A Proof of Loss is a sworn statement that usually must be furnished by the insured to an insurer before any loss under a policy may be paid.

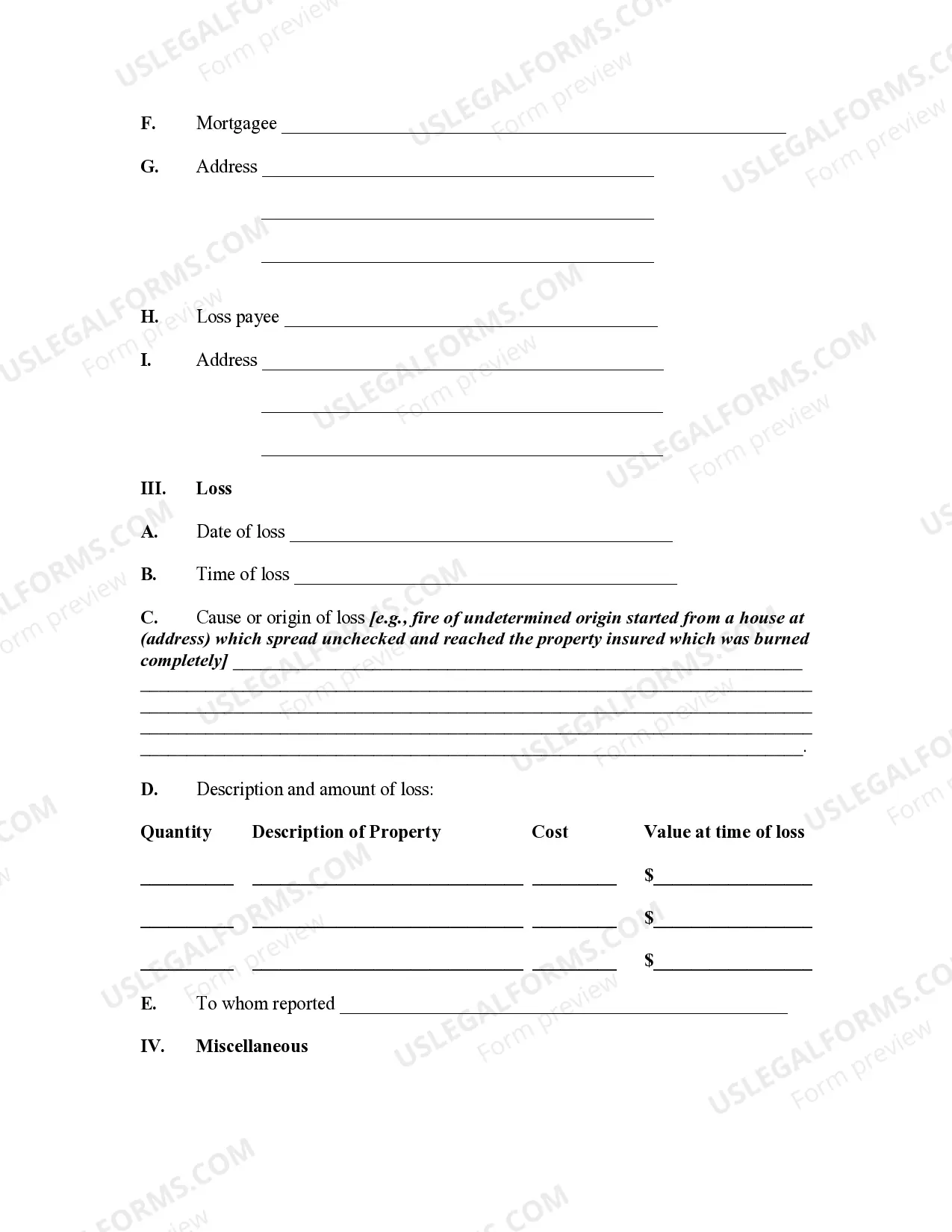

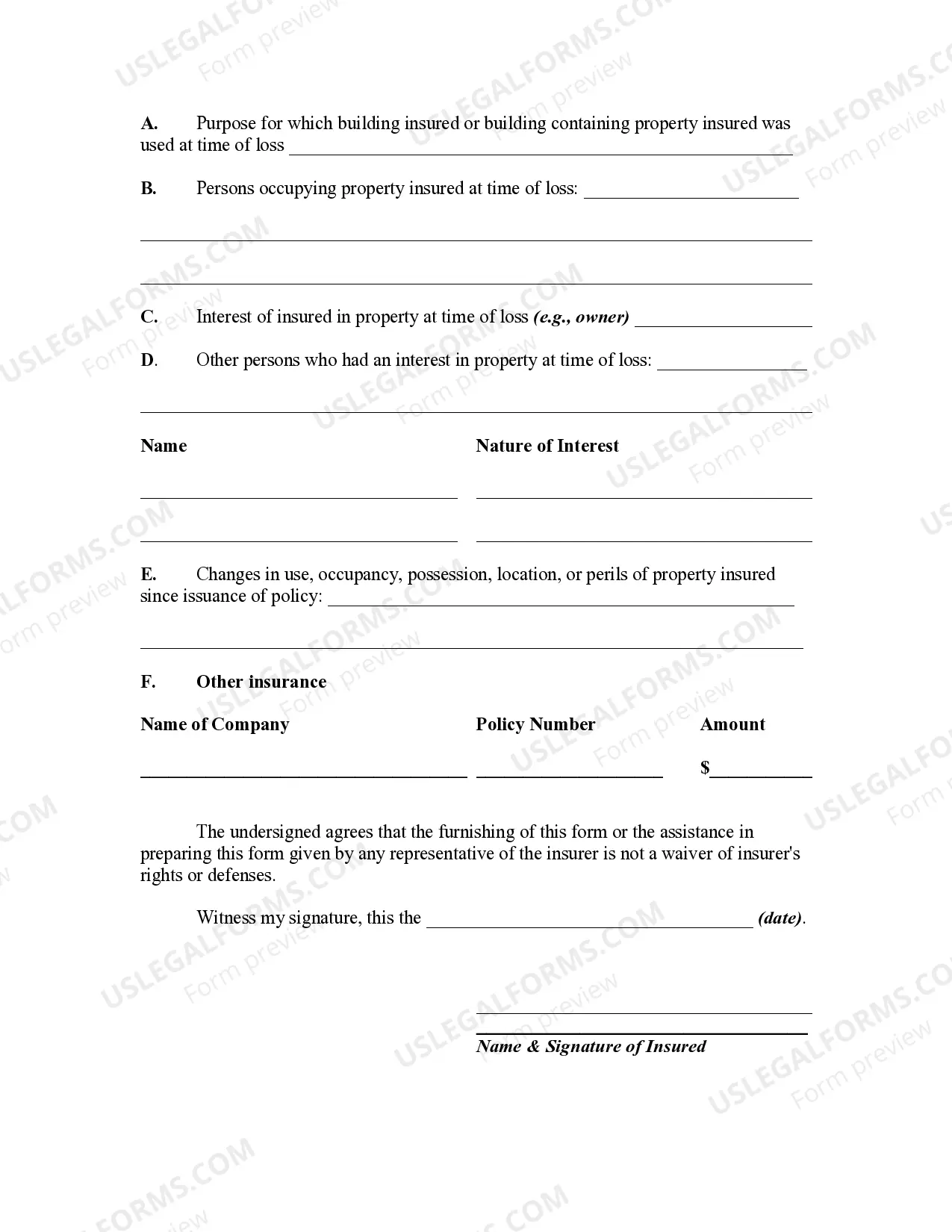

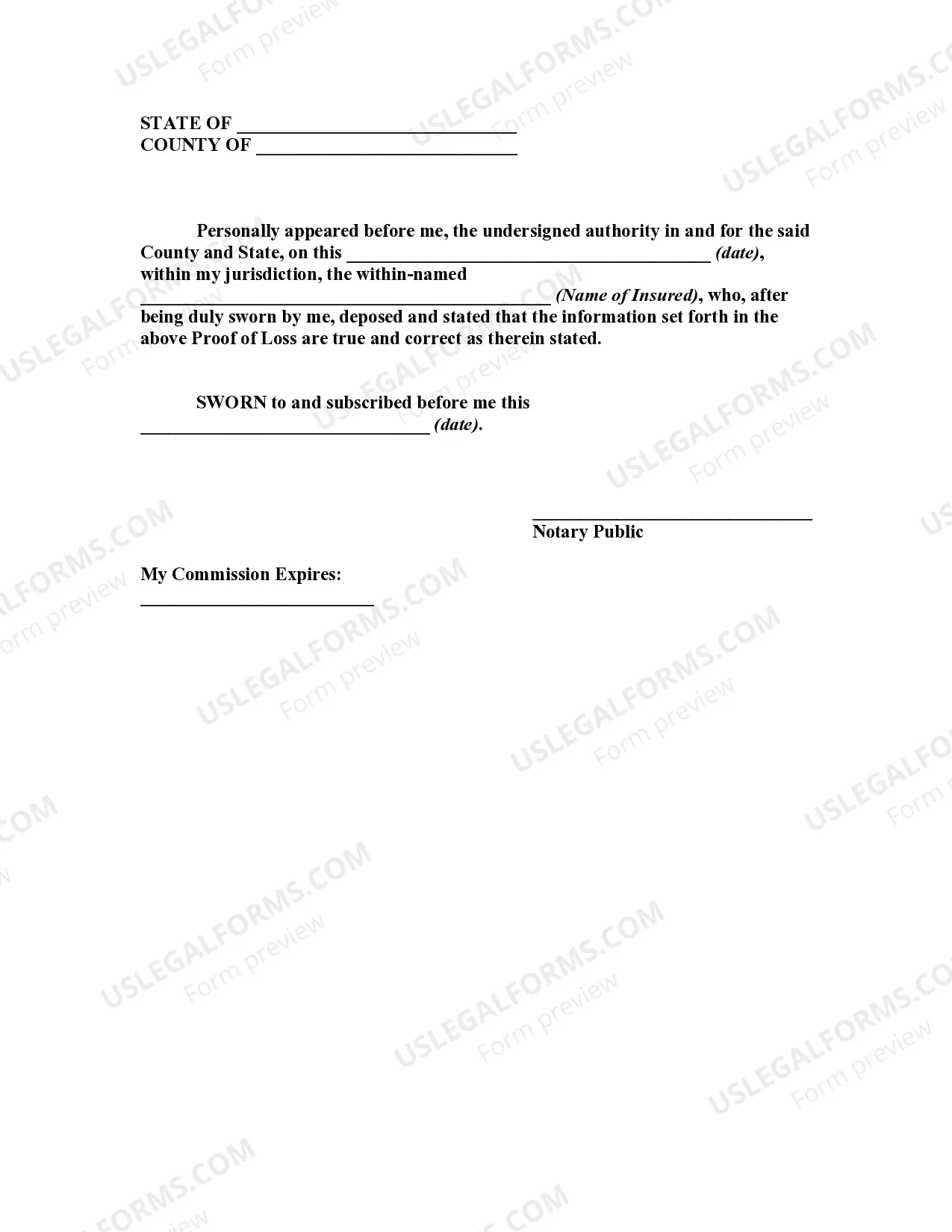

Santa Clara California Proof of Loss for Fire Insurance Claim is a crucial document required by insurance companies when filing a claim for fire-related damages in Santa Clara, California. This detailed description will highlight the significance of Proof of Loss, its content, and the different types available. Proof of Loss is a legal document used by policyholders to officially notify their insurance provider about the extent of property loss or damage caused by a fire incident. This document presents a comprehensive account of the items affected, their value, and the cost of repair or replacement, helping the insurance company accurately assess the claim. The following are the essential components typically included in a Santa Clara California Proof of Loss for Fire Insurance Claim: 1. Policyholder Information: The document starts with the policyholder's details, including their name, address, contact number, and the insurance policy number. 2. Date and Location: It includes the date and time of the fire incident, as well as the address of the property affected in Santa Clara, California. 3. Description of Damages: A detailed inventory of the damaged items is provided, specifying each item's description, quantity, pre-fill condition, and value. This section should cover everything from furniture, appliances, electronics, clothing, to valuable belongings like jewelry and artwork. 