This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

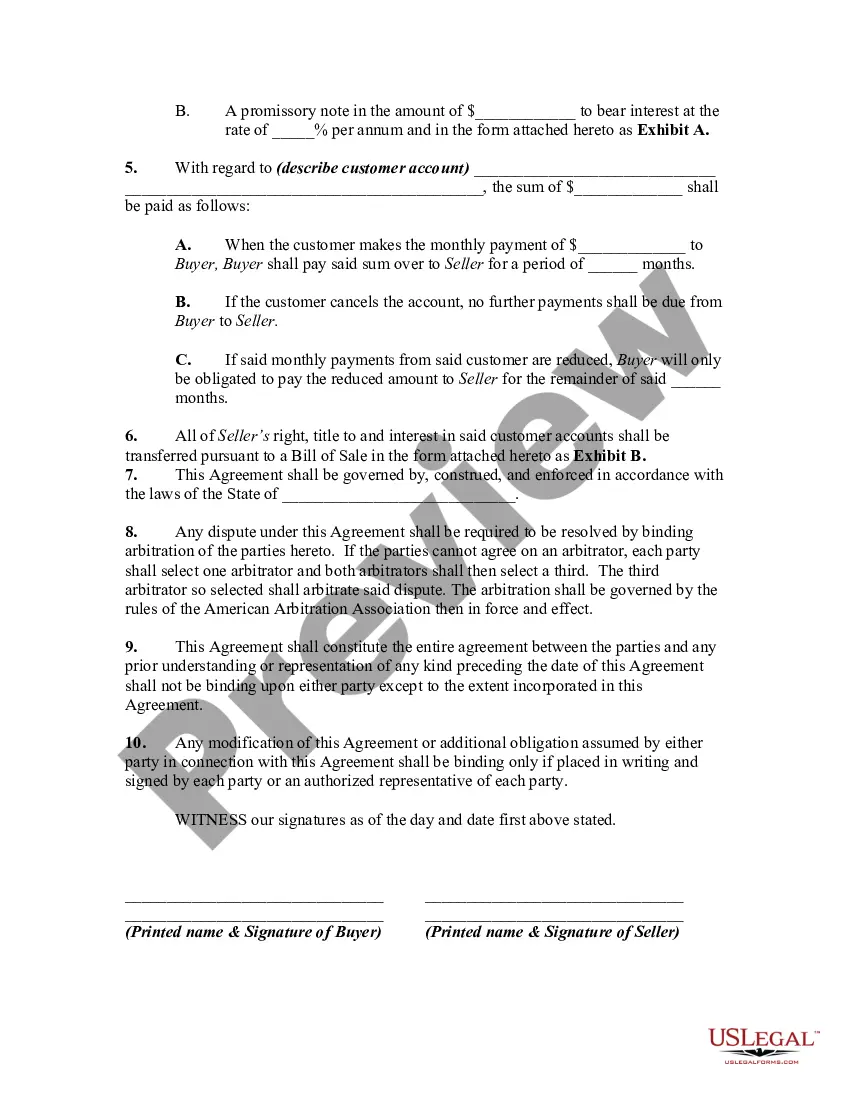

The Clark Nevada Agreement to Sell and Purchase Customer Accounts is a legal document that outlines the terms and conditions governing the transfer of customer accounts from one party to another. This agreement is commonly used in the business realm, particularly in industries such as banking, telecommunications, and utilities where customer accounts hold significant value. The agreement aims to ensure a smooth and transparent transaction process while protecting the rights and interests of both the buyer and seller. When drafting a Clark Nevada Agreement to Sell and Purchase Customer Accounts, certain essential components must be included. These typically consist of the following: 1. Parties: The agreement should clearly identify the buyer and the seller involved in the transaction. This could be a company, an individual, or any other legal entity. 2. Definitions: To eliminate ambiguity, the agreement should provide a section that defines key terms related to customer accounts, such as "customer account," "account balance," "default," and "termination." 3. Purchase Price: The agreement should stipulate the total purchase price or the method of calculating it. This may include a lump sum payment or installment payments based on the value of the customer accounts being transferred. 4. Customer Account Details: This section should outline the specifics of the customer accounts being transferred, including the account numbers, names of customers, outstanding balances, and any other relevant details. 5. Representations and Warranties: The buyer and seller must make certain representations and warranties regarding the accuracy of the customer account information and that there are no undisclosed liabilities associated with the accounts. 6. Release and Indemnification: The agreement should specify the liability of each party in the event of any claims, losses, or damages arising from the transaction. This section also includes a release clause, whereby both parties release each other from future claims related to the transferred customer accounts. 7. Non-Compete and Non-Solicitation: To protect the buyer's interests, the agreement may include clauses preventing the seller from competing in the same market or attempting to solicit customers from the transferred accounts for a specified period. Different types of Clark Nevada Agreements to Sell and Purchase Customer Accounts may exist depending on the nature of the business or industry involved. Some specific variations include: 1. Financial Institution Account Purchase Agreement: This type of agreement specifically covers the sale and purchase of customer accounts within the banking or financial sector. It may include additional clauses related to banking regulations and compliance. 2. Telecommunications Account Purchase Agreement: This agreement focuses on the transfer of customer accounts within the telecommunications' industry. It may address issues specific to phone lines, internet services, and subscription-based plans. 