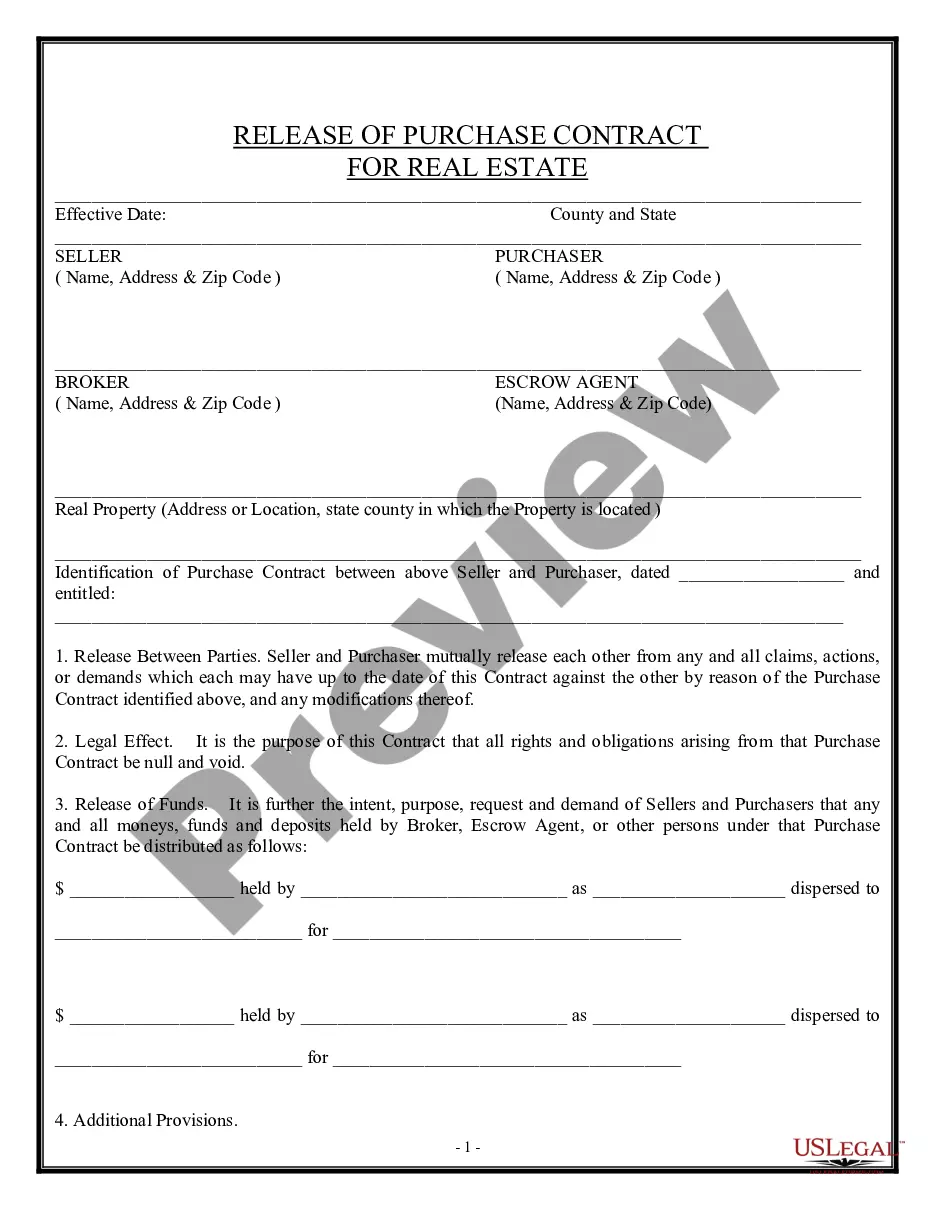

An agreement modifying a loan agreement and mortgage should be signed by both parties to the transaction and recorded in the office of the register of deeds and mortgages where the original mortgage was recorded. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

San Antonio Texas Agreement to Modify Interest Rate, Maturity Date, and Payment Schedule of Promissory Note Secured by a Mortgage

Description

How to fill out Agreement To Modify Interest Rate, Maturity Date, And Payment Schedule Of Promissory Note Secured By A Mortgage?

