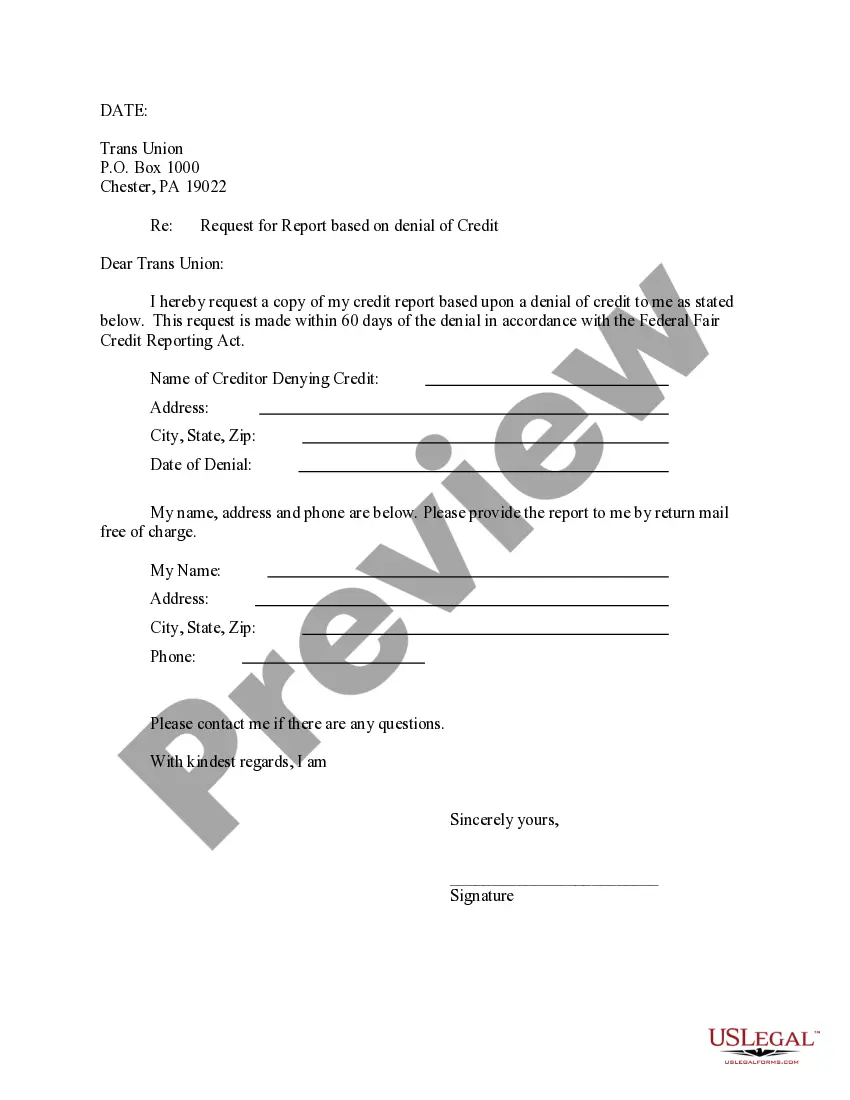

The Fair Credit Reporting Act (FCRA) is designed to help ensure that credit bureaus furnish correct and complete information to businesses to use when evaluating your application. Your rights include:

The right to receive a copy of your credit report. The copy of your report must contain all of the information in your file at the time of your request.

The right to know the name of anyone who received your credit report in the last year for most purposes or in the last two years for employment purposes.

Any company that denies your application must supply the name and address of the credit bureau they contacted, provided the denial was based on information given by the credit bureau.

The right to a free copy of your credit report when your application is denied because of information supplied by the credit bureau. Your request must be made within 60 days of receiving your denial notice.

If you contest the completeness or accuracy of information in your report, you should file a dispute with the credit bureau and with the company that furnished the information to the bureau. Both the credit bureau and the furnisher of information are legally obligated to investigate your dispute.

A right to add a summary explanation to your credit report if your dispute is not resolved to your satisfaction.

Allegheny, Pennsylvania is a county located in the southwestern region of the state. It is home to numerous towns and cities, including the city of Pittsburgh, which serves as the county seat. With a rich history and diverse population, Allegheny offers a wide range of cultural, recreational, and educational opportunities. When it comes to credit applications, individuals have the right to request a disclosure of reasons for denial if the decision was based on information not obtained by the reporting agency. This request allows them to understand why their application was denied and take appropriate action. The different types of Allegheny Pennsylvania Request for Disclosure of Reasons for Denial of Credit Application Where Action Was Based on Information Not Obtained by Reporting Agency include: 1. Individual Request: An individual who has been denied credit based on information not obtained by the reporting agency can submit a request for disclosure. This type of request is made by the applicant personally. 2. Legal Representative Request: In some cases, an individual may choose to have a legal representative make the request on their behalf. This can be useful if the applicant is unable to communicate effectively or wishes to involve a professional in handling the matter. 3. Formal Written Request: To ensure the request is properly documented, it is essential to make a formal written request. This includes providing all the necessary information, such as personal details, date of denial, and any supporting documents, to assist in the clarification process. 4. Supporting Documentation: If there are any supporting documents or evidence that can help in understanding the reasons for denial, it is crucial to include them in the request. This may include proof of payment, income statements, or any other relevant documents that provide additional context to support the applicant's case. 5. Contact Information: To facilitate communication, the applicant must provide accurate contact information, including phone numbers, email addresses, and physical addresses. This enables the reporting agency to reach out for any further information or to provide a response to the request. 6. Timely Submission: It is important to submit the request for disclosure in a timely manner. The applicant should closely follow the instructions provided by the reporting agency regarding the deadline for submission. 7. Compliance with Laws: It is essential to ensure that the request for disclosure complies with all applicable laws and regulations governing credit applications. This includes adhering to any specific requirements or procedures set forth by the reporting agency or governing bodies. Requesting a disclosure of reasons for denial of a credit application can help individuals understand the factors that influenced the decision. By addressing any issues or inaccuracies, applicants may be able to rectify the situation and improve their creditworthiness.