3. Utility Account Purchase Agreement: Utility companies may utilize this type of agreement to facilitate the sale and purchase of customer accounts related to electricity, gas, water, or other utility services. In conclusion, a Clark Nevada Agreement to Sell and Purchase Customer Accounts is a critical legal document that safeguards the interests of both parties involved in the transfer of customer accounts. By including the aforementioned key components, businesses can ensure a smooth and secure transaction process while outlining the rights and responsibilities of each party.The Clark Nevada Agreement to Sell and Purchase Customer Accounts is a legal document that outlines the terms and conditions governing the transfer of customer accounts from one party to another. This agreement is commonly used in the business realm, particularly in industries such as banking, telecommunications, and utilities where customer accounts hold significant value. The agreement aims to ensure a smooth and transparent transaction process while protecting the rights and interests of both the buyer and seller. When drafting a Clark Nevada Agreement to Sell and Purchase Customer Accounts, certain essential components must be included. These typically consist of the following: 1. Parties: The agreement should clearly identify the buyer and the seller involved in the transaction. This could be a company, an individual, or any other legal entity. 2. Definitions: To eliminate ambiguity, the agreement should provide a section that defines key terms related to customer accounts, such as "customer account," "account balance," "default," and "termination." 3. Purchase Price: The agreement should stipulate the total purchase price or the method of calculating it. This may include a lump sum payment or installment payments based on the value of the customer accounts being transferred. 4. Customer Account Details: This section should outline the specifics of the customer accounts being transferred, including the account numbers, names of customers, outstanding balances, and any other relevant details. 5. Representations and Warranties: The buyer and seller must make certain representations and warranties regarding the accuracy of the customer account information and that there are no undisclosed liabilities associated with the accounts. 6. Release and Indemnification: The agreement should specify the liability of each party in the event of any claims, losses, or damages arising from the transaction. This section also includes a release clause, whereby both parties release each other from future claims related to the transferred customer accounts. 7. Non-Compete and Non-Solicitation: To protect the buyer's interests, the agreement may include clauses preventing the seller from competing in the same market or attempting to solicit customers from the transferred accounts for a specified period. Different types of Clark Nevada Agreements to Sell and Purchase Customer Accounts may exist depending on the nature of the business or industry involved. Some specific variations include: 1. Financial Institution Account Purchase Agreement: This type of agreement specifically covers the sale and purchase of customer accounts within the banking or financial sector. It may include additional clauses related to banking regulations and compliance. 2. Telecommunications Account Purchase Agreement: This agreement focuses on the transfer of customer accounts within the telecommunications' industry. It may address issues specific to phone lines, internet services, and subscription-based plans. 3. Utility Account Purchase Agreement: Utility companies may utilize this type of agreement to facilitate the sale and purchase of customer accounts related to electricity, gas, water, or other utility services. In conclusion, a Clark Nevada Agreement to Sell and Purchase Customer Accounts is a critical legal document that safeguards the interests of both parties involved in the transfer of customer accounts. By including the aforementioned key components, businesses can ensure a smooth and secure transaction process while outlining the rights and responsibilities of each party.