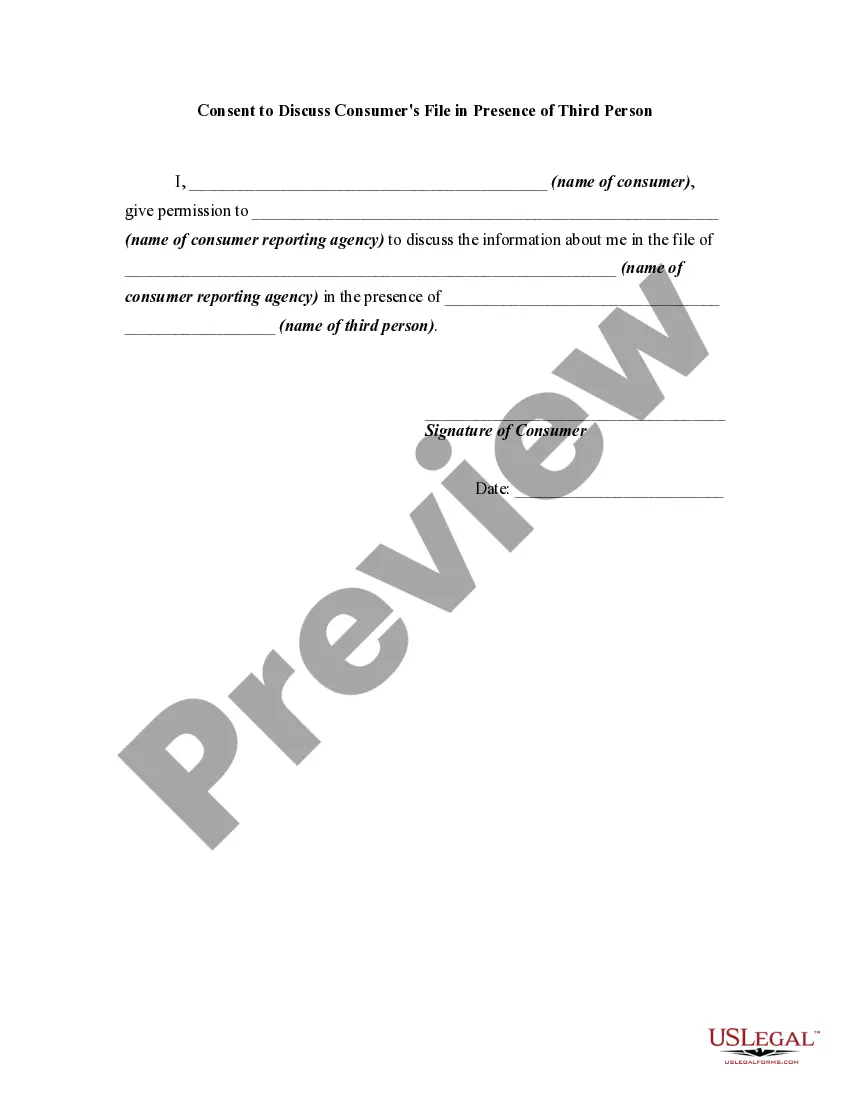

The Fair Credit Reporting Act provides that the consumer, in obtaining disclosure of information in the consumer's file from a consumer reporting agency personally, is permitted to be accompanied by one other person of the consumer's choosing, which person must provide reasonable identification. The act further provides that the consumer reporting agency may require the consumer to furnish a written statement granting permission to the consumer reporting agency to discuss the consumer's file in such person's presence.

