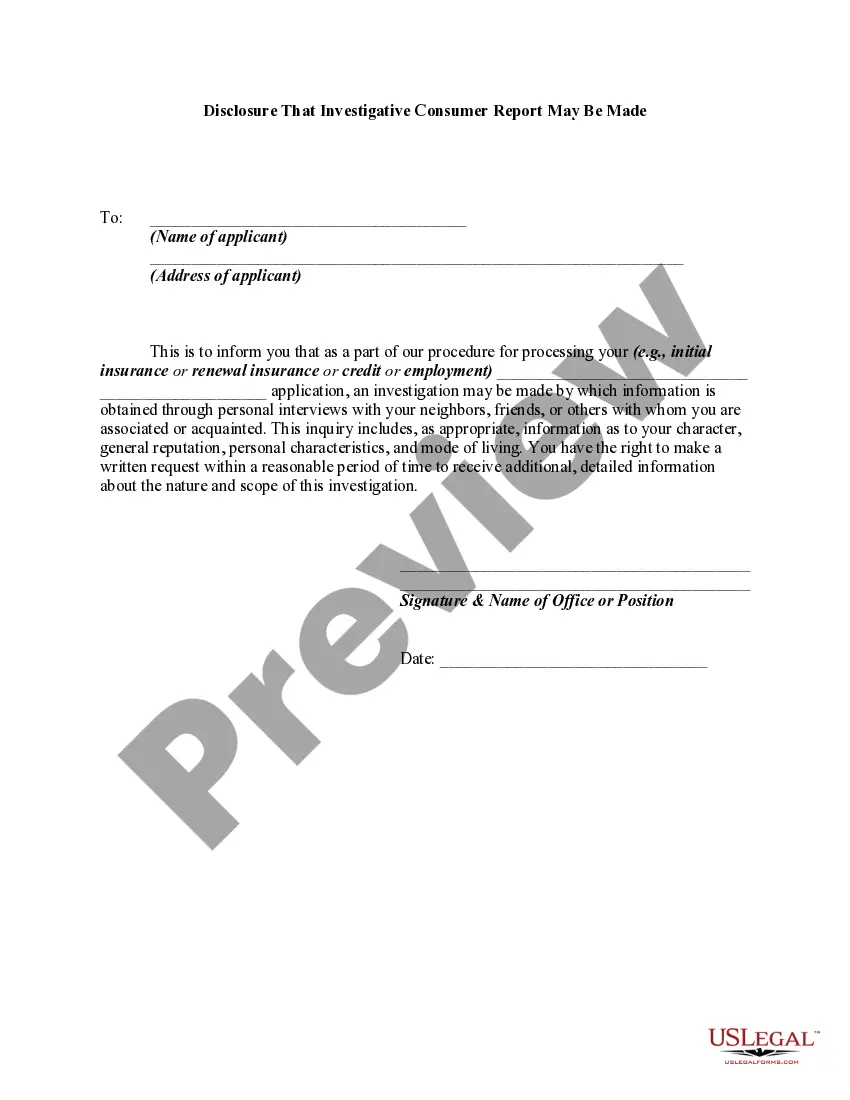

Under the Fair Credit Reporting Act, a person may not procure or cause to be prepared an investigative consumer report on any consumer unless: (1) it is clearly and accurately disclosed to the consumer that an investigative consumer report, including information as to character, general reputation, personal characteristics, and mode of living, whichever is or are applicable, may be made, and such disclosure: (a) is made in a writing mailed, or otherwise delivered, to the consumer not later than three days after the date on which the report was first requested; and (b) includes a statement informing the consumer of the right to request additional disclosures from the person requesting the report and the written summary of rights of the consumer prepared pursuant to ?§ 1681g(c) of the Act; and (2) the person certifies or has certified to the consumer reporting agency that the person has made the proper disclosures to the consumer as required under the Act.

