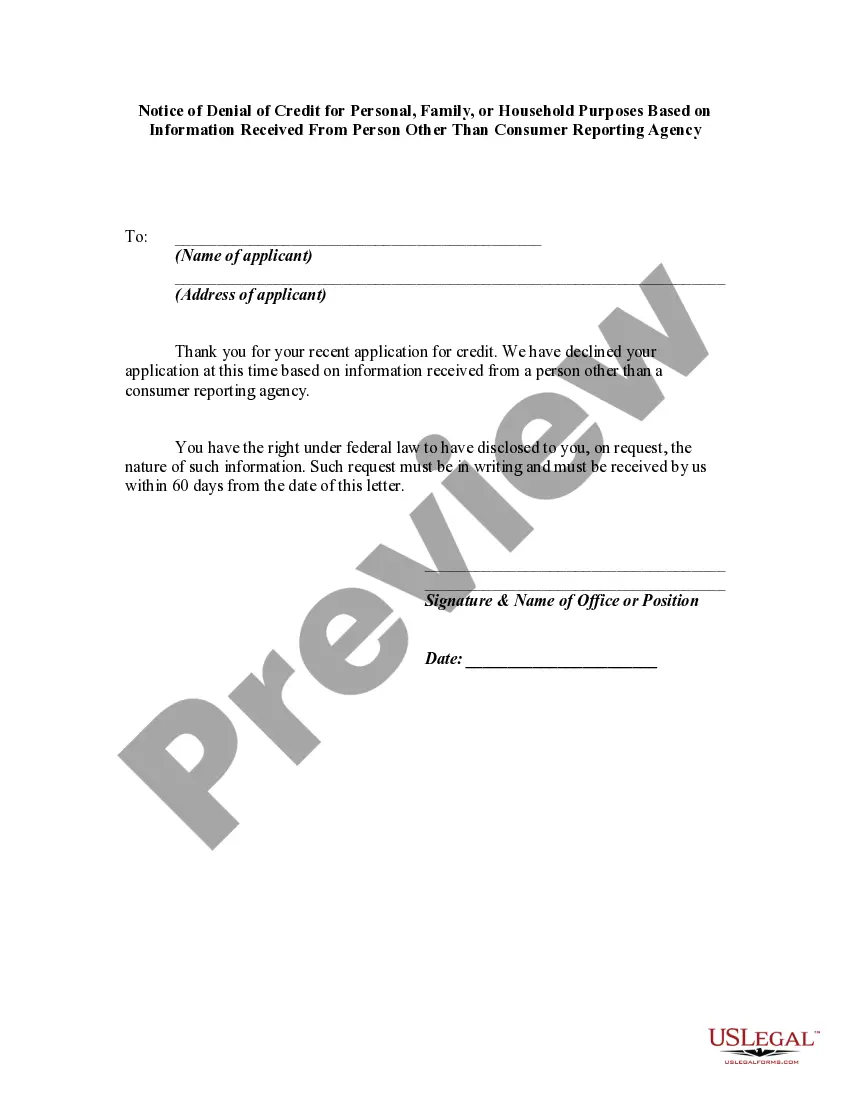

Whenever credit for personal, family, or household purposes involving a consumer is denied or the charge for the credit is increased either wholly or partly because of information obtained from a person other than a credit reporting agency bearing on the consumer's creditworthiness, credit standing, credit capacity, character, general reputation, personal characteristics, or mode of living, certain requirements must be met. The user of such information, when the adverse action is communicated to the consumer, must clearly and accurately disclose the consumer's right to make a written request for disclosure of the information.