Phoenix, Arizona Consent to Discuss Consumer's File in Presence of Third Person — A Comprehensive Guide In Phoenix, Arizona, the Consent to Discuss Consumer's File in Presence of Third Person is a legal document that allows authorized individuals to discuss and access an individual's financial and personal information in the presence of a third person. This consent ensures transparency and protects the privacy of individuals while enabling crucial discussions regarding their credit history, financial standing, and other related matters. This consent form is vital for protecting the rights and privacy of consumers as it ensures that sensitive personal information is only shared in the presence of trusted parties, preventing unauthorized access or misuse of valuable data. It serves as a safeguard against fraud and identity theft, providing consumers with peace of mind when discussing their file. There are various types of Phoenix, Arizona Consent to Discuss Consumer's File in Presence of Third-Person forms that cater to different scenarios: 1. Financial Institution Consent: This specific type of consent form relates to discussions between consumers and financial institutions such as banks, credit unions, or mortgage lenders. It enables consumers to authorize third persons, such as a spouse, lawyer, or financial advisor, to be present during conversations involving their account details, loan applications, credit scores, and other relevant financial matters. 2. Credit Bureau Consent: Credit bureaus play a significant role in compiling individuals' credit information, determining credit scores, and maintaining credit reports. This type of consent form allows the consumer to grant permission for third persons to access their credit file in the presence of the consumer. It enables the discussion of credit disputes, credit history, inquiries, and any other credit-related topics while ensuring confidentiality. 3. Medical Information Consent: In cases where medical bills and healthcare expenses are being discussed, this consent form allows a third person, such as a family member or trusted representative, to be present during conversations related to personal medical records, billing statements, insurance claims, and other pertinent details. This form ensures transparency and accurate communication during medical financial discussions. In conclusion, the Phoenix, Arizona Consents to Discuss Consumer's File in Presence of Third Person is a crucial document that guarantees privacy and empowers individuals to control who can access their personal financial and credit-related information. By granting permission only to trusted third persons, consumers can legally discuss their files, protecting themselves from potential frauds, miscommunications, or identity thefts. It is essential for consumers to opt for the appropriate consent form according to the specific context in which they require discussions to occur, such as financial institutions, credit bureaus, or medical settings.

Phoenix, Arizona Consent to Discuss Consumer's File in Presence of Third Person — A Comprehensive Guide In Phoenix, Arizona, the Consent to Discuss Consumer's File in Presence of Third Person is a legal document that allows authorized individuals to discuss and access an individual's financial and personal information in the presence of a third person. This consent ensures transparency and protects the privacy of individuals while enabling crucial discussions regarding their credit history, financial standing, and other related matters. This consent form is vital for protecting the rights and privacy of consumers as it ensures that sensitive personal information is only shared in the presence of trusted parties, preventing unauthorized access or misuse of valuable data. It serves as a safeguard against fraud and identity theft, providing consumers with peace of mind when discussing their file. There are various types of Phoenix, Arizona Consent to Discuss Consumer's File in Presence of Third-Person forms that cater to different scenarios: 1. Financial Institution Consent: This specific type of consent form relates to discussions between consumers and financial institutions such as banks, credit unions, or mortgage lenders. It enables consumers to authorize third persons, such as a spouse, lawyer, or financial advisor, to be present during conversations involving their account details, loan applications, credit scores, and other relevant financial matters. 2. Credit Bureau Consent: Credit bureaus play a significant role in compiling individuals' credit information, determining credit scores, and maintaining credit reports. This type of consent form allows the consumer to grant permission for third persons to access their credit file in the presence of the consumer. It enables the discussion of credit disputes, credit history, inquiries, and any other credit-related topics while ensuring confidentiality. 3. Medical Information Consent: In cases where medical bills and healthcare expenses are being discussed, this consent form allows a third person, such as a family member or trusted representative, to be present during conversations related to personal medical records, billing statements, insurance claims, and other pertinent details. This form ensures transparency and accurate communication during medical financial discussions. In conclusion, the Phoenix, Arizona Consents to Discuss Consumer's File in Presence of Third Person is a crucial document that guarantees privacy and empowers individuals to control who can access their personal financial and credit-related information. By granting permission only to trusted third persons, consumers can legally discuss their files, protecting themselves from potential frauds, miscommunications, or identity thefts. It is essential for consumers to opt for the appropriate consent form according to the specific context in which they require discussions to occur, such as financial institutions, credit bureaus, or medical settings.