Fulton Georgia Disclosure That Investigative Consumer Report May Be Made: A Detailed Overview Fulton Georgia Disclosure That Investigative Consumer Report May Be Made is a legal requirement that informs individuals about the possibility of their consent being sought to conduct an investigative consumer report. This report could be relevant for various purposes such as employment screening, tenant screening, or loan applications. In Fulton County, Georgia, employers and organizations are required to follow specific rules and guidelines when conducting investigative consumer reports. The disclosure ensures transparency and allows individuals to make informed decisions about their personal data being used for background checks. Keywords: — Fulton Georgia: Refers to Fulton County, located in the state of Georgia, United States. — Disclosure: The action of making something known or revealing information. — Investigative Consumer Report: A comprehensive background investigation that includes collecting personal, professional, and financial information about an individual. — Consent: Permission granted by an individual allowing an organization or employer to perform an investigative consumer report. — Employment Screening: The process of verifying an individual's qualifications, criminal history, and other relevant information before hiring them. — Tenant Screening: A process used by landlords or property managers to evaluate potential tenants based on their credit history, criminal records, and rental history. — Loan Applications: The submission of an individual's financial information to a financial institution or lender to request a loan. Different Types of Fulton Georgia Disclosure That Investigative Consumer Report May Be Made: 1. Employment Screening Disclosure: Specifically designed for employers, this document notifies potential employees that their consent may be sought to conduct an investigative consumer report as part of the hiring process. 2. Tenant Screening Disclosure: Aimed at landlords or property management companies, this disclosure informs prospective tenants that an investigative consumer report may be requested to evaluate their suitability as tenants. 3. Loan Application Disclosure: Provided by financial institutions or lenders, this disclosure notifies loan applicants that their consent may be required to perform an investigative consumer report to assess their creditworthiness and financial history. Remember, the Fulton Georgia Disclosure That Investigative Consumer Report May Be Made ensures transparency and informs individuals about the potential use of investigative consumer reports, allowing them to make informed decisions about their personal information.Fulton Georgia Disclosure That Investigative Consumer Report May Be Made: A Detailed Overview Fulton Georgia Disclosure That Investigative Consumer Report May Be Made is a legal requirement that informs individuals about the possibility of their consent being sought to conduct an investigative consumer report. This report could be relevant for various purposes such as employment screening, tenant screening, or loan applications. In Fulton County, Georgia, employers and organizations are required to follow specific rules and guidelines when conducting investigative consumer reports. The disclosure ensures transparency and allows individuals to make informed decisions about their personal data being used for background checks. Keywords: — Fulton Georgia: Refers to Fulton County, located in the state of Georgia, United States. — Disclosure: The action of making something known or revealing information. — Investigative Consumer Report: A comprehensive background investigation that includes collecting personal, professional, and financial information about an individual. — Consent: Permission granted by an individual allowing an organization or employer to perform an investigative consumer report. — Employment Screening: The process of verifying an individual's qualifications, criminal history, and other relevant information before hiring them. — Tenant Screening: A process used by landlords or property managers to evaluate potential tenants based on their credit history, criminal records, and rental history. — Loan Applications: The submission of an individual's financial information to a financial institution or lender to request a loan. Different Types of Fulton Georgia Disclosure That Investigative Consumer Report May Be Made: 1. Employment Screening Disclosure: Specifically designed for employers, this document notifies potential employees that their consent may be sought to conduct an investigative consumer report as part of the hiring process. 2. Tenant Screening Disclosure: Aimed at landlords or property management companies, this disclosure informs prospective tenants that an investigative consumer report may be requested to evaluate their suitability as tenants. 3. Loan Application Disclosure: Provided by financial institutions or lenders, this disclosure notifies loan applicants that their consent may be required to perform an investigative consumer report to assess their creditworthiness and financial history. Remember, the Fulton Georgia Disclosure That Investigative Consumer Report May Be Made ensures transparency and informs individuals about the potential use of investigative consumer reports, allowing them to make informed decisions about their personal information.