Wake North Carolina Notice of Denial of Credit for Personal, Family, or Household Purposes Based on Information Received From Person Other Than Consumer Reporting Agency In Wake, North Carolina, if you have been denied credit for personal, family, or household purposes due to information received from a person other than a consumer reporting agency, you have the right to receive a notice explaining the reason for the denial. This notice is essential for understanding the factors that contributed to the credit denial and can help you take appropriate action to rectify any inaccuracies or disputes. The Wake North Carolina Notice of Denial of Credit is a legal document provided by the creditor or lender explaining the reasons behind the credit denial. The notice is intended to inform consumers about the specific details that influenced the decision, allowing them to better understand their creditworthiness and take necessary steps to improve it. This notice is important, as it provides transparency and helps protect consumers from unfair lending practices. It ensures that you are aware of the factors considered in the credit decision, helping you identify any incorrect or misleading information that may have affected the outcome of your application. Keywords: Wake, North Carolina, Notice of Denial of Credit, Personal, Family, Household, Purposes, Information, Received, Person Other Than Consumer Reporting Agency. Different types of Wake North Carolina Notice of Denial of Credit for Personal, Family, or Household Purposes Based on Information Received From Person Other Than Consumer Reporting Agency may include: 1. Notice of Denial of Credit for Personal Purposes: This type of notice specifically addresses credit denial for personal use, such as obtaining a personal loan or credit card. 2. Notice of Denial of Credit for Family Purposes: This notice pertains to credit denial related to family purposes, such as applying for a mortgage or financing for a family vacation. 3. Notice of Denial of Credit for Household Purposes: If you have been denied credit for household purposes, such as acquiring a loan for home improvement or purchasing furniture for your residence, this notice will detail the reasons behind the denial. It is crucial to thoroughly review the Wake North Carolina Notice of Denial of Credit and understand the information provided. If you believe any of the information to be inaccurate, you have the right to dispute it with the lender or creditor. The notice will typically outline the steps you should take to initiate a dispute and correct any errors in the information used to evaluate your creditworthiness. Remember, this notice is primarily intended to help consumers make informed decisions regarding their credit and take corrective action, if necessary.Wake North Carolina Notice of Denial of Credit for Personal, Family, or Household Purposes Based on Information Received From Person Other Than Consumer Reporting Agency In Wake, North Carolina, if you have been denied credit for personal, family, or household purposes due to information received from a person other than a consumer reporting agency, you have the right to receive a notice explaining the reason for the denial. This notice is essential for understanding the factors that contributed to the credit denial and can help you take appropriate action to rectify any inaccuracies or disputes. The Wake North Carolina Notice of Denial of Credit is a legal document provided by the creditor or lender explaining the reasons behind the credit denial. The notice is intended to inform consumers about the specific details that influenced the decision, allowing them to better understand their creditworthiness and take necessary steps to improve it. This notice is important, as it provides transparency and helps protect consumers from unfair lending practices. It ensures that you are aware of the factors considered in the credit decision, helping you identify any incorrect or misleading information that may have affected the outcome of your application. Keywords: Wake, North Carolina, Notice of Denial of Credit, Personal, Family, Household, Purposes, Information, Received, Person Other Than Consumer Reporting Agency. Different types of Wake North Carolina Notice of Denial of Credit for Personal, Family, or Household Purposes Based on Information Received From Person Other Than Consumer Reporting Agency may include: 1. Notice of Denial of Credit for Personal Purposes: This type of notice specifically addresses credit denial for personal use, such as obtaining a personal loan or credit card. 2. Notice of Denial of Credit for Family Purposes: This notice pertains to credit denial related to family purposes, such as applying for a mortgage or financing for a family vacation. 3. Notice of Denial of Credit for Household Purposes: If you have been denied credit for household purposes, such as acquiring a loan for home improvement or purchasing furniture for your residence, this notice will detail the reasons behind the denial. It is crucial to thoroughly review the Wake North Carolina Notice of Denial of Credit and understand the information provided. If you believe any of the information to be inaccurate, you have the right to dispute it with the lender or creditor. The notice will typically outline the steps you should take to initiate a dispute and correct any errors in the information used to evaluate your creditworthiness. Remember, this notice is primarily intended to help consumers make informed decisions regarding their credit and take corrective action, if necessary.