Some information obtained by credit reporting bureaus is based on statements made by persons, such as neighbors who were interviewed by the bureau's investigator. Needless to say, these statements are not always correct and are sometimes the result of gossip. In any event, such statements may go on the records of the bureau without further verification and may be furnished to a client of the bureau who will regard the statements as accurate. A person has the limited right to request an agency to disclose the nature and substance of the information possessed by the bureau to see if the information is accurate. If the person claims that the information of the bureau is erroneous, the bureau must take steps within a reasonable time to determine the accuracy of the disputed items.

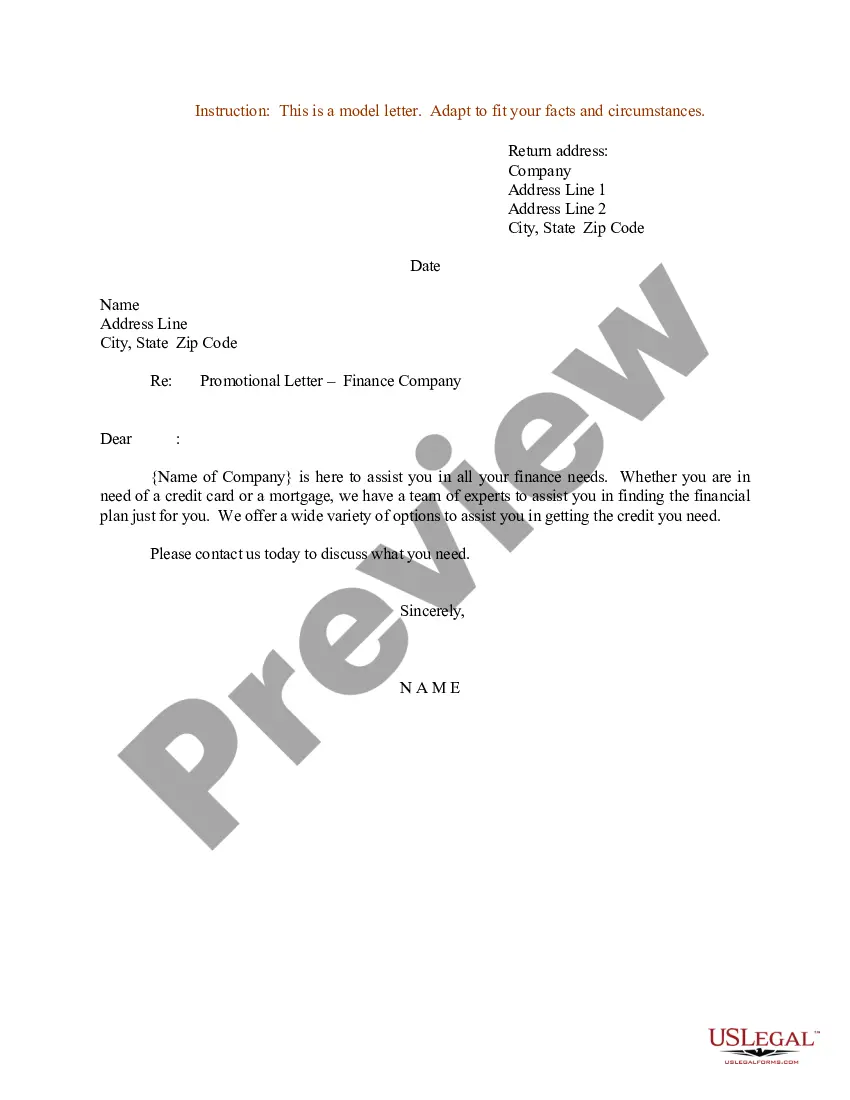

Title: A Comprehensive Overview of Los Angeles, California — A Powerhouse City with Endless Opportunities Keywords: Los Angeles, California, description, consumer, credit reporting agency, disputing information, file Introduction: Welcome to the vibrant and bustling city of Los Angeles, California! Located on the west coast of the United States, Los Angeles is not just a city; it's a beacon of opportunity, diversity, and cultural richness. In this letter, we will explore the essence of Los Angeles and guide consumers on how to write a letter to a credit reporting agency disputing information in their credit file. 1. Los Angeles, California: Los Angeles, often referred to as LA, is the largest city in California and the second most populous city in the United States. Renowned for its sun-drenched beaches, iconic landmarks, and the entertainment industry, LA attracts millions of locals and visitors alike each year. 2. Consumer Rights and Credit Reporting Agencies: In the modern world, credit reporting agencies play a pivotal role in assessing an individual's creditworthiness. Consumers have the right to scrutinize and dispute any inaccurate information present in their credit reports within the guidelines set by the Fair Credit Reporting Act (FCRA). 3. Types of Disputes: a) Identity Theft Dispute: If a consumer suspects fraudulent activity or identity theft on their credit file, they must follow specific steps to notify the credit reporting agency and protect their financial well-being. b) Incorrect Information Dispute: In cases where the consumer finds discrepancies, errors, or outdated information in their credit report, they should address these concerns with the credit reporting agency promptly. c) Mix-Up Dispute: Occasionally, a credit file might get mixed up, leading to errors on the consumer's credit report. In such cases, the consumer should notify the credit reporting agency immediately to rectify the issue. 4. Writing a Los Angeles, California Letter to Credit Reporting Agencies: When disputing information in their credit file, consumers from Los Angeles, California, should follow these steps: a) Begin with a formal heading: Include the date, your full name, address, and contact information. Address the credit reporting agency by their official name and address. b) Clearly State the Reason for Dispute: In a concise and assertive manner, explain why you are disputing the information in your credit file. Provide specific details, such as account numbers, dates, and the type of dispute. c) Support Your Claim: Attach any supporting documents, such as copies of relevant bills, statements, or correspondence that back up your position. d) Request Action: Clearly request the credit reporting agency to investigate and correct the disputed information within the time limit set by the FCRA. e) Keep Copies and Maintain Documentation: Make copies of your letter, supporting documents, and any future correspondence related to the dispute. This will serve as evidence of your efforts. Conclusion: Los Angeles, California, is an exceptional city that thrives on creativity, diversity, and opportunity. Alongside navigating the incredible opportunities the city offers, consumers must also be vigilant about their credit reports to ensure accuracy. By writing a letter to a credit reporting agency disputing information in their credit file, consumers can protect their financial future and take control of their creditworthiness in this dynamic city.