensure to include a thorough description of each item, including brand, model, age, and approximate value before the fire. 4. Supporting Documentation: Attach any relevant documents that support the claimed damages. This may include photographs, videos, receipts, invoices, repair estimates, and any other evidence that substantiates the loss. 5. Value Assessment: Assign an estimated value or cost of repair for each damaged item based on current market prices. Consider seeking professional assistance, such as appraisers or contractors, to ensure accurate valuations. 6. Additional Expenses: Include any additional expenses incurred as a result of the fire incident, such as temporary lodging, rental costs, and transportation expenses, if applicable. 7. Declarations and Signatures: End the document with a declaration stating that the information provided is true and accurate to the best of the policyholder's knowledge. Include respective dates and the insured's signature. Different types of Salt Lake Utah Proof of Loss for Fire Insurance Claim may arise based on specific scenarios, such as: 1. Residential Property Claim: This type of proof of loss is used for residential properties, including houses, condominiums, or apartments affected by fire. 2. Commercial Property Claim: If the fire incident occurs in a commercial establishment, such as an office building, retail store, or warehouse, a commercial property claim proof of loss is necessary. 3. Renter's Insurance Claim: Tenants who have renter's insurance can file a separate proof of loss to claim their damaged personal belongings in a rented property. 4. Landlord's Insurance Claim: Property owners who possess landlord insurance can submit a distinct proof of loss for the structural damages to their rental property. By providing a comprehensive Salt Lake Utah Proof of Loss for Fire Insurance Claim, policyholders can maximize their chances of a fair settlement while also aiding the insurance company in accurately evaluating the damages incurred during a fire incident in Salt Lake City, Utah.Salt Lake Utah Proof of Loss for Fire Insurance Claim is a comprehensive document that provides detailed information about the damages incurred due to a fire incident in Salt Lake City, Utah. It serves as evidence for the insurance company to assess the extent of losses and process the claim accordingly. This proof of loss document is crucial in ensuring a smooth and fair claims settlement process for both the insured and the insurer. It outlines the necessary information and supporting documentation required to substantiate the fire-related damages, aiding in the accurate evaluation of the claim. The essential details that should be included in a Salt Lake Utah Proof of Loss for Fire Insurance Claim are as follows: 1. Policyholder Information: Begin the document by providing the insured's name, contact information, and policy number. This ensures that the insurer can easily identify and locate the policyholder's records. 2. Incident Date and Location: Clearly state the date when the fire incident occurred and provide the precise location, including the address of the damaged property in Salt Lake City, Utah. 3. Description of Damages: Provide a comprehensive inventory of the damaged items, including personal belongings, structures, contents, and other relevant properties affected by the fire. Ensure to include a thorough description of each item, including brand, model, age, and approximate value before the fire. 4. Supporting Documentation: Attach any relevant documents that support the claimed damages. This may include photographs, videos, receipts, invoices, repair estimates, and any other evidence that substantiates the loss. 5. Value Assessment: Assign an estimated value or cost of repair for each damaged item based on current market prices. Consider seeking professional assistance, such as appraisers or contractors, to ensure accurate valuations. 6. Additional Expenses: Include any additional expenses incurred as a result of the fire incident, such as temporary lodging, rental costs, and transportation expenses, if applicable. 7. Declarations and Signatures: End the document with a declaration stating that the information provided is true and accurate to the best of the policyholder's knowledge. Include respective dates and the insured's signature. Different types of Salt Lake Utah Proof of Loss for Fire Insurance Claim may arise based on specific scenarios, such as: 1. Residential Property Claim: This type of proof of loss is used for residential properties, including houses, condominiums, or apartments affected by fire. 2. Commercial Property Claim: If the fire incident occurs in a commercial establishment, such as an office building, retail store, or warehouse, a commercial property claim proof of loss is necessary. 3. Renter's Insurance Claim: Tenants who have renter's insurance can file a separate proof of loss to claim their damaged personal belongings in a rented property. 4. Landlord's Insurance Claim: Property owners who possess landlord insurance can submit a distinct proof of loss for the structural damages to their rental property. By providing a comprehensive Salt Lake Utah Proof of Loss for Fire Insurance Claim, policyholders can maximize their chances of a fair settlement while also aiding the insurance company in accurately evaluating the damages incurred during a fire incident in Salt Lake City, Utah.