4. Cost Estimations: The Proof of Loss needs to include an estimation of the cost to repair or replace each damaged item. This can be based on actual invoices, quotes from contractors or professionals, or fair market value assessments from appraisers. 5. Supporting Documentation: All relevant documents supporting the proofs, such as photographs of the damages, receipts, invoices, and any other evidence validating ownership and value, should be attached to the Proof of Loss. 6. Sworn Statement: The policyholder must sign a sworn statement affirming the information provided in the Proof of Loss is true and accurate. In addition to the standard Proof of Loss, there may be variations depending on the specific requirements of insurance providers. Some possible types of Santa Clara California Proof of Loss for Fire Insurance Claim might include: 1. Contents Proof of Loss: This focuses solely on damaged belongings and personal items within the property. 2. Dwelling Proof of Loss: This specifically addresses damages to the structure of the insured property, including walls, roofs, flooring, and other structural components. 3. Additional Living Expenses Proof of Loss: In case the policy covers temporary relocation expenses due to fire damage, this type of Proof of Loss documents the additional living costs incurred during the displacement period. 4. Business Interruption Proof of Loss: If the insured property operates as a business, this Proof of Loss outlines the losses and expenses related to the interruption of business operations caused by the fire. Submitting a complete and accurate Santa Clara California Proof of Loss for a Fire Insurance Claim is vital to ensure a smooth claim settlement process. Policyholders should carefully