A deed of trust is a document which pledges real property to secure a loan, used instead of a mortgage in certain states. A deed of trust involves a third party called a trustee, usually an attorney of officer of the lender, who acts on behalf of the lender. When you sign a deed of trust, you in effect are giving a trustee title to the property, but you hold the rights and privileges to use and live in or on the property. If the loan becomes delinquent the beneficiary can file a notice of default and, if the loan is not brought current, can demand that the trustee begin foreclosure on the property so that the beneficiary (lender) may either be paid or obtain title. Unlike a mortgage, a deed of trust also gives the trustee the right to foreclose on your property without taking you to court first.

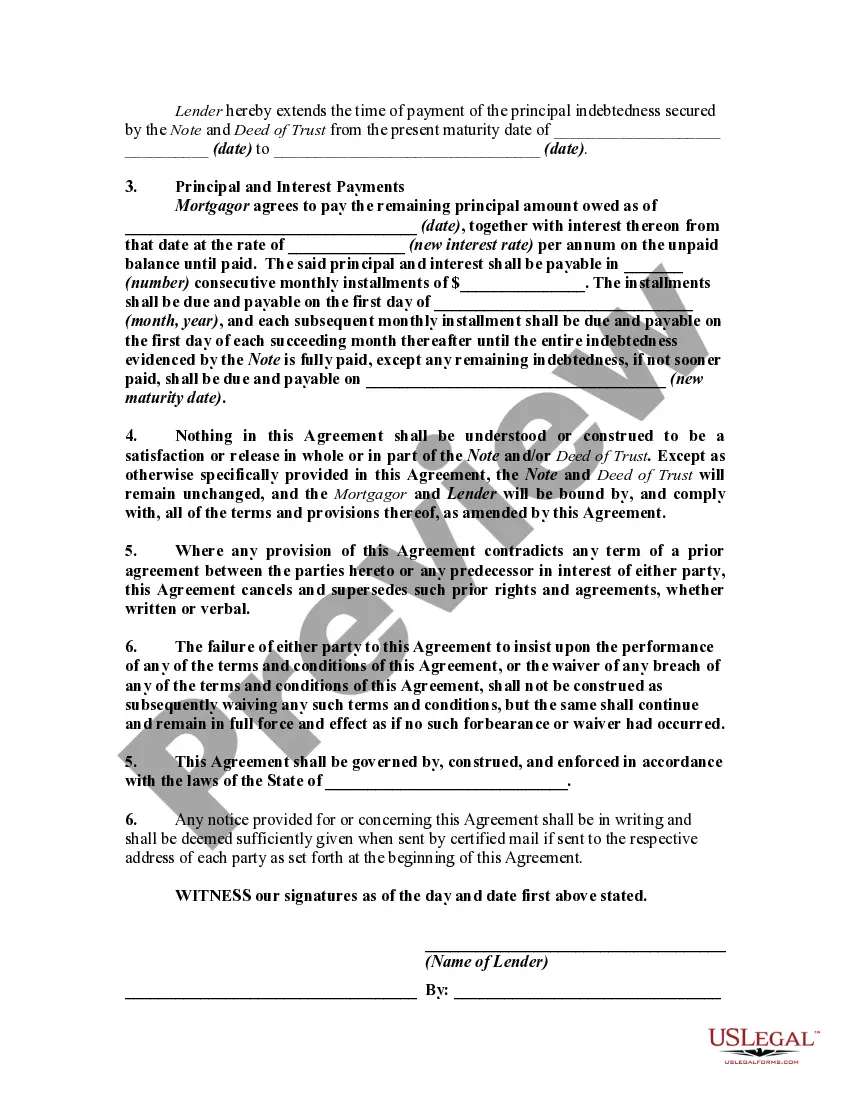

An agreement modifying a promissory note and deed of trust should be signed by both parties to the transaction and recorded in the office of the register of deeds and mortgages where the original deed of trust was recorded.

The Hennepin Minnesota Agreement to Change or Modify Interest Rate, Maturity Date, and Payment Schedule of Promissory Note Secured by a Deed of Trust is a legal document that allows parties involved in a loan agreement to make alterations or adjustments to the existing terms of the loan. These modifications primarily focus on changing the interest rate, maturity date, and payment schedule of the promissory note that is backed by a deed of trust in real estate transactions. One type of the Hennepin Minnesota Agreement to Change or Modify Interest Rate, Maturity Date, and Payment Schedule of Promissory Note Secured by a Deed of Trust is an Interest Rate Modification Agreement. This type of agreement allows the parties to negotiate and agree upon changing the interest rate associated with the loan. It can involve lowering the rate to make the loan more affordable or increasing it to adjust for market conditions. Another type is the Maturity Date Modification Agreement. In this type of agreement, the parties involved can extend or accelerate the maturity date of the loan. Extending the maturity date allows for a longer repayment period, which can reduce the monthly payment amount. Conversely, accelerating the maturity date shortens the repayment period, but often requires larger monthly payments. The Payment Schedule Modification Agreement is also a type of Hennepin Minnesota Agreement to Change or Modify Interest Rate, Maturity Date, and Payment Schedule of Promissory Note Secured by a Deed of Trust. This agreement enables parties to alter the repayment schedule of the loan. They can negotiate changes in the frequency (monthly, quarterly, etc.), timing, or amount of the payments. Adjusting the payment schedule can help borrowers align their loan repayments with their cash flow or financial situation. When drafting any of these agreements, it is crucial to ensure compliance with Minnesota state laws and regulations governing loan modification and real estate transactions. Parties must carefully review and understand the terms and implications of any modifications made to the original loan agreement. Consulting legal professionals or experts with experience in the Hennepin County area of Minnesota is recommended to ensure the agreement is properly executed and legally binding.The Hennepin Minnesota Agreement to Change or Modify Interest Rate, Maturity Date, and Payment Schedule of Promissory Note Secured by a Deed of Trust is a legal document that allows parties involved in a loan agreement to make alterations or adjustments to the existing terms of the loan. These modifications primarily focus on changing the interest rate, maturity date, and payment schedule of the promissory note that is backed by a deed of trust in real estate transactions. One type of the Hennepin Minnesota Agreement to Change or Modify Interest Rate, Maturity Date, and Payment Schedule of Promissory Note Secured by a Deed of Trust is an Interest Rate Modification Agreement. This type of agreement allows the parties to negotiate and agree upon changing the interest rate associated with the loan. It can involve lowering the rate to make the loan more affordable or increasing it to adjust for market conditions. Another type is the Maturity Date Modification Agreement. In this type of agreement, the parties involved can extend or accelerate the maturity date of the loan. Extending the maturity date allows for a longer repayment period, which can reduce the monthly payment amount. Conversely, accelerating the maturity date shortens the repayment period, but often requires larger monthly payments. The Payment Schedule Modification Agreement is also a type of Hennepin Minnesota Agreement to Change or Modify Interest Rate, Maturity Date, and Payment Schedule of Promissory Note Secured by a Deed of Trust. This agreement enables parties to alter the repayment schedule of the loan. They can negotiate changes in the frequency (monthly, quarterly, etc.), timing, or amount of the payments. Adjusting the payment schedule can help borrowers align their loan repayments with their cash flow or financial situation. When drafting any of these agreements, it is crucial to ensure compliance with Minnesota state laws and regulations governing loan modification and real estate transactions. Parties must carefully review and understand the terms and implications of any modifications made to the original loan agreement. Consulting legal professionals or experts with experience in the Hennepin County area of Minnesota is recommended to ensure the agreement is properly executed and legally binding.