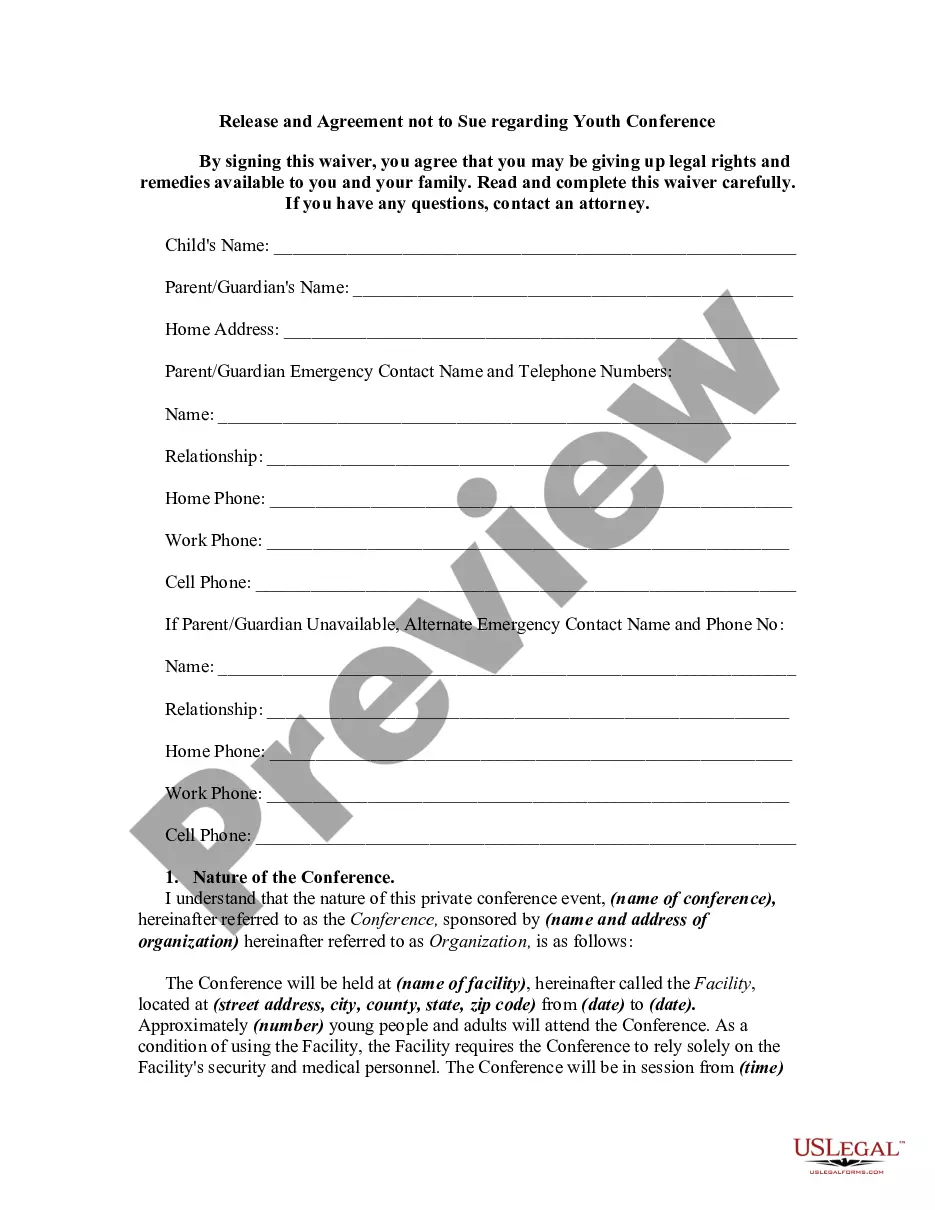

Navigating legal documents is essential in the contemporary world. Nevertheless, you don't always need to enlist professional help to create certain ones from the beginning, such as the San Antonio Agreement to Change Interest Rate, Maturity Date, and Payment Schedule of Promissory Note Secured by a Mortgage, with a service like US Legal Forms.

US Legal Forms offers more than 85,000 templates to choose from across various categories including living wills, real estate contracts, and divorce papers. All forms are categorized by their applicable state, making the searching process more manageable.

You may also discover comprehensive resources and tutorials on the website to simplify any tasks related to document execution.

If you’re already subscribed to US Legal Forms, you can find the necessary San Antonio Agreement to Change Interest Rate, Maturity Date, and Payment Schedule of Promissory Note Secured by a Mortgage, Log In to your account, and download it. Of course, our service cannot fully replace a legal expert. If faced with a particularly intricate situation, we recommend utilizing an attorney's services to examine your document prior to execution and filing.