follow their insurance provider's instructions and seek professional guidance if needed to prepare a thorough and well-supported claim.Santa Clara California Proof of Loss for Fire Insurance Claim is a crucial document required by insurance companies when filing a claim for fire-related damages in Santa Clara, California. This detailed description will highlight the significance of Proof of Loss, its content, and the different types available. Proof of Loss is a legal document used by policyholders to officially notify their insurance provider about the extent of property loss or damage caused by a fire incident. This document presents a comprehensive account of the items affected, their value, and the cost of repair or replacement, helping the insurance company accurately assess the claim. The following are the essential components typically included in a Santa Clara California Proof of Loss for Fire Insurance Claim: 1. Policyholder Information: The document starts with the policyholder's details, including their name, address, contact number, and the insurance policy number. 2. Date and Location: It includes the date and time of the fire incident, as well as the address of the property affected in Santa Clara, California. 3. Description of Damages: A detailed inventory of the damaged items is provided, specifying each item's description, quantity, pre-fill condition, and value. This section should cover everything from furniture, appliances, electronics, clothing, to valuable belongings like jewelry and artwork. 4. Cost Estimations: The Proof of Loss needs to include an estimation of the cost to repair or replace each damaged item. This can be based on actual invoices, quotes from contractors or professionals, or fair market value assessments from appraisers. 