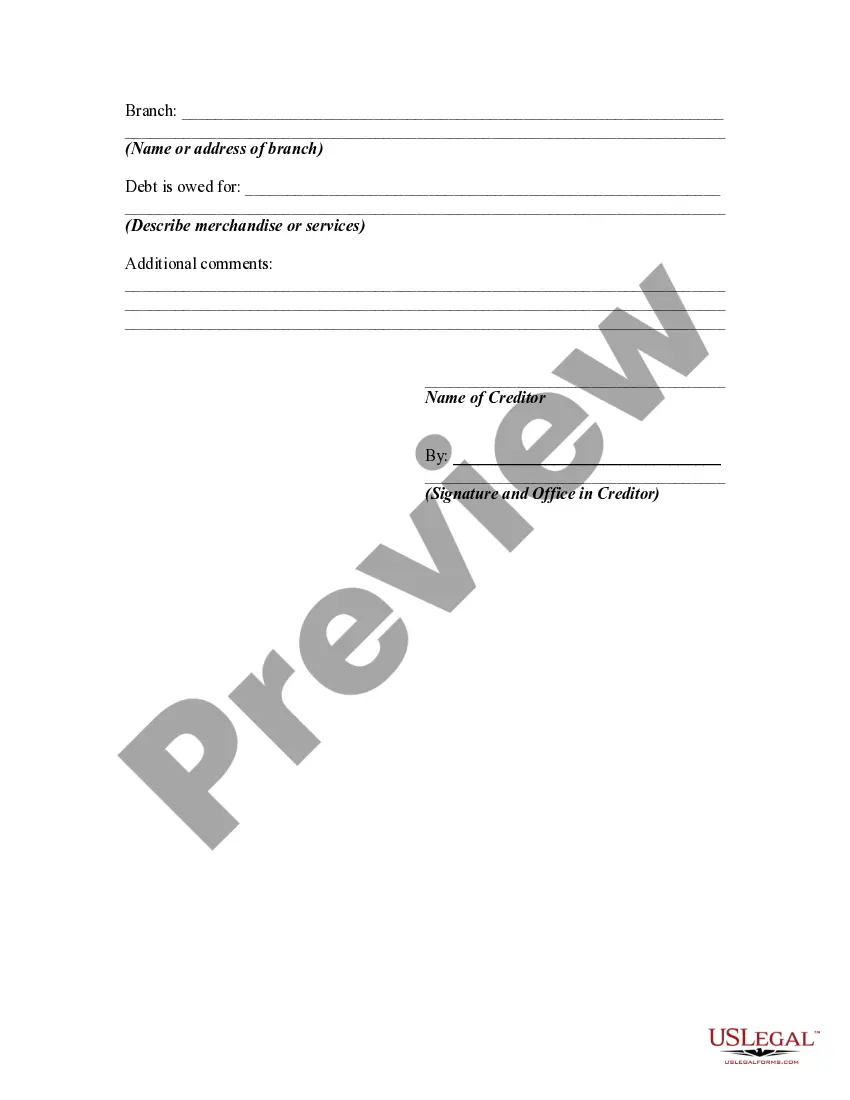

The letter or notice by which a claim is transferred to a collection agency need not take any particular form. However, since collection agencies handle overdue accounts on a volume basis and generally develop regular clients, it may be desirable that such instruments be standardized. The letter or notice should be clear as to whether it is an assignment of the claim and, thus, enables the agency to bring suit on the claim in its own name. Whether a collection agency may solicit and accept assignments of claims from creditors depends on the law of the particular jurisdiction. Local statutes should be consulted to determine the allowable scope of activities of collection agencies.

The Harris Texas Assignment of Claim for Collection With Right to Initiate Legal Proceedings is a crucial legal document in debt collection cases. This assignment allows a creditor to transfer the rights and ownership of a claim to another party, typically a collection agency or debt buyer. This process helps creditors recover delinquent debts and enables the assignee to pursue legal remedies, if necessary, to collect the debt on behalf of the original creditor. When it comes to the types of Harris Texas Assignment of Claim for Collection With Right to Initiate Legal Proceedings, there are several variations depending on the specific needs and circumstances of the parties involved. These may include: 1. General Assignment of Claim: This is the most common type of assignment where a creditor transfers ownership of a claim to a collection agency. It empowers the assignee to pursue collection efforts using legal means available under the law. 2. Medical Debt Assignment: This type of assignment focuses specifically on medical debts, allowing healthcare providers to transfer patient debts to collection agencies with the right to pursue legal action if necessary. 3. Business Debt Assignment: Businesses often use this assignment to transfer their outstanding debts or receivables to third-party collectors. This includes invoice collections for unpaid services, outstanding payments, or non-compliance issues. 4. Consumer Debt Assignment: Consumer debt assignment occurs when an individual's outstanding debts, such as credit card debt or personal loans, are assigned to a collection agency for recovery. The assignee can initiate legal proceedings to retrieve the debt on behalf of the original creditor. 5. Landlord-Tenant Debt Assignment: In cases where a tenant has unpaid rent or violates the lease agreement, a landlord can assign the debt to a collection agency with the right to initiate legal proceedings. This allows for efficient collection efforts and increases the chances of fully recovering the debt. In summary, the Harris Texas Assignment of Claim for Collection With Right to Initiate Legal Proceedings is a vital legal document that enables creditors to transfer ownership of a debt to a third-party collector while granting them the right to pursue legal remedies if required. With various types of assignments available depending on debt categories, this process streamlines the collections process and ensures the best possible chance of successful debt recovery.The Harris Texas Assignment of Claim for Collection With Right to Initiate Legal Proceedings is a crucial legal document in debt collection cases. This assignment allows a creditor to transfer the rights and ownership of a claim to another party, typically a collection agency or debt buyer. This process helps creditors recover delinquent debts and enables the assignee to pursue legal remedies, if necessary, to collect the debt on behalf of the original creditor. When it comes to the types of Harris Texas Assignment of Claim for Collection With Right to Initiate Legal Proceedings, there are several variations depending on the specific needs and circumstances of the parties involved. These may include: 1. General Assignment of Claim: This is the most common type of assignment where a creditor transfers ownership of a claim to a collection agency. It empowers the assignee to pursue collection efforts using legal means available under the law. 2. Medical Debt Assignment: This type of assignment focuses specifically on medical debts, allowing healthcare providers to transfer patient debts to collection agencies with the right to pursue legal action if necessary. 3. Business Debt Assignment: Businesses often use this assignment to transfer their outstanding debts or receivables to third-party collectors. This includes invoice collections for unpaid services, outstanding payments, or non-compliance issues. 4. Consumer Debt Assignment: Consumer debt assignment occurs when an individual's outstanding debts, such as credit card debt or personal loans, are assigned to a collection agency for recovery. The assignee can initiate legal proceedings to retrieve the debt on behalf of the original creditor. 5. Landlord-Tenant Debt Assignment: In cases where a tenant has unpaid rent or violates the lease agreement, a landlord can assign the debt to a collection agency with the right to initiate legal proceedings. This allows for efficient collection efforts and increases the chances of fully recovering the debt. In summary, the Harris Texas Assignment of Claim for Collection With Right to Initiate Legal Proceedings is a vital legal document that enables creditors to transfer ownership of a debt to a third-party collector while granting them the right to pursue legal remedies if required. With various types of assignments available depending on debt categories, this process streamlines the collections process and ensures the best possible chance of successful debt recovery.