With more than 25 years in the industry, US Legal Forms has established itself as a trusted source for various legal documents for millions of users. Join them today and acquire your state-specific paperwork effortlessly!

- Review the document's preview and summary (if available) to obtain a broad understanding of what you will receive after acquiring the document.

- Confirm that the template you select is suitable for your state/county/area as local laws can influence the validity of certain documents.

- Explore similar document templates or initiate a new search to find the appropriate file.

- Click Purchase now and set up your account. If you already possess one, opt to Log In.

- Select the pricing {plan, then an appropriate payment method, and acquire the San Antonio Agreement to Change Interest Rate, Maturity Date, and Payment Schedule of Promissory Note Secured by a Mortgage.

- Decide to store the form template in any available file format.

- Go to the My documents section to download the file again.

Form popularity

FAQ

A promissory note can be legally binding without notarization if it meets other essential legal criteria, such as having a clear agreement and being signed by the parties involved. However, notarization can add an extra layer of verification and credibility, which may be beneficial for documents like the San Antonio Texas Agreement to Modify Interest Rate, Maturity Date, and Payment Schedule of Promissory Note Secured by a Mortgage. It's worthwhile to consider this option for enhanced protection.

A promissory note does not automatically have an expiration date unless specified within its terms. However, statutes of limitations can apply, which may affect how long you can enforce it. Including clear timelines in your San Antonio Texas Agreement to Modify Interest Rate, Maturity Date, and Payment Schedule of Promissory Note Secured by a Mortgage can help you avoid confusion down the line.

Various issues can render a promissory note invalid. Common factors include lack of essential terms, absence of signatures, or if it violates public policy. It is imperative to ensure that your San Antonio Texas Agreement to Modify Interest Rate, Maturity Date, and Payment Schedule of Promissory Note Secured by a Mortgage is properly drafted to avoid these pitfalls.

Yes, a promissory note can hold up in a court of law as long as it adheres to legal standards. Courts typically enforce notes that contain clear terms and fulfill all legal requirements, which is essential for things like the San Antonio Texas Agreement to Modify Interest Rate, Maturity Date, and Payment Schedule of Promissory Note Secured by a Mortgage. Hence, it's crucial to draft it carefully to avoid disputes.

A promissory note does not necessarily require a maturity date, but having one can clarify the timeline for repayment. Including a maturity date also reinforces the terms outlined in the San Antonio Texas Agreement to Modify Interest Rate, Maturity Date, and Payment Schedule of Promissory Note Secured by a Mortgage. It helps both parties plan their finances and obligations accordingly.

To modify a promissory note, first review the existing terms you wish to change. Prepare a new document that outlines the changes, such as adjustments to the interest rate or payment schedule. It's essential to have all parties consent to these modifications, which can be formalized through a San Antonio Texas Agreement to Modify Interest Rate, Maturity Date, and Payment Schedule of Promissory Note Secured by a Mortgage. Utilizing platforms like uslegalforms can streamline this process.

Several factors can void a promissory note, including illegal purpose, lack of capacity of the signer, or failure to include essential terms. Other issues, like fraud or coercion, can also play a role. To avoid these pitfalls, employ a San Antonio Texas Agreement to Modify Interest Rate, Maturity Date, and Payment Schedule of Promissory Note Secured by a Mortgage to ensure clarity and legality.

Yes, promissory notes are legally binding in Texas when they meet specific criteria. They must include clear repayment terms and be signed by the borrower. Using a San Antonio Texas Agreement to Modify Interest Rate, Maturity Date, and Payment Schedule of Promissory Note Secured by a Mortgage adds an extra layer of legal assurance.

A promissory note is void if it is based on illegal activities or lacks the necessary legal elements. Other conditions, such as mental incompetence of the signer at the time of signing, can also void it. To safely navigate these aspects, consider a San Antonio Texas Agreement to Modify Interest Rate, Maturity Date, and Payment Schedule of Promissory Note Secured by a Mortgage.

In Texas, a promissory note can be invalid due to a lack of essential elements, such as a clear repayment promise or improper signatures. Factors like fraud, lack of consideration, or ambiguous terms can also render it invalid. To avoid such issues, utilize a San Antonio Texas Agreement to Modify Interest Rate, Maturity Date, and Payment Schedule of Promissory Note Secured by a Mortgage.