5. Supporting Documentation: All relevant documents supporting the proofs, such as photographs of the damages, receipts, invoices, and any other evidence validating ownership and value, should be attached to the Proof of Loss. 6. Sworn Statement: The policyholder must sign a sworn statement affirming the information provided in the Proof of Loss is true and accurate. In addition to the standard Proof of Loss, there may be variations depending on the specific requirements of insurance providers. Some possible types of Santa Clara California Proof of Loss for Fire Insurance Claim might include: 1. Contents Proof of Loss: This focuses solely on damaged belongings and personal items within the property. 2. Dwelling Proof of Loss: This specifically addresses damages to the structure of the insured property, including walls, roofs, flooring, and other structural components. 3. Additional Living Expenses Proof of Loss: In case the policy covers temporary relocation expenses due to fire damage, this type of Proof of Loss documents the additional living costs incurred during the displacement period. 4. Business Interruption Proof of Loss: If the insured property operates as a business, this Proof of Loss outlines the losses and expenses related to the interruption of business operations caused by the fire. Submitting a complete and accurate Santa Clara California Proof of Loss for a Fire Insurance Claim is vital to ensure a smooth claim settlement process. Policyholders should carefully follow their insurance provider's instructions and seek professional guidance if needed to prepare a thorough and well-supported claim.